Market Overview

The Israel combat helmet market current size stands at around USD ~ million, reflecting sustained procurement activity and ongoing capability refresh cycles across operational units. Field evaluations referenced protection standards 3 and 4, while training rotations increased testing frequency to 2 cycles annually. Integration readiness emphasized communications mounts and optics interfaces, and acceptance protocols expanded to include 5 impact vectors. Manufacturing throughput aligned with quality audits, and logistics planning coordinated staged deliveries. Documentation frameworks supported traceability, and configuration governance reduced variability without delaying fielding.

Demand concentration remains anchored around Tel Aviv, Haifa, and Beersheba, supported by training infrastructure, testing facilities, and mature supplier networks. Jerusalem contributes through policy coordination and certification oversight, while southern corridors host field trials and acceptance activities. The ecosystem benefits from proximity between end users and integrators, enabling rapid feedback loops. Supply chains remain resilient due to diversified materials sourcing and established compliance pathways. Urban training environments continue shaping requirements, reinforcing continuous coordination between operational commands and industrial partners.

Market Segmentation

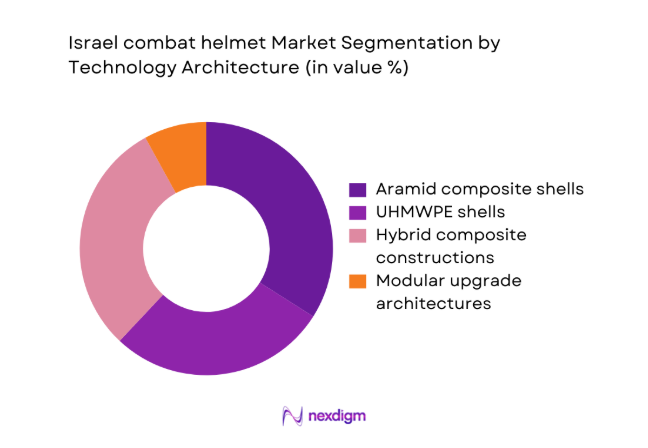

By Technology Architecture

Composite-based architectures dominate because they balance protection performance with ergonomic priorities and compatibility with accessories. Aramid solutions remain relevant for proven reliability, while UHMWPE variants gain attention for weight optimization. Hybrid constructions increasingly bridge requirements for blunt impact and fragmentation resistance without compromising stability. Procurement stakeholders value modular interfaces that support communications and night-vision integration. Testing protocols emphasize repeatability and fit across anthropometrics, reinforcing consistent acceptance outcomes. Logistics teams prefer standardized components, reducing maintenance complexity. In 2024, evaluation cycles favored architectures demonstrating documented compliance and scalable production readiness. These factors collectively concentrate adoption toward composite and hybrid platforms within operational units.

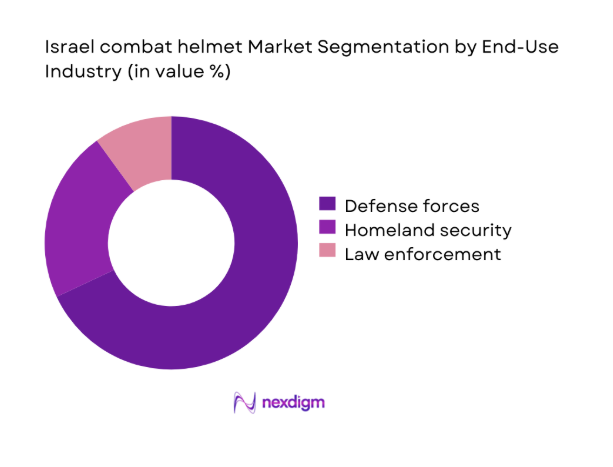

By End-Use Industry

Defense forces represent the primary demand center due to continuous readiness requirements and structured replacement cycles. Homeland security organizations contribute steady volumes driven by urban operations and training intensity. Law enforcement adoption remains selective, focusing on crowd-control and specialized response units requiring accessory compatibility. End users prioritize interoperability with existing protective ensembles and communications equipment. Acceptance criteria emphasize comfort during extended patrols and rapid configuration changes. In 2024, coordinated trials improved confidence across agencies, while logistics planning supported differentiated issue patterns. Policy alignment and certification governance further consolidate defense-led demand, keeping other segments supportive yet strategically important.

Competitive Landscape

The competitive environment features a mix of domestic integrators and international suppliers emphasizing certification readiness, modular compatibility, and reliable service support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rabintex Industries | 1950 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Gentex | 1894 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Galvion | 2002 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| ArmorSource | 2005 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel combat helmet Market Analysis

Growth Drivers

Rising force modernization and soldier survivability programs

In 2024 procurement planners aligned infantry modernization with survivability doctrines, accelerating helmet replacement programs across multiple operational brigades. The emphasis expanded during 2025, integrating training feedback loops and fielded sensors without disrupting established logistics and maintenance practices. Command authorities prioritized head protection upgrades alongside body armor, reinforcing consistent standards across reserve formations and active maneuver units. Doctrine updates encouraged modular interfaces, enabling communications mounts and night optics attachments while preserving balance, comfort, and long-duration wearability requirements. Procurement cycles shortened as testing protocols matured, reducing friction between specification committees and operational evaluators across multiple service branches. Stakeholders referenced casualty mitigation benchmarks, translating lessons into procurement language that aligned training curricula with deployment readiness objectives. Industrial partners responded with iterative prototypes, coordinating certification schedules and ensuring interoperability with existing personal equipment ensembles used by soldiers. Feedback mechanisms formalized requirements documents, improving traceability between operational needs, acceptance testing milestones, and staged production decisions across programs. Planners measured readiness indicators using exercise outcomes, reinforcing budget prioritization and maintaining schedule discipline within acquisition governance frameworks. This alignment sustained momentum, ensuring modernization narratives translated into fielded protection improvements without compromising unit availability or training tempo.

Increasing urban warfare and asymmetric threat exposure

Operational patterns during 2024 emphasized dense terrain engagements, increasing fragmentation risks and reinforcing the necessity for reliable head protection solutions. Commanders reported varied threat vectors, prompting scenario-based equipment evaluations and more frequent configuration changes across units conducting urban training rotations. In 2025 operational rehearsals incorporated drone observation, complicating concealment and amplifying requirements for compatibility with communications and situational awareness accessories. Helmet programs adapted by emphasizing coverage geometry, suspension stability, and impact mitigation across repeated close-quarters movement cycles during operations. Procurement staff aligned testing with urban scenarios, validating retention systems and accessory mounts under realistic vibration and shock conditions. Training feedback emphasized comfort during extended patrols, linking fatigue reduction to sustained situational awareness and decision-making accuracy in cities. Interoperability with protective eyewear and respirators gained attention, preventing interference during rapid transitions between indoor and outdoor environments. Logistics teams prepared diversified inventories, supporting unit-level customization without disrupting standardized training syllabi or maintenance documentation processes and schedules. Risk assessments informed acceptance criteria, balancing protection priorities with mobility needs for squads operating in constrained vertical spaces. Collectively these pressures sustained demand, keeping development cycles active and ensuring procurement plans remained responsive to evolving operational realities.

Challenges

Weight and comfort trade-offs with higher protection levels

Design teams in 2024 faced persistent trade-offs, where additional ballistic layers increased mass and altered center-of-gravity during prolonged missions. User feedback highlighted neck fatigue, prompting revisions to padding systems and suspension geometries across multiple helmet configurations in service. In 2025 trial protocols expanded comfort metrics, yet protection benchmarks still constrained allowable mass targets for frontline deployments. Accessory ecosystems compounded challenges, because mounted devices shifted balance and introduced pressure points during rapid movement and vehicle egress drills. Procurement committees weighed soldier feedback against certification results, sometimes delaying approvals while iterative refinements addressed ergonomic shortcomings in evaluations. Manufacturers explored material substitutions, but performance envelopes limited reductions without compromising multi-threat protection expectations and service life requirements. Training cadres reported adaptation periods, indicating that even minor weight changes affected posture, stability, and endurance across long exercises. Maintenance units observed accelerated wear in comfort components, necessitating more frequent inspections and replacement scheduling coordination with depots. Commanders balanced mission loads, sometimes limiting accessories to preserve mobility, which constrained adoption of optional integrated capabilities during operations. These tensions persisted, requiring careful compromise decisions and reinforcing the importance of incremental improvements rather than abrupt specification escalations.

Budget constraints and multi-year procurement cycles

Fiscal planning frameworks in 2024 prioritized readiness, yet constrained envelopes required staged commitments and deferred nonessential configuration expansions. Multi-year cycles complicated synchronization with training calendars, creating gaps between acceptance testing, delivery windows, and fielding milestones for units. In 2025 budget committees emphasized predictability, favoring framework agreements that limited rapid specification pivots requested by operational stakeholders. Cash flow phasing influenced supplier capacity planning, occasionally compressing production runs and complicating quality assurance resourcing schedules during peaks. Contract governance introduced checkpoints, extending decision timelines and requiring repeated documentation updates across review boards and audit functions. Program managers mitigated risk through buffer inventories, yet carrying strategies conflicted with efficiency goals and storage optimization initiatives. Exchange rate movements introduced planning uncertainty, even without direct pricing focus, because imported materials affected scheduling commitments and approvals. Oversight requirements mandated extensive reporting, increasing administrative workloads and reducing time available for iterative technical coordination sessions with suppliers. Units adapted expectations, planning phased rollouts rather than comprehensive upgrades during single training cycles or deployment windows for contingencies. These constraints reinforced disciplined prioritization, shaping roadmaps and aligning ambitions with feasible execution horizons under governance frameworks and oversight.

Opportunities

Lightweight materials and ergonomic design innovation

Research programs in 2024 explored hybrid composites, targeting mass reduction while preserving impact resistance across representative operational scenarios. Human factors teams collaborated with engineers, refining fit systems and padding architectures to distribute loads more evenly during movement. In 2025 pilot lines demonstrated repeatable processes, enabling scale transitions without sacrificing quality assurance or documentation completeness standards. Ergonomic testing incorporated diverse anthropometrics, improving inclusivity and reducing adjustment time during unit issue and fitting sessions and training. Material roadmaps emphasized recyclability and durability, supporting lifecycle stewardship goals without compromising protection performance requirements in field operations. Iterative prototyping shortened feedback loops, allowing rapid incorporation of soldier comments into production-ready design baselines for programs and fleets. Supplier collaboration frameworks facilitated risk sharing, aligning incentives around manufacturability, consistency, and long-term supportability objectives for deployments and training. Testing regimes validated blunt impact improvements, complementing ballistic metrics and strengthening acceptance confidence among operational evaluators and committees alike. Documentation updates codified ergonomic criteria, enabling consistent audits and smoother transitions between development, testing, and fielding stages for programs. These advances positioned suppliers to differentiate offerings through comfort and weight, reinforcing procurement confidence and long-term adoption trajectories across programs.

Modular upgrade kits and accessory ecosystems

Modular architectures in 2024 enabled incremental capability additions, reducing disruption and preserving continuity within established training and maintenance frameworks. Accessory standards simplified interoperability, allowing units to tailor configurations for missions without extensive requalification or additional documentation overhead burdens. In 2025 logistics planning benefited, because kits could be issued centrally while attachments were distributed according to operational priorities. Inventory visibility improved, supporting readiness reporting and reducing mismatches between platform availability and accessory demand signals across units nationwide. Training syllabi incorporated configuration drills, ensuring soldiers understood mounting procedures and safety checks before operational employment in field environments. Maintenance planning adapted, stocking common spares and reducing downtime associated with incompatible components or outdated interface specifications during deployments. Supplier roadmaps highlighted ecosystem thinking, encouraging third-party accessories while preserving governance over safety and certification pathways for user organizations. Evaluation teams assessed compatibility matrices, preventing procurement of isolated solutions that complicated training, storage, and lifecycle management and planning. Contract structures supported options, enabling phased acquisitions and reducing risk when integrating emerging accessories with baseline helmets across fleets. Overall modularity strengthened resilience, ensuring systems evolved without forcing wholesale replacements or disrupting operational readiness schedules for units nationwide.

Future Outlook

The market will continue aligning modernization priorities with operational feedback, emphasizing comfort, interoperability, and modularity. Policy coordination and certification governance will remain central to acceptance timelines. Supply chains are expected to prioritize material resilience and documentation traceability. Incremental upgrades will coexist with platform refresh cycles. Collaboration between users and suppliers will shape practical innovation pathways.

Major Players

- Elbit Systems

- Rabintex Industries

- Gentex

- Galvion

- ArmorSource

- MSA Safety

- Avon Protection

- Point Blank Enterprises

- NP Aerospace

- MKU Limited

- BAE Systems

- 3M

- Rheinmetall

- DuPont

- Marom Dolphin

Key Target Audience

- Israel Ministry of Defense procurement directorates

- Israel Defense Forces Procurement and Logistics Division

- Israel Police and Border Police command units

- Homeland security agencies responsible for public order operations

- Special operations units and training commands

- Defense system integrators and prime contractors

- Investments and venture capital firms focused on defense technologies

- Standards and regulatory bodies overseeing certification and compliance

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across protection performance, ergonomics, interoperability, and certification readiness. Operational use cases, training intensity, and logistics constraints were mapped to ensure relevance. Documentation requirements and acceptance workflows were incorporated. Assumptions were recorded to maintain analytical consistency.

Step 2: Market Analysis and Construction

Segment structures were constructed around technology architectures and end-use categories. Operational feedback loops and procurement governance were embedded into the framework. Comparative assessment criteria emphasized interoperability and comfort. Scenario mapping ensured coverage of urban and conventional deployments.

Step 3: Hypothesis Validation and Expert Consultation

Working hypotheses were reviewed with practitioners involved in testing, logistics, and training. Feedback refined assumptions around ergonomics and modularity. Iterations reconciled certification pathways with operational needs. Consistency checks ensured alignment with governance processes.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a coherent narrative focused on readiness and practicality. Segment insights were cross-validated for internal consistency. Language and structure were standardized for decision use. Final outputs emphasized actionable implications for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for ballistic head protection, Segmentation by protection level materials and user units, Bottom-up unit procurement and fleet inventory sizing, Revenue attribution by contract type and ASP bands, Primary interviews with IDF procurement integrators and suppliers, Import export and MoD tender award tracking, Assumptions on classified volumes and retrofit cycles and data triangulation)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and certification environment

- Growth Drivers

Rising force modernization and soldier survivability programs

Increasing urban warfare and asymmetric threat exposure

Adoption of integrated communications and sensor mounts

Higher ballistic and blunt impact performance requirements

Replacement cycles for aging legacy helmets

Local production and offset policies - Challenges

Weight and comfort trade-offs with higher protection levels

Budget constraints and multi-year procurement cycles

Certification and testing timelines

Supply chain dependence on advanced fibers and resins

Integration complexity with night vision and comms systems

Export control and technology transfer restrictions - Opportunities

Lightweight materials and ergonomic design innovation

Modular upgrade kits and accessory ecosystems

Domestic manufacturing and localization

Exports to allied and regional markets

Lifecycle services and refurbishment contracts

Digital soldier system integration programs - Trends

Shift toward UHMWPE and hybrid composites

Emphasis on comfort padding and fit systems

Standardization around accessory rails and shrouds

Data-enabled and sensor-ready helmet platforms

Smaller batch procurements with faster refresh cycles

Increased testing for blunt impact and fragmentation - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Infantry brigades

Armored corps crews

Special operations units

Border police and gendarmerie units - By Application (in Value %)

Infantry combat operations

Urban warfare and CQB

Training and readiness

Riot control and internal security - By Technology Architecture (in Value %)

Aramid composite shells

UHMWPE shells

Hybrid composite constructions

Applique and modular upgrade architectures - By End-Use Industry (in Value %)

Defense forces

Homeland security

Law enforcement - By Connectivity Type (in Value %)

Standalone non-networked helmets

Communications-ready integrated helmets

Sensor-integrated networked helmets - By Region (in Value %)

Northern District

Central District

Southern District

Jerusalem District

Haifa District

Export programs

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Protection level, Weight, Accessory compatibility, Certification standards, Unit price, Delivery lead time, Local content, After-sales support) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Gentex (Ops-Core)

Avon Protection

Galvion (Revision Military)

MSA Safety

ArmorSource

Elbit Systems

Rabintex Industries

Marom Dolphin

NP Aerospace

MKU Limited

Point Blank Enterprises

BAE Systems

3M

DuPont

Rheinmetall

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035