Market Overview

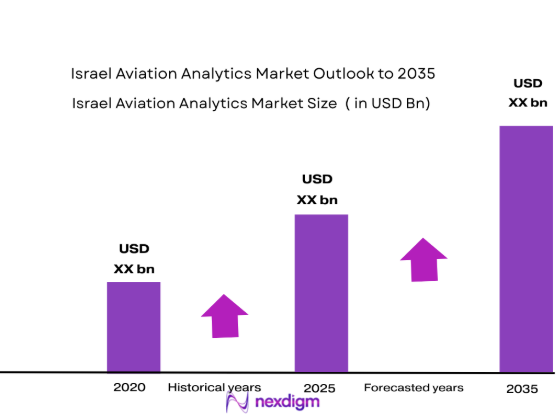

The Israel Aviation Analytics market is experiencing robust growth, driven by advancements in data analytics, artificial intelligence (AI), and machine learning. Based on recent historical assessments, the market size in Israel is valued at approximately USD ~ billion, fueled by the increasing adoption of these technologies in both military and commercial aviation sectors. With a growing demand for predictive maintenance, operational efficiency, and enhanced safety protocols, these factors collectively contribute to the market’s expansion.

The market’s dominance is particularly seen in Tel Aviv and Herzliya, where technological innovation and government-backed defense projects drive the aviation analytics sector. Israel’s well-established aerospace and defense industry, strong technological infrastructure, and strategic alliances with global players further bolster its position as a leader in the field. The country’s emphasis on national security, coupled with its thriving high-tech ecosystem, ensures Israel’s continued dominance in the aviation analytics market.

Market Segmentation

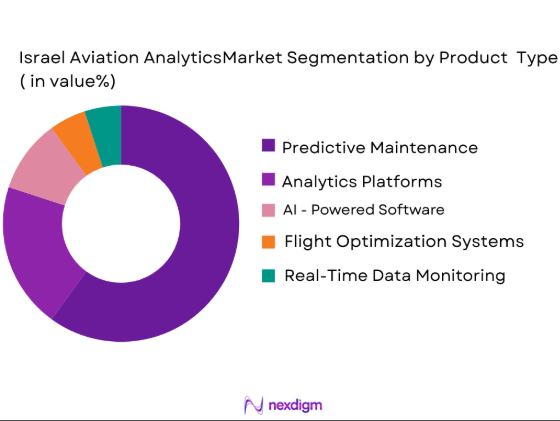

By Product Type

The Israel Aviation Analytics market is segmented by product type into predictive maintenance tools, analytics platforms, AI-powered software solutions, flight optimization systems, and real-time data monitoring tools. Predictive maintenance tools have a dominant market share due to increasing demand in both commercial and military sectors, driven by the need for operational efficiency and reduced downtime. Airlines and defense contractors prioritize these solutions to ensure aircraft reliability and minimize maintenance costs, making them essential for the market’s growth.

By Platform Type

The market is segmented by platform type into airborne platforms, ground-based platforms, satellite platforms, hybrid platforms, and drone platforms. Airborne platforms hold the largest market share, driven by their widespread adoption for data collection and analysis in both military and commercial aviation. Airborne platforms’ ability to provide real-time flight data for operational optimization and predictive maintenance contributes significantly to their dominance in the market.

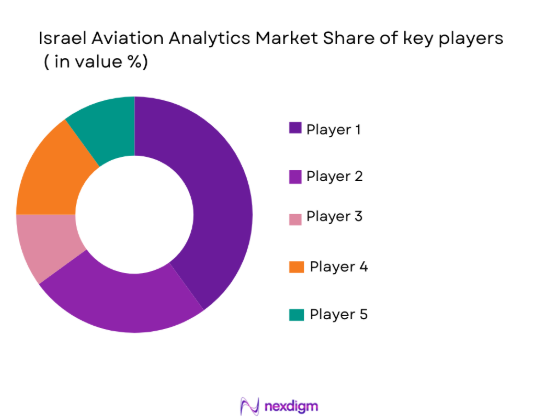

Competitive Landscape

The Israel Aviation Analytics market is characterized by a high level of competition, with major players such as Elbit Systems, Israel Aerospace Industries, and Rafael Advanced Defense Systems driving market growth. These companies have consolidated their positions through strategic partnerships, technological innovation, and government contracts. The competitive intensity in the market is expected to rise as both local and international companies expand their operations, and new players bring innovative solutions to address evolving industry demands.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Aeronautics Ltd. | 1997 | Yavne, Israel | ~ | ~ | ~ | ~ |

| Magal Security Systems | 1970 | Be’er Sheva, Israel | ~ | ~ | ~ | ~ |

Israel Aviation Analytics Market Analysis

Growth Drivers

Technological Advancements in AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) in aviation analytics is a major growth driver in Israel’s aviation analytics market. AI and ML enable predictive maintenance, real-time flight data analysis, and operational optimization, which help airlines and military agencies reduce downtime and improve safety. The ability to process vast amounts of real-time data, identify patterns, and predict failures before they occur has revolutionized maintenance schedules, reducing operational costs, and enhancing aircraft lifespan. With Israel being a global leader in AI and ML research, its aviation industry is well-positioned to leverage these technologies. The collaboration between Israel’s government and private sector, as well as its strong emphasis on defense innovation, drives the application of AI and ML in aviation. The combination of these technologies with IoT (Internet of Things) devices enables enhanced data collection, which further fuels the demand for AI-powered analytics solutions. As the aviation sector increasingly adopts these technologies, the market is expected to see sustained growth, particularly in the areas of predictive maintenance and flight optimization. Israel’s focus on technological advancements in AI and machine learning will continue to position it at the forefront of global aviation analytics.

Demand for Predictive Maintenance Solutions

The rising demand for predictive maintenance solutions is a key growth driver in Israel’s aviation analytics market. Predictive maintenance tools use real-time data from sensors embedded in aircraft to predict potential system failures before they occur, reducing downtime and avoiding costly repairs. As airlines and defense contractors strive to improve operational efficiency, predictive maintenance solutions have become integral to their strategies. These tools leverage advanced analytics and machine learning algorithms to analyze performance data from various aircraft systems and predict when maintenance or repairs are needed. This proactive approach helps to extend the life of aircraft, optimize flight schedules, and enhance safety protocols. In the military sector, predictive maintenance solutions are particularly valuable in ensuring the reliability of critical defense aircraft and UAVs. Israel’s aerospace and defense industries are early adopters of these technologies, and the nation’s strong research and development capabilities have made it a leader in the field. As the aviation industry continues to embrace digital transformation, predictive maintenance is expected to remain a key driver of growth in Israel’s aviation analytics market.

Market Challenges

Integration of New Technologies with Legacy Systems

One of the primary challenges facing the Israel Aviation Analytics market is the integration of new technologies with legacy systems. Many aviation operators, particularly in military applications, still rely on older systems that were not designed to incorporate modern analytics tools. This presents challenges in terms of compatibility, performance, and the ability to fully leverage the capabilities of advanced analytics solutions. Upgrading legacy systems to support new technologies such as AI, machine learning, and big data analytics can be expensive and time-consuming. Furthermore, retrofitting older aircraft with modern sensors and data analytics capabilities requires significant investment. For defense contractors and airlines with large fleets of older aircraft, the cost of system upgrades and the complexities of integration are significant barriers. Despite these challenges, Israel’s advanced technological infrastructure and its focus on innovation in the defense and aerospace sectors offer potential solutions for overcoming these hurdles. The country’s expertise in cybersecurity also plays a role in mitigating integration risks, but addressing the integration of new technologies with legacy systems remains a critical challenge for the market.

Cybersecurity and Data Privacy Concerns

With the increasing reliance on data analytics in the aviation sector, cybersecurity and data privacy concerns are becoming more prevalent. Aviation operators collect vast amounts of sensitive data, including flight information, passenger details, and maintenance records, which are often transmitted across interconnected systems. This makes the industry a prime target for cyberattacks, which can lead to operational disruptions, data breaches, and compromised security. In Israel, where defense and cybersecurity are top priorities, protecting aviation data has become a key challenge for both commercial and military aviation sectors. The Israeli government has implemented stringent regulations and cybersecurity frameworks to safeguard critical infrastructure, but the rapidly evolving nature of cyber threats means that aviation analytics systems must be constantly updated to counteract emerging risks. Additionally, the integration of AI and machine learning tools into aviation analytics raises concerns over data privacy, as these systems often require access to large volumes of personal and operational data. Ensuring that aviation analytics systems comply with global data protection regulations while maintaining the security of sensitive data remains a key challenge for the market.

Opportunities

Expansion of Smart Airports

The rise of smart airports presents a significant opportunity for the Israel Aviation Analytics market. Smart airports utilize advanced technologies such as AI, IoT, and big data analytics to streamline airport operations, improve passenger experience, and enhance security. By integrating analytics solutions into airport systems, operators can optimize flight schedules, reduce delays, and improve baggage handling processes. The demand for smart airports is expected to increase as air travel grows and as passengers expect more efficient and personalized services. Israel’s technological expertise and its strong focus on innovation position the country to play a major role in the development of smart airport technologies. Israel’s airports, such as Ben Gurion International, have already begun adopting digital solutions to enhance operational efficiency, making the country a leader in this field. As global air travel increases and airports seek to modernize, Israel’s aviation analytics market stands to benefit from the growing demand for smart airport solutions. This presents an exciting growth opportunity for analytics providers who can offer solutions that integrate seamlessly into airport infrastructure.

Growth of UAVs and Drone Analytics

Another major opportunity for the Israel Aviation Analytics market lies in the growing use of unmanned aerial vehicles (UAVs) and drones. UAVs and drones are increasingly used for various applications, including surveillance, reconnaissance, cargo transport, and infrastructure inspection. As these devices generate large amounts of data, the need for advanced analytics solutions to process and interpret this data is growing. Israel is a global leader in UAV technology, and the country’s defense and aerospace industries are at the forefront of drone development and deployment. The increasing integration of drones into both military and commercial sectors presents significant opportunities for analytics providers to offer real-time data analysis, flight optimization, and maintenance predictions for UAVs. As drone operations expand, there is a growing demand for analytics platforms that can ensure safety, optimize flight paths, and predict equipment failures. Israel’s strong defense industry, coupled with its focus on technology and innovation, positions it as a key player in the global drone analytics market, offering substantial growth potential for local companies.

Future Outlook

The Israel Aviation Analytics market is expected to continue growing as technological advancements in AI, machine learning, and UAV analytics drive demand across both military and commercial aviation sectors. With increased focus on smart airports, predictive maintenance, and real-time flight data analysis, the market will experience sustained expansion. Additionally, regulatory support and Israel’s strong cybersecurity measures will ensure a secure environment for data-driven aviation operations, further boosting market growth. The next five years will see significant investments in digital transformation, positioning Israel as a leader in aviation analytics.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Aeronautics Ltd.

- Magal Security Systems

- Amdocs

- IAI Elta Systems

- ICL Group

- Checkmarx

- Mobileye

- NICE Systems

- Qualys

- Vayeca

- Gilat Satellite Networks

- Skylark Drones

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aviation companies

- Aerospace and defense contractors

- Private aviation operators

- UAV manufacturers

- Technology developers and integrators

- Data analytics firms

Research Methodology

Step 1: Identification of Key Variables

Key variables such as technological trends, market drivers, and challenges are identified to guide the research focus.

Step 2: Market Analysis and Construction

Data is collected from primary and secondary sources to construct a comprehensive market model and estimate the market size.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses formed during the research phase are validated through consultations with industry experts and stakeholders.

Step 4: Research Synthesis and Final Output

The findings are synthesized into a final report, providing actionable insights and market forecasts for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing Demand for Predictive Maintenance

Increasing Military Spending

Technological Advancements in AI and Big Data

Focus on Autonomous Aircraft

Government Support for Aviation Safety & Standards - Market Challenges

High Initial Investment Costs

Integration of Advanced Technologies

Data Security & Privacy Concerns

Regulatory Compliance Complexity

Lack of Skilled Professionals - Market Opportunities

Expansion of Smart Airports

Development of Autonomous Air Mobility

Emerging Markets in Aviation Analytics - Trends

Adoption of IoT in Aviation

Emerging Role of Blockchain in Aviation Analytics

Use of AI for Flight Path Optimization

Increased Investment in Cybersecurity

Shift Towards Sustainable Aviation Practices - Government Regulations & Defense Policy

Regulations on Data Privacy

Government Funding for Research & Development

Aviation Safety Standards & Compliance - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aviation Analytics

Military Aviation Analytics

Helicopter Analytics

Unmanned Aerial Vehicle (UAV) Analytics

Private Jet Analytics - By Platform Type (In Value%)

Airborne Platforms

Ground-based Platforms

Hybrid Platforms

Satellite Platforms

Drone Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Solutions

Integrated Systems

Software Solutions

Platform Specific Fitment - By End User Segment (In Value%)

Airlines

Military Agencies

Private Operators

Government & Regulatory Bodies

Aerospace & Defense Contractors - By Procurement Channel (In Value%)

Direct Sales

Online Platforms

Third-Party Distributors

Government Contracts

OEM Partnerships - By Material / Technology (In Value%)

Artificial Intelligence

Big Data Analytics

Cloud-Based Solutions

Data Encryption & Cybersecurity

Machine Learning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Adoption, Geographic Reach, Market Penetration, Customer Base, Product Innovation, Cost Leadership, Regulatory Compliance, Brand Strength, Strategic Alliances)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Aeronautics Ltd.

Checkmarx

Bluebird Aero Systems

Magal Security Systems

Rafael Advanced Defense Systems

AeroVironment

Israel Aircraft Industries

Gilat Satellite Networks

MELRANG Aerospace

Skytrac Systems

Cedar Aerospace

Eltek Ltd.

SkySoft-ATM

- Increased Adoption of Predictive Analytics by Airlines

- Military Applications of Advanced Analytics

- Private Sector Use of Real-Time Flight Data

- Regulatory Bodies Enhancing Analytics Capabilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035