Market Overview

The Israel CBRNE Defense market current size stands at around USD ~ million, supported by sustained procurement cycles aligned with operational readiness and modernization priorities. Capability upgrades continue to be planned within multi-year defense programs to maintain preparedness across critical response units. Procurement focus remains centered on enhancing detection, protection, and response integration across operational environments. Program continuity supports steady modernization of deployed systems and training infrastructure. Institutional emphasis on resilience planning underpins ongoing capability refresh cycles across agencies and operational commands.

Activity concentrates around metropolitan defense clusters and border-adjacent operational corridors where infrastructure density supports rapid deployment and sustainment. Coastal logistics hubs enable accelerated maintenance cycles and secure component flows. Centralized command facilities anchor networked detection and response integration across agencies. Industrial ecosystems support sensor calibration, ruggedization, and software validation workflows. Policy environments prioritize resilience standards, interoperability frameworks, and readiness drills, reinforcing concentrated demand across mature operational theaters.

Market Segmentation

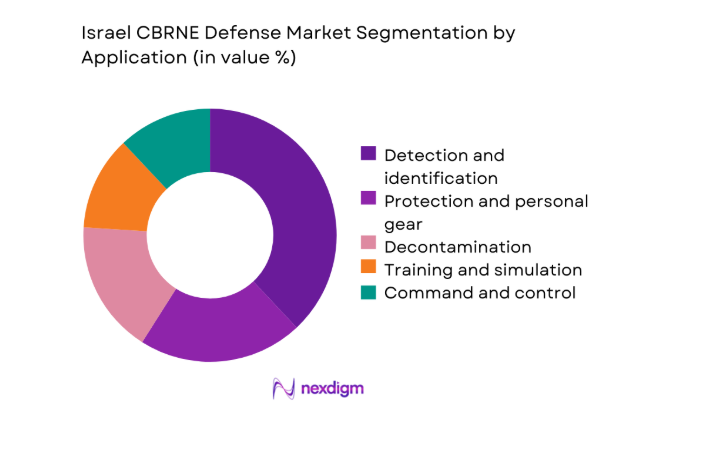

By Application

Detection and identification dominate adoption because early warning reduces operational exposure and accelerates coordinated responses across agencies. Field deployments prioritize multi-sensor fusion to improve threat discrimination in dense urban corridors. Decontamination follows where infrastructure protection mandates require rapid site restoration and continuity planning. Training and simulation grows as readiness cycles intensify and doctrine evolves toward joint operations. Command and control integration expands with networked platforms improving situational awareness and response orchestration. Demand patterns reflect operational risk concentration and infrastructure criticality rather than uniform national distribution, reinforcing targeted procurement strategies.

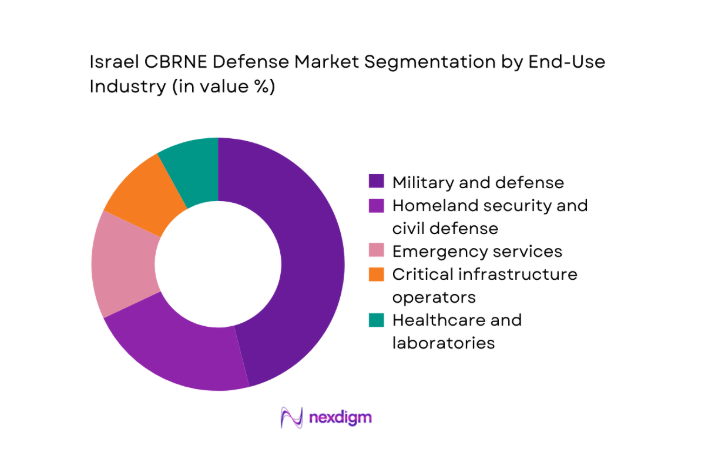

By End-Use Industry

Military and defense procurement leads adoption due to sustained readiness mandates and continuous platform modernization programs. Homeland security and civil defense adoption accelerates as urban resilience planning integrates detection with emergency coordination. Emergency services adoption rises with standardized protocols requiring interoperable protective equipment and rapid triage support. Critical infrastructure operators invest to safeguard transport nodes, energy assets, and water facilities. Healthcare and laboratories expand preparedness capabilities to manage exposure risks and maintain continuity of operations under incident scenarios.

Competitive Landscape

The competitive environment emphasizes integrated system portfolios, lifecycle services, and secure interoperability across multi-agency deployments. Vendors differentiate through sensor performance, ruggedization, cyber-hardened connectivity, and sustained training support embedded within long-term programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ | ~ |

| Chemring Group | 1905 | Romsey | ~ | ~ | ~ | ~ | ~ | ~ |

| Smiths Detection | 2002 | London | ~ | ~ | ~ | ~ | ~ | ~ |

Israel CBRNE Defense Market Analysis

Growth Drivers

Rising regional threat perception and force protection needs

Heightened regional tensions increased operational alert levels across specialized units during 2024 exercises nationwide. Threat simulations conducted in 2025 emphasized multi-domain coordination, elevating demand for integrated detection networks. Operational commanders prioritized early warning coverage across dense corridors to minimize responder exposure. Expanded perimeter monitoring improved situational awareness for mobile units during complex response scenarios. Interagency drills reinforced standardized protocols for hazardous material identification and containment operations. Enhanced readiness metrics improved deployment tempos across forward operating areas during peak readiness cycles. Sensor fusion platforms reduced false positives during congested urban operations significantly. Secure communications ensured resilient data exchange across distributed teams during simulated incidents. Training throughput increased to sustain operator proficiency across rotating units annually. Procurement prioritization reflected sustained readiness objectives aligned with evolving threat environments.

Modernization of IDF CBRN units and multi-domain operations

Modernization initiatives emphasized interoperability between ground units and aerial reconnaissance assets during 2024 exercises. Multi-domain operations frameworks in 2025 integrated sensor data across tactical networks for coordinated responses. Platform upgrades improved ruggedization for harsh operating environments and sustained mission availability. Software-defined architectures enabled modular capability insertion without extended downtime cycles. Digital twins supported training realism and accelerated doctrine refinement across participating units. Standardized interfaces reduced integration friction between legacy assets and newer platforms. Lifecycle sustainment planning improved readiness by streamlining maintenance scheduling across depots. Network resilience enhancements improved uptime under contested electromagnetic environments during drills. Operator feedback loops informed iterative upgrades aligned with evolving mission profiles. Modernization roadmaps prioritized scalability to accommodate expanding sensor networks.

Challenges

Budget prioritization versus other defense programs

Competing modernization priorities constrained allocation decisions across multiple capability domains during 2024 planning cycles. Capital-intensive programs diverted resources from incremental CBRNE upgrades in several units. Program sequencing required tradeoffs between platform refresh and training investments. Long procurement timelines delayed capability fielding across priority operational corridors. Multi-year planning cycles complicated synchronization with rapid threat evolution. Sustainment funding pressures affected maintenance throughput and spare availability. Readiness benchmarks faced variability when funding allocations shifted unexpectedly. Interagency coordination required additional governance overhead to align budget envelopes. Procurement governance introduced delays during requirement revalidation stages. Budget volatility reduced predictability for vendors supporting long-term support commitments.

Export control and classification constraints on advanced sensors

Classification constraints limited technology transfer options for certain high-sensitivity sensor components. Export controls complicated sourcing strategies for specialized detection modules during 2025 programs. Approval workflows extended timelines for integrating advanced analytics capabilities. Restricted documentation access constrained cross-agency technical collaboration efforts. Secure handling requirements increased compliance overhead across supply chains. Localization mandates required adaptation of firmware and encryption modules. Testing protocols expanded to satisfy security accreditation standards across environments. Vendor onboarding faced extended vetting cycles affecting delivery schedules. Compliance audits increased administrative load for program management offices. Classification barriers constrained rapid experimentation with emerging detection methodologies.

Opportunities

AI-enabled detection and decision support upgrades

AI-enabled analytics improved pattern recognition across heterogeneous sensor feeds during 2024 trials. Decision support tools accelerated triage prioritization for responders in complex environments. Automated anomaly detection reduced operator cognitive load during sustained operations. Edge processing enhanced responsiveness in bandwidth-constrained operational contexts. Model updates supported rapid adaptation to evolving threat signatures. Human-machine teaming improved situational awareness across multi-agency coordination centers. Validation frameworks strengthened trust in algorithmic recommendations during drills. Secure model deployment pipelines ensured compliance with operational security requirements. Continuous learning loops improved performance with operational feedback incorporation. Scalable architectures enabled expansion across additional deployment nodes.

Dual-use platforms for civil and critical infrastructure protection

Dual-use deployments strengthened protection for transport nodes and utility assets during readiness exercises. Shared platforms enabled cost-efficient interoperability between civil responders and defense units. Infrastructure operators integrated detection capabilities within existing monitoring frameworks. Joint training improved coordination across emergency management stakeholders. Standardized equipment reduced logistical complexity across response organizations. Policy alignment facilitated procurement for shared capability development initiatives. Common interfaces simplified maintenance and spares provisioning across fleets. Incident simulations validated cross-sector response workflows under varied scenarios. Public safety mandates accelerated adoption within municipal protection programs. Dual-use architectures supported incremental upgrades without service disruptions.

Future Outlook

The market outlook emphasizes deeper integration across agencies, resilient connectivity under contested environments, and modular capability upgrades aligned with evolving threat profiles. Over the coming years, policy alignment and interoperability frameworks will guide procurement roadmaps. Emphasis will remain on networked detection, rapid deployment kits, and training modernization. Sustained readiness investments will support scalable deployments and lifecycle optimization.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Aeronautics Group

- Controp Precision Technologies

- Chemring Group

- Bruker

- Thermo Fisher Scientific

- Smiths Detection

- Teledyne FLIR

- Rheinmetall

- Saab

- Thales

- Leonardo

- Honeywell

Key Target Audience

- Defense ministries and procurement authorities

- Homeland security agencies and civil defense authorities

- National emergency management agencies

- Military operational commands and CBRN units

- Critical infrastructure operators and utilities agencies

- Public safety and first responder organizations

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Key operational use cases, deployment architectures, and interoperability requirements are mapped across defense and civil response contexts. Capability taxonomies define detection, protection, decontamination, training, and command integration variables. Policy constraints and security accreditation parameters are incorporated to bound scope.

Step 2: Market Analysis and Construction

Program-level procurement cycles, lifecycle sustainment pathways, and upgrade cadences structure the analytical framework. Capability adoption patterns are aligned with operational readiness objectives. Scenario mapping connects infrastructure concentration with deployment priorities.

Step 3: Hypothesis Validation and Expert Consultation

Operational workflows and doctrine alignment are validated through practitioner feedback and program office inputs. Assumptions around integration complexity and sustainment readiness are stress-tested. Cross-agency coordination dynamics inform feasibility assessments.

Step 4: Research Synthesis and Final Output

Findings are reconciled across operational, policy, and technology dimensions to ensure coherence. Insights are structured into decision-relevant narratives. Outputs emphasize actionable implications for procurement planning and capability roadmaps.

- Executive Summary

- Research Methodology (Market Definitions and CBRNE Threat Scope Mapping, System Taxonomy by Detection Protection and Decontamination Platforms, Bottom-up Program-based Procurement Sizing for Israel, Revenue Attribution by Contracts Sustainment and Upgrades, Primary Interviews with IDF MoD and Integrators, Triangulation Across Tender Data SIPRI and Company Disclosures, Assumptions on Classification Export Controls and Budget Cycles)

- Definition and Scope

- Market evolution

- Operational usage and response pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and standards environment

- Growth Drivers

Rising regional threat perception and force protection needs

Modernization of IDF CBRN units and multi-domain operations

Integration of sensors with C2 and ISR networks

Increased investment in homeland security and civil defense readiness

Procurement of unmanned and standoff detection solutions

International collaboration and technology transfer programs - Challenges

Budget prioritization versus other defense programs

Export control and classification constraints on advanced sensors

Integration complexity across legacy and new platforms

Training and sustainment costs for specialized units

Supply chain dependence on niche components

Interoperability across military and civil responders - Opportunities

AI-enabled detection and decision support upgrades

Dual-use platforms for civil and critical infrastructure protection

Lifecycle services and upgrade contracts

Unmanned and remote sensing payload expansion

Interoperable systems aligned to NATO and allied standards

Local manufacturing and offset-driven partnerships - Trends

Shift toward networked sensor fusion and common operating pictures

Growth of standoff and non-contact detection technologies

Emphasis on rapid deployable and modular systems

Increased use of simulation and digital training environments

Cyber-hardened connectivity for CBRN systems

Data-driven procurement and performance-based contracts - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-site installations

Mobile tactical units

Vehicle-mounted systems

Unmanned platforms

Wearable soldier systems - By Application (in Value %)

Detection and identification

Protection and personal gear

Decontamination

Training and simulation

Command and control - By Technology Architecture (in Value %)

Sensor fusion networks

Standalone point sensors

Integrated platform suites

Cloud-edge analytics

AI-enabled decision support - By End-Use Industry (in Value %)

Military and defense

Homeland security and civil defense

Emergency services

Critical infrastructure operators

Healthcare and laboratories - By Connectivity Type (in Value %)

Standalone offline

Secure wired networks

Tactical radio links

SATCOM-enabled

Encrypted IP networks - By Region (in Value %)

Northern District

Central District

Southern District

Jerusalem District

Nationwide programs

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product breadth, Detection performance, Integration capability, Cyber and communications, Local support footprint, Program management track record, Pricing and lifecycle cost, Compliance and certifications)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Aeronautics Group

Controp Precision Technologies

Chemring Group

Bruker

Thermo Fisher Scientific

Smiths Detection

Teledyne FLIR

Rheinmetall

Saab

Thales

Leonardo

Honeywell

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035