Market Overview

The Israel Cargo Drones market current size stands at around USD ~ million, supported by increasing commercial deployments, pilot corridors, and regulated flight permissions. Fleet activity expanded steadily with ~ units operating across medical, logistics, and industrial missions, while licensed operators exceeded ~ organizations. During recent periods, trial flights surpassed ~ missions annually, reflecting growing operational confidence. Technology readiness improved through local manufacturing depth, autonomous navigation maturity, and controlled beyond-visual-line-of-sight testing. Demand intensity strengthened across healthcare logistics and time-critical deliveries, reinforcing ecosystem momentum.

Market activity remains concentrated around Tel Aviv, Central Israel, and Haifa due to dense logistics networks, advanced digital infrastructure, and proximity to technology developers. These regions benefit from mature air traffic coordination frameworks, supportive municipal pilots, and high demand for rapid delivery services. Southern and Northern districts show gradual adoption driven by infrastructure access challenges and emergency logistics use cases. Policy alignment, defense-derived aviation expertise, and coordinated civil aviation oversight continue shaping regional deployment patterns and scalability.

Market Segmentation

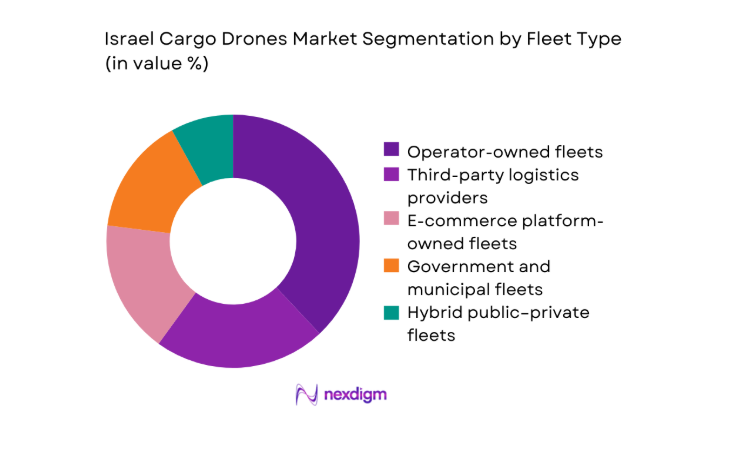

By Fleet Type

Operator-owned fleets dominate the Israel cargo drones market due to greater control over compliance, scheduling flexibility, and asset utilization optimization. Logistics providers and healthcare operators increasingly favor ownership to ensure mission-critical reliability and rapid deployment responsiveness. Government and municipal fleets also contribute meaningfully, particularly for emergency response and infrastructure monitoring. Third-party service fleets remain active in pilot programs, though long-term dominance favors entities integrating drones into core logistics strategies. Ownership models benefit from local manufacturing support, maintenance access, and regulatory familiarity.

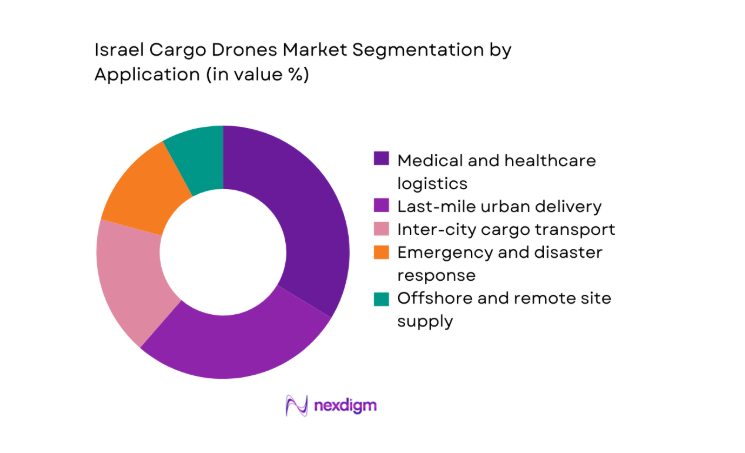

By Application

Medical and healthcare logistics represent the most dominant application, driven by urgency-sensitive deliveries and controlled route approvals. Last-mile urban delivery follows closely, supported by dense consumer clusters and e-commerce expectations. Inter-city cargo transport remains emerging due to regulatory complexity but shows strong pilot momentum. Emergency response applications maintain strategic importance, particularly for remote access scenarios. Offshore and industrial supply use cases contribute niche demand, supported by specialized payload requirements and autonomous flight capabilities.

Competitive Landscape

The competitive landscape reflects a mix of domestic aerospace leaders, autonomous drone specialists, and international logistics-focused entrants. Competition centers on regulatory readiness, autonomous capability depth, and integration with national airspace management frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Airobotics | 2014 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Flytrex | 2013 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Cargo Drones Market Analysis

Growth Drivers

Urban congestion and demand for rapid delivery

Urban congestion across major Israeli cities has intensified delivery inefficiencies, driving interest in aerial cargo alternatives for time-sensitive logistics operations. E-commerce penetration increased transaction volumes, pressuring last-mile networks and encouraging operators to test drone-enabled delivery models. Healthcare institutions expanded drone usage to bypass road delays, improving response times for critical medical supplies. Pilot programs recorded ~ flights annually, validating operational feasibility in dense environments. Consumer expectations for same-day fulfillment reinforced willingness among retailers to explore unmanned delivery solutions. Municipal authorities supported trials to reduce traffic congestion impacts and emissions indirectly. Autonomous routing improvements enhanced reliability despite complex urban airspaces. Payload optimization enabled consistent transport of lightweight, high-value goods. Operator confidence improved as incident-free missions accumulated. Urban delivery demand continues reshaping logistics planning priorities.

Government-backed UAV traffic management initiatives

Government-backed UAV traffic management initiatives accelerated structured integration of cargo drones into controlled national airspace systems. Dedicated corridors enabled safe separation between manned aviation and unmanned logistics flights. Regulatory sandboxes allowed operators to conduct ~ test missions under supervised conditions. Centralized flight authorization platforms reduced administrative delays and improved predictability. Collaboration between civil aviation authorities and technology providers strengthened compliance frameworks. Data-sharing protocols enhanced situational awareness and risk mitigation. These initiatives lowered entry barriers for compliant operators. Public-sector endorsement increased investor and stakeholder confidence. Municipal participation expanded geographic coverage of trials. Structured airspace management remains foundational for scalable deployment.

Challenges

Airspace integration and BVLOS regulatory approvals

Airspace integration remains challenging due to stringent safety requirements governing beyond-visual-line-of-sight operations across civilian environments. Approval processes involve multiple agencies, increasing timelines for commercial scaling. Operators must demonstrate redundant navigation, detect-and-avoid capabilities, and secure communications reliability. Limited approved corridors restrict routing flexibility and mission frequency. Coordination with manned aviation introduces operational complexity. Regulatory frameworks continue evolving, creating uncertainty for long-term planning. Smaller operators face compliance resource constraints. Testing requirements increase operational costs indirectly. Delays impact service-level commitments to end users. Regulatory clarity remains critical for broader adoption.

Limited payload capacity versus ground transport

Limited payload capacity restricts cargo drones primarily to lightweight, high-value shipments compared with traditional ground logistics vehicles. This constraint limits applicability for bulk goods and reduces addressable logistics segments. Multiple drone trips may be required to match single-vehicle capacity. Payload restrictions also influence aircraft design trade-offs affecting range and endurance. Operators must carefully select use cases to maintain economic viability. Customer expectations sometimes exceed technical realities. Weather conditions further reduce effective payload margins. Hybrid VTOL platforms partially mitigate constraints but increase complexity. Ground transport remains dominant for heavy freight. Payload innovation remains an ongoing engineering focus.

Opportunities

Nationwide UAV logistics corridor deployment

Nationwide UAV logistics corridor deployment presents significant opportunities for standardized, scalable cargo drone operations across diverse regions. Interconnected corridors would enable predictable routing between urban centers and peripheral areas. Such networks support higher flight frequencies and fleet utilization efficiency. Government coordination can streamline approvals across jurisdictions. Logistics providers could integrate drones into national distribution strategies. Healthcare supply chains benefit from reliable inter-city aerial links. Corridor expansion reduces dependence on ad-hoc permissions. Infrastructure investments improve safety oversight and monitoring. National coverage attracts international partnerships. Corridor deployment underpins long-term market maturation.

Integration with smart city infrastructure

Integration with smart city infrastructure enables cargo drones to operate seamlessly alongside connected urban systems. Data exchange with traffic management platforms enhances situational awareness and routing optimization. Smart rooftops and designated landing zones simplify operations. Energy management systems support automated charging and fleet turnaround. Municipal digital twins facilitate risk assessment and planning. Integration reduces community disruption through optimized flight paths. Real-time monitoring improves compliance transparency. Cities gain insights into logistics flows. Technology providers unlock new service layers. Smart city alignment strengthens public acceptance.

Future Outlook

The Israel cargo drones market outlook through 2035 reflects gradual transition from pilot deployments toward structured commercial networks. Regulatory frameworks are expected to mature alongside autonomous traffic management capabilities. Expansion beyond medical logistics into broader commercial delivery remains likely as payload technologies advance. Continued collaboration between government, municipalities, and private operators will shape sustainable scaling.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Aeronautics Group

- Airobotics

- Flytrex

- Percepto

- HevenDrones

- Steadicopter

- XTEND

- DJI

- Zipline

- Wing Aviation

- Matternet

- Dronamics

- Sabrewing Aircraft Company

Key Target Audience

- Logistics and parcel delivery companies

- Healthcare providers and hospital networks

- E-commerce platforms

- Energy and infrastructure operators

- Municipal authorities and city governments

- Israel Civil Aviation Authority

- Ministry of Transport and Road Safety

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables included platform types, payload classes, application use cases, regulatory pathways, and fleet ownership structures. These variables defined market boundaries and analytical scope.

Step 2: Market Analysis and Construction

Qualitative and quantitative inputs were synthesized to construct segment-level assessments. Deployment intensity, operational constraints, and ecosystem maturity informed analytical modeling.

Step 3: Hypothesis Validation and Expert Consultation

Industry operators, aviation specialists, and regulatory stakeholders were consulted to validate assumptions. Feedback refined operational feasibility and adoption trajectory assessments.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a coherent narrative aligning market dynamics, risks, and opportunities. Outputs were reviewed for internal consistency and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for civilian cargo UAVs in Israel, Platform taxonomy by payload class and flight architecture, Bottom-up fleet and shipment-based market sizing, Revenue attribution by system sales and service contracts, Primary interviews with Israeli operators regulators and OEMs, Cross-validation using flight permit data pilot programs and customs records)

- Definition and Scope

- Market evolution

- Usage and logistics pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Urban congestion and demand for rapid delivery

Government-backed UAV traffic management initiatives

Strong domestic UAV manufacturing ecosystem

Rising healthcare logistics digitization

Military-to-civilian technology transfer

Growth of e-commerce fulfillment expectations - Challenges

Airspace integration and BVLOS regulatory approvals

Limited payload capacity versus ground transport

Public safety and noise concerns in dense cities

High upfront system and certification costs

Weather sensitivity and operational reliability

Insurance and liability uncertainties - Opportunities

Nationwide UAV logistics corridor deployment

Integration with smart city infrastructure

Cold-chain medical delivery expansion

Export of Israeli cargo drone platforms

Autonomous fleet management software monetization

Public–private partnerships for rural logistics - Trends

Shift toward hybrid VTOL platforms

Increasing use of 5G-enabled command systems

Focus on autonomous fleet operations

Growth of drone-in-a-box cargo concepts

Standardization of payload modules

Data-driven air traffic deconfliction systems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Operator-owned fleets

Third-party logistics service providers

E-commerce platform–owned fleets

Government and municipal fleets

Hybrid public–private pilot fleets - By Application (in Value %)

Last-mile urban delivery

Inter-city and regional cargo transport

Medical and healthcare logistics

Emergency and disaster response logistics

Offshore and remote site supply - By Technology Architecture (in Value %)

Multirotor cargo drones

Fixed-wing cargo drones

Hybrid VTOL cargo drones - By End-Use Industry (in Value %)

E-commerce and retail logistics

Healthcare and medical services

Postal and parcel services

Energy and infrastructure operators

Public sector and defense-adjacent civil logistics - By Connectivity Type (in Value %)

RF line-of-sight control

LTE and 5G-enabled BVLOS control

Satellite-assisted command and control - By Region (in Value %)

Central Israel

Tel Aviv District

Northern District

Haifa District

Jerusalem District

Southern District

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Payload capacity, Flight range, Autonomy level, Regulatory readiness, Unit pricing, Fleet management software, After-sales support, Local manufacturing presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Aeronautics Group

Airobotics

Flytrex

Percepto

HevenDrones

Steadicopter

XTEND

DJI

Zipline

Wing Aviation

Matternet

Dronamics

Sabrewing Aircraft Company

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035