Market Overview

Based on a recent historical assessment, the Israel Border Security Market was valued at USD ~ billion, derived from the country’s homeland security expenditure where border security represents a core and consistently funded component. This market size is driven by sustained government spending on border surveillance systems, advanced sensor integration, command and control infrastructure, and physical security barriers. Demand is further reinforced by persistent geopolitical tensions, evolving cross-border threat vectors, and the prioritization of technological superiority in national security planning, resulting in continuous procurement and system upgrades across multiple border domains.

Based on a recent historical assessment, Israel dominates its border security landscape through strategic hubs such as Tel Aviv, Haifa, and Beersheba, which host major defense manufacturers, R&D centers, and system integrators supporting border security deployments. National leadership in this market is reinforced by strong domestic defense industrial capabilities, close coordination between military and homeland security agencies, and a regulatory environment favoring rapid technology adoption. Regional dominance is supported by operational experience, export-oriented defense innovation, and centralized procurement structures enabling efficient nationwide implementation.

Market Segmentation

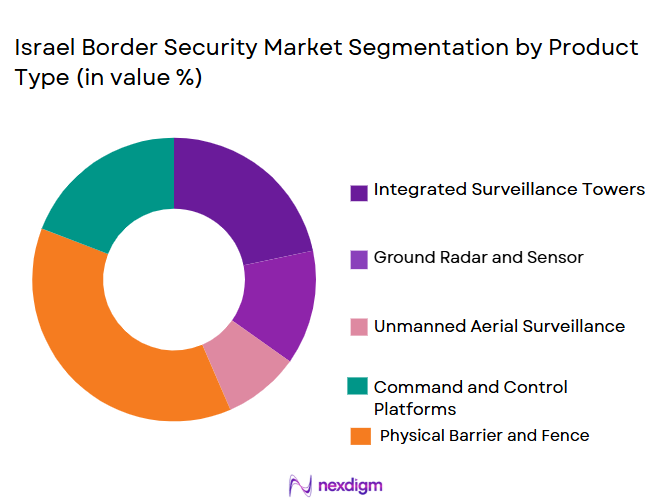

By Product Type

Israel Border Security Market is segmented by product type into surveillance systems, detection sensors, command and control systems, physical barriers, and communication systems. Recently, surveillance systems have held a dominant market share due to sustained demand for electro-optical sensors, thermal imaging, radar-based monitoring, and integrated surveillance towers deployed across land and maritime borders. Continuous threat detection requirements, combined with Israel’s emphasis on early warning and real-time situational awareness, have driven consistent investment in surveillance-centric solutions. Strong domestic manufacturing capability, proven operational effectiveness, and ease of integration with legacy systems further reinforce the dominance of surveillance systems within national border security deployments.

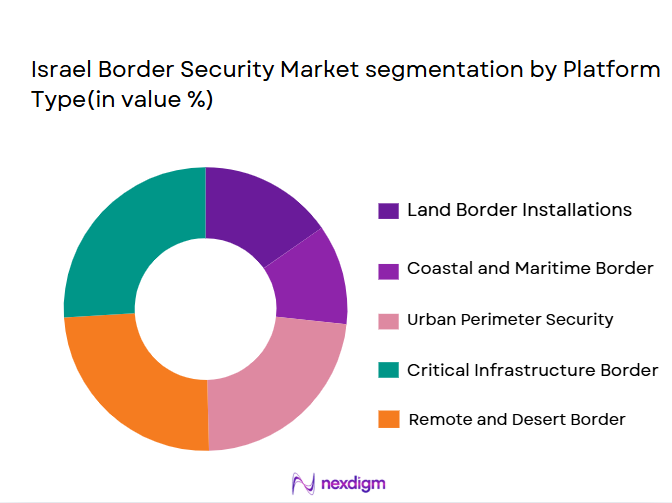

By Platform Type

Israel Border Security Market is segmented by platform type into land borders, coastal borders, aerial surveillance platforms, urban perimeter security, and critical infrastructure borders. Recently, land border platforms have maintained a dominant market share due to extensive land-based border lengths requiring layered security architectures. Persistent ground infiltration risks and the need for continuous monitoring across diverse terrains have prioritized land-based deployments. Government focus on fencing, ground radar, and integrated sensor networks along land borders, supported by established infrastructure and operational doctrine, has reinforced the dominance of this platform segment.

Competitive Landscape

The Israel Border Security Market is characterized by moderate to high consolidation, with a small group of domestic defense primes and specialized technology firms exerting strong influence over system development, integration, and deployment. Major players benefit from long-standing government relationships, vertically integrated capabilities, and continuous innovation pipelines supported by defense-funded research. Competition is primarily driven by technological differentiation, system interoperability, and operational reliability rather than pricing alone.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Border Security Specialization |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~

|

~

|

~

|

~

|

~

|

| Israel Aerospace Industries | 1953 | Lod | ~

|

~

|

~

|

~

|

~

|

| Magal Security Systems | 1965 | Yehud | ~

|

~

|

~

|

~

|

~

|

| Elta Systems | 1967 | Ashdod | ~

|

~

|

~

|

~

|

~

|

Israel Border Security Market Analysis

Growth Drivers

Advanced Integrated Surveillance Modernization Programs

Advanced Integrated Surveillance Modernization Programs: Israel’s border security growth is strongly driven by sustained modernization initiatives focused on integrating advanced surveillance technologies across land, maritime, and aerial borders, reflecting long-term national security priorities rather than short-term procurement cycles. Continuous upgrades to electro-optical sensors, thermal imaging systems, ground radar, and AI-enabled analytics have expanded system capabilities from passive monitoring to predictive threat detection. Government agencies emphasize end-to-end situational awareness, requiring seamless integration between sensors, command centers, and response units. Domestic defense firms benefit from close collaboration with operational forces, allowing rapid field testing and iterative improvements. These modernization programs are embedded within multi-year defense planning frameworks, ensuring stable funding flows and minimizing procurement volatility. Integration of autonomous and unmanned systems further amplifies system reach while reducing manpower dependency. Cyber-secure data fusion platforms enhance decision-making speed and accuracy, reinforcing reliance on technologically dense solutions. Collectively, these modernization efforts create a sustained demand environment for advanced border security systems.

Persistent Geopolitical and Cross-Border Threat Environment

Persistent Geopolitical and Cross-Border Threat Environment: The ongoing complexity of Israel’s regional security landscape continues to generate structural demand for robust border security systems, directly influencing procurement scale and technological depth. Cross-border infiltration risks, asymmetric threats, and evolving tactics necessitate constant adaptation of border protection measures. Border security is treated as a frontline defense layer, prompting continuous reassessment of vulnerabilities and rapid deployment of countermeasures. The need to protect civilian populations and critical infrastructure elevates border security from a tactical requirement to a strategic imperative. This environment encourages investment in redundancy, layered defenses, and rapid-response capabilities. Operational lessons learned from real-world incidents feed directly into system upgrades and new acquisitions. As threats evolve technologically, demand shifts toward smarter, more autonomous systems capable of operating in contested environments. This persistent threat backdrop ensures long-term market resilience.

Market Challenges

High Capital Intensity and Long Deployment Cycles

High Capital Intensity and Long Deployment Cycles: One of the most significant challenges in the Israel Border Security Market is the high capital expenditure required for large-scale, integrated border security deployments, which involve complex hardware, software, and infrastructure investments. Surveillance towers, sensor networks, and command centers demand substantial upfront funding before operational benefits are realized. Long deployment timelines are common due to terrain complexity, regulatory approvals, and integration testing requirements. These extended cycles can strain annual defense budgets and complicate procurement planning. System upgrades often require partial dismantling of existing infrastructure, increasing lifecycle costs. Budget prioritization across competing defense needs can delay border security projects. Additionally, maintaining technological relevance over long deployment horizons requires continuous reinvestment. These financial and operational constraints can slow adoption despite clear security needs.

System Integration and Cybersecurity Complexity

System Integration and Cybersecurity Complexity: Israel’s border security architecture relies on integrating diverse technologies sourced from multiple vendors, creating challenges related to interoperability, data fusion, and system resilience. Legacy systems must often be integrated with next-generation platforms, increasing engineering complexity and testing requirements. Cybersecurity risks are amplified as border systems become increasingly networked and data-driven. Protecting sensitive operational data from cyber intrusion is critical, yet requires constant updates and specialized expertise. Any system vulnerability can have national security implications, raising the cost and scrutiny of deployments. Ensuring seamless coordination between military, police, and intelligence systems further complicates integration. These challenges increase implementation risk and demand highly skilled technical resources.

Opportunities

Expansion of Autonomous and AI-Driven Border Systems

Expansion of Autonomous and AI-Driven Border Systems: A significant opportunity exists in expanding autonomous and AI-driven solutions across Israel’s border security infrastructure, building on existing technological leadership. AI-enabled analytics can enhance threat detection accuracy while reducing operator workload. Autonomous ground and aerial platforms extend surveillance coverage into hard-to-reach areas without proportional increases in manpower. These systems support continuous monitoring with lower long-term operating costs. Government interest in force multiplication aligns with broader defense digitization strategies. Domestic firms can leverage proven AI expertise to develop exportable solutions. Integration of machine learning improves system adaptability to evolving threat patterns. This opportunity supports both domestic modernization and international market expansion.

International Collaboration and Export-Led Growth

International Collaboration and Export-Led Growth: Israel’s strong reputation in border security technology creates opportunities for international collaboration and export-driven growth, indirectly strengthening the domestic market. Export success enables economies of scale, reducing unit costs for domestic deployments. Joint development programs with allied nations accelerate innovation and standardization. International operational feedback improves product maturity and reliability. Government support for defense exports reinforces industry sustainability. Export-led revenues can be reinvested into next-generation R&D. This dynamic enhances long-term competitiveness while supporting domestic security objectives.

Future Outlook

Over the next five years, the Israel Border Security Market is expected to maintain steady growth supported by continuous technological innovation and sustained government commitment to national security. Advancements in artificial intelligence, autonomous platforms, and data fusion technologies will reshape border monitoring capabilities. Regulatory support for indigenous defense solutions will remain strong, reinforcing domestic industry participation. Demand-side drivers will continue to be influenced by regional security dynamics and the need for resilient, adaptive border protection systems.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elta Systems

- Magal Security Systems

- ContropPrecision Technologies

- Aeronautics Group

- RT LTA Systems

- SK Group

- Camero Tech

- Nice Systems

- Orbit Communication Systems

- Seraphim Optronics

- TadiranTelecom

- Smart Shooter

Key Target Audience

- Defense ministries

- Homeland security agencies

- Border security forces

- Law enforcement agencies

- Critical infrastructure operators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense system integrators

Research Methodology

Step 1: Identification of Key Variables

Key variables related to demand, technology adoption, regulatory frameworks, and procurement patterns were identified through secondary research. These variables were validated against defense policy documents. Emphasis was placed on relevance to border security applications. Only variables with direct market impact were retained.

Step 2: Market Analysis and Construction

Market structure was constructed using a top-down and bottom-up analytical approach. Data from defense budgets, industry disclosures, and security programs were synthesized. Segment-level insights were developed to reflect operational realities. Cross-validation ensured internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultation with defense analysts and industry experts. Hypotheses were refined based on expert feedback. Discrepancies were resolved through additional data triangulation. This ensured analytical robustness.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a cohesive market narrative. Quantitative and qualitative findings were aligned for consistency. Final outputs were reviewed for methodological accuracy. The report structure was finalized to ensure clarity.

- Executive Summary

- Israel Border Security Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Escalation of cross border security threats and infiltration risks

Government prioritization of advanced border surveillance modernization

Integration of artificial intelligence and autonomous monitoring systems

Rising defense and homeland security budget allocations

Increased emphasis on real time situational awareness and data fusion - Market Challenges

High capital expenditure and long deployment cycles

System integration complexity across multi layer security architectures

Cybersecurity vulnerabilities in networked border systems

Operational constraints in harsh and remote border environments

Regulatory and compliance requirements for surveillance technologies - Market Opportunities

Expansion of smart border initiatives and digital fence projects

Adoption of autonomous and unmanned border monitoring solutions

Export potential for Israeli developed border security technologies - Trends

Shift toward AI driven threat detection and predictive analytics

Increased use of unmanned aerial and ground platforms

Convergence of physical and digital border security systems

Emphasis on interoperable command and control platforms

Growing focus on cyber resilience in border security networks - Government Regulations & Defense Policy

Strengthening of national border protection mandates

Defense procurement policies favoring indigenous technologies

Enhanced regulatory oversight on surveillance and data security - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Integrated Surveillance Towers

Ground Radar and Sensor Systems

Unmanned Aerial Surveillance Systems

Command and Control Platforms

Physical Barrier and Fence Systems - By Platform Type (In Value%)

Land Border Installations

Coastal and Maritime Borders

Urban Perimeter Security

Critical Infrastructure Border Zones

Remote and Desert Border Areas - By Fitment Type (In Value%)

New Border Infrastructure Deployment

Upgrade and Modernization Programs

Temporary and Mobile Installations

Permanent Fixed Installations

Emergency Rapid Deployment Systems - By EndUser Segment (In Value%)

Military Border Security Forces

Homeland Security Agencies

Border Police Units

Intelligence and Reconnaissance Agencies

Critical Infrastructure Authorities - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Ministry Contracts

Public Sector Integrators

OEM Direct Supply Agreements

Public Private Partnership Models - By Material / Technology (in Value %)

Electro Optical and Infrared Sensors

Artificial Intelligence Based Analytics

Advanced Radar and RF Technologies

Autonomous and Robotics Systems

Secure Communication and Data Fusion Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Technology Integration Capability, AI and Analytics Maturity, System Scalability, Cybersecurity Strength, Deployment Track Record, Government Contract Experience, After Sales Support Capability, Interoperability Standards Compliance, Cost Efficiency) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elta Systems

Aeronautics Group

Magal Security Systems

Controp Precision Technologies

Smart Shooter

RT LTA Systems

SK Group

Nice Systems

Tadiran Telecom

Orbit Communication Systems

Camero Tech

Seraphim Optronics

- Rising operational reliance on integrated multi sensor border systems

- Growing demand for real time intelligence sharing across agencies

- Preference for scalable and upgradeable security architectures

- Increased training and doctrine alignment with advanced technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035