Market Overview

The Israel Aviation Weather Radar Market is valued at approximately USD ~ million, with growth primarily driven by increasing demand for accurate weather forecasting systems in the aviation industry. This market has witnessed substantial development due to advancements in radar technologies, along with the rising need for real-time weather data to enhance flight safety. The demand for sophisticated radar systems is fueled by a combination of evolving aviation infrastructure and heightened focus on reducing weather-related aviation incidents.

The market is dominated by regions such as Tel Aviv and Haifa, where the presence of leading technology companies and defense contractors drives the adoption of cutting-edge radar systems. These cities host major research and development activities, creating a robust ecosystem for the production and deployment of advanced weather radar systems. The country’s strategic location and growing military investments further contribute to Israel’s leadership in this market.

Market Segmentation

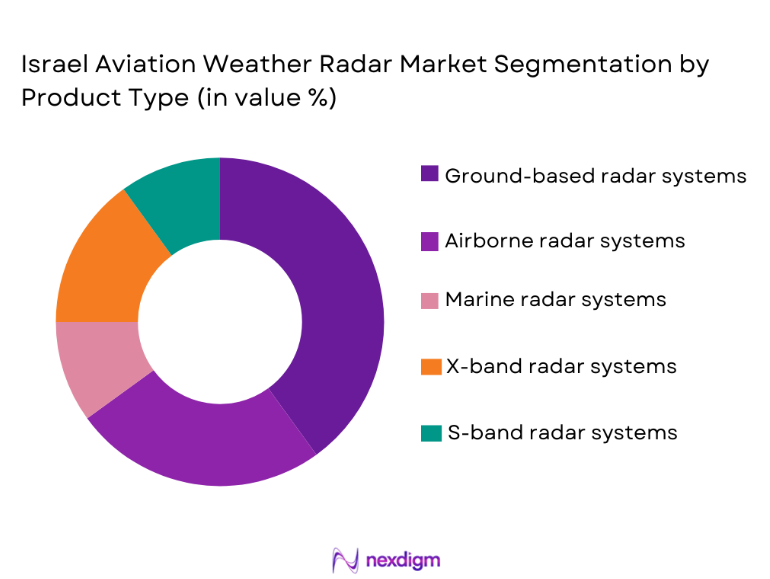

By Product Type

The Israel Aviation Weather Radar Market is segmented by product type into ground-based radar systems, airborne radar systems, marine radar systems, X-band radar systems, and S-band radar systems. Recently, ground-based radar systems have dominated the market share due to their widespread use in both commercial and military aviation. Ground-based systems provide consistent weather monitoring over vast areas, making them essential for air traffic control and aviation operations. Furthermore, the development of more affordable and efficient radar technology has contributed to the dominance of ground-based systems in airports, weather stations, and military bases. Their integration with other systems for improved situational awareness has also played a significant role in their market leadership.

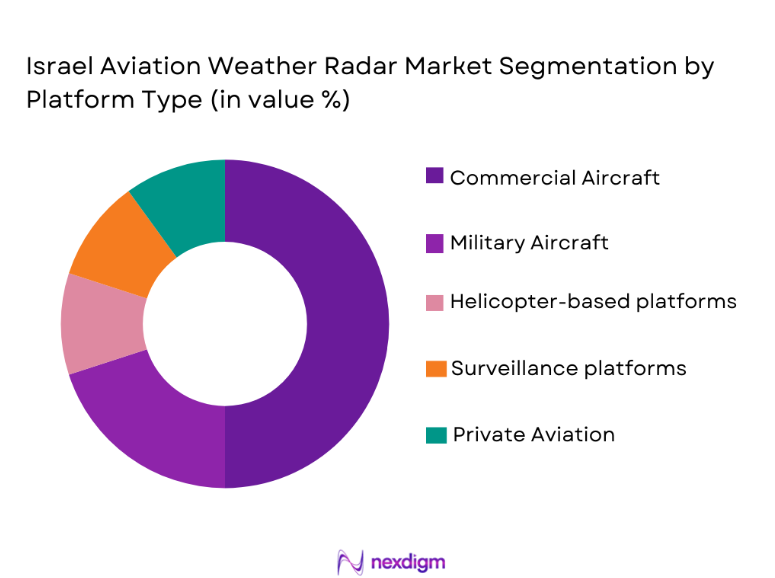

By Platform Type

The Israel Aviation Weather Radar Market is segmented by platform type into commercial aviation, military aviation, private aviation, helicopter-based platforms, and surveillance platforms. Recently, commercial aviation has maintained a dominant market share due to the growing number of international flights and the need for accurate weather predictions to ensure passenger safety. Commercial airlines require reliable radar systems to navigate through adverse weather conditions, ensuring smooth operations. The expansion of air travel, along with investments in state-of-the-art radar systems by major airline operators, has led to the dominance of commercial aviation in the radar market.

Competitive Landscape

The competitive landscape of the Israel Aviation Weather Radar Market is characterized by a mixture of established multinational players and innovative local companies. Major players are continuously involved in mergers and acquisitions to expand their technological capabilities and market reach. Additionally, collaboration between defense contractors and aviation technology firms has become a critical factor for innovation. As the market continues to evolve, these firms are focused on enhancing product performance, reducing costs, and complying with international regulations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Market Focus |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2007 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Aviation Weather Radar Market Analysis

Growth Drivers

Advancement in Radar Technologies

The advancement of radar technologies is a significant growth driver for the Israel Aviation Weather Radar Market. As radar systems become more sophisticated, they can detect and track weather patterns with increased precision, which enhances safety and operational efficiency in aviation. Modern radar technologies like phased array radar and Doppler radar enable real-time weather monitoring, providing critical data for decision-making processes in both military and commercial aviation. These advancements allow for the detection of hazardous weather conditions such as turbulence, thunderstorms, and severe wind shear, which directly contribute to improved flight safety. Moreover, the integration of weather radar systems with other advanced technologies, such as satellite and GPS systems, enables a more comprehensive understanding of atmospheric conditions, making radar systems indispensable in aviation. These developments not only bolster the reliability of weather forecasting systems but also ensure that aircraft can avoid weather-related disruptions, thus reducing delays and improving overall flight efficiency. As these technologies continue to evolve, their application in commercial and military aviation sectors will grow, thereby driving the market forward.

Increase in Aviation and Defense Investments

Increased investments in aviation infrastructure and defense systems are driving the growth of the Israel Aviation Weather Radar Market. Israel has made significant strides in both commercial and military aviation, with the country’s robust defense budget contributing to the modernization of military and civilian aviation systems. In particular, the Israeli government’s focus on enhancing national defense capabilities, coupled with international demand for advanced aviation technologies, has led to substantial investments in radar systems. Moreover, the booming tourism and airline industries have further fueled demand for sophisticated weather radar systems to ensure the safety of passengers and crew. Israel’s leadership in technological advancements, particularly in radar technology, allows for better integration with other systems such as air traffic management and weather forecasting, making it a hub for innovation. As the country continues to expand its aviation network and defense infrastructure, the demand for high-performance weather radar systems will likely grow, driving further growth in the market.

Market Challenges

High Production and Maintenance Costs

The high production and maintenance costs associated with weather radar systems are a significant challenge in the Israel Aviation Weather Radar Market. Weather radar systems require advanced technology and highly specialized components, making them expensive to manufacture and maintain. The complexity of the technology involved, coupled with the need for precise calibration, results in substantial operational costs for both commercial and military aviation operators. Furthermore, these radar systems often require periodic upgrades and extensive testing to ensure they meet the latest safety standards, which can add to the overall cost. Many smaller airlines or defense contractors with limited budgets may find it challenging to invest in such high-cost systems, thus limiting their adoption. The maintenance of these radar systems requires skilled technicians and dedicated infrastructure, which further adds to operational expenses. As a result, the high cost of weather radar systems presents a barrier for broader adoption, particularly among smaller players in the aviation and defense sectors.

Regulatory Compliance and Certification

Another challenge faced by the Israel Aviation Weather Radar Market is the stringent regulatory compliance and certification requirements for radar systems. Given the critical nature of weather radar in ensuring aviation safety, these systems are subject to a wide range of international and local regulations. The certification process for weather radar systems involves meeting various safety, quality, and environmental standards, which can be time-consuming and costly. Additionally, as the market expands globally, manufacturers must adhere to different regulatory frameworks, further complicating the development and deployment of radar systems. The evolving nature of aviation safety standards and the introduction of new regulations related to environmental impact, electromagnetic interference, and data privacy may require frequent adjustments and modifications to existing systems, adding to the operational costs. Manufacturers must navigate these complex regulatory landscapes to ensure that their products meet all necessary requirements, which can slow down market growth and innovation.

Opportunities

Expansion of Commercial Aviation in Emerging Markets

One of the significant opportunities for the Israel Aviation Weather Radar Market is the expansion of commercial aviation in emerging markets. As the aviation industry continues to grow, countries in Asia, the Middle East, and Africa are investing in new airports and upgrading their aviation infrastructure. The growing demand for air travel in these regions creates an opportunity for the adoption of advanced weather radar systems to improve flight safety and efficiency. These emerging markets are increasingly seeking to adopt international aviation standards, which include incorporating high-tech weather radar systems into their fleets and airports. As such, manufacturers of weather radar systems have a unique opportunity to enter these markets and establish themselves as key players in the region. The expansion of commercial aviation in emerging markets presents a large and untapped market for weather radar systems, which will be essential for ensuring the safety of air travelers in these regions.

Adoption of Advanced Radar Systems by Military and Defense Sectors

The adoption of advanced radar systems by the military and defense sectors is another opportunity for the Israel Aviation Weather Radar Market. Israel’s robust defense sector is already a significant consumer of advanced radar technologies, and there is increasing demand for weather radar systems that can support military operations, particularly in surveillance and navigation. These systems are vital for enhancing the safety of military aircraft and ensuring that they can operate effectively in diverse weather conditions. As geopolitical tensions persist in various parts of the world, the need for accurate and reliable weather radar systems in military applications will continue to rise. Furthermore, the integration of weather radar with other defense technologies, such as unmanned aerial vehicles (UAVs) and autonomous systems, offers new opportunities for innovation and growth. The growing focus on modernizing defense capabilities will drive the demand for advanced radar systems in military aviation, providing a substantial growth opportunity for manufacturers in the coming years.

Future Outlook

The future outlook for the Israel Aviation Weather Radar Market is optimistic, with steady growth anticipated over the next five years. Technological innovations in radar systems, particularly in areas such as miniaturization and signal processing, will continue to enhance the performance and affordability of weather radar solutions. Regulatory support for aviation safety and environmental compliance will further drive demand for these systems. Additionally, the growing aviation infrastructure in emerging markets and the modernization of military defense systems will create new opportunities for the adoption of advanced radar technologies. As the market evolves, advancements in radar integration with AI and IoT technologies will play a crucial role in shaping future developments.

Major Players

- Elta Systems

- Raytheon Technologies

- Honeywell International

- Thales Group

- L3Harris Technologies

- Leonardo S.p.A

- Northrop Grumman

- Rockwell Collins

- Airbus

- Saab AB

- Indra Sistemas

- Mitsubishi Electric Corporation

- Boeing

- Curtiss-Wright Corporation

- General Electric

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Military and defense contractors

- Airports and air traffic control services

- Aviation safety organizations

- Radar system integrators

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

Key variables affecting the market, such as product types, platform types, and geographic demand, are identified through primary and secondary research to ensure a comprehensive understanding.

Step 2: Market Analysis and Construction

Market trends, growth drivers, challenges, and segmentation are analyzed to build a well-structured model that provides insights into the competitive landscape and emerging opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry professionals validate the hypotheses, ensuring the research findings align with real-world market dynamics and stakeholder needs.

Step 4: Research Synthesis and Final Output

All collected data and insights are synthesized into a cohesive report, highlighting actionable insights and strategic recommendations for market participants.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for accurate weather forecasting

Growth of the commercial aviation sector

Technological advancements in radar systems

Rising investment in military aviation

Focus on safety and efficiency in aviation operations - Market Challenges

High initial costs of radar systems

Integration challenges with existing aviation infrastructure

Maintenance and operational costs

Regulatory constraints on radar technology usage

Complexity in adapting to diverse environments - Market Opportunities

Expansion of weather radar systems in emerging markets

Development of next-gen radar technologies

Partnerships between manufacturers and government agencies - Trends

Shift towards radar systems with higher resolution

Increased adoption of advanced signal processing

Integration of weather radar with autonomous flight systems

Growing focus on radar miniaturization for small aircraft

Rise in cloud-based weather radar solutions - Government Regulations & Defense Policy

International regulations on radar emissions

Safety standards for aviation radar systems

Government-funded defense radar development initiatives - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-based radar systems

Airborne radar systems

Marine radar systems

X-band radar systems

S-band radar systems - By Platform Type (In Value%)

Commercial aviation

Military aviation

Private aviation

Helicopter-based platforms

Surveillance platforms - By Fitment Type (In Value%)

OEM radar systems

Aftermarket radar systems

Upgraded radar systems

Custom-built radar systems

Portable radar systems - By EndUser Segment (In Value%)

Airlines

Military organizations

Private aviation companies

Weather forecasting agencies

Airports - By Procurement Channel (In Value%)

Direct sales

Distributors

Online sales

Government contracts

Third-party vendors - By Material / Technology (In Value%)

Solid-state radar technology

Microelectronics

Antenna technology

Signal processing technology

Radar data processing systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Market Value, Installed Units, System Complexity Tier, Pricing, Technological Advancements, End-User Adoption, Regional Presence, Government Contracts, Regulatory Compliance, Product Customization)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elta Systems

Raytheon Technologies

Honeywell International

Thales Group

L3Harris Technologies

Leonardo S.p.A

Northrop Grumman

Rockwell Collins

Airbus

Saab AB

Indra Sistemas

Mitsubishi Electric Corporation

Boeing

Curtiss-Wright Corporation

General Electric

- Demand for advanced radar systems from commercial airlines

- Military focus on weather radar for strategic operations

- Private aviation sector adopting weather radar for safety

- Weather forecasting agencies enhancing prediction accuracy

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035