Market Overview

The Israel Ballistic Missile Market recorded a market size of approximately USD ~ billion based on a recent historical assessment, supported by disclosures from national defense budget allocations, missile program funding releases, and procurement records published by the Ministry of Defense and Stockholm International Peace Research Institute. Market activity is driven by sustained investments in strategic deterrence systems, continuous upgrades to existing missile inventories, indigenous research and development programs, and integration of advanced guidance and propulsion technologies. Ongoing regional security pressures, coupled with long term defense planning, have reinforced consistent demand for both offensive and defensive ballistic missile systems across multiple operational layers.

Israel’s ballistic missile ecosystem is dominated by Tel Aviv, Haifa, and Be’er Sheva due to the concentration of defense headquarters, missile development centers, and advanced testing infrastructure. Tel Aviv anchors strategic program management and defense procurement oversight, while Haifa supports naval and interceptor integration activities through its industrial base. Be’er Sheva has emerged as a critical node for missile electronics, cyber defense integration, and testing facilities linked to nearby military installations. National dominance is reinforced by Israel’s vertically integrated defense industry, strong government backing, and established collaboration between armed forces, research institutions, and domestic manufacturers.

Market Segmentation

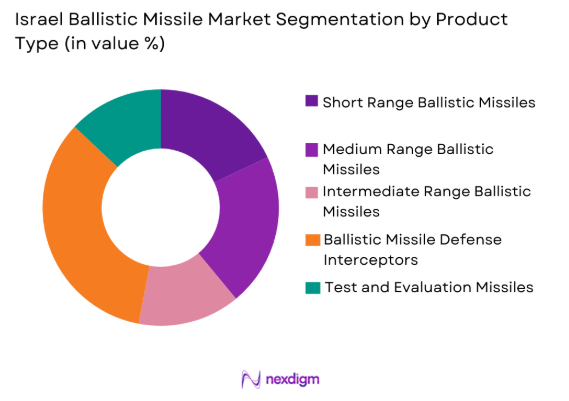

By Product Type

Israel Ballistic Missile market is segmented by product type into short range ballistic missiles, medium range ballistic missiles, intermediate range ballistic missiles, ballistic missile defense interceptors, and test and evaluation missiles. Recently, ballistic missile defense interceptors have a dominant market share due to persistent regional threat environments, emphasis on population and infrastructure protection, and continuous upgrades to multilayer missile defense architecture. Strong government prioritization of interception capability, repeated operational validation, and sustained funding for systems designed to counter evolving threats have reinforced dominance. Domestic production capabilities, proven battlefield performance, and integration with radar and command systems further strengthen demand. The strategic focus on defensive readiness and rapid response capabilities has consistently positioned interceptor systems as the most critical product category within national missile programs.

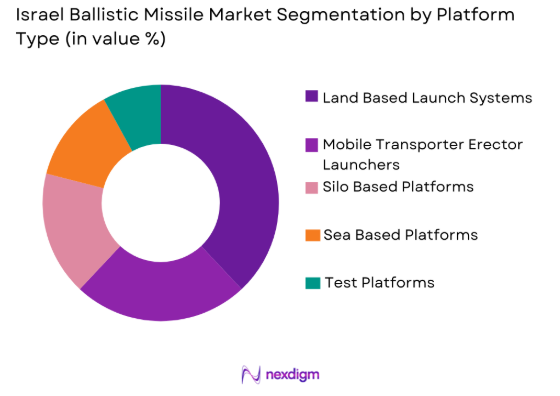

By Platform Type

Israel Ballistic Missile market is segmented by platform type into land based launch systems, mobile transporter erector launchers, silo based platforms, sea based platforms, and test platforms. Recently, land based launch systems have a dominant market share due to their strategic flexibility, rapid deployment capability, and compatibility with existing defense infrastructure. These platforms support both deterrence and defense missions while enabling efficient integration with national command and control networks. Established deployment doctrines, lower operational complexity compared to naval platforms, and ease of maintenance contribute to their dominance. Continuous modernization of land based systems and their suitability for diverse missile classes further reinforce their leading position across national missile deployments.

Competitive Landscape

The Israel Ballistic Missile Market exhibits a moderately consolidated competitive landscape characterized by a small number of vertically integrated defense manufacturers with deep government ties. Major players benefit from long term defense contracts, strong domestic demand, and sustained research funding. Competition is shaped by technological capability, system reliability, and alignment with national defense priorities rather than price sensitivity. Continuous innovation, classified development programs, and close collaboration with defense authorities limit new entrants while reinforcing the influence of established firms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Strategic Role |

| Israel Aerospace Industries | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon | ~ | ~ | ~ | ~ | ~ |

| Tomer Ltd | 1981 | Haifa | ~ | ~ | ~ | ~ | ~ |

Israel Ballistic Missile Market Analysis

Growth Drivers

Regional Strategic Deterrence and National Security Imperatives

Regional Strategic Deterrence and National Security Imperatives drive sustained growth in the Israel Ballistic Missile Market by anchoring missile systems as a core pillar of national defense doctrine and long term security planning. Persistent geopolitical volatility, cross border threat escalation, and the presence of advanced missile capabilities among regional adversaries compel continuous reinforcement of deterrence credibility. Ballistic missiles provide strategic depth by enabling rapid response, survivability, and escalation control across multiple operational scenarios. Government defense frameworks emphasize maintaining qualitative military superiority, directly translating into consistent funding allocations for missile development, testing, and deployment programs. Indigenous missile capabilities reduce strategic dependency and ensure uninterrupted operational readiness under restrictive international conditions. Integration of ballistic systems with layered air and missile defense architectures enhances national resilience against evolving threats. Continuous modernization programs focused on accuracy, mobility, and survivability further sustain procurement demand. As deterrence remains inseparable from national security priorities, ballistic missile investments continue to expand in scale and sophistication.

Advancement of Indigenous Missile Technology and Industrial Capability

Advancement of Indigenous Missile Technology and Industrial Capability accelerates market growth by enabling continuous performance enhancement and technological self reliance within domestic defense ecosystems. Significant investments in propulsion science, guidance systems, and reentry vehicle engineering support development of next generation missile platforms. Close collaboration between armed forces, research institutions, and defense manufacturers allows rapid translation of operational feedback into system upgrades. Indigenous production capabilities strengthen supply chain security and mitigate exposure to international sanctions or export controls. Technological spillovers from aerospace, electronics, and materials science sectors further improve missile reliability and lifecycle efficiency. Localized innovation reduces long term costs while maintaining strict quality and security standards. Expansion of advanced testing infrastructure supports validation of increasingly complex systems. These dynamics collectively reinforce sustained market expansion through technology driven demand.

Market Challenges

High Development Costs and Program Complexity

High Development Costs and Program Complexity challenge the Israel Ballistic Missile Market by increasing financial exposure and extending development timelines for advanced systems. Ballistic missile programs require substantial capital investment across research, prototyping, testing, and deployment phases. Sophisticated propulsion, guidance, and interception technologies demand highly specialized engineering expertise and infrastructure. Extensive testing regimes are necessary to validate performance, safety, and reliability under diverse operational conditions. Program delays or technical setbacks can escalate costs and strain defense budgets. Continuous threat evolution necessitates frequent system upgrades, increasing total lifecycle expenditure. Integration with command, control, and sensor networks further complicates development processes. Managing cost discipline while sustaining technological leadership remains a persistent constraint.

International Regulatory Constraints and Export Restrictions

International Regulatory Constraints and Export Restrictions limit operational flexibility and commercial scalability within the Israel Ballistic Missile Market. Missile related technologies are subject to stringent multilateral control regimes governing development, testing, and transfer. Compliance requirements can restrict access to specialized components and advanced materials sourced externally. Export limitations reduce opportunities to achieve economies of scale through international sales. Diplomatic sensitivities may influence program scope and collaboration potential. Regulatory uncertainty complicates long term planning and partnership formation. Balancing transparency with national security secrecy further adds complexity. These constraints collectively shape development pathways and market structure.

Opportunities

Next Generation Missile Defense Modernization Programs

Next Generation Missile Defense Modernization Programs create substantial opportunities by driving demand for advanced interceptors, sensors, and command architectures. Evolving threat profiles require enhanced interception accuracy and response speed. Government commitments to multilayer defense systems ensure long term funding continuity. Integration of artificial intelligence and improved radar technologies enhances system effectiveness. Modernization initiatives prioritize interoperability across defense layers. Continuous upgrades stimulate recurring procurement cycles. These programs reinforce domestic industrial participation. Modernization thus represents a critical growth avenue.

Expansion of Precision Strike and Advanced Guidance Capabilities

Expansion of Precision Strike and Advanced Guidance Capabilities presents opportunities through rising demand for accuracy, maneuverability, and controlled response options. Precision systems align with defense doctrines emphasizing minimized collateral impact. Advances in navigation and targeting technologies enhance operational effectiveness. Indigenous innovation accelerates deployment of upgraded platforms. Integration with intelligence assets increases strategic value. Enhanced guidance capabilities strengthen deterrence credibility. These advancements drive sustained investment momentum.

Future Outlook

The Israel Ballistic Missile Market is expected to maintain stable expansion over the next five years, supported by sustained defense spending, evolving regional security dynamics, and continued modernization of strategic deterrence systems. Technological development will increasingly focus on precision guidance, survivability, and integration with layered missile defense networks. Regulatory support for indigenous defense manufacturing and research will remain strong, ensuring continuity of long term programs. Demand will also be shaped by upgrades to legacy systems, interoperability requirements, and alignment with broader national security doctrine emphasizing rapid response and resilience.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- IMI Systems

- Tomer Ltd

- Aeronautics Defense Systems

- Elisra Electronic Systems

- Controp Precision Technologies

- RT LTA Systems

- BIRD Aerosystems

- Silver Arrow

- BlueBird Aero Systems

- SCD Semiconductor Devices

- Astro Aerospace

- UVision Air

Key Target Audience

- Defense ministries and armed forces

- Investments and venture capitalist firms

- Government and regulatory bodies

- Missile defense and aerospace manufacturers

- Defense electronics suppliers

- Strategic security agencies

- System integrators and prime contractors

- Policy and defense planning organizations

Research Methodology

Step 1: Identification of Key Variables

The research begins with identification of critical market variables including missile types, platforms, end users, and procurement mechanisms. Defense spending patterns and program disclosures are reviewed to establish scope. Key performance and technology indicators are defined. Relevant geopolitical and regulatory factors are mapped.

Step 2: Market Analysis and Construction

Quantitative and qualitative data from defense budgets, procurement records, and industry disclosures are analyzed. Market structure is constructed by segment and platform. Competitive positioning is evaluated based on capability and integration depth. Consistency checks are applied across data sources.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings are validated through consultation with defense analysts and industry experts. Assumptions related to demand drivers and challenges are tested. Conflicting inputs are reconciled through cross verification. Insights are refined to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Validated data is synthesized into a structured market model. Narrative analysis is aligned with quantitative findings. Final outputs are reviewed for coherence and compliance with scope. The report is finalized with clear segmentation and strategic insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Heightened regional threat perception and deterrence requirements

Continuous investment in indigenous missile development programs

Integration of layered missile defense and offense architectures

Advancements in guidance accuracy and propulsion efficiency

Strategic emphasis on survivability and rapid response capability - Market Challenges

High development and testing costs for advanced missile systems

International regulatory scrutiny and export control restrictions

Technological complexity in reentry and interception systems

Long development cycles impacting rapid deployment

Dependence on critical high end components and materials - Market Opportunities

Expansion of next generation missile defense interceptor programs

Upgrades of legacy ballistic missile platforms with advanced guidance

Collaboration in joint development and testing initiatives - Trends

Shift toward precision guided and maneuverable reentry vehicles

Increased focus on survivable and mobile launch platforms

Integration of digital command and control architectures

Use of advanced composites for weight and performance optimization

Emphasis on interoperability with multi layer defense systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Short Range Ballistic Missiles

Medium Range Ballistic Missiles

Intermediate Range Ballistic Missiles

Exo Atmospheric Interceptor Missiles

Ballistic Missile Defense Interceptors - By Platform Type (In Value%)

Land Based Launch Systems

Mobile Transporter Erector Launchers

Silo Based Platforms

Sea Based Platforms

Test and Evaluation Platforms - By Fitment Type (In Value%)

New System Deployment

Upgrade and Retrofit Programs

Indigenous Development Fitment

Joint Development Fitment

Experimental and Test Fitment - By End User Segment (In Value%)

Strategic Missile Forces

Air and Missile Defense Commands

Defense Research Organizations

Armed Forces Strategic Units

Government Security Agencies - By Procurement Channel (In Value%)

Direct Government Procurement

Domestic Defense Contracts

Strategic Bilateral Agreements

Joint Development Programs

Technology Transfer Agreements - By Material / Technology (in Value %)

Solid Fuel Propulsion Systems

Advanced Guidance and Navigation Systems

Composite Airframe Materials

Reentry Vehicle Heat Shield Technology

Command Control and Telemetry Systems

- Market share snapshot of major players

- Cross Comparison Parameters (system range capability, guidance accuracy, propulsion technology, payload capacity, response time, platform mobility, integration compatibility, lifecycle support, indigenous content level)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

Tomerd Technologies

Aeronautics Defense Systems

IMI Systems

UVision Air

BIRD Aerosystems

Controp Precision Technologies

SCD Semiconductor Devices

Elisra Electronic Systems

Astro Aerospace

RT LTA Systems

Silver Arrow

BlueBird Aero Systems

- Strategic forces prioritize long range deterrence and rapid response readiness

- Defense command units focus on interception capability and system integration

- Research organizations emphasize testing validation and technology advancement

- Security agencies demand reliability and secure command control systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035