Market Overview

The Israel Armored Vehicle Procurement and Upgrade market is projected to reach a substantial size in the coming years, driven by continuous defense modernization and regional security requirements. Based on a recent historical assessment, the market size for 2024 is valued at approximately USD ~ billion. This growth is supported by ongoing investments in military capabilities, technological advancements in armored vehicle systems, and the increasing demand for enhanced protection and mobility in defense operations. With Israel’s strategic focus on improving the operational efficiency of its armored vehicles, the market is positioned for steady growth.

Israel has established itself as a dominant player in the global defense sector due to its advanced technology and significant defense investments. The country’s dominance in the armored vehicle procurement and upgrade market is driven by its robust defense infrastructure, including leading defense contractors such as Rafael Advanced Defense Systems and Elbit Systems. Additionally, Israel’s geopolitical positioning, with an emphasis on border security and military readiness, has prompted substantial governmental spending on defense systems. This has cemented the country’s status as a hub for advanced defense technologies, making it a key player in the global market.

Market Segmentation

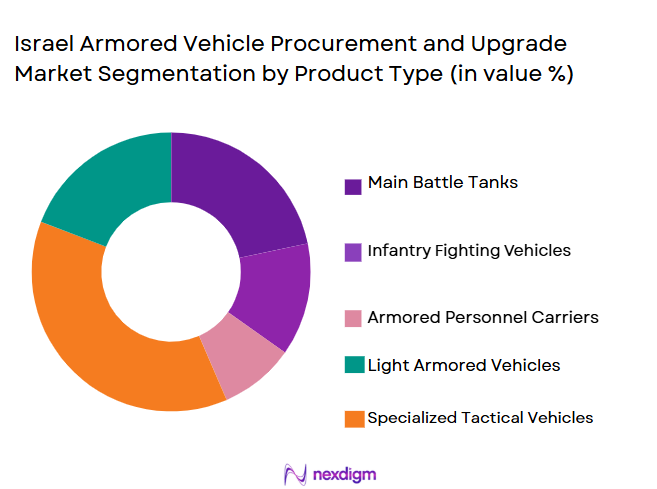

By Product Type

The Israel Armored Vehicle Procurement and Upgrade market is segmented by product type into categories such as Main Battle Tanks, Infantry Fighting Vehicles, Armored Personnel Carriers, Light Armored Vehicles, and Specialized Tactical Vehicles. Recently, the Main Battle Tanks segment has maintained a dominant market share due to their critical role in ensuring battlefield superiority and strategic defense. This dominance is attributed to the increasing focus on military modernization programs that prioritize heavy-duty, versatile vehicles capable of withstanding diverse operational environments and advanced threats. The substantial investments in upgrading tank fleets with state-of-the-art armor, weaponry, and communication systems also contribute to the segment’s leading position.

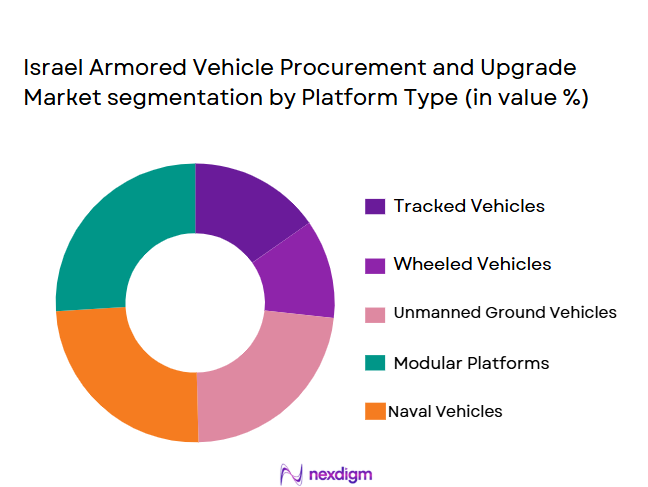

By Platform Type

The Israel Armored Vehicle Procurement and Upgrade market is segmented by platform type into Tracked Vehicles, Wheeled Vehicles, Hybrid Vehicles, Unmanned Vehicles, and Modular Vehicles. Tracked vehicles have consistently dominated this segment due to their superior mobility and durability in various terrains, making them ideal for combat situations. Israel’s focus on terrain adaptability and its requirement for robust defense systems have led to a greater preference for tracked platforms. Additionally, the Israeli Defense Forces (IDF) have a long history of utilizing tracked vehicles, further enhancing their market dominance. Investment in track-based platforms is further strengthened by the vehicles’ ability to support advanced weapon systems and armor solutions.

Competitive Landscape

The Israel Armored Vehicle Procurement and Upgrade market is characterized by intense competition, with several well-established defense companies vying for dominance. Consolidation has occurred in recent years, with key players focusing on innovation and military partnerships to expand their reach. Israel’s defense industry is heavily influenced by its major players, who are at the forefront of providing advanced armored vehicles and upgrade solutions for both domestic and international clients. Their investments in research and development, along with continuous upgrades of military platforms, are key drivers of the market’s evolution.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Defense Capabilities |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

Israel Armored Vehicle Procurement and Upgrade Market Analysis

Growth Drivers

Increasing Geopolitical Instability

Increasing geopolitical instability in the Middle East has significantly contributed to the demand for advanced armored vehicles in Israel. Given the volatile security landscape, Israel’s military has prioritized enhancing its defense systems, which include upgrading and procuring new armored vehicles to bolster national security. The evolving nature of regional threats, ranging from conventional warfare to hybrid and cyber warfare, has underscored the need for robust military infrastructure. As a result, Israel has continued to invest in armored vehicles with cutting-edge protection, mobility, and weaponry. These vehicles are designed to withstand evolving threats, including high-intensity conflicts and asymmetric warfare scenarios. Furthermore, Israel’s strategic defense initiatives have led to collaborations with international defense organizations, which, in turn, have enhanced its capabilities. This growing focus on military preparedness has further driven the demand for advanced armored vehicle procurement and upgrades. The Israeli government’s continued allocation of defense funds, aimed at strengthening military readiness and response capabilities, supports this growth trajectory.

Technological Advancements in Armored Vehicles

The rapid technological advancements in armored vehicles have served as a key driver in the growth of the Israel Armored Vehicle Procurement and Upgrade market. With the increasing integration of digital systems, advanced materials, and precision weaponry, the performance and efficiency of these vehicles have been significantly enhanced. Innovations such as autonomous systems, artificial intelligence, and advanced armor technologies are making armored vehicles more effective in modern combat scenarios. These technologies not only improve vehicle survivability but also enable real-time decision-making and better battlefield management. Israel’s defense sector, known for its emphasis on technological innovation, has been a major player in integrating these advanced technologies into armored vehicle platforms. Consequently, demand for upgraded vehicles that incorporate these innovations is rising, as military forces seek to maintain technological superiority. Additionally, the development of lighter, more agile armored vehicles equipped with high-tech sensors and communication systems has made these vehicles suitable for a wider range of combat and peacekeeping missions, further driving the market’s growth.

Market Challenges

High Upgrade Costs

The high cost of upgrading existing armored vehicle fleets represents a significant challenge for the Israel Armored Vehicle Procurement and Upgrade market. Military modernization programs are often expensive, and the integration of advanced technologies, such as new armor materials and next-generation weapon systems, increases the financial burden. While these upgrades are essential to maintaining military superiority, the budget constraints faced by defense ministries often slow down the pace of procurement and upgrades. The need to balance cost-effective solutions with the demand for cutting-edge technology is a continual challenge for defense contractors in Israel. Additionally, as the complexity of vehicle systems increases, the cost of maintenance and training for personnel also rises. This challenge is compounded by the uncertainty surrounding defense budgets, as geopolitical tensions and global defense trends fluctuate.

Supply Chain Disruptions

Supply chain disruptions have become a critical challenge for the Israel Armored Vehicle Procurement and Upgrade market, as defense manufacturers rely on a vast network of suppliers for various components, including electronics, armor materials, and weapon systems. Global supply chain issues, particularly in the wake of the COVID-19 pandemic, have impacted the timely delivery of components, leading to delays in production and upgrades. In addition, trade restrictions, geopolitical tensions, and natural disasters can disrupt the availability of critical materials, further exacerbating the challenges faced by defense contractors. As the complexity of armored vehicles increases, supply chain dependencies become more intricate, and delays can result in missed deadlines and cost overruns. The ability to manage these disruptions and ensure a steady supply of high-quality components is vital for maintaining the smooth operation of military programs and protecting national security interests.

Opportunities

Autonomous Armored Vehicles

One of the most promising opportunities in the Israel Armored Vehicle Procurement and Upgrade market is the integration of autonomous technologies into military vehicles. Israel’s advanced defense technology sector is already exploring unmanned vehicles capable of performing complex battlefield tasks without human intervention. These autonomous vehicles are expected to revolutionize military operations, enhancing both efficiency and safety. By reducing the risk to human life, these vehicles can be deployed in high-risk environments, such as minefields or conflict zones, where human-operated vehicles would be vulnerable. Moreover, autonomous systems can be equipped with advanced sensors and communication systems, enabling better situational awareness and faster decision-making on the battlefield. As Israel continues to lead in defense innovation, the development of autonomous armored vehicles presents an exciting growth opportunity in the coming years.

International Defense Partnerships

Another significant opportunity for the Israel Armored Vehicle Procurement and Upgrade market lies in expanding international defense partnerships. Israel has long been known for its strong defense industry and has built strategic alliances with countries across Europe, North America, and Asia. By expanding these partnerships and offering tailored solutions for foreign military forces, Israeli defense contractors can tap into new revenue streams and broaden their market reach. These international collaborations are especially valuable in the context of upgrading existing fleets, as many countries look to modernize their armored vehicle systems with advanced Israeli technologies. As global defense spending continues to rise, international defense partnerships represent a key avenue for growth and market expansion for Israel’s defense industry.

Future Outlook

The future outlook for the Israel Armored Vehicle Procurement and Upgrade market is promising, with strong growth expected over the next five years. Technological advancements in armor and weaponry, combined with increased demand for security in volatile regions, are driving the market forward. Additionally, Israel’s defense infrastructure continues to modernize, paving the way for more sophisticated armored vehicles that can meet the evolving needs of the military. With further investments in autonomous systems, AI, and modular vehicle platforms, Israel is well-positioned to lead in the global armored vehicle market. The continued focus on strategic defense initiatives and international partnerships will further bolster Israel’s market position, ensuring sustained demand for its armored vehicle procurement and upgrade solutions.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- General Dynamics

- BAE Systems

- Lockheed Martin

- Thales Group

- Northrop Grumman

- Navistar Defense

- Oshkosh Defense

- L3Harris Technologies

- Saab Group

- BAE Systems Hagglunds

- Kongsberg Gruppen

- ST Engineering

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense industry manufacturers

- International defense agencies

- National defense forces

- Private sector defense companies

- Aerospace and defense equipment suppliers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the core market variables such as technological advancements, market size, and demand drivers.

Step 2: Market Analysis and Construction

In this phase, detailed market analysis is conducted, including assessing market trends, segmentation, and key drivers.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts help validate the hypotheses and assumptions made during market analysis.

Step 4: Research Synthesis and Final Output

Data and findings are synthesized into a comprehensive report, with final analysis and forecasting included.

- Executive Summary

- Israel Armored Vehicle Procurement and Upgrade Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets

Technological Advancements in Armored Vehicles

Rising Geopolitical Tensions in the Middle East - Market Challenges

High Cost of Upgrades

Supply Chain Disruptions

Complexity of Integration with Existing Systems - Market Opportunities

Emerging Demand for Autonomous Armored Vehicles

Increasing Focus on Modular Design

Expansion of Strategic Defense Partnerships - Trends

Adoption of Advanced Armoring Technologies

Integration of AI and Autonomous Capabilities

Collaborative Military Upgrades - Government Regulations & Defense Policy

Tightening Defense Regulations on Procurement Processes

Development of New Security Frameworks

Increased Focus on Sustainable and Green Technologies - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Battle Tanks

Infantry Fighting Vehicles

Armored Personnel Carriers

Light Armored Vehicles

Specialized Tactical Vehicles - By Platform Type (In Value%)

Tracked Vehicles

Wheeled Vehicles

Hybrid Vehicles

Unmanned Vehicles

Modular Vehicles - By Fitment Type (In Value%)

Factory-Fitted Upgrades

Retrofit Solutions

OEM Modifications

Third-Party Upgrades

Self-Initiated Modifications - By EndUser Segment (In Value%)

National Defense Forces

Military Contractors

Private Defense Companies

International Defense Forces

Government and Military Agencies - By Procurement Channel (In Value%)

Direct Government Procurement

Through Military Contractors

Foreign Military Sales

Private Defense Procurement

Joint Ventures & Collaborations

- Market Share Analysis

- Cross Comparison Parameters

(Technology, Platform Compatibility, Procurement Strategy, Cost Efficiency, Upgrade Flexibility, Geographic Reach, Customer Support, Compliance, System Complexity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

General Dynamics

BAE Systems

Lockheed Martin

Thales Group

Northrop Grumman

Navistar Defense

Oshkosh Defense

L3Harris Technologies

Saab Group

BAE Systems Hagglunds

Kongsberg Gruppen

ST Engineering

- Demand from Defense Forces for Specialized Vehicles

- Government-Driven Infrastructure and Procurement Projects

- International Demand for Israeli Upgrades

- Private Sector’s Role in Armored Vehicle Innovations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035