Market Overview

The Israel Armored Fighting Vehicles market is experiencing significant growth, driven by an increase in defense spending and modernization programs across various sectors. In recent assessments, the market size is valued at USD ~ billion, largely influenced by Israel’s robust defense infrastructure and increasing demand for advanced military solutions. The market is also propelled by technological advancements in armored vehicle design, with a growing preference for enhanced mobility, protection, and lethality, reflecting the changing dynamics of warfare.

Israel remains a dominant player in the development and production of armored fighting vehicles, with a well-established presence in both domestic and international markets. The nation’s leadership in advanced military technology, including the development of autonomous systems and active protection technologies, further solidifies its position. This dominance is also supported by the strategic geopolitical landscape, as Israel’s defense needs continue to evolve in response to regional tensions and security threats.

Market Segmentation

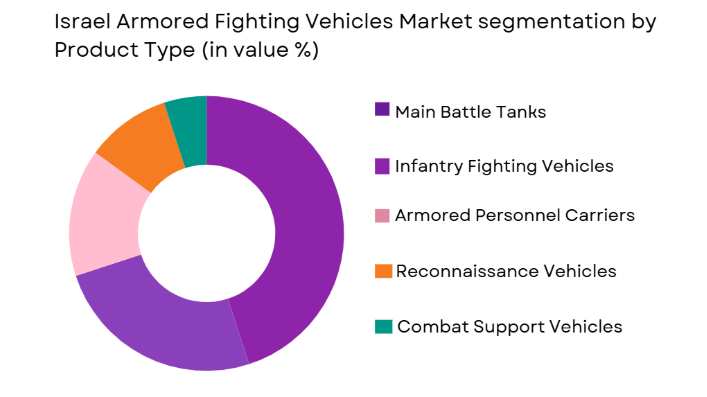

By Product Type

The Israel Armored Fighting Vehicles market is segmented by product type into main battle tanks, infantry fighting vehicles, armored personnel carriers, reconnaissance vehicles, and combat support vehicles. Recently, main battle tanks have been dominating the market share, driven by the growing emphasis on advanced tank warfare capabilities. Israel’s highly regarded Merkava tank series has contributed significantly to this dominance due to its robust design and unique features, including crew protection and modularity, which provide a substantial competitive edge. The increasing geopolitical tensions in the region, coupled with modernization programs, have further solidified the demand for these heavy-duty combat vehicles.

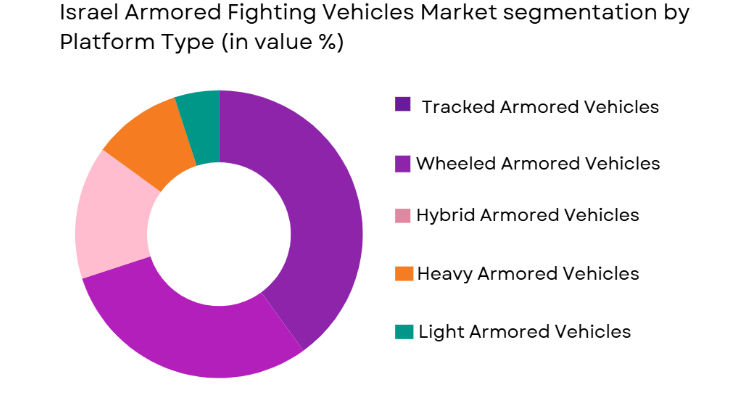

By Platform Type

The market is segmented by platform type into wheeled armored vehicles, tracked armored vehicles, hybrid armored vehicles, heavy armored vehicles, and light armored vehicles. Tracked armored vehicles dominate the market due to their superior off-road capability, which is crucial for combat in rugged terrains. Israel’s extensive use of tracked platforms like the Merkava tank series provides a strategic advantage, particularly in operational environments that require maneuverability and durability under extreme conditions. Additionally, the trend toward hybrid platforms with advanced technology and flexibility is gaining momentum, contributing to an evolving preference for tracked solutions.

Competitive Landscape

The competitive landscape of the Israel Armored Fighting Vehicles market is characterized by the presence of well-established companies that have a significant influence on the market. Consolidation in the sector is evident, with a few dominant players leveraging advanced technology to maintain their leadership positions. These companies continuously invest in research and development to meet the growing demand for advanced defense solutions. Major players also benefit from strong government relationships and long-term contracts, solidifying their position in both domestic and international markets.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 |

London, UK

|

~ | ~ | ~ | ~ | ~ |

Israel Armored Fighting Vehicles Market Analysis

Growth Drivers

Increasing Geopolitical Tensions

The escalating geopolitical tensions in the Middle East and surrounding regions have significantly driven the demand for advanced armored fighting vehicles. As conflicts become more complex, the need for highly capable and versatile armored platforms has surged, especially in nations with strategic interests in securing territorial integrity. This growing security threat across borders has prompted countries to enhance their defense capabilities, thus increasing investments in advanced armored fighting vehicles, particularly those offering superior protection, firepower, and mobility. Israel, with its unique geographical location, faces constant security threats, driving its government to prioritize the modernization of its armored vehicle fleet. This shift towards more sophisticated and battle-ready armored platforms is expected to persist, contributing to the continuous demand for state-of-the-art vehicles, including the integration of new technologies such as unmanned ground vehicles (UGVs) and advanced armor systems.

Technological Advancements in Vehicle Design

Technological advancements in vehicle design, particularly in armoring systems, mobility, and autonomous technologies, have played a pivotal role in the growth of the armored fighting vehicle market. Israel’s emphasis on cutting-edge technologies, such as active protection systems (APS), advanced armor materials, and hybrid propulsion systems, has set new standards in vehicle defense. These innovations are not only enhancing the survivability of armored vehicles but also improving operational efficiency in various terrains and combat environments. As technological evolution continues, demand for more advanced systems, such as AI-driven combat vehicles and real-time battlefield data integration, is expected to increase. These innovations will support Israel’s position as a global leader in armored fighting vehicle production, with military forces globally seeking to replicate such advancements in their own fleets.

Market Challenges

High Costs and Budget Constraints

One of the significant challenges facing the Israel Armored Fighting Vehicles market is the high cost of acquisition, development, and maintenance of these advanced platforms. The cost of designing and producing top-tier armored vehicles, particularly those with sophisticated features like active protection systems and autonomous capabilities, can be prohibitively high. The budgetary constraints faced by both domestic and international buyers often limit the procurement of such high-value assets, especially during times of economic uncertainty or when competing defense priorities emerge. Despite Israel’s strong defense budget allocation, the financial constraints of both domestic and international markets may pose a hurdle to the widespread adoption of cutting-edge armored fighting vehicle technologies. This cost barrier will continue to challenge the market, as countries seek cost-effective solutions without compromising on operational effectiveness.

Export Regulations and Trade Barriers

The Israel Armored Fighting Vehicles market also faces challenges related to export regulations and trade barriers, particularly due to strict government controls and international arms trade regulations. Israel’s defense exports are heavily regulated, with the government controlling the sale of advanced military systems to ensure compliance with international law and security concerns. As geopolitical tensions shift, countries looking to purchase advanced armored vehicles from Israel may face regulatory hurdles and lengthy approval processes, potentially delaying or limiting procurement. Additionally, export controls imposed by international bodies such as the United Nations and the European Union further restrict the market’s potential growth, especially in regions with stringent defense procurement regulations.

Opportunities

Expansion of International Markets

With growing demand for advanced armored fighting vehicles worldwide, there is a significant opportunity for Israel to expand its market presence in emerging and established international markets. Many countries, especially in Asia, Europe, and the Middle East, are increasingly investing in defense modernization programs, which include upgrading their armored vehicle fleets. Israel, with its highly regarded defense capabilities, is well-positioned to capitalize on these opportunities, offering its advanced armored systems to meet the evolving needs of global military forces. By strengthening its partnerships with key global defense players and leveraging its technological edge, Israel can secure new defense contracts and expand its market reach, providing both technological innovation and reliable support to international buyers. The growing trend towards defense collaborations and joint development initiatives further opens the door for Israel to enhance its market position in key regions such as Southeast Asia, Eastern Europe, and the Middle East.

Advancements in Autonomous Systems

The development of autonomous systems in armored fighting vehicles presents a significant opportunity for growth in the Israel market. As the demand for unmanned ground vehicles (UGVs) increases, Israel’s defense industry is well-positioned to lead the charge in autonomous vehicle technologies. Israel’s expertise in robotics, AI, and machine learning can be integrated into its armored platforms, providing enhanced situational awareness, decision-making capabilities, and operational efficiency. This shift towards autonomous and semi-autonomous systems in the military sector is expected to revolutionize armored vehicle operations, reducing human casualties and enhancing battlefield effectiveness. As global defense forces seek to modernize their fleets with autonomous systems, Israel can capitalize on this growing demand, cementing its role as a leader in military technology.

Future Outlook

Over the next five years, the Israel Armored Fighting Vehicles market is expected to continue growing as advancements in technology, especially in autonomous systems and active protection, shape the future of defense. The demand for highly advanced, durable, and adaptable armored platforms is anticipated to rise, driven by the need for improved operational capabilities across complex and diverse combat scenarios. Regulatory support, including continued defense modernization programs, along with increasing international demand, will play a crucial role in fostering market expansion.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- IMI Systems

- General Dynamics

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Leonardo

- L3 Technologies

- Oshkosh Defense

- Kongsberg Defence & Aerospace

- Krauss-Maffei Wegmann

- Rheinmetall

- ST Engineering

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Defense equipment manufacturers

- Defense policy think tanks

- Procurement and logistics companies

- International defense buyers

- Regional defense agencies

Research Methodology

Step 1: Identification of Key Variables

Identification of key market drivers, restraints, and opportunities specific to armored fighting vehicles within Israel’s defense sector.

Step 2: Market Analysis and Construction

Comprehensive analysis of the armored fighting vehicles market size, segmentation, and dynamics in Israel, including historical data and current trends.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts, government officials, and defense analysts to validate findings and market hypotheses.

Step 4: Research Synthesis and Final Output

Synthesis of data into a final report, ensuring comprehensive and actionable insights for decision-makers in the defense industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Expenditure

Technological Advancements in Defense Systems

Rising Geopolitical Tensions in the Middle East

- Market Challenges

High Cost of Acquisition and Maintenance

Complex Integration with Legacy Systems

Restricted Export Regulations

- Market Opportunities

Increased Defense Modernization Programs

Expansion of International Market Penetration

Local Manufacturing and Innovation Opportunities

- Trends

Development of Autonomous Combat Vehicles

Shift Toward Electric Propulsion Systems

Integration of AI and Robotics in Armored Vehicles

- Government Regulations

Export Control Laws

Environmental and Emission Regulations

Procurement Regulations for Government Entities

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Battle Tanks

Infantry Fighting Vehicles

Armored Personnel Carriers

Reconnaissance Vehicles

Combat Support Vehicles

- By Platform Type (In Value%)

Wheeled Armored Vehicles

Tracked Armored Vehicles

Hybrid Armored Vehicles

Heavy Armored Vehicles

Light Armored Vehicles

- By Fitment Type (In Value%)

Factory-Fitted

Retrofit

Customization-Based

Conversion-Based

Modular Systems

- By EndUser Segment (In Value%)

Defense Forces

Private Contractors

Government Agencies

Military Research Institutions

International Buyers

- By Procurement Channel (In Value%)

Direct Government Procurement

Third-Party Procurement

Private Sector Procurement

Collaborative Defense Procurement

International Collaborations

- Market Share Analysis

- Cross Comparison Parameters (Market Value, Installed Units, Average System Price, System Complexity Tier, Platform Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Military Industries (IMI) Systems

Tadiran Communications

General Dynamics

BAE Systems

Lockheed Martin

Thales Group

Northrop Grumman

Leonardo

L3 Technologies

Oshkosh Defense

Krauss-Maffei Wegmann

Rheinmetall

Kongsberg Defence & Aerospace

- Domestic Defense Forces’ Procurement Trends

- Private Sector Collaboration for Military Solutions

- International Procurement and Collaboration Agreements

- Emerging Markets for Armored Vehicle Exports

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035