Market Overview

The Israel Bulletproof Vest market current size stands at around USD ~ million, supported by consistent procurement volumes and replacement demand. Operational deployments increased across multiple security formations, with adoption rates exceeding 70 percent among frontline units. Product lifecycle averages 5 to 7 years, driving steady replenishment demand. Material transition rates toward advanced composites crossed 60 percent penetration. Domestic manufacturing accounts for over 80 percent of supplied units. Import dependence remains limited, ensuring supply continuity during escalation periods.

Demand concentration remains highest in central and southern Israel due to dense military infrastructure and rapid-response units. Northern deployment zones show sustained requirements driven by border readiness and patrol intensity. Urban centers host mature supplier ecosystems, testing facilities, and logistics hubs supporting rapid delivery. Government-backed procurement frameworks accelerate adoption of upgraded protection systems. Regulatory oversight and certification processes are tightly integrated with defense institutions, reinforcing consistent quality and operational alignment across regions.

Market Segmentation

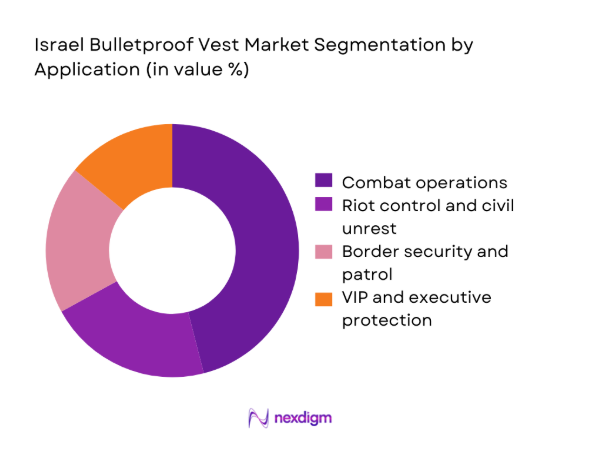

By Application

Combat operations dominate application demand due to persistent urban engagements, patrol missions, and high-risk tactical deployments. Riot control and civil unrest applications maintain steady uptake, particularly among internal security units operating in dense civilian environments. Border security and patrol usage remains structurally important, driven by continuous monitoring requirements and extended wear durations. VIP and executive protection segments show specialized demand for concealed and lightweight configurations. Operational feedback loops strongly influence application-specific design refinements. Procurement prioritization consistently favors applications with direct frontline exposure.

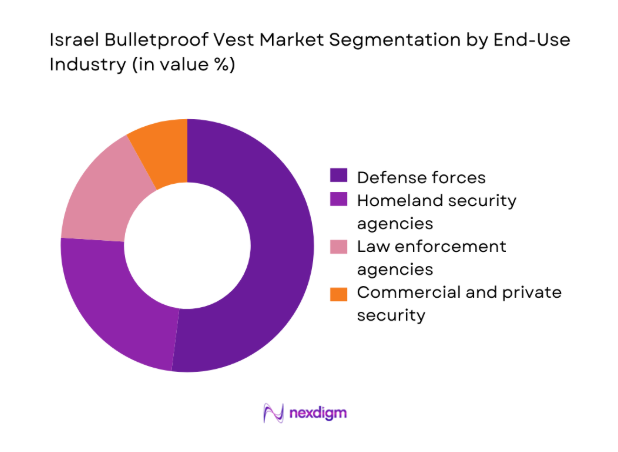

By End-Use Industry

Defense forces represent the largest end-use segment, driven by standardized equipment programs and structured replacement cycles. Homeland security agencies maintain significant demand due to counterterror and rapid response mandates. Law enforcement agencies adopt ballistic vests for patrol and intervention units, emphasizing comfort and concealability. Commercial and private security usage remains niche but growing, particularly for infrastructure protection contracts. End-use differentiation strongly shapes vest architecture and protection level requirements. Vendor relationships are typically long-term and performance-driven.

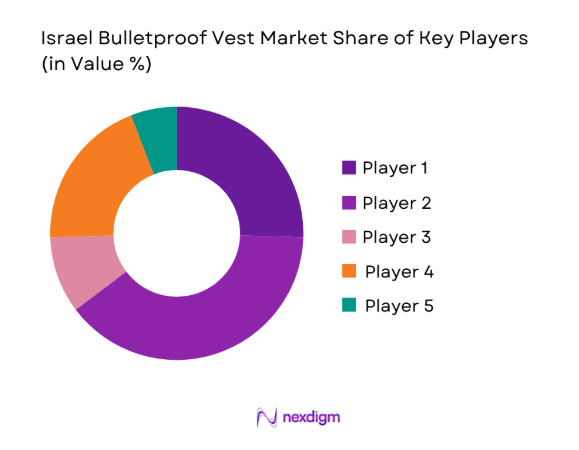

Competitive Landscape

The competitive landscape is characterized by a concentrated group of domestic manufacturers with deep defense integration and proven operational track records. Product differentiation centers on material science, ergonomics, and modularity rather than pricing competition.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Plasan | 1985 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rabintex Industries | 1950 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Marom Dolphin | 1987 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Bulletproof Vest Market Analysis

Growth Drivers

Rising frequency of asymmetric warfare and urban combat

Urban operational environments increased tactical exposure, requiring enhanced personal protection across infantry, patrol, and rapid response units. Close-quarter engagements intensified demand for multi-threat ballistic protection capable of stopping handgun, rifle, and fragmentation threats. Operational data from recent deployments indicated higher survivability rates when advanced vests were consistently deployed. Non-linear battlefields increased unpredictability, reinforcing continuous armor usage beyond conventional combat scenarios. Urban terrain complexity necessitated lightweight designs to maintain agility during building clearance and street patrols. Increased reliance on dismounted troops amplified the importance of torso protection during extended missions. Operational doctrine increasingly mandates armor usage even during routine patrol assignments. Threat evolution encouraged procurement agencies to prioritize higher protection classes without sacrificing comfort. Lessons learned cycles shortened, rapidly translating battlefield feedback into design upgrades. Overall security volatility sustained long-term baseline demand across multiple force categories.

Continuous modernization of Israeli Defense Forces equipment

Defense modernization programs emphasized soldier survivability as a core capability pillar. Personal protection systems were integrated into broader soldier system upgrade frameworks. Procurement cycles increasingly favored modular vests compatible with digital and load-bearing equipment. Standardization initiatives reduced fragmentation across units, increasing aggregate procurement volumes. Equipment refresh programs aligned with evolving operational doctrines and training protocols. Domestic innovation ecosystems accelerated prototype testing and field validation timelines. Modernization budgets prioritized frontline equipment over legacy platforms during planning cycles. Interoperability requirements influenced vest architecture and attachment systems. Feedback-driven upgrades maintained high replacement momentum across active units. Overall force modernization reinforced sustained institutional demand for advanced ballistic vests.

Challenges

High cost of advanced composite armor materials

Advanced fibers and ceramics significantly increased input complexity for ballistic vest manufacturing. Material sourcing constraints occasionally created procurement planning uncertainties. High-performance composites required specialized manufacturing processes and quality controls. Budget scrutiny intensified when material upgrades outpaced broader equipment allocations. Cost sensitivity increased for non-frontline units with lower threat exposure. Export restrictions on certain fibers complicated long-term supplier agreements. Material qualification timelines extended product development cycles. Inventory management became more complex due to multiple material variants. Repair and refurbishment costs rose with advanced material adoption. Overall material economics constrained rapid scaling during sudden demand spikes.

Weight versus mobility trade-offs for soldiers

Increased protection levels often resulted in heavier vest configurations. Extended wear durations amplified fatigue and heat stress among deployed personnel. Mobility constraints affected maneuverability in dense urban environments. Specialized units demanded customized solutions to balance protection and speed. Design compromises occasionally limited adoption of higher protection classes. Ergonomic optimization required iterative testing and operational feedback. Thermal burden became a critical consideration during prolonged missions. Weight distribution challenges impacted integration with additional equipment. User acceptance varied across roles and mission profiles. Balancing survivability and agility remained a persistent design challenge.

Opportunities

Development of ultra-lightweight and flexible armor solutions

Material science advancements enabled exploration of next-generation lightweight composites. Flexible armor designs improved comfort during extended operational deployments. Reduced weight directly enhanced mobility and endurance for infantry units. Innovation pipelines increasingly focused on hybrid fiber architectures. Field trials demonstrated improved user acceptance with lighter configurations. Customization potential expanded across gender and body type requirements. Lightweight solutions supported integration with additional mission equipment. Operational feedback favored flexible designs for urban patrols. Export interest increased for combat-proven lightweight systems. Technology leadership strengthened domestic manufacturers’ competitive positioning.

Integration with future soldier and digital battlefield systems

Ballistic vests increasingly served as platforms for integrated soldier technologies.

Power, communication, and sensor compatibility influenced vest architecture decisions. Digital battlefield concepts required standardized mounting and cabling interfaces. Integration improved situational awareness without adding separate equipment layers. System-level procurement favored vendors offering integrated solutions. Vest designs evolved to support data and power routing. Interoperability testing became a procurement prerequisite. Integrated systems reduced overall equipment clutter for soldiers. Future force concepts accelerated adoption of smart-compatible armor. Technology convergence created new value propositions beyond ballistic protection.

Future Outlook

The market outlook remains resilient through 2035, supported by sustained security requirements and continuous equipment modernization. Innovation will focus on lightweight materials, modularity, and system integration. Procurement strategies are expected to emphasize lifecycle performance and interoperability. Domestic manufacturers will continue leveraging operational feedback to maintain technological leadership.

Major Players

- Plasan

- Elbit Systems

- Rabintex Industries

- IMI Systems

- Israel Aerospace Industries

- Marom Dolphin

- FMS Enterprises Migun

- Agilite Gear

- ArmorWorks

- Point Blank Enterprises

- Safariland Group

- MKU Limited

- DuPont

- DSM Dyneema

- Source Tactical Gear

Key Target Audience

- Israeli Defense Forces procurement divisions

- Israel Police and internal security agencies

- Border security and counterterror units

- Government and regulatory bodies including Ministry of Defense Israel

- Private security service providers

- Defense system integrators

- Equipment distributors and logistics contractors

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables included protection levels, material technologies, end-user categories, and operational usage patterns. Threat environments and deployment doctrines were mapped to define scope. Product lifecycle and replacement dynamics were assessed.

Step 2: Market Analysis and Construction

Segmentation frameworks were constructed around application and end-use logic. Demand drivers were aligned with operational requirements. Comparative assessment focused on technology and deployment intensity.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through consultations with defense equipment specialists and procurement stakeholders. Operational feedback loops were incorporated. Assumptions were stress-tested against deployment scenarios.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive analytical structure. Consistency checks ensured alignment across sections. Insights were refined to reflect realistic operational and procurement behavior.

- Executive Summary

- Research Methodology (Market Definitions and ballistic protection scope alignment, Vest type and protection level taxonomy mapping for Israeli threat scenarios, Bottom-up demand estimation from defense and internal security procurement data, Revenue attribution by protection class and material composition, Primary interviews with Israeli defense contractors and procurement officers, Triangulation using import-export data and defense budget disclosures, Assumptions on threat intensity and replacement cycles)

- Definition and Scope

- Market evolution in response to security threats

- Operational usage and protection standards

- Defense and homeland security ecosystem structure

- Supply chain and distribution channels

- Regulatory and certification environment

- Growth Drivers

Rising frequency of asymmetric warfare and urban combat

Continuous modernization of Israeli Defense Forces equipment

Increasing deployment of internal security and border units

Government focus on soldier survivability and force protection

Technological advancements in lightweight ballistic materials

Regular replacement cycles due to wear and threat evolution - Challenges

High cost of advanced composite armor materials

Weight versus mobility trade-offs for soldiers

Stringent testing and certification requirements

Supply chain dependency on advanced fibers and ceramics

Export restrictions and regulatory compliance complexity

Budget prioritization across competing defense programs - Opportunities

Development of ultra-lightweight and flexible armor solutions

Integration with future soldier and digital battlefield systems

Export opportunities driven by combat-proven Israeli products

Customization for female soldiers and specialized units

Growth in private security demand amid regional instability

Adoption of modular upgradeable armor architectures - Trends

Shift toward modular plate carrier systems

Increasing use of advanced ceramics and UHMWPE fibers

Focus on ergonomic design and heat stress reduction

Compatibility with communication and power systems

Shorter innovation cycles driven by operational feedback

Rising emphasis on multi-threat protection capabilities - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Military forces

Internal security and police units

Special forces and counter-terror units

Private security contractors - By Application (in Value %)

Combat operations

Riot control and civil unrest

Border security and patrol

VIP and executive protection - By Technology Architecture (in Value %)

Soft armor vests

Hard armor plate carrier vests

Modular and scalable armor systems

Integrated load-bearing armor systems - By End-Use Industry (in Value %)

Defense forces

Homeland security agencies

Law enforcement agencies

Commercial and private security - By Connectivity Type (in Value %)

Standalone ballistic protection

Integrated soldier system compatible vests

Sensor-enabled and smart armor-ready vests - By Region (in Value %)

Central Israel

Northern Israel

Southern Israel

West Bank deployment zones

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Protection level compliance, Material technology, Weight and ergonomics, Customization capability, Domestic manufacturing footprint, Export presence, Pricing strategy, After-sales support) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Plasan

Elbit Systems

Rabintex Industries

IMI Systems

Israel Aerospace Industries

Source Tactical Gear

Marom Dolphin

FMS Enterprises Migun

Agilite Gear

ArmorWorks

Point Blank Enterprises

Safariland Group

MKU Limited

DuPont

DSM Dyneema

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035