Market Overview

The Israel Battlefield Management Systems market recorded a value of USD ~ billion based on a recent historical assessment, supported by budgetary disclosures from the Israeli Ministry of Defense and corroborated by SIPRI defense expenditure reporting. The market size is driven by persistent operational readiness requirements, continuous military modernization initiatives, and the need for real-time command, control, and situational awareness across complex threat environments. High adoption of network-centric warfare doctrines, integration of sensor-to-shooter architectures, and sustained investments in secure digital command infrastructure continue to reinforce procurement activity across all operational branches.

Israel dominates the battlefield management systems ecosystem due to a highly concentrated defense technology base in cities such as Tel Aviv, Haifa, and Beersheba, where defense primes, cyber firms, and military R&D units operate in close coordination. These locations benefit from proximity to operational commands, advanced software engineering talent, and live operational feedback loops. The country’s security environment accelerates deployment cycles, while strong collaboration between armed forces and domestic industry enables rapid customization, testing, and iterative system enhancement aligned with evolving operational doctrines.

Market Segmentation

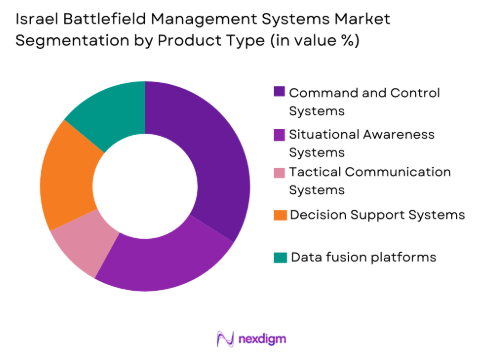

By Product Type

Israel Battlefield Management Systems market is segmented by product type into command and control software, situational awareness systems, decision support tools, data fusion platforms, and tactical communication management systems. Recently, command and control software has a dominant market share due to its critical role in aggregating operational data, synchronizing multi-unit activities, and enabling real-time decision-making across land, air, and naval forces. Israeli defense doctrine emphasizes centralized visibility with decentralized execution, which strongly favors advanced command software solutions. Continuous software upgrades, embedded cybersecurity layers, AI-enabled decision modules, and interoperability with legacy platforms further sustain procurement volumes, reinforcing dominance across operational deployments.

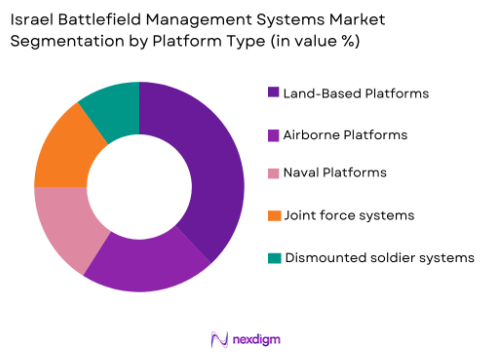

By Platform Type

Israel Battlefield Management Systems market is segmented by platform type into land-based systems, airborne platforms, naval platforms, joint force systems, and dismounted soldier systems. Recently, land-based systems have a dominant market share due to the operational focus on ground maneuver units, border security formations, and armored brigades that require persistent command connectivity. High deployment density of ground forces, frequent system upgrades on armored vehicles, and extensive integration with intelligence and surveillance assets support dominance. Land-based platforms also serve as primary nodes for joint force coordination, driving sustained investment and upgrade cycles.

Competitive Landscape

The Israel Battlefield Management Systems market exhibits a moderately consolidated competitive landscape dominated by established domestic defense firms with strong government relationships and vertically integrated capabilities. Major players benefit from long-term defense contracts, indigenous development mandates, and close operational collaboration with military units, enabling continuous product refinement. Smaller technology firms often operate as subsystem or software module suppliers, while prime contractors control system-level integration and lifecycle support.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Defense Segment |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ |

| Tadiran Communications | 1962 | Holon, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Battlefield Management Systems Market Analysis

Growth Drivers

Network-Centric Warfare Modernization Initiatives

Network-centric warfare modernization initiatives constitute a critical growth driver for the Israel Battlefield Management Systems market as defense forces increasingly prioritize integrated, real-time command environments across all operational domains. Battlefield management systems enable seamless connectivity between sensors, shooters, intelligence assets, and command nodes, allowing commanders to maintain continuous situational awareness in complex threat scenarios. The Israeli defense doctrine emphasizes rapid decision cycles and synchronized multi-unit operations, which directly elevates demand for advanced command and control platforms. Continuous modernization programs focus on replacing fragmented legacy command structures with unified digital architectures. These systems support joint operations by enabling data sharing across land, air, and naval forces without latency. Strong domestic software engineering capabilities allow rapid customization aligned with operational needs. Government-backed funding ensures long-term continuity of modernization roadmaps. Integration of artificial intelligence within network-centric frameworks further enhances operational effectiveness. Together, these factors sustain consistent procurement and upgrade activity across the market.

Persistent High-Intensity Operational Environment

Persistent high-intensity operational environment acts as a major growth driver due to Israel’s continuous security readiness requirements and frequent operational deployments. Battlefield management systems are essential for managing rapidly evolving combat situations where timely intelligence and coordinated responses determine mission outcomes. High operational tempo necessitates systems that can function reliably under electronic warfare, cyber threats, and contested communication environments. Commanders rely heavily on real-time battlefield visualization to manage dispersed units and complex engagements. Continuous exposure to live operational conditions accelerates feedback-driven system refinement and adoption. Lessons learned from deployments directly inform software upgrades and feature enhancements. This operational feedback loop reduces technology adoption risk and strengthens confidence in system effectiveness. Regular exercises and readiness drills further reinforce dependence on robust command platforms. As long as operational intensity remains elevated, demand for resilient battlefield management systems will continue to grow steadily.

Market Challenges

Complex Integration Across Heterogeneous Legacy and Modern Platforms

Complex integration across heterogeneous legacy and modern platforms represents a significant challenge for the Israel Battlefield Management Systems market because operational units continue to rely on a wide mix of aging and next-generation assets. Many armored vehicles, aircraft, naval platforms, and command posts were commissioned over different decades, creating incompatibilities in hardware interfaces, data standards, and communication protocols. Battlefield management systems must be engineered to operate seamlessly across this fragmented environment without disrupting ongoing operations. Custom middleware development and interface adaptation increase system complexity and extend deployment timelines. Integration testing often requires live operational validation, which constrains scheduling flexibility and elevates risk. Maintaining uninterrupted command functionality during system upgrades adds further operational pressure. Training personnel to operate hybrid environments combining old and new systems increases the cognitive and logistical burden on units. Lifecycle maintenance costs rise as vendors must support multiple configurations simultaneously. These integration challenges slow scalability, limit rapid fielding, and place sustained pressure on program budgets.

Cybersecurity Vulnerabilities and Data Integrity Assurance Requirements

Cybersecurity vulnerabilities and data integrity assurance requirements pose a critical challenge because battlefield management systems operate within highly contested digital environments. These systems are prime targets for cyber intrusion, data manipulation, jamming, and electronic warfare due to their central role in command and decision-making. Ensuring secure data transmission across distributed networks requires advanced encryption, continuous monitoring, and rapid threat detection capabilities. Cyber hardening significantly increases system development and lifecycle costs. Frequent software updates are necessary to address emerging vulnerabilities, which can disrupt operational availability if not carefully managed. Compliance with national cyber defense regulations imposes additional design constraints and certification requirements. Maintaining data integrity across multiple nodes and coalition interfaces further complicates system architecture. Specialized cybersecurity expertise is required throughout development, deployment, and operations. These combined factors make cybersecurity a persistent and resource-intensive challenge for market participants.

Opportunities

Artificial Intelligence Driven Decision Support and Automation Expansion

Artificial intelligence driven decision support and automation expansion represents a substantial opportunity for the Israel Battlefield Management Systems market as defense forces increasingly seek to compress decision cycles and reduce cognitive burden on commanders operating in complex environments. AI-enabled battlefield management systems can rapidly process large volumes of sensor data, intelligence feeds, and operational inputs to generate prioritized insights and actionable recommendations. This capability enhances situational understanding and supports faster, more accurate command decisions under time pressure. Automated data fusion minimizes manual interpretation errors and improves consistency across operational echelons. Predictive analytics enable proactive threat anticipation and resource allocation before engagement escalation. Israel’s strong domestic ecosystem in artificial intelligence, machine learning, and data science accelerates integration of advanced algorithms into operational systems. Continuous operational feedback improves model accuracy and relevance. Government support for AI research and defense digitization further strengthens commercialization pathways. Export demand for AI-enabled command solutions is rising among allied forces seeking proven technologies. These combined factors position AI-driven battlefield management capabilities as a key growth opportunity.

Defense Export Collaboration and Interoperability Driven International Demand

Defense export collaboration and interoperability driven international demand presents a major opportunity as Israel leverages its reputation for combat-proven battlefield management systems. Allied and partner nations increasingly prioritize interoperable command systems capable of supporting joint and coalition operations. Israeli battlefield management platforms are well positioned due to their modular architectures and adaptability to diverse operational doctrines. Participation in joint development programs enhances system compatibility and broadens addressable markets. Export contracts enable economies of scale, reducing unit costs and supporting sustained research investment. International military exercises provide validation and demonstration opportunities for system effectiveness. Regulatory frameworks supporting defense exports facilitate cross-border collaboration. Customizable system configurations allow tailoring to regional security requirements. Long-term support and upgrade agreements strengthen customer relationships. As coalition operations and multinational exercises expand, demand for interoperable battlefield management systems is expected to increase, creating sustained opportunity for market participants.

Future Outlook

The Israel Battlefield Management Systems market is expected to maintain steady expansion over the next five years driven by continuous modernization, digital transformation of command architectures, and integration of artificial intelligence. Advancements in cybersecurity, sensor fusion, and cloud-enabled command platforms will shape system evolution. Regulatory support for indigenous development and export collaboration will remain strong. Demand-side drivers include persistent security challenges, joint-force operational doctrines, and rapid technology refresh cycles across defense platforms.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- Tadiran Communications

- Aeronautics Defense Systems

- Elisra Group

- Controp Precision Technologies

- Orbit Communication Systems

- Bynet Electronics

- RT LTA Systems

- Magal Security Systems

- Third Eye Systems

- SCD Semiconductor Devices

- Telemenia Defense Systems

Key Target Audience

- Defense ministries

- Armed forces and military commands

- Homeland security agencies

- Border security forces

- Defense procurement agencies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense system integrators

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identification of demand-side, supply-side, and regulatory variables influencing the Israel Battlefield Management Systems market. Data inputs are derived from defense budgets, procurement disclosures, and operational requirements. Technology trends and platform deployment data are mapped. Variables are validated for relevance and consistency.

Step 2: Market Analysis and Construction

Market structure is constructed using triangulation of primary defense sources and secondary databases. Segment relationships are analyzed to understand demand drivers. Competitive positioning is evaluated using contract activity. Market size validation is conducted through cross-referencing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are tested through consultations with defense analysts and industry experts. Assumptions are refined based on expert feedback. Operational relevance is verified. Risk factors are reassessed.

Step 4: Research Synthesis and Final Output

All validated data is synthesized into a coherent analytical framework. Findings are structured according to market dynamics and competitive insights. Consistency checks are applied. Final outputs are reviewed for accuracy and clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Grow

- Growth Drivers

Rising emphasis on network-centric warfare concepts

Increased defense digitization and automation initiatives

High operational tempo requiring real-time situational awareness

Integration of multi-domain operations across land, air, and sea

Strong domestic defense innovation ecosystem - Market Challenges

High system integration complexity across legacy platforms

Cybersecurity vulnerabilities in networked battlefield systems

Budgetary constraints affecting large-scale deployments

Interoperability issues with allied and coalition forces

Rapid technology obsolescence cycles - Market Opportunities

Expansion of artificial intelligence driven decision-support tools

Growing demand for joint force and multi-domain integration systems

Export potential to allied and partner defense forces - Trends

Adoption of AI-assisted command decision frameworks

Shift toward software-centric and modular architectures

Increased focus on real-time data fusion from multiple sensors

Enhanced cybersecurity and encrypted communications integration

Greater emphasis on interoperability and coalition operations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and control software suites

Situational awareness and tracking systems

Decision support and mission planning tools

Data fusion and intelligence management systems

Tactical communication management systems - By Platform Type (In Value%)

Land-based battlefield systems

Airborne command and control platforms

Naval combat management interfaces

Joint force integrated platforms

Dismounted soldier systems - By Fitment Type (In Value%)

New platform integration

Platform upgrade and retrofit

Modular add-on systems

Network-centric integration kits

Standalone deployable systems - By End User Segment (In Value%)

Army and ground forces

Air force operational units

Naval and coastal defense forces

Joint command headquarters

Special operations forces - By Procurement Channel (In Value%)

Direct government procurement

Defense modernization programs

Indigenous development contracts

Public-private partnership models

Intergovernmental defense agreements - By Material / Technology (in Value %)

Artificial intelligence enabled analytics

Secure cloud-based command platforms

Advanced encryption and cybersecurity layers

Sensor fusion and data integration technologies

Software-defined communication architectures

- Market share snapshot of major players

- Cross Comparison Parameters (System interoperability, AI integration capability, Cybersecurity resilience, Platform scalability, Deployment flexibility, Indigenous content level, Upgrade and lifecycle support, Integration with legacy systems, Export readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

Tadiran Communications

Aeronautics Defense Systems

Elisra Group

Controp Precision Technologies

Orbit Communication Systems

SCD Semiconductor Devices

RT LTA Systems

Bynet Electronics

Telemecanique Defense Solutions Israel

Magal Security Systems

Third Eye Systems

- Operational commanders seeking faster decision-making cycles

- Field units requiring real-time situational awareness and coordination

- Joint headquarters focusing on integrated multi-domain operations

- Special forces demanding lightweight and secure command systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035