Market Overview

The Israel AR and VR in Defense market is experiencing significant growth, driven by increasing demand for advanced training solutions and operational enhancements in defense operations. The market size for 2024 is estimated to be valued at USD ~ billion, with augmented reality (AR) and virtual reality (VR) technologies playing a central role in military simulations, operational awareness, and mission planning. The demand for immersive technologies is being propelled by the modernization of defense capabilities, with both the government and private sector increasing their investments in these technologies to enhance security and operational effectiveness.

Dominant players in the market include Israel’s top defense contractors and global technology leaders focusing on AR and VR applications for military use. The country’s advanced defense infrastructure, combined with significant government investment in high-tech solutions, has made Israel a leader in AR and VR for defense. Cities like Tel Aviv and Haifa serve as key hubs for technological innovation, where collaboration between defense and tech sectors is driving the development of state-of-the-art training simulators and real-time operational systems. These cities benefit from a strong focus on cybersecurity, high-tech expertise, and a robust defense network.

Market Segmentation

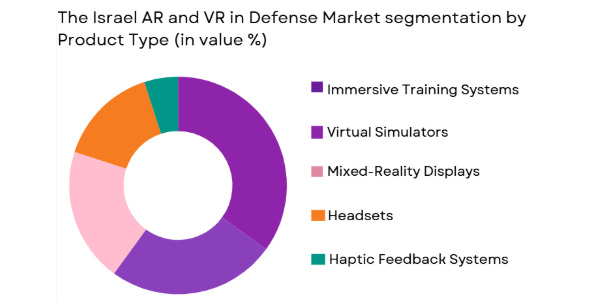

By Product Type

Israel AR and VR in Defense market is segmented by product type into headsets, immersive training systems, virtual simulators, mixed-reality displays, and haptic feedback systems. Recently, immersive training systems have dominated the market share due to their application in providing realistic training environments that mimic real-world combat scenarios. These systems are becoming increasingly popular as militaries seek more effective ways to train personnel, improve operational readiness, and enhance battlefield simulations. The demand for immersive training solutions is driven by the need to reduce operational costs and enhance soldier readiness without exposing them to real-world risks.

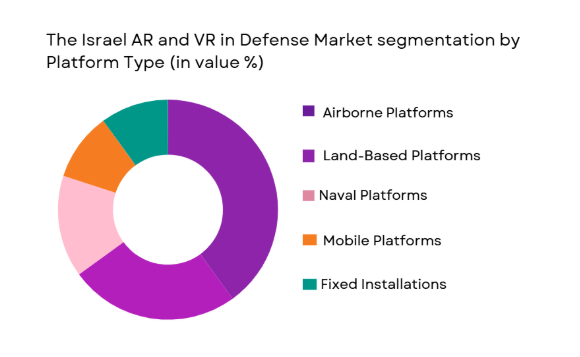

By Platform Type

Israel AR and VR in Defense market is segmented by platform type into airborne platforms, land-based platforms, naval platforms, mobile platforms, and fixed installations. Airborne platforms have emerged as the dominant sub-segment due to the rising use of AR and VR technologies in training pilots and supporting real-time situational awareness during missions. These platforms provide enhanced operational support, allowing military personnel to visualize data and combat scenarios directly within their field of vision. The integration of AR/VR into airborne platforms is expanding rapidly as defense agencies focus on increasing the efficiency and effectiveness of flight training programs.

Competitive Landscape

The competitive landscape of the Israel AR and VR in Defense market is marked by high consolidation, with major defense contractors and technology companies leading the market. Israel’s strong defense technology infrastructure and its government-backed initiatives have attracted both local and international players. Companies are focused on integrating advanced technologies such as AI and machine learning with AR and VR solutions to provide more immersive and effective training tools. Major players are also working on creating modular and scalable systems that can be integrated into various defense platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

The Israel AR and VR in Defense Market Analysis

Growth Drivers

Government Investment in Defense Technology

The primary growth driver in the Israel AR and VR in Defense market is the increased government investment in modernizing defense technologies. Israel’s government has allocated significant funds toward enhancing defense capabilities, including the adoption of advanced simulation systems to improve the training and readiness of its military. These investments are part of a broader effort to maintain technological superiority in a highly competitive regional defense environment. AR and VR technologies, which provide cost-effective training methods, are key enablers of this modernization. The demand for more immersive and sophisticated systems is being driven by a push to reduce costs associated with live-fire exercises and to enhance the quality of training without exposing soldiers to actual combat risks. The government’s focus on innovation and collaboration with tech companies has further accelerated the adoption of these technologies, creating new opportunities for defense contractors. As Israel continues to prioritize technological advancements in its defense sector, the demand for AR and VR solutions is expected to rise significantly in the coming years.

Rise of Smart Military Platforms

Another significant growth driver is the increasing integration of smart technologies into military platforms. Israel’s defense industry is focusing on the development of smart, interconnected systems that provide real-time data and enhance situational awareness. AR and VR technologies are a natural fit for these smart military platforms, offering soldiers and officers immersive, real-time data visualization during operations. The adoption of these technologies enhances mission effectiveness, allowing personnel to make faster and more informed decisions. These innovations are integrated into airborne, land-based, and naval platforms, which is driving the demand for AR and VR solutions that provide operational support. As the military sector increasingly shifts towards automation and enhanced intelligence systems, AR and VR technologies are becoming indispensable components of next-generation military platforms. These platforms, coupled with advances in communication systems, provide real-time, actionable intelligence that improves operational efficiency and effectiveness, further accelerating the adoption of immersive defense technologies.

Market Challenges

High Costs of AR and VR Solutions

One of the major challenges facing the Israel AR and VR in Defense market is the high cost associated with developing and deploying these technologies. The development of AR and VR solutions for defense applications requires significant investments in research, design, and integration with existing defense systems. The price of hardware, such as headsets and simulation systems, along with the complexity of software development, adds to the overall cost. This can limit the adoption of these technologies, particularly for smaller defense contractors and countries with constrained defense budgets. Furthermore, the integration of AR and VR systems into existing military infrastructure can be a complex and expensive process. Despite the long-term cost savings provided by AR and VR solutions in training, the initial investment remains a major hurdle. This high cost of entry for smaller defense companies and countries may limit the growth potential of the market in the short term, even though the technology offers significant long-term benefits in terms of operational efficiency and soldier training effectiveness.

Integration Challenges with Legacy Systems

The integration of AR and VR technologies with legacy military systems presents another significant challenge. Many defense platforms in Israel and globally rely on outdated hardware and software, and retrofitting these systems to support new technologies can be a complex and costly process. Ensuring that AR and VR solutions are compatible with existing platforms without compromising their performance requires extensive testing, customization, and adaptation, which adds to the overall cost and time required for deployment. Additionally, military personnel may face resistance to adopting new technologies due to the learning curve associated with operating AR/VR systems. This integration challenge is particularly difficult in countries with older military equipment or where defense budgets are stretched thin, as the upfront costs for upgrading systems can be prohibitive. Addressing these integration challenges will be crucial for expanding the adoption of AR and VR technologies in defense applications.

Opportunities

Enhanced Training Simulations

One of the most significant opportunities in the Israel AR and VR in Defense market is the continued demand for advanced training simulations. These technologies offer a unique ability to create realistic, immersive environments for training without the risks and costs associated with live exercises. AR and VR training systems allow military personnel to practice in simulated combat scenarios, improving their readiness and operational effectiveness. The demand for more sophisticated training solutions is expected to grow as militaries seek to provide more efficient and cost-effective training methods. Furthermore, AR and VR technologies can be used to simulate a wide range of environments and scenarios, from battlefield operations to crisis management, allowing defense agencies to tailor training programs to specific operational needs. As the demand for realistic training solutions continues to rise, the market for AR and VR technologies in defense will expand, providing opportunities for companies that specialize in immersive training solutions.

International Defense Collaborations

Another opportunity in the Israel AR and VR in Defense market is the growing trend of international defense collaborations. Israel is increasingly collaborating with other countries to share knowledge and technology, particularly in the areas of defense innovation and advanced technologies. This has led to a rise in joint defense programs, where Israel’s defense industry plays a significant role in providing AR and VR solutions for foreign militaries. As countries around the world modernize their defense capabilities, they are increasingly turning to Israel for expertise in defense technologies, including AR and VR systems. These collaborations offer a significant opportunity for Israeli defense contractors to expand their market reach and increase their global footprint. Additionally, international defense partnerships can lead to the development of standardized AR and VR solutions that can be used across multiple platforms, further enhancing their adoption in the global defense sector.

Future Outlook

The Israel AR and VR in Defense market is expected to experience continued growth over the next five years, driven by technological advancements, regulatory support, and increasing demand for more immersive training and operational solutions. The integration of artificial intelligence and machine learning with AR/VR systems is expected to lead to more advanced, adaptive, and efficient technologies. Governments and defense agencies around the world are likely to increase their investments in these technologies, supporting their widespread adoption. As the military continues to modernize, the role of AR and VR in enhancing training, mission planning, and battlefield operations will be crucial in shaping the future of defense technologies.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Northrop Grumman

- Boeing

- Thales Group

- General Dynamics

- BAE Systems

- Raytheon Technologies

- SAAB

- L3Harris Technologies

- FLIR Systems

- Leonardo

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense technology developers

- Aerospace and aviation firms

- Homeland security agencies

- International defense agencies

- Technology providers

Research Methodology

Step 1: Identification of Key Variables

We identify key factors that influence the AR and VR defense market, such as technological advancements, government investments, and industry dynamics.

Step 2: Market Analysis and Construction

This involves assessing the AR and VR market’s size, key players, and segmentation by product, platform, and end-user to build a comprehensive market structure.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and stakeholders validate the hypotheses, ensuring our market estimates are based on real-time data and projections.

Step 4: Research Synthesis and Final Output

We synthesize all gathered data, analyze trends, and prepare the final output that reflects the current and future state of the AR and VR in Defense market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Demand for advanced training simulations

Increasing use of immersive technology in battlefield operations

Rise in military modernization programs

Technological advancements in AR and VR systems

Government focus on defense innovation and technology integration - Market Challenges

High initial investment costs

Integration complexity with legacy defense systems

Lack of standardized platforms and frameworks

Limited real-time data processing in AR and VR systems

Regulatory barriers related to the use of emerging technologies - Market Opportunities

Increased adoption of AR and VR in defense training

Growth of cross-border defense collaborations

Development of AR and VR for mission-critical defense applications - Trends

Integration of artificial intelligence in AR and VR systems

Growing interest in mobile and portable defense systems

Enhancement of battlefield situational awareness using AR

Collaborative AR-based solutions for remote support

Trend toward customizable, adaptive VR training environments - Government Regulations & Defense Policy

Tighter security protocols for AR/VR systems

Standardization efforts in defense technology

Regulations on military use of immersive technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Augmented Reality Headsets

Virtual Reality Simulators

Immersive Training Systems

Mixed Reality Displays

Haptic Feedback Systems - By Platform Type (In Value%)

Airborne Platforms

Land-Based Platforms

Naval Platforms

Mobile Platforms

Fixed Training Installations - By Fitment Type (In Value%)

Helmet-Mounted Displays

Vehicle-Mounted Systems

Portable Systems

Embedded Training Systems

Headset Integration Kits - By EndUser Segment (In Value%)

Defense Contractors

Military and Government Agencies

Private Sector (Security & Surveillance)

Aerospace and Aviation

Education and Research Institutions - By Procurement Channel (In Value%)

Government Contracts

Private Procurement

Defense Agencies and Military Sales

International Procurement

Research and Development Collaborations - By Material / Technology (in Value %)

Optical and Sensor Technologies

Graphene-Based Materials

AI-Integrated Systems

Wireless Communication Technology

Advanced Display Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Market Value, Technology Adoption, System Complexity, Procurement Channels, System Integration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Boeing

Lockheed Martin

Northrop Grumman

Thales Group

General Dynamics

BAE Systems

Raytheon Technologies

SAAB

L3Harris Technologies

FLIR Systems

Leonardo

Harris Corporation

- Growing demand from military simulation centers

- Increased focus on enhancing soldier performance

- Partnerships between defense contractors and tech companies

- Expanding use of AR/VR for defense equipment testing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035