Market Overview

Based on a recent historical assessment, the Israel Communication Navigation and Surveillance Systems Market recorded a total market size of USD ~ billion, supported by sustained defense modernization programs and continuous investments in network-centric warfare capabilities. Demand is driven by the integration of advanced communication links, precision navigation solutions, and multi-layered surveillance architectures across military and security operations. Increased adoption of software-defined radios, secure satellite communication, and real-time intelligence systems strengthens procurement volumes. Government-backed indigenous development programs and long-term procurement frameworks further reinforce spending continuity across operational domains and platforms nationwide.

Based on a recent historical assessment, Israel remains the dominant country within this market, with cities such as Tel Aviv, Haifa, and Be’er Sheva acting as core technology and defense manufacturing hubs. These locations host leading defense integrators, electronics developers, and cybersecurity specialists that collectively shape system innovation and deployment. Strong collaboration between the Ministry of Defense, armed forces, and domestic technology firms accelerates system testing and fielding. Proximity to advanced R&D infrastructure, skilled engineering talent, and secure testing environments sustains operational and technological leadership.

Market Segmentation

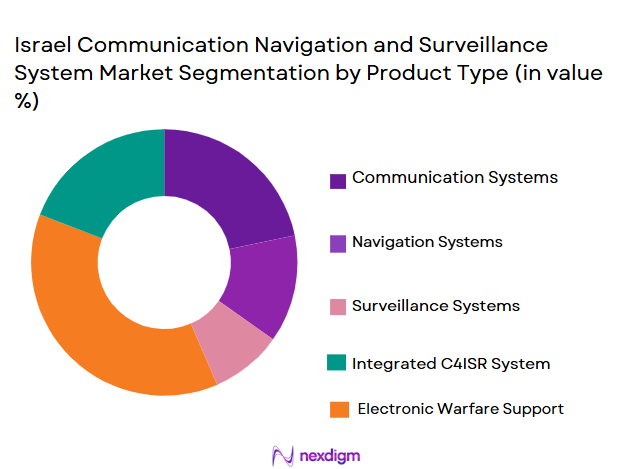

By Product Type

Israel Communication Navigation and Surveillance Systems Market is segmented by product type into communication systems, navigation systems, radar surveillance systems, electro-optical surveillance systems, and integrated C4ISR solutions. Recently, integrated C4ISR solutions have a dominant market share due to their ability to unify command, control, communications, intelligence, and surveillance functions within a single operational framework. Defense forces increasingly prioritize interoperability and real-time decision-making, which integrated systems provide more efficiently than standalone products. Indigenous suppliers offer mature, combat-proven architectures aligned with national security doctrines. High system reliability, scalable upgrades, and compatibility with multiple platforms reinforce procurement preference, sustaining dominance across operational deployments.

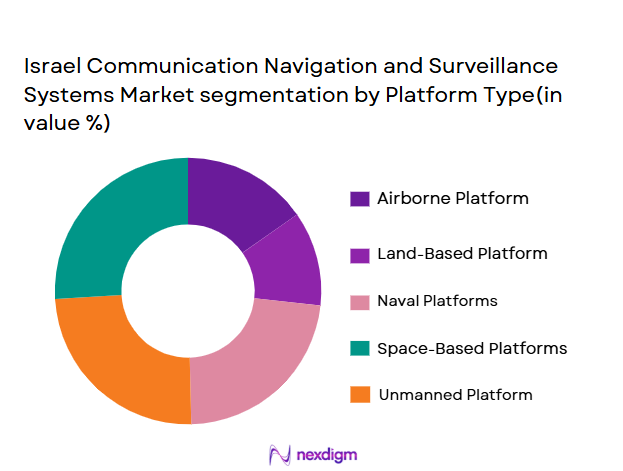

By Platform Type

Israel Communication Navigation and Surveillance Systems Market is segmented by platform type into land-based platforms, airborne manned platforms, unmanned aerial platforms, naval platforms, and space-based assets. Recently, unmanned aerial platforms have a dominant market share due to extensive deployment in intelligence, surveillance, and reconnaissance missions. These platforms require advanced communication links, autonomous navigation, and persistent surveillance payloads, driving concentrated system demand. Operational flexibility, reduced risk to personnel, and continuous mission endurance enhance procurement focus. Strong domestic expertise in unmanned systems and export-ready designs further solidify platform dominance.

Competitive Landscape

The competitive landscape is moderately consolidated, led by a small group of vertically integrated defense companies with strong government relationships and export portfolios. Major players leverage proprietary technologies, long-term contracts, and continuous R&D investment to maintain competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Specialization |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Ashdod | ~ | ~ | ~ | ~ | ~ |

| Tadiran Telecommunications | 1962 | Holon | ~ | ~ | ~ | ~ | ~ |

Israel Communication Navigation and Surveillance Systems Market Analysis

Growth Drivers

Indigenous Defense Modernization and Sovereign Technology Development:

Indigenous defense modernization and sovereign technology development are core growth drivers for the Israel Communication Navigation and Surveillance Systems Market as national security strategy emphasizes operational independence and technological superiority. Sustained government investment supports domestic research, development, and manufacturing of secure communication networks, resilient navigation systems, and advanced surveillance architectures. Local defense programs prioritize end-to-end system control, reducing reliance on foreign suppliers for critical mission systems. Continuous collaboration between the armed forces, defense laboratories, and private industry accelerates innovation cycles and ensures systems are aligned with real operational requirements. Indigenous development also enables rapid customization, faster upgrades, and tighter cybersecurity control. Long-term procurement frameworks and multi-year defense budgets provide revenue visibility for suppliers. Export approval for selected systems further scales production volumes, reinforcing the domestic industrial base. These combined factors consistently stimulate demand and reinforce market expansion.

Rising Adoption of Network-Centric and Multi-Domain Operational Concepts:

Rising adoption of network-centric and multi-domain operational concepts is a significant growth driver as modern military operations increasingly rely on real-time data exchange and integrated situational awareness. Communication, navigation, and surveillance systems form the backbone of command and control across land, air, sea, space, and cyber domains. Defense forces require secure, high-bandwidth communication links to connect sensors, platforms, and decision-makers under contested conditions. Advanced navigation solutions are essential for precision operations when satellite signals are degraded or denied. Surveillance systems provide persistent intelligence inputs that support rapid response and threat mitigation. The growing deployment of unmanned and autonomous platforms further amplifies system demand. Interoperability with allied forces drives continuous upgrades and standardization. These evolving operational doctrines directly translate into sustained procurement and modernization activity across the market.

Market Challenges

Stringent Export Control Frameworks and Regulatory Compliance Burden:

Stringent export control frameworks and regulatory compliance burden represent a persistent challenge for the Israel Communication Navigation and Surveillance Systems Market due to the sensitive nature of defense technologies involved. Communication encryption, navigation resilience, and surveillance sensor technologies are tightly regulated under national security laws and international arms control agreements. Companies must navigate multi-layered approval processes before system deployment, foreign sales, or technology collaboration. These requirements often extend sales cycles, delay revenue realization, and restrict access to certain international markets despite strong demand. Compliance costs associated with licensing, documentation, cybersecurity audits, and monitoring mechanisms place additional financial pressure on suppliers, particularly mid-sized firms. Differences in regulatory expectations across partner countries further complicate export strategies and system customization. Technology transfer limitations can constrain joint development programs and reduce scalability benefits. While these controls are essential for national security, they reduce operational flexibility and limit rapid market expansion opportunities.

High System Integration Complexity and Accelerated Technology Obsolescence:

High system integration complexity and accelerated technology obsolescence create significant challenges as communication, navigation, and surveillance systems become more software-intensive and interconnected. Modern platforms require seamless interoperability across land, air, sea, space, and cyber domains, increasing engineering complexity and integration timelines. Legacy platforms often lack standardized interfaces, making upgrades costly and technically demanding. Rapid advancements in electronics, artificial intelligence, and cybersecurity shorten system relevance cycles, forcing frequent upgrades to maintain operational effectiveness. Procurement delays can result in newly delivered systems approaching obsolescence shortly after deployment. Dependence on specialized semiconductors and advanced electronic components introduces supply chain vulnerabilities and cost volatility. Extensive testing and certification requirements further lengthen deployment schedules. These factors collectively raise lifecycle costs, strain defense budgets, and challenge suppliers to balance innovation speed with long-term system reliability.

Opportunities

Artificial Intelligence Enabled Integrated Surveillance and Decision Support Systems:

Artificial intelligence enabled integrated surveillance and decision support systems represent a significant opportunity for the Israel Communication Navigation and Surveillance Systems Market as operational environments become more data intensive and time sensitive. Defense and security operators increasingly face information overload from multiple sensors, platforms, and communication nodes, creating demand for automated data fusion and intelligent analytics. AI-driven algorithms improve target recognition, threat prioritization, and anomaly detection across radar, electro-optical, and signal intelligence inputs. These capabilities reduce operator workload while improving response accuracy and speed. Domestic expertise in artificial intelligence, cybersecurity, and software engineering enables rapid development and secure deployment of such systems. Integration of AI into command and control architectures enhances predictive decision-making and mission planning. Export markets also seek AI-enabled surveillance solutions proven in complex operational scenarios. As procurement strategies shift toward outcome-based performance, intelligent systems that enhance situational awareness and operational efficiency are positioned for sustained adoption and long-term revenue growth.

Modernization and Modular Upgrading of Legacy Communication and Navigation Infrastructure:

Modernization and modular upgrading of legacy communication and navigation infrastructure offers a substantial opportunity as a large installed base of platforms requires enhanced capability without full system replacement. Many land, air, and naval platforms continue to operate with aging communication links and navigation systems that lack resilience against electronic warfare and cyber threats. Modular open-architecture solutions allow incremental upgrades, reducing cost, downtime, and operational disruption. Demand is increasing for software-defined radios, resilient positioning technologies, and secure data links that can be integrated onto existing platforms. Government-backed modernization programs support lifecycle extension rather than platform retirement. Domestic manufacturers benefit from long-term support contracts, retrofit programs, and system integration services. Export customers similarly seek cost-effective upgrade paths for legacy fleets. The emphasis on interoperability with allied forces further accelerates demand for standardized modular systems. This opportunity aligns with budget efficiency goals while delivering enhanced operational capability, positioning modernization initiatives as a stable and recurring revenue stream.

Future Outlook

The market is expected to maintain steady expansion over the next five years, supported by continuous defense modernization, growing unmanned system deployments, and increasing emphasis on secure network-centric operations. Technological advances in artificial intelligence, cyber resilience, and satellite-based navigation will shape procurement priorities. Regulatory support for domestic manufacturing and sustained defense budgets will reinforce demand. Export opportunities for combat-proven systems will further contribute to growth momentum.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- TadiranTelecommunications

- Orbit Communication Systems

- Aeronautics Group

- BlueBirdAero Systems

- ContropPrecision Technologies

- Commtact

- Camero Tech

- BIRD Aerosystems

- UVisionAir

- Shikun& Binui Defense

- NextVisionStabilized Systems

Key Target Audience

- Defense ministries

- Armed forces

- Homeland security agencies

- Intelligence organizations

- Aerospace and defense manufacturers

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of defense procurement programs, system categories, and operational requirements. Demand drivers and constraints were mapped. Data relevance was verified. Variable interdependencies were established.

Step 2: Market Analysis and Construction

Market structure was developed using primary and secondary sources. Segmentation logic was applied. Competitive positioning was assessed. Data consistency checks were conducted.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations. Industry perspectives refined assumptions. Conflicting data points were reconciled. Final hypotheses were confirmed.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a unified framework. Analytical outputs were reviewed. Market narratives were finalized. The report was structured for clarity.

- Executive Summary

- Israel Communication Navigation and Surveillance Systems Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense modernization and network centric warfare requirements

Increasing reliance on real time intelligence and situational awareness

Expansion of unmanned and autonomous platforms across services

Growing cybersecurity and encrypted communication needs

Continuous investment in indigenous defense technology development - Market Challenges

High system complexity and integration costs

Stringent export control and regulatory compliance requirements

Rapid technology obsolescence and upgrade cycles

Interoperability constraints across legacy and new platforms

Supply chain dependence on specialized electronic components - Market Opportunities

Integration of artificial intelligence across surveillance and command systems

Upgrading legacy platforms with modular communication architectures

Expansion of dual use technologies for civil security applications - Trends

Shift toward software defined and open architecture systems

Increased adoption of multi sensor data fusion platforms

Growing use of satellite based navigation resilience solutions

Enhanced focus on cyber resilient communication networks

Convergence of communication navigation and surveillance functions - Government Regulations & Defense Policy

Strengthening of national defense procurement localization policies

Emphasis on secure and sovereign communication infrastructure

Alignment with allied interoperability and compliance standards - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Secure Tactical Communication Systems

Satellite Communication and Data Links

Radar and Electro Optical Surveillance Systems

Navigation and Positioning Systems

Integrated C4ISR Solutions - By Platform Type (In Value%)

Land Based Military Platforms

Airborne Manned Aircraft

Unmanned Aerial Vehicles

Naval Surface and Subsurface Platforms

Space Based Assets - By Fitment Type (In Value%)

New Platform Integration

Retrofit and Upgrade Programs

Portable and Manpack Systems

Vehicle Mounted Systems

Fixed Infrastructure Installations - By EndUser Segment (In Value%)

Defense Forces

Homeland Security Agencies

Intelligence and Surveillance Units

Border and Coastal Security

Civil Aviation and Critical Infrastructure Operators - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Prime Contractors

System Integrators

Foreign Military Sales

Public Private Partnership Programs - By Material / Technology (in Value %)

Software Defined Radio Technologies

Advanced Sensor Fusion Algorithms

Artificial Intelligence Enabled Analytics

Cyber Hardened Communication Hardware

Encrypted Data Processing Modules

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Integration Capability, Technology Maturity, Platform Compatibility, Cybersecurity Strength, R&D Intensity, Government Contract Exposure, Export Readiness, Lifecycle Support Capability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

Tadiran Telecommunications

Orbit Communication Systems

Aeronautics Group

BlueBird Aero Systems

Controp Precision Technologies

Commtact

Camero Tech

BIRD Aerosystems

UVision Air

Shikun & Binui Defense

NextVision Stabilized Systems

- Defense forces prioritizing integrated and interoperable C4ISR capabilities

- Intelligence agencies demanding high precision real time data processing

- Border security units focusing on persistent surveillance coverage

- Civil operators emphasizing navigation safety and system reliability

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035