Market Overview

The Israel C5ISR market current size stands at around USD ~ million, reflecting sustained defense digitization activities supported by approximately ~ active systems deployments nationwide. Operational demand intensified across ~ platforms during recent procurement cycles, while system upgrades expanded at nearly ~ installations annually. Networked command infrastructure adoption accelerated, with interoperability requirements influencing around ~ percent of new deployments. The market demonstrates stable maturity driven by continuous modernization mandates and integration-focused investments across tactical and strategic command layers.

The market remains geographically concentrated around central defense clusters, southern operational zones, and northern border regions supporting high-readiness formations. These areas benefit from dense military infrastructure, mature systems integration ecosystems, and proximity to core defense agencies. Urban technology hubs enable rapid development, testing, and deployment of advanced command architectures. Policy alignment between defense planners and technology developers further strengthens localized demand concentration and accelerates implementation timelines.

Market Segmentation

By Fleet Type

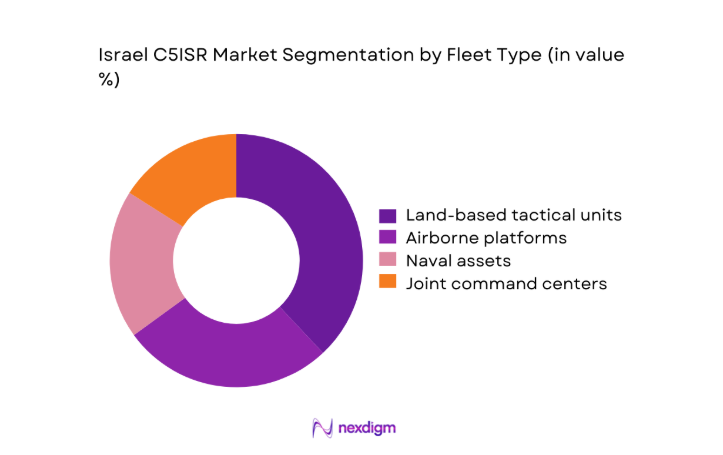

Land-based tactical and command units dominate the Israel C5ISR market due to persistent border security requirements and continuous ground force readiness operations. These fleets rely heavily on integrated command networks to coordinate maneuver units, intelligence feeds, and real-time battlefield awareness. High deployment frequency, combined with frequent system refresh cycles, reinforces sustained demand within this segment. Airborne and naval platforms follow, yet land-based units retain prominence due to infrastructure density, training intensity, and operational scalability across varied threat environments.

By Application

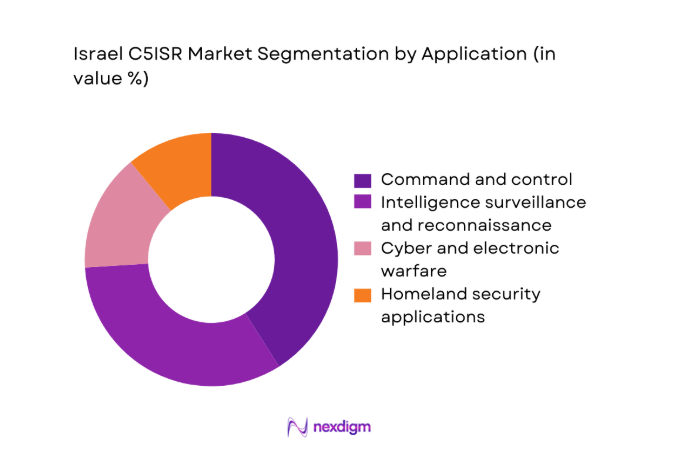

Command and control operations represent the leading application segment, driven by the need for synchronized multi-domain operations and rapid decision-making capabilities. These systems form the backbone of operational command structures, integrating surveillance, intelligence, and communications layers. Intelligence surveillance and reconnaissance applications follow closely, benefiting from sensor fusion and data analytics enhancements. The dominance of command-centric applications reflects doctrinal emphasis on network-centric warfare and centralized situational awareness frameworks.

Competitive Landscape

The Israel C5ISR market features a concentrated competitive structure characterized by deep technological specialization and long-term defense program participation. Companies compete primarily on integration depth, system reliability, and alignment with evolving operational doctrines rather than price-led differentiation.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel C5ISR Market Analysis

Growth Drivers

Rising multi-domain threat environment

Escalating regional tensions increased operational readiness requirements, driving expanded adoption of integrated command systems across multiple operational domains. Persistent asymmetric threats required continuous situational awareness improvements, strengthening demand for advanced intelligence fusion capabilities. Operational exercises conducted during 2024 highlighted limitations of legacy command architectures under high-tempo scenarios. Decision latency reductions became critical for mission success across land, air, maritime, cyber, and space environments. Commanders increasingly relied on real-time data synchronization to manage simultaneous engagements effectively. Cross-domain threat vectors intensified complexity, necessitating unified command visibility across dispersed units. Advanced C5ISR platforms supported faster response cycles and improved force coordination. Threat unpredictability reinforced continuous system availability and redundancy planning. Integrated platforms enabled adaptive responses to rapidly evolving operational conditions. These factors collectively reinforced sustained procurement momentum for resilient command solutions.

Modernization of IDF network-centric warfare capabilities

Ongoing modernization programs emphasized digitized command frameworks supporting network-centric operational doctrines. Legacy systems constrained data interoperability, prompting accelerated replacement and upgrade initiatives. During 2025, operational units expanded deployment of software-defined command platforms. Network-centric capabilities improved information sharing across hierarchical command structures. Enhanced connectivity supported decentralized decision-making while maintaining centralized situational awareness. Integration with unmanned systems further amplified operational effectiveness. Training programs increasingly aligned with digital command environments. Modern architectures enabled scalable upgrades without full system replacement. Interoperability standards improved joint-force coordination efficiency. These modernization priorities consistently elevated demand for advanced C5ISR solutions.

Challenges

High system integration complexity

Complex integration requirements emerged from diverse legacy systems operating across multiple operational domains. Compatibility constraints increased deployment timelines and technical risk exposure. During 2024, integration testing cycles extended beyond planned schedules. Customization needs limited rapid scalability of standardized platforms. Interfacing sensors, communication links, and analytics engines required extensive validation. Integration bottlenecks strained internal technical resources. Multi-vendor environments complicated system harmonization efforts. Operational disruptions risked temporary capability gaps during transitions. Continuous updates further increased integration burdens. These complexities constrained deployment efficiency across defense units.

Cybersecurity vulnerabilities in networked systems

Expanding network connectivity increased exposure to sophisticated cyber intrusion attempts. Command systems became high-value targets due to centralized operational control functions. During recent operational assessments, simulated breaches revealed potential data integrity risks. Securing distributed nodes required layered defense architectures. Patch management across deployed platforms introduced operational challenges. Cyber resilience investments competed with functional upgrade priorities. Interoperability requirements occasionally conflicted with security protocols. Continuous monitoring increased system management complexity. Cyber incidents risked temporary command degradation during operations. These vulnerabilities remained a persistent operational concern.

Opportunities

AI-driven command decision automation

Artificial intelligence integration offered significant potential to enhance decision support accuracy. Automated analytics reduced cognitive load on command personnel during complex engagements. In 2025, pilot deployments demonstrated improved response prioritization outcomes. Machine learning models supported predictive threat assessments. AI-enabled fusion engines processed multi-source data streams efficiently. Decision automation shortened operational reaction times. Adaptive algorithms improved with continuous operational feedback. Commanders benefited from scenario-based recommendations. Human-machine teaming strengthened operational confidence. These advancements created strong opportunities for next-generation system adoption.

Integration of space-based ISR assets

Space-based sensors expanded persistent surveillance coverage beyond terrestrial limitations. Integration with ground command networks improved strategic situational awareness. Recent deployments enhanced early warning and tracking capabilities. Space assets supported cross-border monitoring with reduced latency. Data integration improved targeting accuracy across domains. Command systems increasingly accommodated satellite-derived intelligence streams. Resilience improved through diversified data sources. Space integration supported joint and allied operational coordination. These capabilities strengthened multi-domain operational planning. Opportunities expanded for advanced ISR-command convergence.

Future Outlook

The Israel C5ISR market is expected to evolve toward software-centric, AI-enabled architectures through 2035. Continued emphasis on multi-domain operations will drive deeper integration of cyber and space capabilities. Policy support for defense digitization and sustained modernization programs will underpin long-term system upgrades and operational innovation.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- ELTA Systems

- Motorola Solutions Israel

- NICE Systems

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Raytheon Technologies

- Thales Group

- BAE Systems

- Saab Group

- Airbus Defence and Space

- Leonardo

Key Target Audience

- Israel Defense Forces procurement divisions

- Ministry of Defense acquisition directorates

- Homeland security and border protection agencies

- Intelligence and cyber defense units

- Defense system integrators and contractors

- Government and regulatory bodies with agency names

- Investments and venture capital firms

- Critical infrastructure security operators

Research Methodology

Step 1: Identification of Key Variables

Involved mapping operational C5ISR definitions, system boundaries, and platform categories relevant to national defense requirements. Capability layers, deployment environments, and lifecycle stages were identified to establish analytical scope.

Step 2: Market Analysis and Construction

Involved structuring segmentation frameworks, validating operational linkages, and assessing system deployment patterns across defense units. Functional relationships between platforms and applications were analyzed.

Step 3: Hypothesis Validation and Expert Consultation

Relied on structured discussions with defense technology specialists, system integrators, and operational planners to validate assumptions and technical feasibility.

Step 4: Research Synthesis and Final Output

Integrated validated insights into coherent market narratives, ensuring internal consistency, analytical rigor, and alignment with operational realities.

- Executive Summary

- Research Methodology (Market Definitions and Israel-specific C5ISR operational scope, defense force structure-based taxonomy and segmentation logic, platform-level and program-based market sizing approach, value attribution across procurement programs and lifecycle phases, primary interviews with IDF officials and domestic defense integrators, triangulation across SIPRI data defense budgets and contract disclosures, assumptions linked to classified programs and export controls)

- Definition and Scope

- Market evolution

- Operational deployment and mission use cases

- Defense and homeland security ecosystem structure

- Supply chain and system integration framework

- Regulatory and export control environment

- Growth Drivers

Rising multi-domain threat environment

Modernization of IDF network-centric warfare capabilities

Increased reliance on real-time intelligence and data fusion

Government investment in digital battlefield transformation

Expansion of unmanned and autonomous platforms

Interoperability requirements across services - Challenges

High system integration complexity

Cybersecurity vulnerabilities in networked systems

Budget prioritization across competing defense programs

Dependence on classified technologies and restricted data

Export control and regulatory constraints

Rapid technology obsolescence - Opportunities

AI-driven command decision automation

Integration of space-based ISR assets

Dual-use applications for homeland security

Export of Israeli-developed C5ISR solutions

Interoperability upgrades with allied forces

Cloud and software-defined defense architectures - Trends

Shift toward software-centric C5ISR platforms

Adoption of artificial intelligence and machine learning

Increased use of autonomous ISR systems

Emphasis on cyber-resilient command networks

Convergence of military and internal security systems

Real-time data sharing across domains - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based tactical and command units

Airborne platforms and UAV fleets

Naval vessels and coastal surveillance assets

Joint and multi-domain command centers - By Application (in Value %)

Command and control operations

Intelligence surveillance and reconnaissance

Cyber and electronic warfare integration

Battlefield management and decision support

Homeland security and border protection - By Technology Architecture (in Value %)

Integrated C4ISR platforms

AI-enabled decision support systems

Cloud-based command architectures

Edge computing and sensor fusion systems - By End-Use Industry (in Value %)

Defense forces

Homeland security agencies

Intelligence organizations

Critical infrastructure protection - By Connectivity Type (in Value %)

Satellite communication networks

Secure terrestrial networks

Tactical radio and data links

Hybrid multi-network connectivity - By Region (in Value %)

Central Israel defense hubs

Southern operational zones

Northern border regions

Coastal and maritime zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform integration depth, AI and analytics capability, cybersecurity resilience, interoperability standards compliance, lifecycle support capability, domestic manufacturing footprint, export readiness, pricing flexibility)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

ELTA Systems

Elbit C4I and Cyber

Motorola Solutions Israel

NICE Systems

Lockheed Martin

Northrop Grumman

L3Harris Technologies

Raytheon Technologies

Thales Group

BAE Systems

Saab Group

Airbus Defence and Space

- Operational demand and mission criticality drivers

- Procurement cycles and defense tender processes

- System reliability and interoperability criteria

- Budget allocation and long-term program funding

- Implementation risks and security clearance constraints

- Lifecycle support and upgrade expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035