Market Overview

The Israel armored personnel carrier (APC) market is valued at approximately USD ~ billion, driven by consistent defense budgets and military modernization programs. Israel’s well-established defense sector, coupled with increasing demand for security in conflict-prone regions, plays a crucial role in market expansion. Moreover, the global trend of investing in advanced military technologies further fuels demand for specialized APCs, reinforcing their growth in the defense industry.

The market dominance of Israel in APC production is primarily attributed to the country’s robust defense infrastructure, technological advancements, and a strategic location in a geopolitically volatile region. The demand for Israel’s armored vehicles is heavily influenced by its strong defense exports, particularly to nations in Europe, North America, and the Middle East, who prioritize advanced military systems. The country’s innovation in developing versatile, combat-ready vehicles has contributed to its leadership in the global defense equipment market.

Market Segmentation

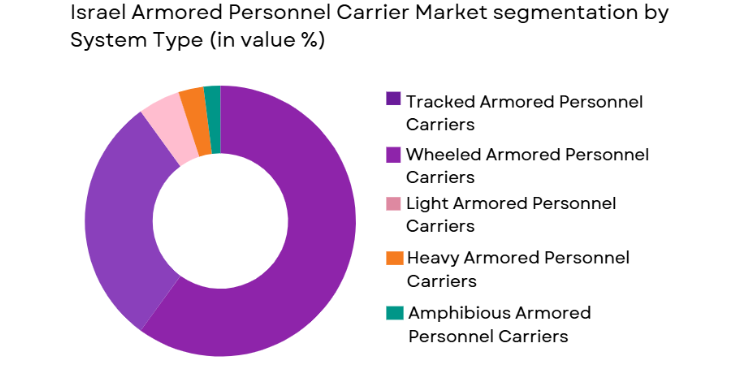

By System Type

The Israel armored personnel carrier market is segmented by system type into tracked and wheeled APCs. Recently, tracked APCs have a dominant market share due to factors such as their superior off-road capabilities, higher armor protection, and adaptability to various battlefield environments. These vehicles are preferred for their durability and ability to handle more demanding military operations, such as deployment in rugged terrains. The increasing demand for robust and versatile APCs for urban and border security operations further strengthens the dominance of tracked systems in the market.

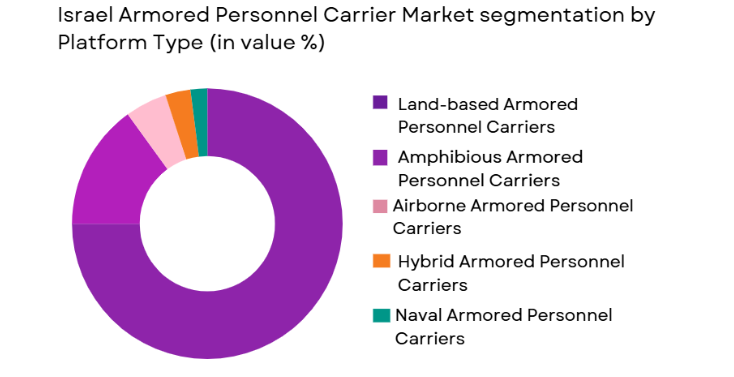

By Platform Type

The market is also segmented by platform type, with land-based armored personnel carriers taking the largest share. The preference for land-based systems is driven by the increasing military demand for vehicles capable of handling complex terrains and various operational conditions, which is essential in both domestic and international military conflicts. The land-based vehicles are seen as versatile, being used for urban warfare, peacekeeping missions, and border patrol, further consolidating their dominance in the APC market.

Competitive Landscape

The Israeli APC market is competitive, with a few dominant players consolidating their positions due to continuous innovation and high-quality production. Leading companies like Elbit Systems and Israel Military Industries (IMI) are recognized for their cutting-edge technologies and extensive defense contracts. Their influence is further extended by collaborations with global defense forces, which secures their foothold in both local and international markets. The market remains competitive as these firms lead innovation in armored vehicle systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Military Industries | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| General Dynamics Land Systems | 1899 | Sterling Heights, USA | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | Oshkosh, USA | ~ | ~ | ~ | ~ |

Israel Armored Personnel Carrier Market Analysis

Growth Drivers

Defense Spending and Modernization Initiatives

Defense spending across Israel has been consistently robust, driven by the country’s strategic geopolitical position and its commitment to maintaining a strong defense sector. With tensions in the Middle East continuing, the demand for advanced military technology, including armored personnel carriers, has surged. The modernization of Israel’s military forces, particularly with an emphasis on enhancing operational mobility and protection, is a critical growth driver. As conflicts evolve, the need for upgraded APCs that offer better protection, firepower, and mobility in both urban and hostile environments has led to a sustained market demand. The Israeli government’s increased budget allocation towards defense innovation further fuels the adoption of advanced armored systems, contributing significantly to the market’s growth trajectory.

Technological Advancements in Vehicle Armor and Mobility

Continuous technological advancements in vehicle armor and mobility have created significant growth opportunities within the Israeli APC market. Innovations such as active protection systems (APS), improved mobility capabilities, and hybrid/electric propulsion systems are revolutionizing the capabilities of APCs. Israel’s robust defense research and development infrastructure, along with its technological prowess, enables the country to maintain a competitive edge. These innovations, particularly the integration of advanced armor technologies such as composite and reactive armors, have made Israeli APCs highly desirable for global markets. Additionally, the introduction of autonomous features in APCs is gaining traction, enhancing operational effectiveness, and making the vehicles more adaptable to complex combat scenarios. This continuous innovation ensures that Israel remains at the forefront of the global armored personnel carrier market.

Market Challenges

High Production and Maintenance Costs

One of the major challenges in the Israeli APC market is the high production and maintenance costs associated with these advanced military vehicles. Armored personnel carriers require specialized manufacturing techniques, high-quality materials, and significant research and development efforts, which contribute to the elevated costs. Additionally, the complexity of maintaining these high-tech vehicles, especially in combat zones, further adds to their lifecycle costs. The need for frequent upgrades and repairs to ensure operational readiness can also put a financial strain on defense budgets, particularly for smaller nations or organizations with limited funding. This challenge has implications for the global market, as nations with limited defense spending might hesitate to invest in such high-cost assets, impacting the overall demand for advanced APCs.

Geopolitical Instability and Regulatory Barriers

Geopolitical instability in the Middle East, particularly in regions bordering Israel, poses a significant challenge for the APC market. The uncertainty surrounding defense contracts, the shifting alliances, and evolving international regulations concerning the export of military technologies can create significant hurdles. Countries that face strict defense regulations or embargoes may struggle to procure the latest APC models from Israel. Additionally, the changing nature of warfare, which emphasizes cybersecurity and unmanned systems, may reduce the demand for traditional armored vehicles in favor of next-generation defense technologies. This shift could create a slower adoption rate of new APC technologies, ultimately affecting market growth.

Opportunities

Global Demand for Peacekeeping and Humanitarian Missions

As international peacekeeping operations and humanitarian missions expand, the demand for armored vehicles, including personnel carriers, is likely to rise. Israel’s reputation for producing high-quality, versatile APCs makes it well-positioned to meet the needs of global peacekeeping forces. These operations often require vehicles that can operate in hostile environments, provide protection, and carry out troop transport in conflict zones. Given Israel’s strong presence in peacekeeping and its commitment to maintaining its defense capabilities, it is likely to see a steady increase in demand for its APCs from global peacekeeping forces and humanitarian organizations operating in politically unstable regions.

Technological Integration and Upgrades in Existing Fleets

Another significant opportunity lies in the ongoing integration of cutting-edge technology into existing APC fleets. As nations look to extend the life cycle of their current armored vehicles, the upgrading of older systems with modern technology such as advanced sensor systems, situational awareness technologies, and integrated communication systems is becoming a key focus. Israel’s extensive experience in APC manufacturing and technological upgrades offers an opportunity to expand its market share by providing retrofitting services for older fleets. Additionally, the growing interest in autonomous and semi-autonomous vehicle technologies presents a promising opportunity for the market. The potential for upgrading older systems with these new technologies could lead to substantial growth for Israeli defense contractors, particularly in the global market.

Future Outlook

The Israel armored personnel carrier market is poised for steady growth over the next five years, driven by increasing defense budgets, technological advancements, and the expansion of global peacekeeping operations. Key trends include the adoption of autonomous capabilities, enhanced protection systems, and the development of hybrid and electric-powered APCs. Regulatory support and continuous innovation in military vehicle systems are expected to create a favorable environment for market expansion. The demand for versatile, high-performance APCs will remain strong, especially in volatile geopolitical regions.

Major Players

- Elbit Systems

- Israel Military Industries (IMI)

- Rafael Advanced Defense Systems

- General Dynamics Land Systems

- Oshkosh Defense

- Lockheed Martin

- BAE Systems

- Thales Group

- Krauss-Maffei Wegmann

- Navistar Defense

- ST Engineering

- Rheinmetall Defence

- Textron Systems

- Iveco Defence Vehicles

- Uralvagonzavod

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military forces in conflict-prone regions

- Defense contractors and procurement officials

- Private security firms

- International peacekeeping organizations

- Manufacturers of military vehicles and defense technologies

- Military equipment suppliers and distributors

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the essential factors that influence market trends and size, including geopolitical stability, defense spending, and technological advancements in armored vehicles.

Step 2: Market Analysis and Construction

Data is gathered from primary and secondary sources, including government reports, defense agencies, and industry publications, to develop a comprehensive view of the market’s size, segmentation, and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including military officers, defense contractors, and analysts, are consulted to validate assumptions and hypotheses about market dynamics, growth drivers, and challenges.

Step 4: Research Synthesis and Final Output

The data and insights collected are synthesized to generate the final market report, which includes forecasts, trend analysis, and actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Spending in Israel

Technological Advancements in Armored Vehicle Design

Rising Threat of Terrorism and Cross-border Conflicts

Government Investment in Military Modernization

Expansion of International Peacekeeping Missions - Market Challenges

High Procurement and Maintenance Costs

Geopolitical Instability in the Region

Regulatory and Compliance Barriers

Limited Domestic Production Capacities

Integration with Existing Military Infrastructure - Market Opportunities

Development of Autonomous Armored Vehicles

Enhanced Armoring and Protection Technologies

Global Export Market Expansion - Trends

Increased Demand for Modular and Flexible Designs

Advancements in Active Protection Systems

Focus on Cost-effective Armored Solutions

Shift Towards Electrified Armored Vehicles

Integration of Artificial Intelligence in Vehicle Systems - Government Regulations & Defense Policy

Tightened Export Controls on Military Technology

Growing Emphasis on Military-Industrial Collaboration

Government Mandates for Sustainability in Defense Vehicles - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Wheeled Armored Personnel Carriers

Tracked Armored Personnel Carriers

Light Armored Personnel Carriers

Heavy Armored Personnel Carriers

Modular Armored Personnel Carriers - By Platform Type (In Value%)

Land-based Armored Personnel Carriers

Airborne Armored Personnel Carriers

Naval Armored Personnel Carriers

Hybrid Armored Personnel Carriers

Amphibious Armored Personnel Carriers - By Fitment Type (In Value%)

Military Fitment

Paramilitary Fitment

Civilian Fitment

Hybrid Fitment

Retrofit Fitment - By EndUser Segment (In Value%)

Defense Forces

Government & Law Enforcement Agencies

Private Security Contractors

International Peacekeeping Forces

Commercial & Industrial Applications - By Procurement Channel (In Value%)

Direct Procurement

Through Defense Contractors

Through Authorized Dealers

Through Government Procurement Programs

Through Foreign Military Sales - By Material / Technology (in Value%)

Steel Armor

Composite Armor

Reactive Armor

Nanotechnology Armor

Active Protection Systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product Innovation, Pricing Strategy, Market Reach, Customer Support, Brand Loyalty)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Military Industries (IMI)

Rafael Advanced Defense Systems

General Dynamics Land Systems

Lockheed Martin

BAE Systems

Krauss-Maffei Wegmann

Oshkosh Defense

Thales Group

Textron Systems

ST Engineering

Navistar Defense

Iveco Defense Vehicles

Renault Trucks Defense

Uralvagonzavod

- Enhanced Demand from International Clients

- Government Contracts and Public Sector Demand

- Emerging Need in Peacekeeping and Humanitarian Operations

- Growing Integration of Armored Personnel Carriers in Special Operations Forces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035