Market Overview

The Israel Autonomous BVLOS Drones market is valued at approximately USD ~ billion, driven by technological advancements in drone capabilities, increased government investments, and rising demand in sectors such as agriculture, defense, and logistics. The market is expanding rapidly due to the growth of autonomous flight technology, which enables beyond visual line-of-sight (BVLOS) operations, allowing drones to cover larger areas and perform tasks more efficiently. Additionally, Israel’s leadership in defense technology and its strong regulatory framework provide a favorable environment for market growth.

Israel dominates the autonomous BVLOS drone market, largely due to its well-established defense industry and government support for autonomous technology. Cities like Tel Aviv and Haifa are at the forefront of innovation, attracting key players and fostering research and development. The Israeli government has also played a significant role by providing grants and regulatory frameworks that support drone operations. The country’s advanced infrastructure, combined with strong global export ties, further reinforces Israel’s dominant position in the market.

Market Segmentation

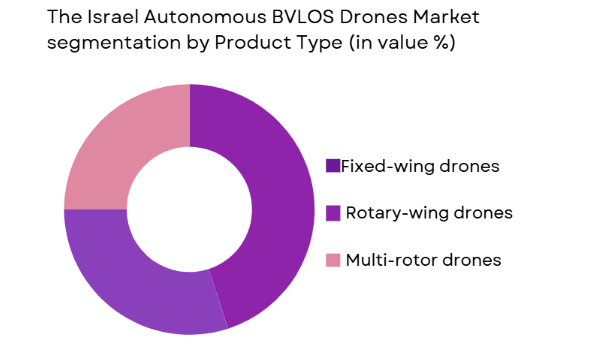

By Product Type

The Israel Autonomous BVLOS Drones market is segmented by product type into fixed-wing drones, rotary-wing drones, and multi-rotor drones. Recently, fixed-wing drones have a dominant market share due to their superior range and endurance, which make them ideal for BVLOS operations in agricultural and defense sectors. The increasing demand for long-duration flight capabilities, particularly in surveillance and large-area monitoring applications, has led to the dominance of this sub-segment. Their ability to cover vast distances without requiring frequent recharges further boosts their appeal in both military and commercial applications.

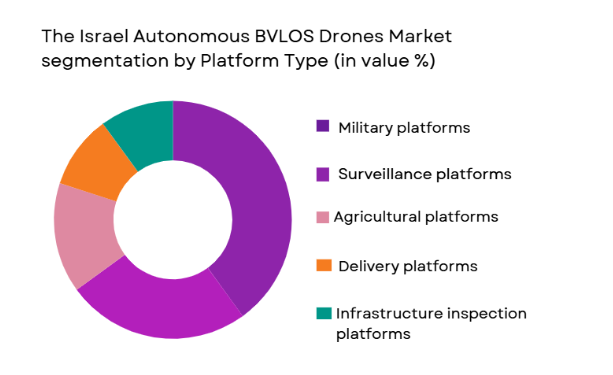

By Platform Type

The Israel Autonomous BVLOS Drones market is segmented by platform type into agricultural platforms, military platforms, infrastructure inspection platforms, delivery platforms, and surveillance platforms. Recently, military platforms have a dominant market share, driven by Israel’s strong defense sector and its focus on advanced UAVs for surveillance and reconnaissance. These drones are designed to meet the rigorous demands of defense operations, offering long flight durations and high payload capacities for surveillance and intelligence-gathering missions. Additionally, the increasing military demand for autonomous drones with BVLOS capabilities has further solidified this sub-segment’s dominance.

Competitive Landscape

The competitive landscape of the Israel Autonomous BVLOS Drones market is characterized by strong competition among established players and new entrants. Major players are focusing on advancing drone technologies, including AI, machine learning, and improved battery systems, to maintain a competitive edge. The market sees significant consolidation, with large defense contractors acquiring smaller startups to enhance their portfolios. These players are expanding their presence globally, tapping into international markets with growing demand for autonomous drone solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Aeronautics Defense Systems | 1997 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Skypersonic | 2014 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Percepto | 2014 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

The Israel Autonomous BVLOS Drones Market Analysis

Growth Drivers

Government Support for UAV Development

The Israel Autonomous BVLOS Drones market is significantly driven by government initiatives that provide financial backing, regulatory frameworks, and infrastructure support. Israel’s Ministry of Defense has prioritized the development and deployment of advanced drone systems to enhance national security and defense capabilities. This governmental support has led to accelerated innovation in autonomous drone technologies, encouraging both private enterprises and defense contractors to invest heavily in research and development. Additionally, the Israeli government has been working on establishing new regulations that facilitate BVLOS operations, further enhancing market growth. Moreover, public-private partnerships have enabled the establishment of testbeds for drone technology, which allows for real-world testing and data collection, leading to more advanced products. With these policies in place, Israel is strengthening its position as a global leader in the drone industry, and the continued emphasis on innovation will help the market grow in the coming years.

Technological Advancements in Autonomous Drones

Another key driver of growth in the Israel Autonomous BVLOS Drones market is the rapid pace of technological advancements in drone capabilities. These advancements include the integration of AI for autonomous flight operations, advanced sensors for enhanced navigation, and more efficient battery systems for longer flight times. Drones that operate beyond visual line of sight (BVLOS) rely heavily on these technologies to ensure safe and efficient operations over long distances. Israeli companies, well known for their expertise in robotics and AI, have made substantial progress in developing drones that can operate autonomously with minimal human intervention. These innovations have led to increased adoption of BVLOS drones across various sectors, including agriculture, infrastructure inspection, and surveillance. As drone technology continues to improve, these systems are becoming more reliable, versatile, and cost-effective, opening up new opportunities for expansion and growth in the market.

Market Challenges

Regulatory Restrictions on BVLOS Operations

One of the major challenges facing the Israel Autonomous BVLOS Drones market is the regulatory environment surrounding BVLOS operations. While Israel has made significant strides in developing regulations for drone operations, the lack of uniformity in global drone regulations remains a major obstacle. Regulatory bodies such as the Civil Aviation Authority in Israel and international organizations have imposed stringent rules regarding BVLOS flight to ensure the safety of both airspace and ground operations. These regulations require drones to have advanced detect-and-avoid systems, which can significantly increase the cost of drone systems. Furthermore, compliance with these regulations is often a lengthy process, hindering the speed at which companies can bring new BVLOS drones to market. Although Israel’s regulatory environment is among the most supportive globally, the evolving nature of BVLOS flight regulations remains a challenge for both drone manufacturers and operators.

High Operational Costs and Infrastructure Limitations

The high costs associated with autonomous BVLOS drones and their required infrastructure present another significant challenge to the market. While the technology behind these drones has advanced, the initial cost of purchasing, maintaining, and operating autonomous BVLOS drones is still relatively high. This is particularly evident in industries like agriculture and logistics, where the cost of adoption can be prohibitive for small and medium-sized enterprises. Additionally, the infrastructure needed to support BVLOS drone operations, such as ground control stations, charging facilities, and data management systems, requires significant investment. While larger enterprises and defense contractors are capable of shouldering these costs, smaller players in emerging markets face difficulties in securing the necessary resources for BVLOS drone deployment. These factors are expected to slow the adoption of BVLOS drones in the short term.

Opportunities

Expansion of BVLOS Applications in Commercial Sectors

One of the most significant opportunities for the Israel Autonomous BVLOS Drones market is the expansion of drone applications in commercial sectors beyond defense and surveillance. Industries such as agriculture, logistics, and infrastructure are increasingly adopting BVLOS drones for tasks such as crop monitoring, supply chain management, and infrastructure inspections. The ability of BVLOS drones to cover large areas without requiring a human operator to be present significantly increases efficiency and reduces operational costs. In agriculture, for example, drones can be used to monitor crop health, assess soil conditions, and even apply fertilizers or pesticides. In logistics, BVLOS drones are being deployed for last-mile delivery, reducing the need for ground-based transportation. As these industries continue to recognize the benefits of BVLOS drones, the demand for these systems is expected to grow, presenting a significant opportunity for market players.

International Market Expansion

Another promising opportunity for the Israel Autonomous BVLOS Drones market lies in international market expansion. Israel is known for its strong defense capabilities, and its drone technology has been widely adopted by military forces globally. As BVLOS drones continue to gain traction in commercial sectors, Israel’s expertise in this technology provides a competitive advantage in foreign markets. Many countries, especially those in Europe and Asia, are looking to adopt autonomous drones for use in agriculture, surveillance, and infrastructure monitoring. Israel’s established relationships with these countries, combined with its reputation for producing reliable, cutting-edge technology, positions the country well to expand its drone exports. As the global demand for BVLOS drones grows, international markets present a key opportunity for Israeli drone manufacturers to increase their revenue and market share.

Future Outlook

The Israel Autonomous BVLOS Drones market is expected to continue its rapid growth in the coming years, driven by advancements in drone technology, government support, and expanding commercial applications. Key growth drivers such as technological innovation and regulatory frameworks are likely to facilitate further market expansion, while challenges like operational costs and regulatory barriers will need to be addressed. The next five years are expected to witness continued demand from sectors such as agriculture, logistics, and defense, along with increased international adoption of autonomous drone technologies.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Aeronautics Defense Systems

- Skypersonic

- Percepto

- Airobotics

- Flytrex

- D-Fend Solutions

- Drone Dynamics

- Flytech UAV

- Quantum Systems

- Urban Aeronautics

- Sky-Futures

- Quantum Systems GmbH

- Aerialtronics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Agriculture firms

- Logistics companies

- Infrastructure companies

- Aviation authorities

- Commercial drone operators

Research Methodology

Step 1: Identification of Key Variables

This step involves determining the key market drivers, challenges, and trends that influence the Israel Autonomous BVLOS Drones market, including technological advancements and regulatory changes.

Step 2: Market Analysis and Construction

In this phase, secondary and primary research is conducted to gather data on market size, segmentation, and growth projections. Market models are constructed based on these findings.

Step 3: Hypothesis Validation and Expert Consultation

This step validates the initial hypotheses with expert consultations, including interviews with industry leaders and stakeholders to ensure accuracy.

Step 4: Research Synthesis and Final Output

The collected data is analyzed and synthesized into a comprehensive report, highlighting key market insights, growth drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investment in autonomous technology

Increasing adoption in agriculture for crop monitoring

Rising demand for surveillance and security applications

Advancements in AI and machine learning for navigation

Enhancements in drone battery technology - Market Challenges

Regulatory constraints on BVLOS operations

High initial investment and operational costs

Limited availability of skilled operators

Data security and privacy concerns

Weather-related operational challenges - Market Opportunities

Expansion of BVLOS operations in new industries

Partnerships between defense and civilian sectors

Growth in international market adoption - Trends

Integration with IoT platforms

Adoption of 5G communication for drones

Increased focus on autonomous flight systems

Growing importance of drone safety technologies

Development of advanced drone swarming capabilities - Government Regulations & Defense Policy

National BVLOS drone operational guidelines

Export regulations for autonomous drone technologies

Defense procurement policies for autonomous drones - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric-powered drones

Hybrid drones

Fixed-wing drones

Rotary-wing drones

Multi-rotor drones - By Platform Type (In Value%)

Agricultural platforms

Military platforms

Infrastructure inspection platforms

Delivery platforms

Surveillance platforms - By Fitment Type (In Value%)

OEM drones

Aftermarket drones

Integrated drones

Customized drones

Hybrid drones - By EndUser Segment (In Value%)

Agriculture

Defense

Logistics

Oil & Gas

Construction - By Procurement Channel (In Value%)

Direct sales

OEM distribution

Online platforms

Government contracts

Third-party retailers - By Material / Technology (In Value%)

Carbon fiber composites

Lightweight alloys

AI & automation technologies

Electric propulsion systems

Satellite communication systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Performance, Battery Life, Payload Capacity, Navigation Systems, Cost Efficiency, Durability, Regulatory Compliance, Market Reach, Customer Support, Brand Reputation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

AeroVironment

General Atomics

Intel Corporation

Northrop Grumman

Textron Systems

Thales Group

Israel Aerospace Industries

Elbit Systems

SkyHopper

D-Fend Solutions

Aeronautics Defense Systems

Evolv Technologies

XAG

Albatross UAVs

- Adoption of drones in precision agriculture

- Military demand for surveillance and reconnaissance drones

- Use of drones in logistics and supply chain optimization

- Rise of drones in infrastructure and energy sector applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035