Market Overview

The Israel Automatic Weapons market has experienced robust growth, with a market size expected to reach USD ~ billion based on a recent historical assessment. Driven by defense modernization and technological advancements, Israel has consistently maintained its position as a global leader in the defense industry. The demand for advanced automatic weapons has been propelled by increasing geopolitical tensions and security concerns, leading to higher investments in military technology. The integration of next-generation features in weapons systems has made Israel a prominent exporter of military-grade automatic weapons.

Israel is known for its strong military infrastructure, with key cities such as Tel Aviv and Haifa driving the market due to their proximity to defense manufacturing facilities and R&D hubs. Israel’s dominance in the automatic weapons market stems from its established defense policies and a history of technological innovation in military systems. The strategic position of the country in the Middle East and its strong alliances with global defense networks have facilitated the growth of its weapons industry. Consequently, Israel’s robust defense sector continues to set global benchmarks in terms of technology and market presence.

Market Segmentation

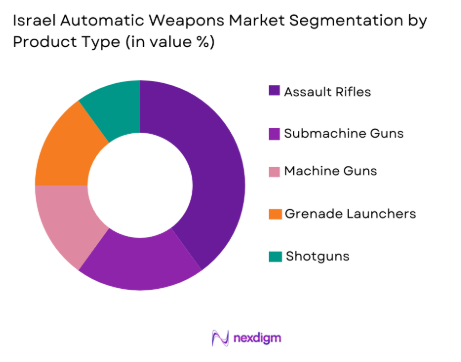

By Product Type

The Israel Automatic Weapons market is segmented by product type into assault rifles, submachine guns, machine guns, grenade launchers, and shotguns. Recently, assault rifles have gained the dominant market share due to the increasing demand from both military and law enforcement agencies worldwide. The demand for assault rifles has surged due to their versatility in various combat situations, as well as their integration with advanced technologies such as AI and smart targeting systems. These rifles are particularly favored for their effectiveness in close combat and long-range engagements, making them essential in modern warfare scenarios. Brand presence and advancements in design have made Israeli-manufactured assault rifles a preferred choice among military forces globally.

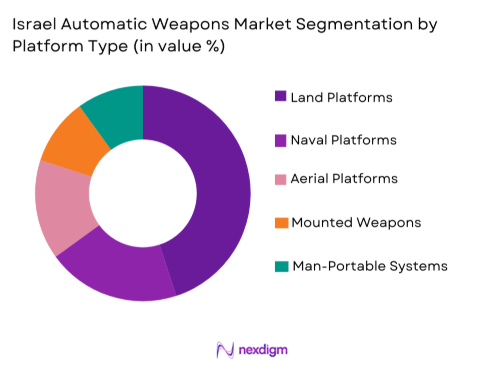

By Platform Type

The Israel Automatic Weapons market is segmented by platform type into land platforms, naval platforms, aerial platforms, mounted weapons, and man-portable systems. Recently, land platforms have dominated the market share due to the increasing focus on terrestrial military operations and ground-based security measures. The reliance on land-based operations, particularly in border control and urban warfare, has led to an increase in the deployment of automatic weapons on armored vehicles and infantry units. Additionally, the expanding use of autonomous land-based systems has further contributed to the growth of this segment. Israel’s technological leadership in ground-based military systems has made it a prime exporter of weapons integrated into land platforms, strengthening its market dominance.

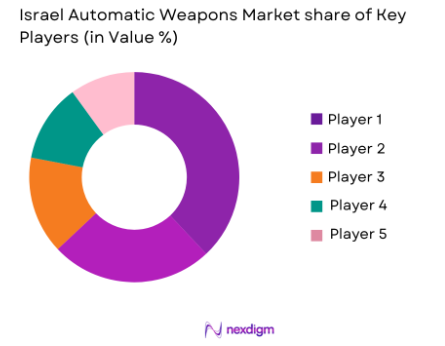

Competitive Landscape

The competitive landscape of the Israel Automatic Weapons market is shaped by several large defense contractors and manufacturers, which contribute to the consolidation of the market. Major players such as Elbit Systems, IMI Systems, and Rafael Advanced Defense Systems are pivotal in driving innovation and market share. Israel’s defense industry is characterized by a high level of technological integration, leading to the continuous development of state-of-the-art automatic weapons. This competitive market is also influenced by the government’s close ties to defense contractors, facilitating advanced military development. Additionally, Israel’s global defense collaborations with countries such as the U.S. and European Union members further cement its position as a leading automatic weapons supplier.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Weapon Industries (IWI) | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| Magal Security Systems | 1969 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Automatic Weapons Market Analysis

Growth Drivers

Technological Advancements in Weaponry

Technological advancements in weaponry have significantly driven the growth of the Israel Automatic Weapons market. The constant pursuit of innovation in military systems, particularly in the development of smart weapons, has made Israel a global leader in automatic weapons technology. The integration of AI, robotics, and sensor systems into firearms has transformed the functionality and accuracy of automatic weapons. Israeli manufacturers have also focused on enhancing the ergonomic design and durability of weapons, ensuring that they perform effectively in various combat conditions, including extreme weather and battlefield environments. Furthermore, the introduction of modular systems has allowed military forces to adapt weapons based on specific operational requirements, thereby boosting the market demand. The focus on lightweight materials and energy-efficient designs has contributed to making automatic weapons more accessible and adaptable to different tactical needs. The continuous advancement in ammunition technology, such as the development of precision-guided bullets, has also played a role in enhancing the operational effectiveness of automatic weapons, further increasing the market’s growth potential. As Israel’s defense forces continue to invest in cutting-edge weapon systems, the global demand for Israeli-manufactured automatic weapons remains strong, ensuring sustained market growth. These innovations not only meet the operational needs of military forces but also address the demand for more sustainable and versatile weaponry, positioning Israel as a key player in the global defense industry.

Security Concerns and Geopolitical Instability

Security concerns and geopolitical instability are crucial growth drivers for the Israel Automatic Weapons market. The Middle East region, where Israel is located, has witnessed persistent conflicts and tensions, prompting countries to increase their defense budgets and prioritize the acquisition of advanced weaponry. Israel, surrounded by nations with fluctuating political landscapes, faces constant security threats, which drive the demand for innovative and reliable automatic weapons. As a result, the country has heavily invested in the development and manufacturing of cutting-edge defense technologies to safeguard its borders and ensure national security. This geopolitical climate has also led to Israel forming strategic alliances with global powers, such as the United States and NATO members, ensuring the continuous development and export of advanced military systems. With growing defense needs across the world, particularly in conflict zones, Israeli manufacturers have capitalized on their expertise in producing high-performance automatic weapons that can be deployed in various military operations. As nations around the world face increased threats from terrorism, insurgencies, and state conflicts, the demand for Israeli weapons continues to rise. Israel’s robust military innovation and ability to cater to evolving security needs have positioned it as a leading supplier of automatic weapons globally, fueling market expansion. With ongoing global instability, the demand for defense products, including automatic weapons, is likely to remain high, further propelling Israel’s market growth.

Market Challenges

High Manufacturing and Development Costs

High manufacturing and development costs present a significant challenge for the Israel Automatic Weapons market. The production of advanced weaponry involves substantial investment in research and development, materials procurement, and labor, all of which contribute to rising costs. The development of cutting-edge technologies, such as smart targeting systems, AI integration, and precision-guided ammunition, requires advanced materials and high-quality manufacturing processes, further driving up expenses. For Israeli manufacturers, the cost of maintaining state-of-the-art production facilities and recruiting highly skilled engineers and designers adds to the financial burden. These factors can result in high prices for automatic weapons, making them less accessible for some potential buyers, particularly in countries with limited defense budgets. While Israel remains a dominant player in the global defense market, the high cost of its advanced weapons systems may limit the market’s reach in price-sensitive regions. Additionally, the competitive global market for defense technology intensifies pricing pressures, forcing manufacturers to balance cost efficiency with technological advancement. High costs also complicate the process of maintaining military inventory, as the continuous need for modernization and replacement of aging weapon systems further strains national defense budgets. This challenge may also hinder the adoption of new automatic weaponry by smaller nations or non-state actors, who may opt for less expensive alternatives.

Stringent Export Regulations and Trade Barriers

Stringent export regulations and trade barriers pose a significant challenge for the Israel Automatic Weapons market. The Israeli government maintains strict control over defense exports, including automatic weapons, in compliance with international arms agreements and to prevent misuse in conflict zones. These regulations can delay the export process, limit market access, and reduce overall export potential. Additionally, countries with stringent arms import restrictions or those with political sensitivities may hesitate to purchase Israeli-manufactured weapons, further hindering market growth. Export control measures require defense companies to navigate complex regulatory environments, including obtaining licenses and approvals from both Israeli authorities and the destination country’s governments. Trade restrictions or political tensions between Israel and certain countries, particularly those in the Middle East, may limit opportunities for expansion into key markets. The application of sanctions, embargoes, or international opposition to arms sales can impact Israel’s ability to meet global demand, thus restricting its market share. These barriers may also force manufacturers to engage in indirect sales, using third-party countries or international brokers to facilitate weapon transfers, adding complexity and risk to the market. As defense markets become more globalized, Israel must adapt to these regulatory challenges to maintain its position as a leading exporter of automatic weapons.

Opportunities

Expansion of Defense Budgets and Military Modernization

The expansion of defense budgets and military modernization initiatives globally presents a significant opportunity for the Israel Automatic Weapons market. Many countries are significantly increasing their defense spending to bolster national security and military capabilities, driven by rising geopolitical threats and regional conflicts. As nations focus on modernizing their armed forces, the demand for advanced automatic weapons has surged, opening new markets for Israeli manufacturers. The growing emphasis on military readiness, technological superiority, and operational efficiency is driving the need for high-performance weapons systems that can be integrated into both traditional and modern military operations. Israel’s expertise in developing cutting-edge weaponry positions it as a key supplier for nations seeking to upgrade their defense capabilities. As part of these modernization efforts, countries are increasingly investing in advanced weaponry, such as precision-guided firearms, smart ammunition, and next-generation assault rifles, further accelerating the demand for Israeli-made automatic weapons. The global shift towards more technologically advanced defense systems aligns perfectly with Israel’s innovation-driven approach to weapons manufacturing, providing significant growth prospects in both established and emerging defense markets. As governments prioritize defense spending, the expansion of defense budgets creates a favorable environment for Israeli manufacturers to secure long-term contracts and establish a strong market presence.

Adoption of Unmanned Systems and Remote Weaponry

The increasing adoption of unmanned systems and remote weaponry presents a promising opportunity for the Israel Automatic Weapons market. Unmanned ground vehicles, drones, and robotic systems are revolutionizing modern warfare, and military forces are increasingly integrating automatic weapons into these systems for enhanced tactical advantages. Israel, known for its advanced robotics and AI-driven technologies, is well-positioned to lead the development of automated and remote-controlled weapons. The ability to deploy automatic weapons on unmanned platforms offers significant operational advantages, including reduced risk to human soldiers, improved mission efficiency, and enhanced precision targeting. As autonomous systems continue to evolve, the demand for automatic weapons that can be remotely operated or integrated into these systems will rise. Israel’s technological prowess in unmanned systems, combined with its leadership in weaponry innovation, makes it an ideal partner for military forces looking to modernize their combat strategies. The rise of unmanned systems, especially in surveillance, reconnaissance, and strike missions, opens new avenues for Israeli manufacturers to expand their market share. The integration of automatic weapons with unmanned platforms will be a key driver of growth for the Israeli defense industry in the coming years.

Future Outlook

Over the next five years, the Israel Automatic Weapons market is expected to experience steady growth driven by continuous technological innovations, expanding defense budgets, and evolving military needs. With the rise of unmanned systems, AI integration, and precision-guided technologies, Israeli manufacturers are well-positioned to remain at the forefront of military weapon development. Increased demand for smart weapons, coupled with geopolitical instability, will continue to fuel market growth. Technological advancements and strategic partnerships with global defense forces will also ensure Israel’s dominance in the global weapons market.

Major Players

- Elbit Systems

- IMI Systems

- Rafael Advanced Defense Systems

- Israel Weapon Industries (IWI)

- Magal Security Systems

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- General Dynamics

- L3 Technologies

- Leonardo

- Thales Group

- Airbus Defense and Space

- SAAB

- Raytheon

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense equipment suppliers

- National defense ministries

- Armed forces

- Private security agencies

- Defense technology developers

Research Methodology

Step 1: Identification of Key Variables

Key variables, including market size, growth trends, and technological innovations, are identified through comprehensive analysis of historical data, market reports, and expert insights.

Step 2: Market Analysis and Construction

A detailed market analysis is conducted using both qualitative and quantitative research methods, including data modeling, to assess demand, pricing, and emerging trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are performed to validate the hypotheses generated from initial research, ensuring the robustness and accuracy of the findings.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report, presenting a clear picture of the market’s current status and future outlook.

Executive Summary

Israel Automatic Weapons Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Demand for advanced military technology

Increase in national defense budgets

Growing importance of homeland security

Technological advancements in weaponry

Increasing geopolitical tensions - Market Challenges

High manufacturing and development costs

Strict government regulations and compliance

Security concerns around weapon systems

Technological obsolescence risks

Geopolitical instability in key regions - Market Opportunities

Emerging demand for lightweight and modular weapons

Advancements in AI-driven weapons systems

Growth in private security sector needs - Trends

Integration of smart technology in weapon systems

Shift towards automation in military weapons

Focus on lightweight and portable designs

Increased demand for unmanned combat systems

Development of advanced ammunition technologies - Government Regulations & Defense Policy

Strict export regulations

Changes in defense procurement processes

Heightened security measures for weapons technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Assault Rifles

Submachine Guns

Machine Guns

Grenade Launchers

Shotguns - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Aerial Platforms

Mounted Weapons

Man-Portable Systems - By Fitment Type (In Value%)

Fixed Weapons

Modular Weapons

Integrated Weapons

Standalone Systems

Custom-Fit Solutions - By End User Segment (In Value%)

Military

Law Enforcement

Private Security

Defense Contractors

Recreational Use - By Procurement Channel (In Value%)

Government Contracts

Private Sector Procurement

International Sales

Direct Government Purchases

Defense Auctions - By Material / Technology (in Value%)

Steel

Aluminum

Polymer Composites

Titanium

Smart Weapon Technology

- Market share snapshot of major players

- Cross Comparison Parameters (Weapon Range, Accuracy, Rate of Fire, Durability, Weight, Integration with Smart Systems, Customizability, Cost, Ammunition Compatibility, Maintenance Requirements)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porte’s Five Forces

- Key Players

Elbit Systems

IMI Systems

Rafael Advanced Defense Systems

Israel Military Industries

IWI

Magal Security Systems

Security and Defense Solutions

Caracal International

Tavor Systems

SABR Tactical

Force Industries

Defense Solutions

Varmint Guns

Israel Defense

Kahr Arms

- Military defense forces expanding technological capabilities

- Law enforcement agencies upgrading to modern weaponry

- Private security companies increasing reliance on automated systems

- Recreational shooting communities adopting advanced firearms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035