Market Overview

The market for artillery ammunition casings in Israel is projected to reach a substantial size, driven by a combination of strategic defense priorities and technological advancements in military ammunition production. As of the latest assessments, the market size for artillery ammunition casings stands at over USD ~ billion, supported by investments in military modernization and defense infrastructure. These expenditures are largely directed towards improving the durability, accuracy, and effectiveness of artillery shells, positioning the industry for consistent growth. The market’s expansion is further bolstered by the growing demand for advanced weaponry systems across Israel’s defense sector, with a notable increase in modernization efforts.

Israel continues to dominate the artillery ammunition casing market, benefiting from its advanced technological capabilities and well-established defense infrastructure. Major urban centers such as Tel Aviv and Haifa are critical to this market due to their proximity to military manufacturing facilities and defense contractors. The government’s ongoing investment in defense R&D, as well as its strategic position in the Middle East, further strengthens Israel’s leadership in this space. International collaborations, particularly in the defense and aerospace sectors, contribute to Israel’s competitive edge, enabling the country to maintain a robust position in global defense markets.

Market Segmentation

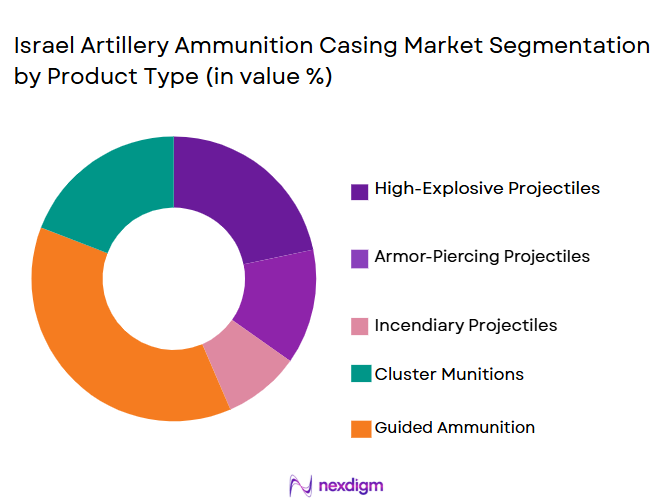

By Product Type

The artillery ammunition casing market is segmented by product type into several categories, with high-explosive projectiles currently holding the largest market share. This dominance is driven by the ongoing demand for precision-guided munitions and the advancement of explosive technologies. High-explosive projectiles are a crucial component of artillery systems, providing the necessary force to achieve desired battlefield effects. Factors such as rising military budgets, enhanced defense capabilities, and the strategic importance of artillery in modern warfare all contribute to the dominance of this sub-segment. With continued advancements in shell casing technology, the high-explosive projectiles remain central to artillery modernization efforts.

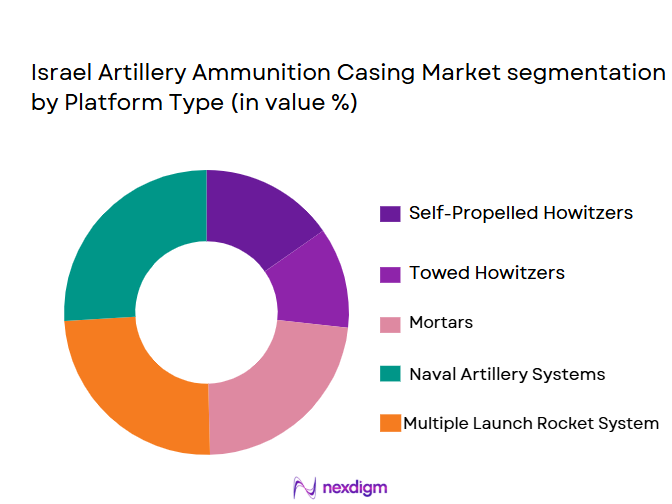

By Platform Type

The artillery ammunition casing market is also segmented by platform type, with self-propelled howitzers taking the largest share. The increasing adoption of self-propelled artillery units, owing to their mobility and firepower, has led to this sub-segment’s dominance. These systems offer strategic advantages, such as faster repositioning and effective long-range artillery support. The demand for advanced self-propelled howitzers is being driven by the military’s need for greater mobility, fire support, and precision. Additionally, the integration of modern targeting and navigation systems into these platforms further reinforces the growth of this sub-segment.

Competitive Landscape

The competitive landscape of the artillery ammunition casing market is characterized by a few dominant players who significantly influence market dynamics. Consolidation within the sector has intensified, with major defense companies forming strategic partnerships to enhance technological development and expand their market reach. Key players are continuously innovating in terms of materials and manufacturing processes to improve the performance and durability of artillery casings. The market also sees a significant number of regional and international players vying for contracts, contributing to the competitive nature of the industry.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Tadiran Electronic Systems | 1967 | Petah Tikva | ~ | ~ | ~ | ~ | ~ |

Israel artillery ammunition casing Market Analysis

Growth Drivers

Increased Military Budgets

As global defense budgets rise, particularly in Israel, there is an increasing emphasis on modernizing and enhancing military capabilities. A significant part of this effort involves upgrading artillery systems, including artillery ammunition casings, to ensure they meet the demands of modern warfare. Rising threats and geopolitical tensions drive governments to prioritize military spending, creating a larger pool of defense contracts for suppliers in the ammunition industry. In addition to conventional artillery, there is also growing demand for advanced projectiles and shells, prompting manufacturers to innovate in casing designs. Technological advancements, such as the development of lighter and more durable materials, are a key factor contributing to the growth of the market. The need for superior artillery firepower, especially in Israel’s strategic defense postures, further enhances demand for high-quality ammunition casings. Additionally, as military forces around the world modernize their arsenals, the demand for more efficient and cost-effective munitions has significantly risen. The continued enhancement of artillery systems to address modern battlefield challenges is expected to drive sustained growth in the artillery ammunition casing market.

Technological Advancements in Ammunition Design

The development of more advanced artillery systems is another key growth driver in the market. Innovations in projectile design, particularly the integration of smart munitions, require the use of highly specialized casings. Advances in materials science and the application of cutting-edge manufacturing techniques, such as 3D printing, have also played a significant role in shaping the future of artillery ammunition casings. These technological breakthroughs result in casings that are lighter, stronger, and more reliable, enhancing their overall performance. The demand for artillery systems capable of engaging targets at longer ranges with greater precision has led to greater investment in the development of new casing technologies. Furthermore, the shift towards eco-friendly materials and the implementation of advanced manufacturing processes contribute to the overall technological advancement of the sector. These developments not only improve the performance of individual projectiles but also offer manufacturers a competitive edge in meeting the evolving needs of the global defense industry.

Market Challenges

High Production Costs

One of the significant challenges facing the artillery ammunition casing market is the high cost of production. The manufacturing of advanced ammunition casings requires the use of expensive materials such as high-strength alloys and composites, which can be costly to procure and process. Furthermore, the intricate manufacturing processes involved in producing specialized casings add to the overall production costs. These expenses are compounded by the need for strict quality control measures and compliance with regulatory standards, which further increase operational costs. For many defense contractors and military organizations, managing the cost of producing artillery ammunition casings is an ongoing challenge. While technological advancements and innovations in manufacturing processes can help reduce these costs, the expense of materials and the complexity of production still pose significant barriers. Consequently, defense organizations are often forced to balance cost constraints with the need for high-performance munitions, which impacts both procurement strategies and market dynamics.

Geopolitical Tensions and Supply Chain Disruptions

Geopolitical instability in key regions, particularly in the Middle East, often leads to unpredictable disruptions in the supply chain for military products, including artillery ammunition casings. Conflicts, trade barriers, and fluctuating regulations across different countries can cause delays in production and shipment, impacting the availability of critical components. Additionally, the imposition of sanctions or restrictions on defense trade can further exacerbate supply chain challenges. These disruptions can create bottlenecks in manufacturing, resulting in delays in the delivery of artillery systems and ammunition. Military contractors must navigate these complex geopolitical dynamics to secure the necessary raw materials, components, and equipment for the production of ammunition casings. This challenge not only affects the cost of production but also introduces uncertainty into long-term procurement plans and defense strategies. The impact of geopolitical tensions on the supply chain is likely to remain a critical challenge for the artillery ammunition casing market.

Opportunities

Emerging Market Demand

There is a growing demand for artillery ammunition casings in emerging markets, particularly in regions with increasing defense budgets and military modernization efforts. Countries in Asia, Africa, and Latin America are ramping up their military capabilities, creating new opportunities for suppliers of artillery systems and components. These markets are looking to modernize their military forces, focusing on upgrading artillery units and enhancing their operational readiness. The growing geopolitical instability in some of these regions, combined with the desire to improve defense infrastructure, is driving this demand. Suppliers can benefit from establishing partnerships with local defense contractors and governments to meet the specific needs of these markets. As emerging markets invest in their defense sectors, the artillery ammunition casing market is poised for growth in these regions. Furthermore, the rise of regional conflicts and security concerns is expected to contribute to the increased adoption of advanced artillery systems, driving further demand for high-quality ammunition casings.

Focus on Eco-friendly Ammunition Solutions

There is a significant opportunity for manufacturers to develop more sustainable and eco-friendly artillery ammunition casings. With growing awareness of environmental issues, there is increasing pressure on defense contractors to consider the ecological impact of their products. This includes reducing the environmental footprint of ammunition casings by using recyclable materials and minimizing the release of harmful substances during manufacturing and disposal. Military forces are also beginning to prioritize sustainability in their procurement strategies, which presents an opportunity for manufacturers to differentiate themselves by offering environmentally friendly solutions. The shift towards green technologies in the defense sector is likely to continue, driven by both regulatory pressures and consumer demand for more sustainable products. Companies that focus on developing environmentally friendly artillery ammunition casings will be better positioned to meet the evolving needs of the defense industry and capitalize on this emerging trend.

Future Outlook

Over the next five years, the artillery ammunition casing market is expected to experience steady growth, driven by increasing defense budgets, ongoing military modernization, and technological advancements. The market will benefit from the adoption of smarter, more durable ammunition systems that enhance overall performance. Additionally, global defense initiatives focusing on sustainability and eco-friendly technologies will shape future product development. With increasing demand from both established and emerging markets, the outlook for the artillery ammunition casing market remains positive, providing ample opportunities for market players to expand their reach.

Major Players

• Rafael Advanced Defense Systems

• IMI Systems

• Israel Aerospace Industries

• Tadiran Electronic Systems

• General Dynamics Ordnance and Tactical Systems

• BAE Systems

• Lockheed Martin

• Northrop Grumman

• L3 Technologies

• Rheinmetall Defence

• Leonardo S.p.A.

• Thales Group

• Denel Land Systems

• Kongsberg Defence & Aerospace

Key Target Audience

• Government and regulatory bodies

• Defense contractors

• Military agencies

• Aerospace manufacturers

• Research and development institutions

• Armament manufacturers

• Ammunition suppliers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the primary variables impacting the artillery ammunition casing market, including technological advancements, market demand, and regulatory factors.

Step 2: Market Analysis and Construction

A thorough analysis of market trends, including historical data and future forecasts, is conducted to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation is sought to validate assumptions and hypotheses regarding market dynamics, product innovation, and competitive landscape.

Step 4: Research Synthesis and Final Output

The final research report is synthesized, including data analysis, conclusions, and actionable insights, presented to stakeholders for decision-making.

- Executive Summary

- Israel Artillery Ammunition Casing Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Expenditures

Technological Advancements in Ammunition Design

Rising Demand for Military Modernization - Market Challenges

High Production Costs

Stringent Regulations on Ammunition Manufacturing

Geopolitical Instability and Supply Chain Disruptions - Market Opportunities

Increased Military Collaborations

Emerging Markets Demand for Artillery Ammunition

Advancements in Ammunition Reusability - Trends

Shift towards Environmentally Friendly Ammunition

Integration of Smart Ammunition Systems

Adoption of Advanced Manufacturing Techniques - Government Regulations & Defense Policy

Defense Budget Allocation Policies

Export Control Regulations

Ammunition Safety Standards - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

High-Explosive Projectiles

Armor-Piercing Projectiles

Incendiary Projectiles

Cluster Munitions

Guided Ammunition - By Platform Type (In Value%)

Self-Propelled Howitzers

Towed Howitzers

Mortars

Naval Artillery Systems

Multiple Launch Rocket Systems - By Fitment Type (In Value%)

Standard Casing

Enhanced Casing

Lightweight Casing

Reinforced Casing

Specialized Casing - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Defense Agencies

Ammunition Manufacturers

Research and Development Organizations - By Procurement Channel (In Value%)

Direct Procurement by Government

Procurement by Defense Contractors

Private Sector Procurement

International Military Procurement

Third-Party Suppliers

- Market Share Analysis

- Cross Comparison Parameters

(Material Strength, Durability, Weight, Cost Efficiency, Production Lead Time) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

IMI Systems

Israel Military Industries

Tadiran Electronic Systems

Carmor Ltd

Soltam Systems

IAI – Israel Aerospace Industries

Oshkosh Defense

Boeing Defense, Space & Security

Lockheed Martin

General Dynamics Ordnance and Tactical Systems

BAE Systems

Northrop Grumman

L3 Technologies

- Military Forces are the largest consumers of artillery ammunition casings.

- Government defense agencies often opt for long-term procurement contracts.

- Defense contractors play a critical role in the development and customization of casings.

- Research and development organizations drive innovations in casing materials and design.

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035