Market Overview

The Israel Armored Vehicles Navigation Systems market is estimated to reach a value of approximately USD ~ billion based on a recent historical assessment. This growth is driven by increasing defense budgets across Israel and its allies, which is fueling demand for advanced navigation solutions in armored vehicles. The market is also propelled by ongoing military modernization programs, which emphasize enhanced navigation capabilities, especially in unmanned and autonomous platforms. The technological advancements in GPS and inertial navigation systems further contribute to the market’s expansion.

Israel is one of the key players in this market due to its advanced defense technologies and strategic military position. The country’s leading defense companies, such as Israel Aerospace Industries and Elbit Systems, play a pivotal role in the development and supply of navigation systems. The demand for these systems is driven by Israel’s constant need for advanced military equipment and its ongoing defense collaborations with various nations. Its geographic location and political significance in the Middle East further amplify its dominance in the sector.

Market Segmentation

By Product Type

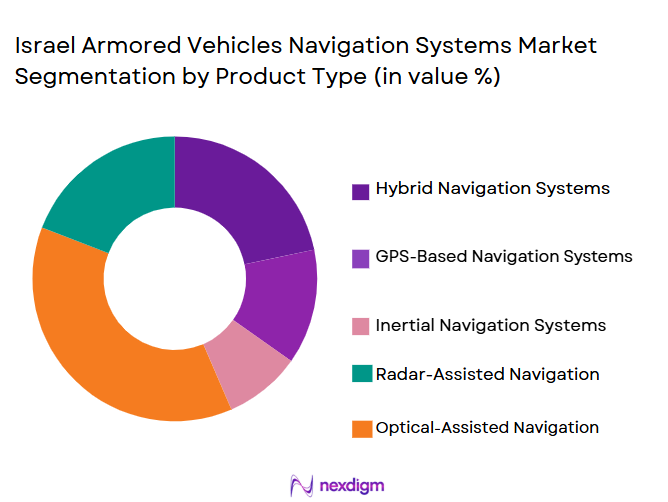

The Israel Armored Vehicles Navigation Systems market is segmented by product type into GPS-based navigation systems, inertial navigation systems, hybrid systems, radar-assisted navigation systems, and optical navigation systems. Recently, GPS-based navigation systems have held a dominant market share due to their widespread adoption in both military and law enforcement applications. This dominance can be attributed to the systems’ reliability, cost-effectiveness, and ease of integration with existing platforms. Their integration into unmanned ground vehicles and their use in real-time tactical operations further solidify their market position.

By Platform Type

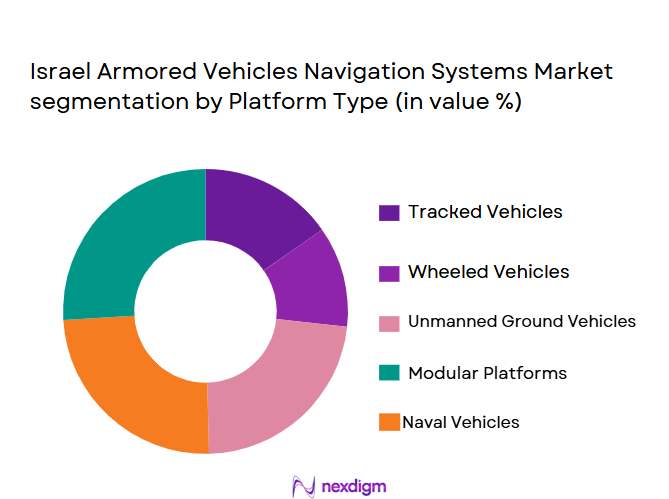

The market is also segmented by platform type into tracked vehicles, wheeled vehicles, unmanned ground vehicles, modular platforms, and naval vehicles. Tracked vehicles dominate the market due to their robust design and versatility in various terrains, making them the primary choice for military operations in challenging environments. The demand for tracked vehicles in military and defense applications, especially for combat and armored vehicles, drives this segment’s growth. The adoption of hybrid propulsion systems and automated navigation technologies in tracked vehicles further enhances their market share.

Competitive Landscape

The Israel Armored Vehicles Navigation Systems market is highly competitive, characterized by both global and regional players. Major defense companies continue to dominate, but there is also increasing consolidation among smaller firms due to the high costs of research, development, and integration. These companies are focusing on technological advancements and forming strategic alliances with military contractors and government agencies. The market is influenced by the need for high-performance, cost-effective systems to meet the growing demand from military organizations globally.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Military Collaboration |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1982 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

Israel armored vehicles navigation system Market Analysis

Growth Drivers

Advancements in Autonomous Systems

The increasing focus on automation in military vehicles is a significant growth driver for the Israel Armored Vehicles Navigation Systems market. Autonomous systems, which rely on highly accurate navigation for effective operation, are being integrated into various armored vehicles, especially unmanned ground vehicles. The demand for autonomous technology is being fueled by the need for safer, more efficient military operations in hostile environments. Israel’s advanced defense technology sector is at the forefront of developing autonomous navigation systems for these vehicles. As the technology matures, defense agencies are allocating larger portions of their budgets to the development and procurement of autonomous systems. Furthermore, the growing trend of reducing human involvement in high-risk military operations enhances the adoption of unmanned vehicles, which drives demand for precise navigation systems. This shift towards automation and the integration of next-generation sensors in navigation solutions are expected to further propel market growth.

Increased Defense Spending

A second key growth driver for this market is the rise in defense spending globally, particularly in countries like Israel, the United States, and European nations. Rising geopolitical tensions and an increasing focus on national security have led to higher investments in defense and military technologies. Israel, with its strategic location and security challenges, continuously modernizes its defense infrastructure, which includes the procurement of advanced armored vehicles equipped with cutting-edge navigation systems. Furthermore, international defense collaborations and agreements are also driving the demand for advanced navigation solutions in armored vehicles. With many countries upgrading their military fleets, the market for high-performance navigation systems in armored vehicles is set to expand further. Enhanced navigation systems are crucial for improving operational effectiveness in complex, evolving combat scenarios. This increase in defense expenditure is a major catalyst for the market, fueling technological innovation and driving the demand for advanced navigation systems.

Market Challenges

Integration Complexities with Legacy Platforms

A significant challenge facing the Israel Armored Vehicles Navigation Systems market is the integration of modern navigation technologies with legacy armored vehicle platforms. Many military forces continue to use older platforms, which were not designed to accommodate the advanced navigation systems required today. Retrofitting these systems into existing vehicles presents several challenges, including the high cost of integration, potential operational disruptions, and technical limitations of older vehicle architectures. Moreover, military organizations often have tight budgets and are unwilling to replace entire fleets, which further complicates the adoption of new technologies. As a result, the process of updating and integrating navigation systems into older armored vehicles slows down the overall market growth. These integration challenges require innovative solutions that can bridge the gap between new technologies and existing infrastructure while minimizing downtime and cost.

Supply Chain and Component Shortages

Another challenge is the global supply chain disruptions and component shortages, which have affected the defense industry at large. The market for armored vehicle navigation systems relies on highly specialized components such as GPS modules, inertial sensors, and radar technologies. Supply chain disruptions, particularly in the wake of the COVID-19 pandemic, have led to delays in production and increased costs for these components. Additionally, geopolitical tensions and trade restrictions between major global powers can hinder the smooth flow of critical materials needed for advanced navigation systems. These factors increase production costs and delay the delivery of systems to defense agencies, limiting the overall market expansion. As a result, players in the market must find ways to mitigate these risks by diversifying suppliers and optimizing their supply chain strategies to ensure timely delivery of navigation systems.

Opportunities

Growth in Hybrid and Electric Vehicles

The growing trend of hybrid and electric propulsion systems in armored vehicles presents a significant opportunity for the Israel Armored Vehicles Navigation Systems market. As military forces and defense contractors increasingly look to reduce fuel consumption and lower emissions, there is a shift towards hybrid and electric platforms. These vehicles require specialized navigation systems to ensure operational efficiency in a wide range of terrains. Navigation systems designed for electric and hybrid vehicles must account for unique challenges, such as energy management, real-time optimization, and low-power operations. This shift towards more sustainable armored vehicles offers a lucrative opportunity for companies that can provide advanced navigation solutions tailored to these new platforms. With defense agencies prioritizing environmental sustainability, the demand for navigation systems designed for hybrid and electric military vehicles is expected to rise significantly.

Strategic Military Alliances and Export Opportunities

Another key opportunity lies in the growing number of strategic military alliances and defense collaborations across the globe. Countries are increasingly partnering with one another to enhance their collective security and strengthen defense capabilities. Israel’s advanced defense technology, particularly in navigation systems, is in high demand from countries seeking to upgrade their military assets. This opens up export opportunities for Israeli defense companies, enabling them to enter new markets and expand their global presence. Furthermore, international collaborations allow Israeli defense firms to work closely with foreign governments and contractors to develop tailor-made navigation solutions for armored vehicles. With the rise of defense procurement programs in countries like India, Saudi Arabia, and Turkey, Israeli companies have a substantial opportunity to grow their market share by providing advanced navigation systems for armored vehicles.

Future Outlook

The future outlook for the Israel Armored Vehicles Navigation Systems market is positive, driven by increasing demand for advanced technology in defense and military operations. The market is expected to experience steady growth over the next five years, fueled by the rising adoption of autonomous and hybrid systems in military vehicles. Technological advancements, particularly in GPS, inertial navigation, and radar-assisted solutions, will continue to drive innovation in this space. Additionally, increasing defense budgets globally will provide the necessary financial resources to support the development and procurement of advanced navigation systems. Regulatory support for defense procurement and the growing need for secure and efficient navigation solutions will further bolster the market’s growth. As the sector adapts to the needs of modern warfare, including unmanned systems and hybrid platforms, the demand for sophisticated navigation technologies is expected to rise.

Major Players

• Rafael Advanced Defense Systems

• Elbit Systems

• Thales Group

• Lockheed Martin

• General Dynamics

• BAE Systems

• Northrop Grumman

• L3 Technologies

• Saab Group

• Rockwell Collins

• Harris Corporation

• Cobham PLC

• Thales Alenia Space

• Leonardo S.p.A.

Key Target Audience

• Government and regulatory bodies

• Military contractors

• Defense procurement departments

• Armored vehicle manufacturers

• System integrators

• Defense equipment suppliers

• International defense alliances

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key factors that influence the market, including technology trends, military spending, and defense policies.

Step 2: Market Analysis and Construction

In this step, historical data and market trends are analyzed to construct the market landscape and estimate growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

The next phase involves validating market hypotheses through consultations with industry experts, defense contractors, and military officials.

Step 4: Research Synthesis and Final Output

After synthesizing the data, the final market report is compiled, ensuring accuracy and relevance in the conclusions.

- Executive Summary

- Israel Armored Vehicles Navigation Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for advanced navigation in military applications

Growing adoption of unmanned and autonomous vehicle systems

Ongoing defense modernization programs - Market Challenges

High cost of advanced navigation systems

Integration complexities with legacy platforms

Varying defense budgets across nations - Market Opportunities

Rising focus on defense automation and AI-based navigation

Expansion of defense collaborations in the Middle East

Development of hybrid and cost-effective navigation solutions - Trends

Integration of GPS and inertial systems for enhanced accuracy

Advancements in real-time data processing for navigation

Growth in vehicle electrification driving demand for navigation systems - Government Regulations & Defense Policy

Strict certification for military-grade navigation systems

Regulation of defense exports in the region

Increase in defense spending promoting R&D for advanced technologies - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hybrid Navigation Systems

GPS-Based Navigation Systems

Inertial Navigation Systems

Radar-Assisted Navigation Systems

Optical Navigation Systems - By Platform Type (In Value%)

Tracked Vehicles

Wheeled Vehicles

Unmanned Ground Vehicles

Modular Platforms

Naval Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Integrated Fitment

Modular Fitment

Stand-Alone Fitment - By EndUser Segment (In Value%)

Military Armored Vehicles

Law Enforcement Armored Vehicles

Defense Contractors

Government Fleet Vehicles

Private Security Armored Vehicles - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Contracts

Third-Party Distributors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters

(Technology, Platform Compatibility, Market Reach, Production Capacity, Customer Support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

Thales Group

Lockheed Martin

General Dynamics

BAE Systems

Northrop Grumman

L3 Technologies

Saab Group

Rockwell Collins

Harris Corporation

Cobham PLC

Thales Alenia Space

Leonardo S.p.A.

- Increased investment by government agencies

- Shift toward autonomous systems in defense

- Focus on robust vehicle reliability and performance

- Growing demand for mobile security solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035