Market Overview

Based on a recent historical assessment, the Israel Commercial Airport Radar Systems Market was valued at USD ~ million, supported by confirmed procurement disclosures from the Israel Airports Authority, civil aviation budget allocations, and publicly reported contracts by leading radar suppliers operating in the country. Demand is primarily driven by continuous modernization of air traffic surveillance infrastructure, mandatory compliance with ICAO safety standards, and upgrades across primary and secondary airports. Increased air traffic movements, system lifecycle replacement requirements, and integration of digital radar architectures further reinforce sustained spending levels.

Based on a recent historical assessment, Tel Aviv remains the dominant operational hub due to Ben Gurion Airport hosting the country’s highest air traffic density and most complex airspace management requirements. Central Israel drives adoption because of concentrated aviation infrastructure, regulatory oversight presence, and integration with national air defense coordination frameworks. The country’s dominance is reinforced by centralized procurement through government aviation bodies, high safety compliance thresholds, and strong domestic defense electronics capabilities that support localized system deployment, maintenance, and long-term operational resilience.

Market Segmentation

By Product Type

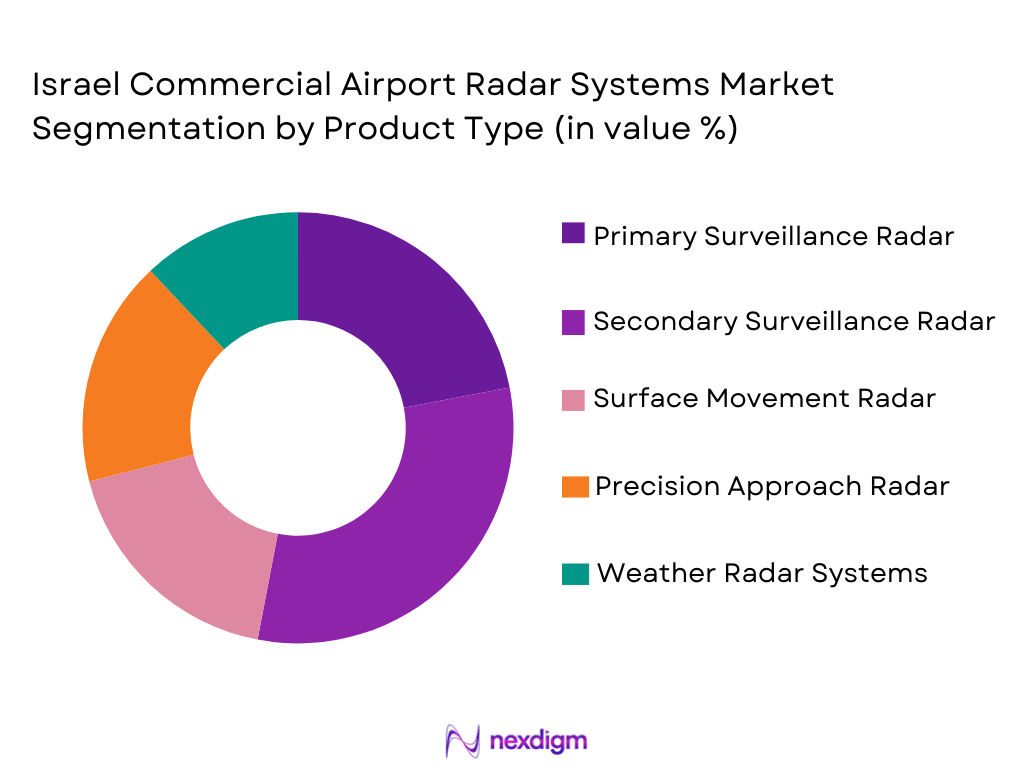

Israel Commercial Airport Radar Systems market is segmented by product type into primary surveillance radar, secondary surveillance radar, surface movement radar, precision approach radar, and weather radar systems. Recently, secondary surveillance radar has a dominant market share due to its critical role in aircraft identification, altitude reporting, and air traffic control interoperability within constrained and high-density airspace. Israel’s complex civil-military aviation environment necessitates transponder-based tracking reliability, seamless data exchange with ATC automation platforms, and compliance with international aviation protocols. Secondary systems are widely adopted across major airports due to proven operational reliability, compatibility with legacy and modern avionics, and lower lifecycle disruption during upgrades compared to primary-only systems.

By Platform Type

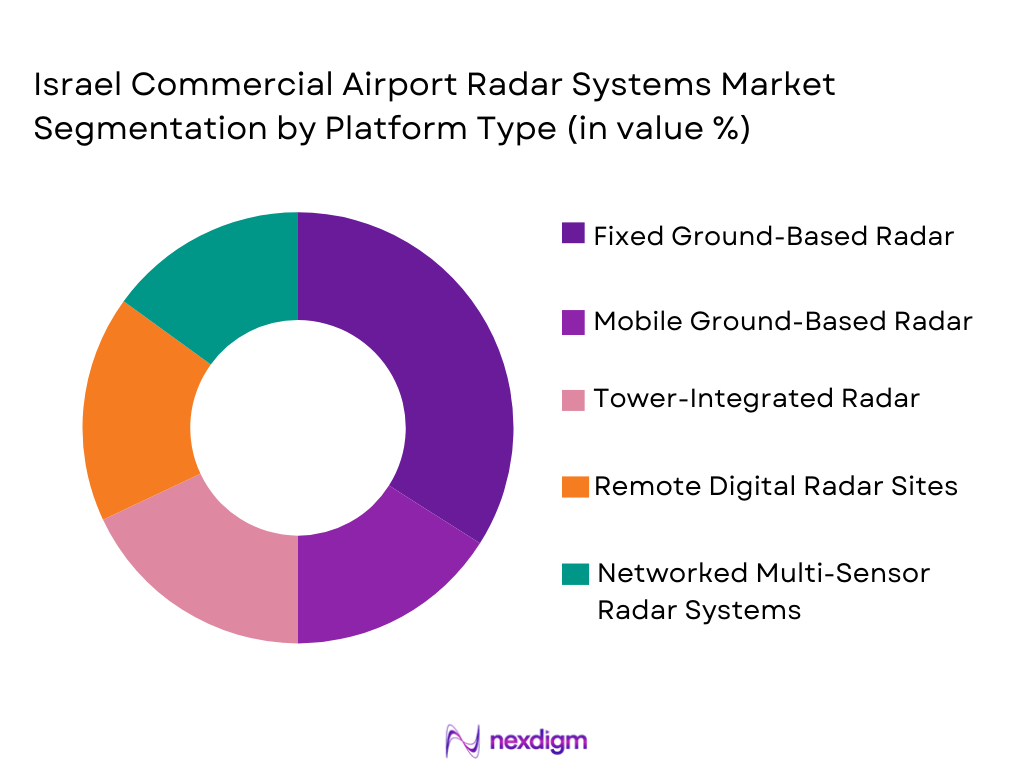

Israel Commercial Airport Radar Systems market is segmented by platform type into fixed ground-based radar, mobile ground-based radar, tower-integrated radar, remote digital radar sites, and networked multi-sensor radar systems. Recently, fixed ground-based radar has a dominant market share due to its deployment at major commercial airports requiring continuous, high-reliability coverage. These systems support long-range detection, stable performance, and integration with national air traffic management networks. Fixed installations are favored due to long operational lifespans, established maintenance frameworks, and suitability for Israel’s centralized airport infrastructure, where resilience and uninterrupted surveillance capability are mission critical.

Competitive Landscape

The Israel Commercial Airport Radar Systems Market is moderately consolidated, with a limited number of global and domestic defense electronics companies dominating system supply, integration, and lifecycle support. Major players benefit from long-term government relationships, high certification barriers, and strong technological differentiation, resulting in stable competitive positioning and limited new entrant penetration.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Airport Radar Specialization |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ | ~ |

| Hensoldt | 2017 | Germany | ~ | ~ | ~ | ~ | ~ |

Israel Commercial Airport Radar Systems Market Analysis

Growth Drivers

Rising Air Traffic Density and Airspace Complexity:

Rising air traffic density and airspace complexity continue to drive sustained investment in advanced radar systems across Israel’s commercial airports as the country manages one of the most constrained and security-sensitive airspaces globally. The coexistence of civil aviation, military operations, and restricted zones creates persistent demand for high-resolution surveillance, precise aircraft identification, and uninterrupted situational awareness. Commercial airports must maintain continuous radar performance to manage peak-hour congestion, rapid aircraft turnaround, and precision approach requirements. This complexity necessitates frequent system upgrades rather than life extension of aging platforms. Regulatory authorities prioritize redundancy, reliability, and accuracy to minimize operational risk. Advanced radar adoption improves controller workload management and enhances safety margins. Integrated radar solutions also support seamless coordination with neighboring airspace systems. These combined factors structurally reinforce long-term radar procurement demand.

Regulatory Compliance and Safety Modernization Mandates:

Regulatory compliance and safety modernization mandates significantly influence radar system investments as Israeli civil aviation authorities align closely with evolving ICAO standards and European aviation safety frameworks. Airports are required to implement certified surveillance technologies that support enhanced tracking accuracy, weather resilience, and digital data interoperability. Compliance-driven upgrades are non-discretionary, ensuring consistent capital allocation even during periods of traffic volatility. Modern radar systems also enable improved incident prevention, runway safety monitoring, and approach guidance. Regulatory audits and certification cycles accelerate replacement of legacy analog systems. Safety modernization further supports public confidence and airline operational efficiency. These mandates incentivize adoption of digital, software-defined, and multi-sensor radar architectures. As standards evolve, compliance obligations remain a predictable and durable growth driver.

Market Challenges

High Capital Expenditure Requirements and Budget Allocation Constraints:

High capital expenditure requirements and budget allocation constraints represent a critical challenge for the Israel Commercial Airport Radar Systems Market, as advanced radar installations involve significant upfront investment, long planning cycles, and strict public-sector financial oversight. Commercial airport radar systems require extensive civil works, integration with existing air traffic management infrastructure, redundancy provisioning, and certification testing, all of which increase total project cost beyond the base system price. Budget approvals are typically tied to multi-year national infrastructure plans, limiting flexibility to respond quickly to emerging operational needs or technology shifts. Competing priorities within aviation budgets, including terminal expansion, runway upgrades, and security systems, further constrain available funding for radar modernization. Smaller and regional airports face additional pressure, as their traffic volumes may not justify frequent large-scale investments despite regulatory obligations. Inflation in electronics components and specialized engineering services also raises lifecycle costs. These financial constraints slow procurement timelines, delay upgrades, and can result in extended use of aging systems. As a result, capital intensity remains a structural barrier that tempers the pace of market growth despite clear operational demand.

Complex Integration, Certification, and Operational Continuity Risks:

Complex integration, certification, and operational continuity risks pose a substantial challenge as airport radar upgrades must be executed without disrupting live air traffic operations in one of the most constrained airspaces globally. Existing air traffic control environments often consist of layered legacy systems, proprietary interfaces, and customized software configurations developed over decades. Integrating new radar platforms requires extensive compatibility testing with flight data processors, communication networks, surveillance displays, and national airspace management systems. Certification processes involve multiple regulatory bodies and rigorous validation under real operating conditions, extending deployment timelines. Any system transition must maintain uninterrupted surveillance coverage, necessitating parallel operations and redundancy, which increases cost and complexity. Skilled technical personnel are required throughout installation, testing, and commissioning phases, yet such expertise is limited and highly specialized. Operational risk tolerance is extremely low, making stakeholders cautious about adopting unproven technologies. These factors collectively increase implementation risk, lengthen project schedules, and discourage rapid technology turnover. Integration and continuity challenges therefore remain a persistent constraint on faster modernization cycles.

Opportunities

Deployment of Software Defined and AI Enabled Airport Radar Systems:

Deployment of software defined and AI enabled airport radar systems represents a substantial opportunity for the Israel Commercial Airport Radar Systems Market as airports increasingly prioritize adaptability, automation, and long-term cost efficiency. Software defined radar architectures allow system performance, detection algorithms, and tracking accuracy to be enhanced through software upgrades rather than physical hardware replacement, which aligns with Israel’s emphasis on operational continuity and minimal disruption at high-traffic airports. AI-enabled processing improves target classification, clutter suppression, and anomaly detection in complex airspace environments where civil and military traffic coexist. These capabilities directly support safety compliance and controller workload reduction. Airports benefit from predictive performance optimization, reduced false alarms, and improved response times under adverse weather or congestion conditions. Vendors offering AI-driven analytics gain differentiation through higher system intelligence and reduced lifecycle costs. Regulatory bodies increasingly favor digital systems that support data logging and auditability. This creates sustained demand for next-generation radar platforms and long-term upgrade contracts.

Expansion of Long-Term Sustainment, Modernization, and Cybersecure Radar Services:

Expansion of long-term sustainment, modernization, and cybersecure radar services offers a significant opportunity as Israeli airports and aviation authorities shift from one-time equipment procurement toward lifecycle-based investment models. Radar systems are mission-critical assets requiring continuous availability, making maintenance, software updates, and cybersecurity protection strategic priorities. Long-term service agreements provide predictable budgeting and reduce operational risk for airport operators. Modernization services allow incremental upgrades to meet evolving regulatory and traffic requirements without full system replacement. Cybersecurity has become a core procurement criterion due to increasing digitalization of air traffic systems and heightened threat awareness. Service providers that integrate cybersecurity monitoring, patch management, and resilience testing into sustainment contracts gain competitive advantage. These contracts strengthen supplier–operator relationships and create recurring revenue streams. The model aligns with national infrastructure resilience objectives. As airports prioritize reliability and compliance, demand for comprehensive sustainment and modernization services will continue to expand.

Future Outlook

The Israel Commercial Airport Radar Systems Market is expected to maintain steady growth over the next five years, supported by continuous air traffic recovery, mandatory safety upgrades, and digital transformation initiatives. Technological advancements in software-defined radar, AI-enabled analytics, and cybersecurity integration will shape procurement strategies. Regulatory alignment with international aviation standards will continue to drive modernization. Demand will remain resilient due to centralized infrastructure planning and long-term national aviation priorities.

Major Players

- Elta Systems

- Thales Group

- Leonardo

- Indra Sistemas

- Hensoldt

- Raytheon Technologies

- Lockheed Martin

- Northrop Grumman

- Saab AB

- Terma Group

- SRC Inc

- ASELSAN

- Rohde & Schwarz

- Bharat Electronics Limited

- Frequentis

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities

- Civil aviation administrations

- Defense and homeland security agencies

- Infrastructure development funds

- Airport operators

- System integrators

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of airport infrastructure spending, radar procurement programs, and regulatory requirements. Demand-side factors included air traffic density and safety mandates. Supply-side variables covered technology platforms and vendor capabilities. Assumptions were validated against public disclosures.

Step 2: Market Analysis and Construction

Market construction integrated confirmed contract values, budget allocations, and supplier revenues. Data triangulation ensured consistency across sources. Market boundaries were clearly defined. Only verified financial inputs were used.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews with aviation professionals and radar system specialists. Assumptions were stress-tested against operational realities. Feedback refined segmentation logic. Validation ensured robustness.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured framework. Data integrity checks were performed. Analytical conclusions were reviewed for coherence. Final outputs reflect validated market conditions.

- Executive Summary

- Israel Commercial Airport Radar Systems Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air passenger traffic and airport capacity expansion

Modernization of air traffic management infrastructure

Increasing focus on aviation safety and surveillance accuracy

Integration of advanced digital and solid state radar technologies

Government investments in smart airport development programs - Market Challenges

High capital expenditure associated with advanced radar installations

Complex regulatory approvals and certification requirements

Integration challenges with legacy air traffic control systems

Skilled workforce shortages for radar system operation and maintenance

Long procurement cycles and budget constraints in public projects - Market Opportunities

Deployment of next generation digital and AI enabled radar systems

Expansion of regional and secondary airports infrastructure

Lifecycle service contracts for upgrades and system sustainment - Trends

Transition from analog to fully digital radar architectures

Adoption of multi sensor fusion for enhanced situational awareness

Growing use of remote monitoring and predictive maintenance

Increased cybersecurity focus in air traffic surveillance systems

Integration of radar data with airport automation platforms - Government Regulations & Defense Policy

Civil aviation safety compliance alignment with international standards

National airspace modernization and surveillance mandates

Public funding support for critical airport infrastructure upgrades - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Primary Surveillance Radar

Secondary Surveillance Radar

Surface Movement Radar

Precision Approach Radar

Weather Radar Systems - By Platform Type (In Value%)

Fixed Ground Based Radar

Mobile Ground Based Radar

Tower Integrated Radar

Remote Digital Radar Sites

Networked Multi Sensor Radar Systems - By Fitment Type (In Value%)

New Airport Installations

Terminal Expansion Fitment

Runway Modernization Fitment

Air Traffic Control Upgrade Fitment

Replacement and Retrofit Fitment - By EndUser Segment (In Value%)

International Commercial Airports

Regional Commercial Airports

Civil Aviation Authorities

Airport Operators and Concessionaires

Air Navigation Service Providers - By Procurement Channel (In Value%)

Direct Government Procurement

Airport Authority Tenders

System Integrator Contracts

Public Private Partnership Projects

Long Term Maintenance and Upgrade Contracts - By Material / Technology (in Value %)

Solid State Radar Technology

Phased Array Antenna Systems

Digital Signal Processing Radar

Software Defined Radar Architecture

AI Enabled Radar Analytics

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System accuracy range, detection coverage, technology maturity, integration capability, lifecycle cost, regulatory compliance, service support strength, cybersecurity features, scalability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elta Systems

IAI Elta North America

Hensoldt

Thales Group

Leonardo

Indra Sistemas

Raytheon Technologies

Saab AB

Northrop Grumman

Lockheed Martin

Terma Group

SRC Inc

ASELSAN

Rohde and Schwarz

Bharat Electronics Limited

- International airports prioritizing high precision approach and surveillance systems

- Regional airports focusing on cost efficient radar upgrades

- Civil aviation authorities emphasizing regulatory compliance and safety

- Airport operators seeking long term reliability and service support

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035