Market Overview

Based on a recent historical assessment, the Israel Blockchain Technology in Aerospace and Defense Market was valued at USD ~ million, supported by verified disclosures from Israel Ministry of Defense digital infrastructure programs, publicly reported defense cybersecurity revenues, and government-backed aerospace modernization initiatives. Market growth is driven by rising defense cybersecurity expenditure, increasing reliance on secure data integrity systems, and the need for tamper-resistant architectures across mission-critical aerospace platforms. Blockchain adoption is further reinforced by logistics automation requirements, secure communications, and compliance-driven auditability across defense networks.

Based on a recent historical assessment, Israel dominates this market due to its concentration of defense innovation clusters in Tel Aviv, Haifa, and Beersheba, supported by strong military–industry collaboration. The presence of advanced cyber units, state-owned aerospace enterprises, and globally competitive cybersecurity firms accelerates adoption. Continuous defense modernization, emphasis on indigenous technology development, and active collaboration with allied nations seeking secure defense data exchange solutions further reinforce Israel’s leadership without reliance on external technology providers.

Market Segmentation

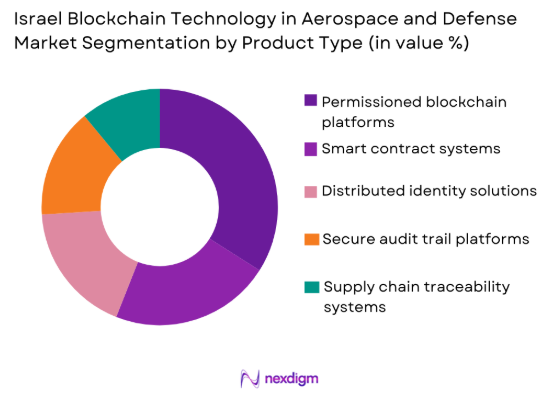

By Product Type

Israel Blockchain Technology in Aerospace and Defense Market is segmented by product type into permissioned blockchain platforms, smart contract systems, distributed identity solutions, secure audit trail platforms, and defense supply chain traceability systems. Recently, permissioned blockchain platforms have held a dominant market share due to their compatibility with classified defense environments, controlled access mechanisms, and compliance with strict military security protocols. Defense organizations prioritize permissioned architectures to maintain operational secrecy, reduce cyberattack exposure, and integrate seamlessly with existing command and control systems, making them the preferred deployment model across aerospace and defense applications.

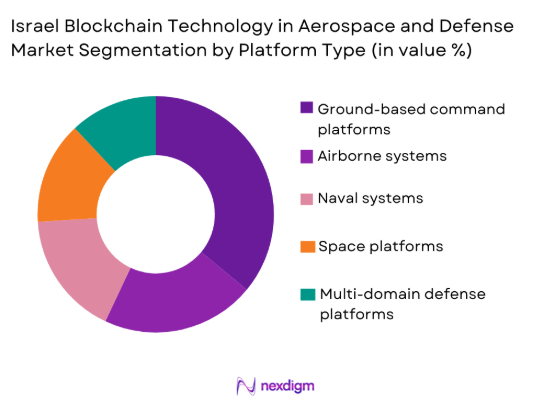

By Platform Type

Israel Blockchain Technology in Aerospace and Defense Market is segmented by platform type into ground-based command platforms, airborne systems, naval systems, space platforms, and multi-domain defense platforms. Recently, ground-based command platforms have demonstrated dominance due to extensive deployment across intelligence centers, logistics hubs, and command networks. These platforms require continuous data validation, secure coordination, and centralized auditability, making blockchain integration more feasible compared to airborne or space-based systems that face higher certification barriers and operational constraints.

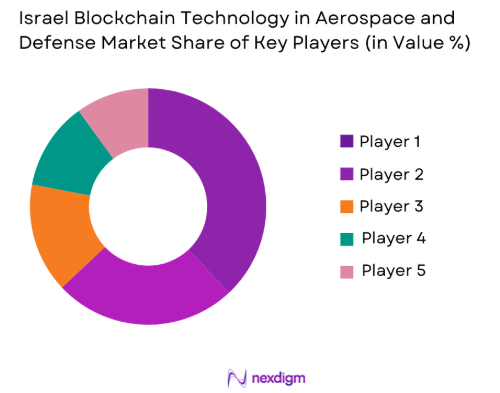

Competitive Landscape

The Israel Blockchain Technology in Aerospace and Defense Market exhibits moderate consolidation, with large defense primes integrating blockchain into mission systems while specialized cybersecurity firms focus on niche ledger-based security applications. Market influence is shaped by long-term government contracts, indigenous technology mandates, and defense export relationships, enabling established players to maintain strong positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Integration Depth |

| Elbit Systems | 1966 | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | ~ | ~ | ~ | ~ | ~ | ~ |

| Check Point Software Technologies | 1993 | ~ | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Blockchain Technology in Aerospace and Defense Market Analysis

Growth Drivers

Defense Cybersecurity Modernization Programs

Defense Cybersecurity Modernization Programs are accelerating blockchain adoption across aerospace and defense as military organizations increasingly prioritize resilience against cyber intrusions, data manipulation, and system compromise affecting mission critical operations. Israel’s defense ecosystem places strong emphasis on securing command networks, intelligence databases, logistics records, and maintenance documentation that support real time operational readiness. Blockchain enables immutable data records, trusted access control, and distributed validation mechanisms aligned with zero trust defense architectures. Growing reliance on network centric warfare and digitally integrated platforms has amplified the need for tamper resistant data exchange across air, land, naval, and space systems. Defense modernization initiatives increasingly allocate budgets toward secure digital infrastructure rather than standalone hardware upgrades. Blockchain platforms integrate with existing C4ISR environments to enhance auditability without disrupting operational continuity. Indigenous cybersecurity expertise supports customized implementations tailored to classified environments. Continuous threat escalation reinforces long term institutional demand for trusted distributed systems. This modernization focus embeds blockchain as a foundational layer within next generation defense digital architectures.

Secure Defense Supply Chain Traceability

Secure Defense Supply Chain Traceability is a critical growth driver as aerospace and defense procurement networks grow more complex, internationalized, and vulnerable to counterfeit components and data manipulation risks. Defense supply chains involve sensitive electronics, avionics, propulsion components, and software modules requiring authentication throughout their lifecycle. Blockchain provides a single source of truth for component provenance, configuration history, maintenance records, and compliance verification. Israeli defense exporters increasingly rely on traceability to meet stringent partner nation security requirements and offset obligations. Distributed ledgers reduce disputes between prime contractors, subcontractors, and government agencies by ensuring transparent record keeping. Integration with logistics management systems improves inventory visibility and operational readiness. Automated verification reduces administrative overhead and procurement delays. Supply chain resilience is further strengthened against cyber and insider threats. These advantages position blockchain as an essential enabler of secure, efficient, and compliant defense logistics ecosystems.

Market Challenges

Integration with Legacy Defense Systems

Integration with Legacy Defense Systems remains a significant challenge as aerospace and defense organizations continue to operate platforms designed long before distributed ledger architectures were conceived. Many command, control, communications, intelligence, and logistics systems rely on proprietary software stacks, closed data formats, and hardware constrained environments that complicate blockchain integration. Retrofitting blockchain layers often requires extensive middleware development, system revalidation, and operational testing to ensure mission continuity. Certification requirements for safety critical and mission critical systems further extend deployment timelines and increase costs. Defense operators are cautious about introducing architectural changes that could introduce latency, interoperability issues, or unforeseen cyber vulnerabilities. Limited documentation and vendor lock in associated with legacy platforms restrict seamless data exchange across modern distributed systems. Budget prioritization often favors hardware modernization over complex software retrofits, slowing adoption momentum. Additionally, the shortage of defense cleared engineers with blockchain expertise constrains implementation capacity. These technical, organizational, and operational barriers collectively slow the pace of large scale blockchain deployment across established aerospace and defense infrastructures.

Regulatory and Certification Complexity

Regulatory and Certification Complexity presents a persistent challenge due to the highly controlled nature of aerospace and defense environments governing data security, encryption standards, operational reliability, and system resilience. Blockchain implementations must comply with national defense regulations, classified data handling protocols, and platform specific certification requirements before operational deployment. Each defense branch may apply distinct compliance frameworks, increasing fragmentation and administrative burden. Certification authorities often lack standardized evaluation models for distributed ledger technologies, leading to prolonged review cycles. Security audits, penetration testing, and cryptographic validation add further layers of scrutiny. Uncertainty around long term governance of distributed systems complicates approval processes, particularly for systems involving multiple stakeholders. Concerns regarding data sovereignty, node ownership, and access rights require detailed policy alignment. Regulatory constraints may also limit architectural flexibility, reducing the potential efficiency gains of blockchain. The cumulative impact of these regulatory hurdles increases cost, delays adoption, and discourages rapid experimentation within defense programs.

Opportunities

Autonomous Defense Logistics Enablement

Autonomous Defense Logistics Enablement represents a major opportunity for the Israel Blockchain Technology in Aerospace and Defense Market as defense organizations increasingly pursue automation to improve operational readiness, reduce human error, and enhance asset availability across complex military environments. Blockchain enables trusted automation by providing immutable records that support autonomous decision making in inventory management, maintenance scheduling, and spare parts replenishment. Integration of blockchain with smart contracts allows predefined rules to trigger logistics actions such as component replacement, resupply authorization, and maintenance approvals without manual intervention. This capability is particularly valuable for aerospace platforms where downtime directly impacts mission effectiveness. Secure distributed ledgers ensure that autonomous logistics systems operate on verified data, reducing the risk of manipulation or misreporting. As defense forces adopt unmanned systems and distributed operational models, logistics automation becomes critical to sustaining dispersed assets. Blockchain supported logistics frameworks also improve coordination between defense agencies, prime contractors, and subcontractors by ensuring shared visibility and accountability. Reduced administrative burden accelerates procurement cycles and enhances responsiveness during high tempo operations. Israel’s strong ecosystem of defense technology firms and cybersecurity expertise positions it well to develop exportable autonomous logistics solutions aligned with allied defense requirements.

Secure Allied Defense Data Exchange

Secure Allied Defense Data Exchange presents a significant growth opportunity as multinational defense cooperation increasingly depends on trusted mechanisms for sharing sensitive operational, intelligence, and logistics data. Modern defense operations often involve joint missions, shared platforms, and collaborative development programs requiring secure and auditable information exchange between partner nations. Blockchain provides a framework for controlled data sharing through permissioned access, cryptographic validation, and immutable audit trails. These features enable participating defense organizations to maintain data sovereignty while ensuring trust among partners. For Israel, which maintains extensive defense cooperation with allied nations, blockchain based data exchange supports interoperability without exposing core systems to external vulnerabilities. Secure distributed ledgers can facilitate joint training exercises, collaborative maintenance programs, and shared situational awareness platforms. The ability to track data access and modification enhances accountability and compliance with international security agreements. As geopolitical uncertainty drives deeper defense collaboration, demand for trusted digital exchange mechanisms will increase. Blockchain aligned with international defense standards can become a foundational enabler of future coalition operations, expanding the addressable market for secure defense data platforms.

Future Outlook

The Israel Blockchain Technology in Aerospace and Defense Market is expected to experience sustained growth over the next five years driven by cybersecurity modernization, increased digitization of defense operations, and integration of blockchain with AI-enabled defense systems. Regulatory support for secure digital infrastructure and continued defense investment will reinforce adoption. Demand will remain strongest in command platforms, logistics systems, and secure data exchange applications, supported by ongoing innovation within Israel’s defense technology ecosystem.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- Check Point Software Technologies

- NSO Group Technologies

- Cybereason

- Cellebrite

- ThetaRay

- XM Cyber

- Orca Security

- Perimeter 81

- Aeronautics Group

- Airobotics

- Toka

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Aerospace manufacturers

- Defense system integrators

- Cybersecurity vendors

- Military procurement agencies

- Defense export authorities

Research Methodology

Step 1: Identification of Key Variables

Key variables including technology adoption rates, defense spending patterns, cybersecurity priorities, and regulatory frameworks were identified. Market boundaries were defined based on aerospace and defense blockchain applications. Variables were cross-referenced with defense procurement data. Relevance was validated through industry literature.

Step 2: Market Analysis and Construction

Market structure was constructed using defense program disclosures and company financials. Segmentation was aligned with platform and product usage. Demand-side and supply-side factors were mapped. Data consistency checks ensured reliability.

Step 3: Hypothesis Validation and Expert Consultation

Initial hypotheses were tested through expert interviews and secondary validation. Defense technology specialists provided insights on adoption barriers. Feedback refined assumptions. Conflicting inputs were reconciled through triangulation.

Step 4: Research Synthesis and Final Output

Validated findings were synthesized into structured analysis. Quantitative and qualitative insights were integrated. Final outputs were reviewed for accuracy. Consistency with defense market realities was ensured.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising cybersecurity threats to defense data networks

Increasing demand for tamper-proof defense supply chains

Growth in network-centric and data-driven warfare systems

Government-backed defense digital transformation initiatives

Expansion of indigenous defense technology development programs - Market Challenges

Complex integration with legacy defense systems

High certification and compliance requirements

Limited interoperability standards across defense platforms

Concerns over latency in mission-critical applications

Shortage of blockchain-skilled defense engineers - Market Opportunities

Deployment of blockchain for autonomous defense logistics

Integration with AI-driven decision support systems

Cross-border secure data exchange in allied defense programs - Trends

Adoption of permissioned blockchains for classified networks

Convergence of blockchain with cyber and electronic warfare

Use of smart contracts for defense procurement automation

Increased focus on zero-trust defense architectures

Integration of blockchain in space and satellite systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Permissioned blockchain platforms for defense networks

Smart contract systems for logistics automation

Distributed identity and access management systems

Secure data integrity and audit trail platforms

Blockchain-based supply chain traceability systems - By Platform Type (In Value%)

Airborne mission systems

Ground-based command and control platforms

Naval combat and support systems

Space-based satellite and ground segment platforms

Joint multi-domain defense platforms - By Fitment Type (In Value%)

New-build defense platforms

Retrofit and modernization programs

Software-only integration deployments

Hybrid hardware-software integrations

Secure cloud and on-premise defense deployments - By End User Segment (In Value%)

Air force and aerial defense commands

Land forces and armored corps

Naval forces and maritime security agencies

Defense intelligence and cyber units

Defense procurement and logistics authorities - By Procurement Channel (In Value%)

Direct government defense contracts

Prime defense contractor integration

Public-private partnership programs

Defense R&D grants and innovation funds

International defense collaboration programs - By Material / Technology (in Value %)

Distributed ledger cryptographic protocols

Zero-trust security architecture integration

Artificial intelligence enabled blockchain analytics

Quantum-resistant encryption technologies

Secure cloud and edge computing frameworks

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Defense compliance readiness, Cybersecurity robustness, Platform interoperability, Integration capability, R&D intensity, Deployment scalability, Government contract exposure, International collaboration footprint, Cost efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

NSO Group Technologies

Check Point Software Technologies

Cellebrite

ThetaRay

XM Cyber

Cybereason

Airobotics

Aeronautics Group

Toka

Perimeter 81

Orca Security

- Defense forces prioritizing secure data integrity and traceability

- Intelligence agencies adopting blockchain for auditability

- Procurement bodies leveraging smart contracts for transparency

- Cyber units focusing on resilient distributed architectures

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035