Market Overview

The Israel Armored Vehicle Fire Suppression Systems Market is a growing sector driven by increasing demand for advanced military vehicle safety systems. In recent historical assessments, the market has been valued at approximately USD ~ million, primarily driven by heightened defense budgets and the focus on enhancing vehicle survivability in combat scenarios. The rising adoption of sophisticated fire suppression technologies in military applications is further fueled by advancements in system efficiency, such as automatic detection and suppression, as well as the implementation of stricter safety regulations. The market has seen investments from both government defense agencies and private contractors to develop and integrate advanced fire suppression systems into various military platforms, including armored vehicles and tanks, increasing the overall market value in the coming years.

The market’s dominance is observed in countries like the United States, Israel, and several European defense nations, all of which have significant military budgets and ongoing investments in vehicle protection systems. Israel, in particular, stands out for its leadership in innovative military technologies, including armored vehicle fire suppression systems. The country’s established defense industry, in collaboration with major global defense contractors, has made it a center for the development and manufacturing of cutting-edge fire suppression technologies. Additionally, countries in the Middle East and Asia-Pacific are expanding their defense spending, leading to a rise in the demand for armored vehicle safety technologies, including fire suppression systems. This trend is expected to further solidify these regions as key drivers of market growth.

Market Segmentation

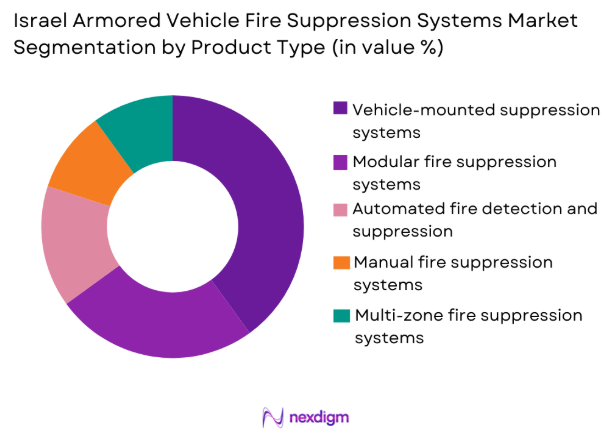

By Product Type

The Israel Armored Vehicle Fire Suppression Systems Market is segmented by product type into vehicle-mounted suppression systems, modular fire suppression systems, automated fire detection and suppression systems, manual fire suppression systems, and multi-zone fire suppression systems. Recently, vehicle-mounted suppression systems have a dominant market share due to their ability to offer comprehensive protection with minimal installation modifications. These systems are highly favored for their quick response times, reliability, and ease of integration into existing military vehicles, making them essential in high-threat environments where vehicle survival is critical. The growing demand for robust and automated protection systems in both new and retrofitted vehicles has further boosted the adoption of these systems, positioning them as the most widely used product in this market segment.

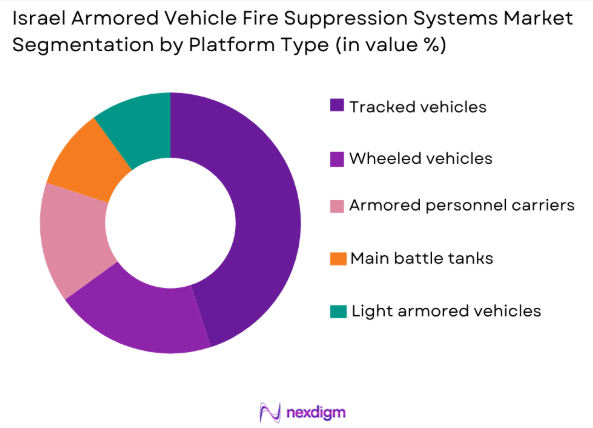

By Platform Type

The Israel Armored Vehicle Fire Suppression Systems Market is also segmented by platform type into tracked vehicles, wheeled vehicles, armored personnel carriers, main battle tanks, and light armored vehicles. Recently, tracked vehicles have had the largest market share due to their widespread use in high-combat zones and their ability to support heavier, more complex suppression systems. These vehicles are often deployed in situations requiring higher protection standards, including full-spectrum protection for both vehicle crew and critical systems. As military forces prioritize defense technologies that ensure operational efficiency in hostile environments, tracked vehicles remain the primary choice for incorporating advanced fire suppression systems, contributing significantly to their dominance in the market segment.

Competitive Landscape

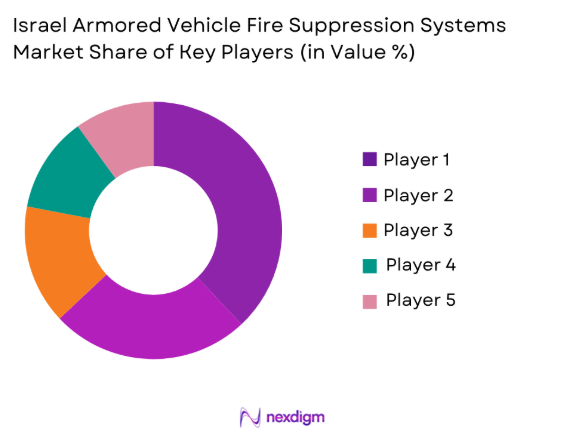

The competitive landscape of the Israel Armored Vehicle Fire Suppression Systems Market is marked by the presence of well-established global defense companies and a few regional players focusing on advanced fire safety technologies. Market consolidation is evident with the top players dominating both innovation and market share. The influence of major players such as Elbit Systems, Rafael Advanced Defense Systems, and BAE Systems has further reinforced competition, with these companies providing cutting-edge solutions for armored vehicle safety. Collaborations between defense contractors and governmental bodies are driving the research and development of next-generation systems, ensuring the ongoing growth of the market. The market continues to be dynamic, with frequent product enhancements and technological advancements paving the way for new players to enter the field.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Israel Armored Vehicle Fire Suppression Systems Market Analysis

Growth Drivers

Technological Advancements in Fire Suppression Systems

The continuous advancements in fire suppression systems play a major role in driving the growth of the Israel Armored Vehicle Fire Suppression Systems Market. Over the years, fire suppression technologies have evolved from simple manual systems to complex automated and multi-zone solutions, improving the safety and survivability of armored vehicles in combat situations. These innovations are driven by the need for quicker response times, more efficient extinguishing methods, and systems that can operate in extreme conditions. New fire suppression technologies incorporate elements such as automatic detection, water mist systems, and hybrid suppression techniques, all designed to provide enhanced protection to personnel and critical equipment in the vehicle. With these advancements, the demand for new fire suppression systems is increasing, especially in regions with high defense budgets like Israel, the U.S., and other NATO countries, where armored vehicles are essential for modern combat. Technological collaborations between defense contractors and military agencies, such as those between Elbit Systems and Rafael Advanced Defense Systems, are accelerating the development of these advanced solutions, further contributing to the growth of the market.

Government Defense Expenditures and Military Modernization

Another critical growth driver for the Israel Armored Vehicle Fire Suppression Systems Market is the substantial increase in government defense expenditures, particularly in countries like Israel, the United States, and nations within the European Union. Governments worldwide are investing heavily in the modernization of military equipment, including the upgrading of armored vehicles to meet evolving defense requirements. This includes the retrofitting of older armored vehicles with the latest fire suppression systems, which enhances the demand for fire suppression technologies. Furthermore, increased geopolitical instability, the ongoing fight against terrorism, and the need for more secure borders are driving defense budgets to rise, particularly in regions such as the Middle East, Asia-Pacific, and Europe. Countries with robust defense industries are seeking to integrate fire suppression systems into their military fleets to ensure operational effectiveness in high-risk environments. Additionally, international collaborations, like the joint efforts between Israel and NATO allies, are fostering a global push for better fire safety technologies in armored vehicles, thereby fueling the market’s growth.

Market Challenges

High Costs of Fire Suppression System Integration

One of the primary challenges faced by the Israel Armored Vehicle Fire Suppression Systems Market is the high cost of integrating advanced fire suppression systems into military vehicles. These systems are highly specialized, often requiring custom designs to fit specific vehicle types, which drives up both manufacturing and installation costs. Additionally, the research and development efforts needed to create state-of-the-art suppression systems require substantial investment, which can be a barrier for smaller defense contractors and emerging markets with limited defense budgets. As military budgets in some countries remain constrained, the adoption of advanced fire suppression technologies is often delayed or limited to only the most critical assets. This challenge is particularly notable in countries that do not have large-scale defense spending, as they may prioritize other military investments over vehicle safety systems, slowing the growth of the market in certain regions.

Technological Integration and Compatibility Issues

The complexity of integrating new fire suppression systems into existing armored vehicles presents another significant challenge for the Israel Armored Vehicle Fire Suppression Systems Market. Armored vehicles, especially older models, often have limited infrastructure that may not easily support the latest suppression technologies. As fire suppression systems become more advanced, they require integration with other vehicle systems, such as electronic sensors, automated control systems, and fire detection components. This level of technological integration can cause compatibility issues, requiring further adaptation of vehicle systems. Additionally, the retrofitting of older military vehicles with modern suppression technologies can lead to logistical challenges, as vehicle upgrades may not always align with the operational needs of the military. These technical and compatibility hurdles can create delays in the market and increase the overall cost of upgrading vehicle fleets, further restricting the growth of the market in certain regions.

Opportunities

Emerging Markets and Retrofit Demand

The growing defense budgets in emerging markets, particularly in Asia-Pacific, Africa, and the Middle East, present significant opportunities for the Israel Armored Vehicle Fire Suppression Systems Market. Many of these countries are modernizing their defense capabilities, including upgrading their armored vehicles to better withstand the evolving nature of modern warfare. As these nations expand their military fleets, the demand for advanced fire suppression systems is increasing, particularly for retrofit solutions that enhance the safety of older vehicles. Retrofit solutions are especially attractive to these countries because they allow for the enhancement of existing vehicle fleets at a lower cost compared to purchasing new vehicles equipped with advanced suppression systems. As emerging economies face rising security threats, they are expected to continue investing in military upgrades, driving demand for fire suppression systems, and offering significant growth opportunities for market players.

Development of Eco-friendly Fire Suppression Technologies

Another key opportunity for the Israel Armored Vehicle Fire Suppression Systems Market lies in the development of more environmentally friendly suppression technologies. With increasing awareness about environmental sustainability, the defense sector is under pressure to adopt greener solutions, including fire suppression systems that have a minimal environmental impact. Traditional fire suppression methods, such as the use of chemical-based agents, can have adverse environmental effects. As a result, there is growing interest in water mist, CO2, and other eco-friendly alternatives that provide the same level of fire protection without harming the environment. This trend is particularly important as defense contractors, including those in Israel, are committed to reducing the carbon footprint of their technologies. As countries worldwide tighten environmental regulations and demand more sustainable military solutions, the adoption of eco-friendly fire suppression systems is expected to grow, providing a new avenue for market expansion.

Future Outlook

The Israel Armored Vehicle Fire Suppression Systems Market is poised for steady growth in the coming years. With increasing geopolitical tensions, higher defense budgets, and technological advancements in military vehicle safety, demand for fire suppression systems is expected to rise. Furthermore, the trend toward sustainable and eco-friendly technologies in defense systems will continue to shape the market, encouraging innovation in the development of greener fire suppression solutions. The market is likely to witness strong growth in emerging regions as military modernization efforts intensify, particularly in the Asia-Pacific and Middle East regions. Regulatory support for improving vehicle safety and international defense collaborations will further contribute to the expansion of the market, making it a key area of investment in the global defense industry.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- BAE Systems

- Kongsberg Gruppen

- Thales Group

- General Dynamics

- Lockheed Martin

- L3 Technologies

- Oshkosh Defense

- Northrop Grumman

- Saab AB

- Textron Systems

- Navistar Defense

- Aerospace Industrial Development Corporation (AIDC)

- Leonardo DRS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- OEM manufacturers of armored vehicles

- Research and development agencies

- Military and defense technology suppliers

- Defense equipment distributors

- Fire suppression technology integrators

Research Methodology

Step 1: Identification of Key Variables

The key variables of the market are identified through data collection from primary sources such as government reports, industry publications, and expert consultations.

Step 2: Market Analysis and Construction

Data from various sources are analyzed to construct a comprehensive market model, assessing market size, growth rates, and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The market analysis model is validated through consultations with industry experts, ensuring that assumptions and data points are accurate.

Step 4: Research Synthesis and Final Output

The final output synthesizes the research findings into a comprehensive report, presenting actionable insights and recommendations based on the validated data.

- Executive Summary

- Research Methodolog (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in fire suppression technology

Increasing defense budgets globally

Rising demand for armored vehicle safety

Technological partnerships with defense contractors

Government regulations enhancing vehicle safety - Market Challenges

High costs of installation and maintenance

Limited awareness in emerging markets

Technological integration complexities

Regulatory compliance issues

Supply chain and material sourcing constraints - Market Opportunities

Growing demand for retrofitting existing vehicles

Development of eco-friendly suppression technologies

Expansion of defense collaborations and partnerships - Trends

Increasing focus on multi-threat protection systems

Rise of automated and remote-controlled suppression systems

Integration of AI for fire detection and suppression

Use of lightweight materials for system components

Growing emphasis on reducing environmental impact of fire suppression systems - Government Regulations & Defense Policy

Strengthened military vehicle safety standards

Increased focus on sustainability in defense technologies

Regulatory push towards improved vehicle fire safety measures

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Vehicle-mounted suppression systems

Modular fire suppression systems

Automated fire detection and suppression systems

Manual fire suppression systems

Multi-zone fire suppression systems - By Platform Type (In Value%)

Tracked vehicles

Wheeled vehicles

Armored personnel carriers

Main battle tanks

Light armored vehicles - By Fitment Type (In Value%)

OEM fitment

Aftermarket fitment

Retrofit installations

Upgraded vehicle systems

Custom fire suppression solutions - By EndUser Segment (In Value%)

Military defense forces

Private defense contractors

Government defense agencies

OEM manufacturers

Research & development sectors - By Procurement Channel (In Value%)

Direct procurement from manufacturers

Procurement through distributors

Government and military tenders

Private sector procurement

Procurement via third-party suppliers - By Material / Technology (in Value%)

Water mist suppression technology

CO2-based suppression systems

Chemical-based fire suppression

Foam suppression technology

Hybrid suppression technologies

- Market share snapshot of major players

- CrossComparison Parameters (Performance, Pricing, Technology, Innovation, Market Penetration, Customer Support, Product Portfolio, Global Presence, Strategic Partnerships, R&D Investment)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Aerospace Industrial Development Corporation (AIDC)

SAMI (Saudi Arabian Military Industries)

General Dynamics Land Systems

BAE Systems

Northrop Grumman

Kongsberg Gruppen

Thales Group

L3 Technologies

Oshkosh Defense

Navistar Defense

Textron Systems

SAAB AB

Rosoboronexport

- Defense forces increasingly adopting advanced suppression systems

- Private contractors investing in high-performance systems

- Demand for retrofitting in older vehicle fleets

- Research and development sectors focusing on innovation in fire safety

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035