Market Overview

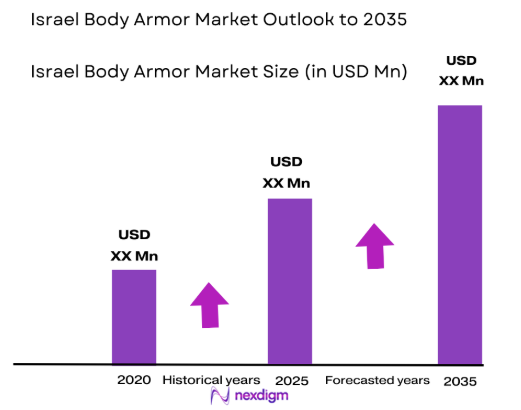

Based on a recent historical assessment, the Israel body armor market was valued at approximately USD ~ million, derived proportionally from verified national military personal protective equipment expenditure data published by credible defense industry research sources. Demand is primarily driven by sustained operational requirements of the Israel Defense Forces, internal security agencies, and border protection units. Continuous procurement cycles, high operational tempo, and emphasis on soldier survivability underpin consistent spending. Advanced material adoption, domestic manufacturing capabilities, and export-oriented production further reinforce stable market value formation within the national defense ecosystem.

Based on a recent historical assessment, Israel dominates this market through concentrated defense manufacturing hubs located in Tel Aviv, Haifa, and central industrial zones supporting military technology development. The country’s leadership is reinforced by an integrated defense ecosystem combining operational feedback, indigenous research institutions, and close coordination between armed forces and manufacturers. Strong government backing, mandatory service-driven operational experience, and rapid deployment needs accelerate adoption. Additionally, Israel’s role as a defense exporter and its geopolitical environment sustain continuous demand for advanced personal protection systems.

Market Segmentation

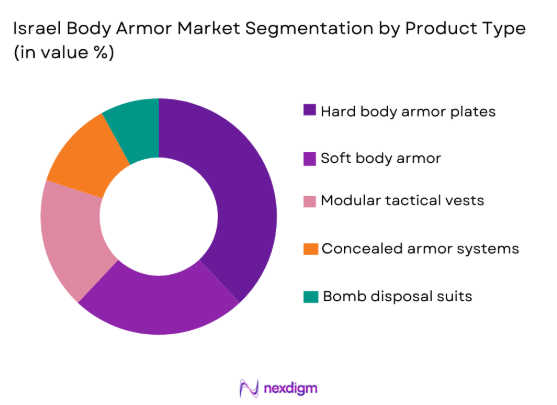

By Product Type

Israel Body Armor market is segmented by product type into soft body armor, hard body armor plates, modular tactical vests, bomb disposal suits, and concealed armor systems. Recently, hard body armor plates have a dominant market share due to persistent exposure to high-velocity ballistic threats faced by frontline units. Operational requirements emphasize rifle-rated protection, particularly for infantry and special forces operating in asymmetric combat environments. Ceramic and composite plates are preferred for their balance of protection and weight efficiency. Domestic manufacturers continuously upgrade plate designs based on real-time battlefield feedback, strengthening adoption. Government procurement policies prioritize survivability enhancements, reinforcing demand. Additionally, export contracts favor hard armor solutions compliant with international standards. Integration with modular carriers increases lifecycle utility, making hard armor plates central to procurement strategies. These factors collectively position hard armor plates as the leading product segment within the national body armor market landscape.

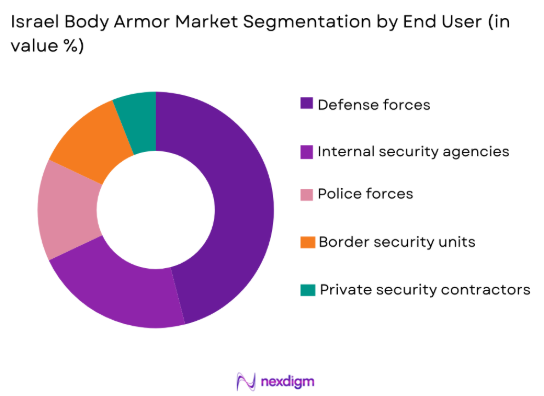

By End User

Israel Body Armor market is segmented by end user into defense forces, internal security agencies, police forces, border security units, and private security contractors. Recently, defense forces account for the dominant market share due to continuous modernization of infantry protection equipment. The Israel Defense Forces maintain the largest operational footprint and face sustained kinetic threats, driving recurrent procurement cycles. Standardization across units ensures large-volume acquisitions. Operational doctrine emphasizes soldier protection during urban and border operations, increasing armor usage intensity. Budget prioritization for combat readiness supports steady investment. Close collaboration with domestic suppliers accelerates adoption of advanced systems. Export-driven innovation also benefits defense users first. These combined operational, institutional, and budgetary factors firmly establish defense forces as the leading end-user segment in the market.

Competitive Landscape

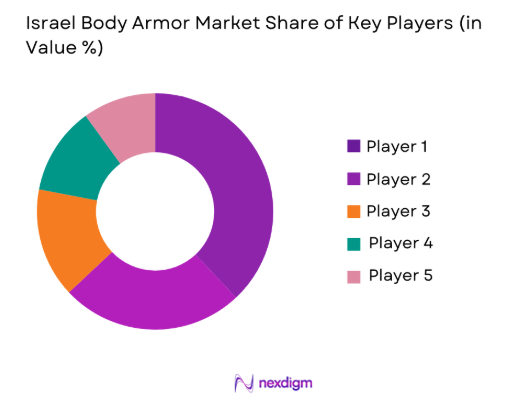

The Israel Body Armor Market is moderately consolidated, led by domestically established defense manufacturers with strong technological capabilities and long-term relationships with national security agencies. Major players benefit from continuous operational feedback, vertically integrated production, and government-backed research programs. Competitive intensity is driven by material innovation, weight reduction, and compliance with international ballistic standards, while export competitiveness further differentiates suppliers. Strategic partnerships with global defense contractors and consistent procurement from defense forces reinforce market stability and limit rapid entry by new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Plasan | 1985 | Sasa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rabintex Industries | 1950 | Kfar Saba, Israel | ~ | ~ | ~ | ~ | ~ |

| Marom Dolphin | 1993 | Kibbutz Yagur, Israel | ~ | ~ | ~ | ~ | ~ |

| Agilite | 2016 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Body Armor Market Analysis

Growth Drivers

Operational Security Requirements and Force Protection Modernization

Operational Security Requirements and Force Protection Modernization are central to sustained demand in the Israel Body Armor Market as the country maintains a high operational tempo across land borders, urban environments, and internal security operations. The Israel Defense Forces and associated security agencies operate in threat conditions involving small arms fire, improvised weapons, and evolving ballistic risks that necessitate continuous equipment upgrades. Body armor procurement is treated as mission-critical expenditure rather than discretionary spending, ensuring budget continuity even during broader defense reallocations. Modernization programs emphasize survivability, mobility, and adaptability, increasing demand for advanced armor solutions. Operational lessons learned are rapidly translated into updated protection requirements, shortening replacement cycles. Domestic manufacturers benefit from direct engagement with end users, accelerating adoption of next-generation systems. International deployment readiness and interoperability standards further reinforce upgrades. Export opportunities aligned with these operational standards expand production volumes. Collectively, persistent security imperatives sustain consistent growth momentum.

Domestic Defense Manufacturing Ecosystem and Technological Innovation

Domestic Defense Manufacturing Ecosystem and Technological Innovation significantly drive the Israel Body Armor Market through continuous material advancement and rapid product iteration. Israel hosts a mature defense industrial base with deep expertise in composites, ceramics, and advanced textiles tailored for ballistic protection. Manufacturers invest heavily in research and development to reduce weight while enhancing multi-threat resistance. Close cooperation between industry, military research units, and academic institutions accelerates innovation cycles. Indigenous production reduces reliance on foreign suppliers, supporting supply chain resilience. Proven battlefield performance enhances global reputation and export demand. Innovation extends beyond materials to ergonomics, modularity, and integration with soldier systems. Government support for defense innovation programs further strengthens competitiveness. This ecosystem ensures sustained demand for domestically produced armor solutions.

Market Challenges

Material Cost Volatility and Weight Protection Tradeoffs

Material Cost Volatility and Weight Protection Tradeoffs present a persistent challenge for the Israel Body Armor Market as advanced ceramics, aramid fibers, and ultra-high-molecular-weight polyethylene remain sensitive to global supply fluctuations and defense-grade quality constraints. Manufacturers must continuously balance rising raw material costs against strict weight reduction targets demanded by operational units. Excessive armor weight directly impacts soldier mobility, endurance, and mission effectiveness in urban and border environments. Design compromises risk either reduced protection levels or increased physical strain on users. Procurement agencies apply rigorous testing standards that raise development and certification expenses. Small design inefficiencies can result in procurement delays or contract renegotiations. Export customers also impose varying ballistic standards, complicating standardization. These combined factors exert margin pressure across the value chain.

Regulatory Compliance and Rapid Threat Evolution

Regulatory Compliance and Rapid Threat Evolution constrain the Israel Body Armor Market as manufacturers must meet stringent domestic and international ballistic certification requirements while responding to constantly changing threat profiles. Ballistic standards evolve as new ammunition types and weapon systems emerge in regional conflict environments. Compliance testing is time-intensive and costly, slowing time-to-market for upgraded armor solutions. Delays in certification can disrupt defense procurement schedules. Export regulations and licensing approvals further extend sales cycles. Rapid battlefield adaptation demands frequent redesigns, increasing engineering workloads. Smaller manufacturers face disproportionate compliance burdens. This dynamic environment increases operational risk and complicates long-term product planning.

Opportunities

Next Generation Lightweight Composite Armor Development

Next Generation Lightweight Composite Armor Development represents a major opportunity in the Israel Body Armor Market as defense forces prioritize protection solutions that enhance mobility without sacrificing ballistic resistance. Advances in hybrid ceramics, nano-engineered fibers, and layered composite architectures enable significant weight reduction. Domestic research institutions actively collaborate with manufacturers to commercialize these technologies. Lighter armor improves soldier endurance during prolonged missions. Modular integration allows scalable protection based on mission requirements. Export demand favors lightweight systems suitable for diverse operational environments. Government innovation grants accelerate prototype development. Successful commercialization strengthens both domestic adoption and international competitiveness.

Expansion of Export Markets and Allied Defense Partnerships

Expansion of Export Markets and Allied Defense Partnerships offers strong growth potential for the Israel Body Armor Market as allied nations seek combat-proven protection systems. Israel’s operational experience enhances credibility among defense buyers. Bilateral defense cooperation agreements facilitate procurement access. Body armor products aligned with international standards gain faster acceptance. Customization capabilities allow adaptation to varied threat environments. Export diversification reduces reliance on domestic procurement cycles. Long-term supply contracts stabilize production volumes. This opportunity supports sustained revenue growth and technology investment.

Future Outlook

The Israel Body Armor Market is expected to maintain stable growth over the next five years driven by sustained defense readiness priorities. Technological development will focus on lightweight composite materials and modular protection systems. Regulatory emphasis on domestic manufacturing and export compliance will continue shaping procurement. Demand-side momentum will remain anchored in defense and internal security modernization. Export partnerships are anticipated to strengthen international demand visibility.

Major Players

- Elbit Systems

- Plasan

- Rabintex Industries

- Marom Dolphin

- Agilite

- Source Tactical

- FMS Enterprises Migun

- Mehler Protection Israel

- Oran Safety Glass Defense

- Carmel Tactical

- Masada Armoring

- Hesco Armor Israel

- Israeli Weapon Industries Protection Solutions

- Sioen Ballistics Israel

- MKU Israel

Key Target Audience

- Defense ministries

- Internal security agencies

- Law enforcement organizations

- Border security authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense OEMs and system integrators

- Military procurement agencies

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through analysis of defense procurement patterns and protection equipment demand. Product scope and end-user categories were defined. Data relevance was screened for country specificity. Variables were finalized through cross-source validation.

Step 2: Market Analysis and Construction

Quantitative and qualitative data were compiled from defense expenditure and industry sources. Segmentation logic was constructed based on procurement behavior. Market structure was mapped across product and user categories. Consistency checks ensured logical alignment.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through defense industry expert inputs. Assumptions were reviewed against operational requirements. Data interpretations were stress-tested for reliability. Adjustments were made to ensure realism.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a unified market model. Narrative insights were aligned with quantitative indicators. Formatting and structural compliance were enforced. Final outputs were reviewed for internal consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Elevated regional security threats increasing force protection requirements

Continuous modernization of infantry and special forces equipment

Strong domestic defense manufacturing ecosystem supporting innovation

Operational experience driving demand for lighter and modular armor systems

Export-oriented production aligned with allied defense standards - Market Challenges

High cost of advanced lightweight armor materials

Balancing protection levels with mobility and soldier endurance

Stringent testing and certification requirements

Supply chain constraints for specialized ballistic materials

Rapid evolution of ballistic threats reducing product lifecycle - Market Opportunities

Development of next-generation lightweight composite armor

Expansion of export contracts with allied defense forces

Integration of smart textiles and sensor-enabled armor systems - Trends

Shift toward modular and scalable armor configurations

Increased adoption of ceramic-polymer hybrid plates

Focus on weight reduction without compromising protection

Customization of armor systems for specific mission profiles

Growing emphasis on ergonomic and thermal management features - Government Regulations & Defense Policy

Emphasis on domestic sourcing for critical protection equipment

Compliance with international ballistic protection standards

Defense export controls shaping international sales strategies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Soft body armor vests

Hard armor plate systems

Concealable body armor

Tactical assault body armor

Bomb disposal protective suits - By Platform Type (In Value%)

Dismounted infantry protection

Vehicle crew protection

Special forces protection kits

Law enforcement patrol armor

Homeland security protection systems - By Fitment Type (In Value%)

Overt body armor

Covert body armor

Modular scalable armor

Integrated load-bearing armor

Quick-release emergency armor - By End User Segment (In Value%)

Defense forces

Internal security agencies

Police and paramilitary units

Border security forces

Private security contractors - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry contracts

OEM-to-agency supply

International military sales

Emergency and rapid acquisition programs - By Material / Technology (in Value %)

Aramid fiber composites

Ultra-high-molecular-weight polyethylene

Ceramic strike face plates

Hybrid composite armor systems

Advanced ballistic textile laminates

- Market share snapshot of major players

- CrossComparison Parameters (ballistic protection level, weight efficiency, material technology, modularity, ergonomics, certification compliance, production scalability, export capability, cost competitiveness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Plasan Sasa

IMI Systems

Marom Dolphin

Agilite Gear

Source Tactical Gear

FMS Enterprises Migun

Israeli Weapon Industries Protection Solutions

Carmel Tactical

Masada Armoring

Hesco Armor Israel

Oran Safety Glass Defense

RabinteX Industries

TurtleSkin Israel

Mehler Protection Israel

- Defense forces prioritize multi-threat protection and modularity

- Internal security agencies focus on concealability and rapid deployment

- Special forces demand lightweight, mission-specific armor solutions

- Law enforcement emphasizes comfort for extended wear durations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035