Market Overview

The Israel artillery ammunition market is valued at approximately USD ~ million, driven by the country’s ongoing investments in advanced military technology, modernization of defense systems, and its strategic positioning in the Middle East. A recent historical assessment indicates an increase in demand for precision-guided ammunition due to the military’s emphasis on improving the accuracy and lethality of artillery systems. Technological advancements in smart munitions, along with strategic defense alliances, contribute significantly to this growth, further boosting the market size.

Israel continues to dominate the artillery ammunition market in the Middle East, owing to its highly advanced defense capabilities, strong government-backed defense spending, and robust technological innovation. The country’s military forces benefit from well-established infrastructure, cutting-edge research and development, and strategic partnerships with global defense contractors. Moreover, Israel’s geographical positioning and its security concerns have fostered a significant demand for advanced artillery ammunition in both domestic and international markets.

Market Segmentation

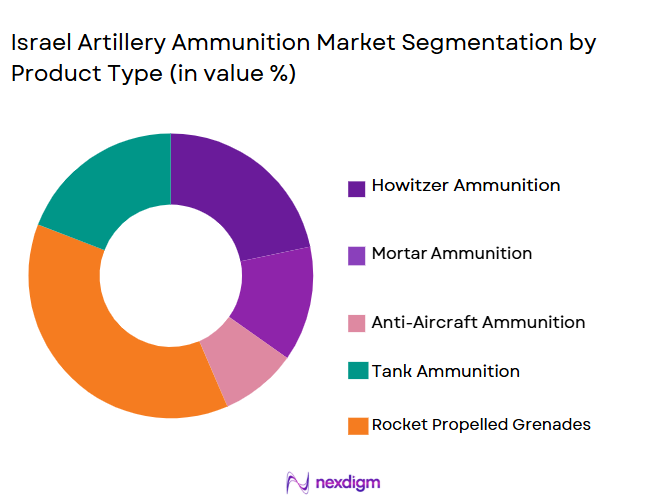

By Product Type

The Israel artillery ammunition market is segmented by product type into Howitzer Ammunition, Mortar Ammunition, Anti-Aircraft Ammunition, Tank Ammunition, and Rocket Propelled Grenades. Recently, Howitzer Ammunition has a dominant market share due to factors such as increasing demand for long-range firepower and its enhanced accuracy in modern artillery systems. This type of ammunition is crucial for Israel’s defense strategy, particularly in its border security operations, as it provides versatile capabilities for both offensive and defensive strategies. Furthermore, technological innovations in guided howitzer shells have made them an essential component of Israel’s military arsenal, reinforcing their dominant position in the market.

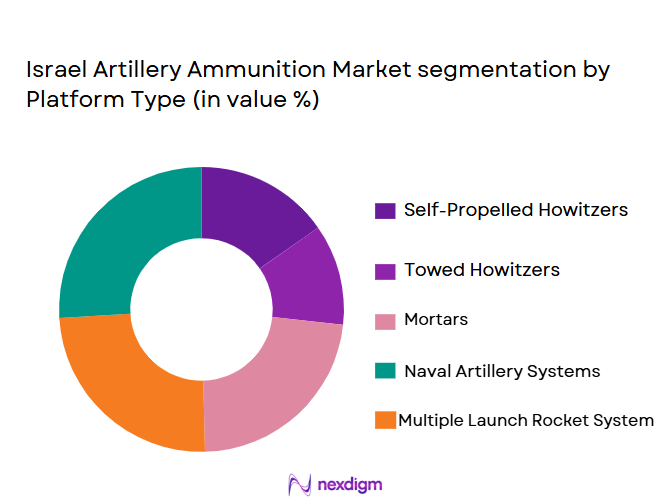

By Platform Type

The Israel artillery ammunition market is segmented by platform type into Self-Propelled Artillery, Towed Artillery, Multiple Launch Rocket Systems, Airborne Artillery, and Naval Artillery. Self-Propelled Artillery dominates the market share due to the increasing preference for mobility and quick deployment. Israel’s self-propelled artillery systems are equipped with advanced targeting and fire control systems, which enhance operational efficiency and versatility, particularly in rapid-response situations. These systems are highly valued for their ability to provide both fire support and protection in dynamic battlefield environments, making them a key component of Israel’s artillery arsenal.

Competitive Landscape

The competitive landscape of the Israel artillery ammunition market is characterized by a mix of global and domestic players, with significant consolidation occurring due to mergers, acquisitions, and collaborations between defense contractors. The market is influenced by major players like Elbit Systems, Rafael Advanced Defense Systems, and Israel Military Industries, which dominate the domestic supply of artillery ammunition. These players focus on continuous innovation, driving technological advancements and maintaining strong relationships with government and military agencies. As the market continues to evolve, the role of advanced military technology, particularly in guided munitions, will remain pivotal.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Military Industries (IMI) | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Krass-Maffei Wegmann | 1931 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Israel artillery ammunition Market Analysis

Growth Drivers

Increasing Defense Budget

Increased defense expenditure in Israel, driven by geopolitical tensions in the Middle East, plays a critical role in propelling the artillery ammunition market. As Israel continues to modernize its military infrastructure and strengthen its defense capabilities, there is a rising demand for more advanced, precise, and efficient artillery systems. The nation’s commitment to investing in cutting-edge defense technology has made artillery ammunition a central component of its military strategy. This trend has spurred the development and deployment of more sophisticated munitions, fostering market growth by expanding the demand for high-tech artillery solutions.

Technological Advancements in Munitions

The ongoing development of precision-guided artillery munitions has significantly enhanced the effectiveness and accuracy of artillery systems, contributing to the growing demand for advanced ammunition. Israel’s military is at the forefront of this development, leveraging its technological prowess to create ammunition that is not only more accurate but also more versatile in various combat scenarios. The shift from traditional munitions to precision-guided projectiles allows for more strategic and effective military operations, ensuring better-targeted strikes while minimizing collateral damage. This growth driver ensures sustained market expansion as countries in the region and globally seek to modernize their artillery capabilities with similar advancements.

Market Challenges

High Manufacturing Costs

One of the primary challenges in the Israel artillery ammunition market is the high cost of production, driven by the advanced technology and precision required to produce modern artillery shells. The demand for more sophisticated, smart munitions adds to the overall production cost, placing pressure on defense contractors to innovate while maintaining cost-effectiveness. Additionally, the limited number of manufacturers capable of producing these advanced systems further exacerbates the challenge, as competition among suppliers remains tight. To counteract these challenges, manufacturers are exploring ways to streamline production processes, such as increasing automation in munitions manufacturing and focusing on cost-reduction strategies in research and development.

Regulatory Barriers and Export Control

Another significant challenge faced by the artillery ammunition market in Israel is the stringent export control regulations imposed by the government. These regulations govern the trade of defense-related products, including artillery ammunition, and can limit market access for international buyers. While Israel has an established reputation as a defense exporter, changes in international policies and political landscapes can disrupt export patterns. The need for compliance with these regulations often results in delays or limitations in fulfilling orders from overseas clients, hindering the market’s global expansion potential. Manufacturers must navigate these regulatory frameworks while still maintaining efficient and timely operations to meet demand.

Opportunities

Expansion in Global Defense Markets

Israel’s artillery ammunition market has significant growth potential in global defense markets. As geopolitical instability continues to rise in regions such as Eastern Europe, the Middle East, and Asia, international demand for advanced military systems, including artillery ammunition, is expected to increase. Israel’s well-established defense industry, combined with its advanced technological capabilities, positions it as a key player in providing high-quality ammunition to countries seeking to modernize their military assets. Defense partnerships with nations requiring upgraded artillery capabilities present an opportunity for expansion, particularly in regions where Israel has built strong strategic relationships.

Collaboration with Global Defense Contractors

Israel’s defense industry has the opportunity to further strengthen its position through collaborations and partnerships with global defense contractors. Joint ventures, licensing agreements, and technology transfer initiatives can help increase the availability of Israeli-made artillery munitions in international markets. These partnerships can also drive further innovations, particularly in the areas of guided munitions, while expanding Israel’s market presence and addressing global defense needs. Collaborating with international firms can enable Israeli manufacturers to access broader markets, create cost-effective production solutions, and ensure a continuous supply of advanced artillery systems.

Future Outlook

Over the next five years, the artillery ammunition market is expected to experience sustained growth, driven by advancements in munitions technology, expanding global defense spending, and the increasing need for precision in military operations. Technological developments, particularly in smart munitions and automation in production, will continue to play a crucial role in shaping market trends. With strong governmental support for defense innovation and strategic military alliances, the market is poised for continued demand from both domestic and international buyers, providing significant opportunities for manufacturers.

Major Players

• Rafael Advanced Defense Systems

• Israel Military Industries (IMI)

• Krass-Maffei Wegmann

• Lockheed Martin

• BAE Systems

• Northrop Grumman

• General Dynamics

• Thales Group

• Saab AB

• Textron Systems

• Denel SOC

• L3Harris Technologies

• Hanwha Defense

• Sagem Defense

Key Target Audience

• Government and regulatory bodies

• Defense contractors

• Military agencies

• International defense suppliers

• Manufacturers of military technology

• Strategic defense alliances

• Private defense companies

Research Methodology

Step 1: Identification of Key Variables

Defining critical factors affecting the artillery ammunition market, such as technological advancements, demand drivers, and regulatory frameworks.

Step 2: Market Analysis and Construction

Analyzing historical data, industry trends, and consumer behavior to construct a comprehensive market model and forecast.

Step 3: Hypothesis Validation and Expert Consultation

Consulting industry experts, conducting primary interviews, and validating assumptions to ensure accuracy and reliability in the research approach.

Step 4: Research Synthesis and Final Output

Synthesizing research findings into a coherent market analysis, ready for presentation and distribution to stakeholders.

- Executive Summary

- Israel Artillery Ammunition Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for advanced military capabilities

Rising defense budgets in Israel and surrounding regions

Technological advancements in artillery ammunition - Market Challenges

High manufacturing costs for advanced ammunition types

Limited supply chains and logistical challenges

Regulatory and compliance barriers in international trade - Market Opportunities

Expansion of defense exports to international markets

Integration of AI and smart technology in ammunition systems

Collaborations and partnerships with global defense contractors - Trends

Growing adoption of precision-guided artillery ammunition

Rising demand for sustainable and environmentally friendly ammunition

Increased focus on joint military operations and interoperability - Government Regulations & Defense Policy

Stringent export controls on defense products

Increase in defense collaborations with international allies

Policy shifts towards enhancing domestic defense industries - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Howitzer Ammunition

Mortar Ammunition

Anti-Aircraft Ammunition

Tank Ammunition

Rocket Propelled Grenades - By Platform Type (In Value%)

Self-Propelled Artillery

Towed Artillery

Multiple Launch Rocket Systems

Airborne Artillery

Naval Artillery - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket Solutions

Refurbished Ammunition

Customized Ammunition Solutions

Integrated Ammunition Packages - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Defense Companies

Foreign Military Assistance Programs - By Procurement Channel (In Value%)

Government Procurement

Private Sector Procurement

Military-to-Military Transfers

International Defense Auctions

Direct Commercial Sales

- Market Share Analysis

- Cross Comparison Parameters

(Market penetration, System type diversity, Production costs, Technological innovations, Product quality, Customization options, Export volume, Research & development investments) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Military Industries

IMI Systems

Krauss-Maffei Wegmann

BAE Systems

Thales Group

Lockheed Martin

General Dynamics Ordnance and Tactical Systems

Northrop Grumman

Raytheon Technologies

Saab AB

Textron Systems

Denel SOC

L3Harris Technologies

- Increasing reliance on artillery systems for border security

- Shift towards more advanced and multi-role artillery units

- Enhanced focus on joint defense training programs

- Growing interest in modernizing older artillery systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035