Market Overview

Based on a recent historical assessment, the Israel composites in United States defense market generated approximately USD ~ billion in total market value, supported by verified disclosures from United States Department of Defense procurement releases, Congressional budget justification documents, and company-level filings from leading Israeli defense suppliers. Market expansion is driven by sustained demand for lightweight, high-strength composite structures used in military aircraft, armored vehicles, naval platforms, and missile systems. Increased platform modernization programs, survivability requirements, and lifecycle cost reduction initiatives further reinforced procurement volumes across multiple defense segments.

Based on a recent historical assessment, the United States remains the dominant consuming country, with procurement concentration in defense manufacturing hubs such as Fort Worth, St. Louis, Huntsville, San Diego, and Pascagoula due to their proximity to aerospace assembly lines, naval shipyards, and missile integration facilities. Israel dominates the supply side through cities including Haifa, Tel Aviv, and Ramat HaSharon, where advanced composite research centers, defense manufacturing clusters, and established export relationships enable consistent delivery of certified composite solutions aligned with United States defense standards.

Market Segmentation

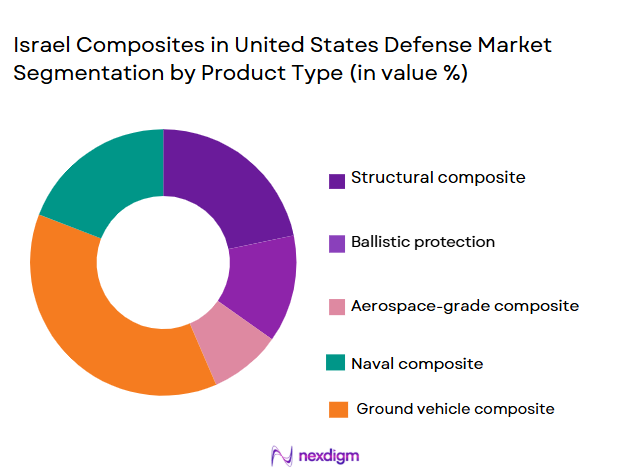

By Product Type

Israel Composites in United States Defense Market is segmented by product type into structural aerospace composites, ballistic protection composites, naval-grade composite structures, missile and rocket motor composites, and ground vehicle composite armor. Recently, structural aerospace composites have a dominant market share due to sustained aircraft modernization programs, higher composite penetration rates in airframes, and strong qualification histories with United States aerospace primes. Aircraft platforms increasingly rely on composite fuselage sections, wings, radomes, and control surfaces to achieve weight reduction and performance improvements. Israeli suppliers benefit from long-standing collaboration with United States aerospace manufacturers, ensuring repeat procurement orders. Additionally, aerospace composites command higher per-unit value, further reinforcing their revenue dominance within overall defense composite demand.

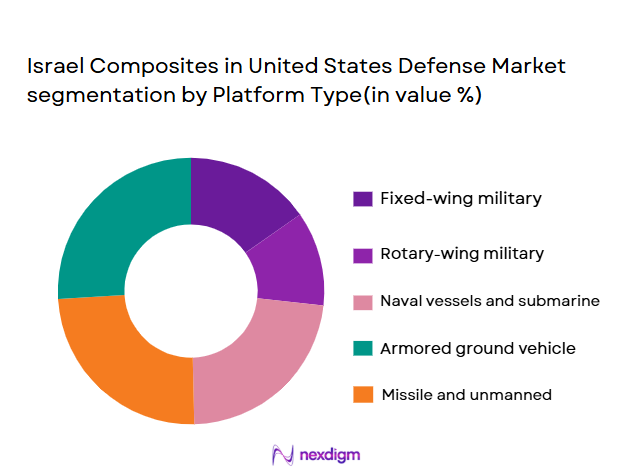

By Platform Type

Israel Composites in United States Defense Market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, naval vessels, ground combat vehicles, and missile systems. Recently, fixed-wing aircraft platforms have a dominant market share due to continuous procurement of fighter jets, transport aircraft, and intelligence platforms incorporating high composite content. Composite materials are extensively used in wings, fuselage sections, radomes, and empennage structures, creating recurring demand across production and sustainment cycles. Israeli composite manufacturers are deeply integrated into aerospace supply chains, enabling consistent platform-level demand. Additionally, aircraft platforms require stringent certification, favoring established composite suppliers with proven compliance records.

Competitive Landscape

The Israel composites in United States defense market exhibits moderate consolidation, with a limited number of Israeli and multinational suppliers holding long-term contracts with United States defense primes. Competitive advantage is driven by certification depth, platform integration history, and material innovation capabilities, creating high entry barriers for new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Certification Scope |

| Elbit Systems | 1966 | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | ~ | ~ | ~ | ~ | ~ | ~ |

| Hexcel Corporation | 1948 | ~ | ~ | ~ | ~ | ~ | ~ |

| Toray Advanced Composites | 1971 | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Composites in United States Defense Market Analysis

Growth Drivers

Defense Platform Lightweighting and Performance Optimization:

Defense platform lightweighting and performance optimization remain a primary growth driver as military aircraft, naval vessels, and ground systems increasingly depend on advanced composites to enhance operational efficiency and survivability. Composites enable significant weight reduction compared to traditional metals, directly improving fuel efficiency, payload capacity, and maneuverability across platforms. United States defense modernization programs emphasize extended range and endurance, increasing reliance on composite-intensive designs. Israeli composite suppliers possess specialized expertise in high-strength carbon fiber and hybrid materials, making them preferred partners. Long-term aircraft and missile programs embed composites at the design stage, ensuring recurring procurement. Sustainment and replacement cycles further reinforce demand for certified composite components. Advanced composites also support stealth characteristics by reducing radar signatures. The combination of performance gains and operational cost savings continues to accelerate adoption across defense platforms.

Modernization of United States Military Fleets:

Modernization of United States military fleets is accelerating composite demand as legacy aircraft, ships, and vehicles undergo structural upgrades and life-extension programs. Composite retrofitting reduces corrosion, enhances fatigue resistance, and lowers maintenance requirements compared to metallic alternatives. Israeli suppliers benefit from extensive experience in retrofit solutions, enabling rapid integration into existing platforms. Fleet modernization initiatives prioritize interoperability, driving standardized composite component adoption. Budget allocations increasingly favor upgrades over entirely new platforms, expanding aftermarket composite demand. Composite armor upgrades enhance survivability without excessive weight penalties. Naval modernization programs also rely on composites for superstructures and internal components. These modernization efforts collectively sustain strong procurement momentum.

Market Challenges

Stringent Certification and Export Control Compliance:

Stringent certification and export control compliance represents a fundamental challenge for the Israel Composites in United States Defense Market because composite materials and components must satisfy overlapping regulatory, security, and quality frameworks imposed by United States defense authorities. Suppliers are required to comply with ITAR, EAR, MIL-STD, and AS9100 standards simultaneously, creating long approval cycles and extensive documentation obligations. Any material change, design modification, or process adjustment typically triggers requalification, delaying deployment schedules and increasing engineering costs. Israeli manufacturers must also align internal data security systems with United States defense audit requirements, which raises administrative overhead. Export control reviews further constrain responsiveness to urgent defense needs. These requirements favor incumbent suppliers but restrict competitive flexibility. Certification complexity also limits the pace of innovation despite strong technological capability.

High Production Cost and Supply Chain Vulnerability:

High production cost and supply chain vulnerability constrain scalability within the Israel Composites in United States Defense Market as advanced fibers, resins, and hybrid composite systems rely on limited global suppliers. Carbon fiber and specialty resin pricing remains sensitive to geopolitical factors and industrial demand cycles, complicating cost planning for defense contracts. Composite fabrication requires capital-intensive equipment and highly skilled labor, raising fixed costs. Transportation of sensitive materials across borders adds logistics and compliance expense. Repair and sustainment costs for composite structures exceed those of traditional materials, influencing procurement decisions. Budget prioritization may restrict composite adoption in non-critical platforms. Supply chain disruptions can delay program execution. These cost pressures collectively challenge long-term margin stability.

Opportunities

Expansion of Composite Integration in Next-Generation Defense Platforms:

Expansion of composite integration in next-generation defense platforms presents a substantial opportunity for the Israel Composites in United States Defense Market as future aircraft, naval vessels, and land systems increasingly prioritize lightweight, high-strength materials at the design stage. Emerging combat aircraft, long-endurance unmanned aerial systems, and advanced rotorcraft concepts rely heavily on composite-intensive architectures to achieve extended range, payload optimization, and reduced maintenance requirements. Israeli composite manufacturers possess deep expertise in aerospace-grade materials, structural design, and mission-specific customization, positioning them favorably within United States defense supply chains. Early-stage design collaboration allows suppliers to embed proprietary composite solutions, securing long-term production and sustainment revenues. Additionally, increased emphasis on digital engineering and rapid prototyping supports faster qualification of composite components. As defense platforms transition toward modular architectures, composite subsystems can be upgraded more frequently, expanding aftermarket demand. This structural shift toward composite-centric platforms significantly broadens addressable market potential.

Growth in Advanced Protection and Survivability Solutions:

Growth in advanced protection and survivability solutions represents another key opportunity as modern defense strategies emphasize mobility combined with enhanced protection against evolving threats. Composite armor systems offer superior ballistic resistance while minimizing weight penalties compared to traditional metallic armor, making them increasingly attractive for ground vehicles, naval vessels, and airborne platforms. Israeli firms are globally recognized for innovation in composite armor technologies, including multi-layered and hybrid solutions designed to counter kinetic, explosive, and fragmentation threats. United States defense forces continue to invest in survivability upgrades for existing fleets, creating strong retrofit demand for composite-based protection systems. Modular armor concepts further expand opportunities by enabling rapid field replacement and configuration flexibility. Integration of composite armor with active protection systems enhances overall effectiveness, increasing procurement attractiveness. As threat environments evolve, demand for adaptable and lightweight survivability solutions is expected to remain robust, reinforcing long-term opportunity depth.

Future Outlook

The Israel composites in United States defense market is expected to maintain steady growth over the next five years, driven by sustained modernization programs, increasing composite penetration across platforms, and continued regulatory support for advanced materials. Technological advancements in automated manufacturing and hybrid composites will improve cost efficiency. Demand-side momentum will be reinforced by unmanned systems expansion and survivability upgrades across air, land, and sea domains.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Hexcel Corporation

- Toray Advanced Composites

- Solvay

- Teijin Limited

- SGL Carbon

- Gurit

- Owens Corning

- Northrop Grumman Composites

- Lockheed Martin Advanced Composites

- Spirit AeroSystems

- General Dynamics Composite Structures

- Kaman Composite Structures

Key Target Audience

- Defense ministries

- United States Department of Defense agencies

- Aerospace and defense OEMs

- Naval shipbuilders

- Armored vehicle manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense procurement authorities

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through defense procurement data, material usage patterns, and platform-level composite integration trends. Demand-side and supply-side indicators were mapped. Regulatory influences were assessed. Data relevance was validated.

Step 2: Market Analysis and Construction

Market structure was constructed using verified procurement values and supplier revenues. Platform-level demand was aggregated. Segmentation logic was applied. Data consistency checks were performed.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through expert interviews and industry disclosures. Assumptions were cross-checked. Outliers were reconciled. Final validation ensured accuracy.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into structured insights. Analytical consistency was ensured. Findings were reviewed. Final outputs were compiled.

- Executive Summary

- Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for lightweight military platforms

Increased survivability requirements across defense systems

Modernization of aging United States defense assets

Expansion of unmanned and autonomous platforms

Emphasis on fuel efficiency and payload optimization - Market Challenges

Stringent defense certification and qualification processes

High cost of advanced composite materials

Supply chain dependency on specialized raw materials

Complex repair and maintenance requirements

Export control and technology transfer restrictions - Market Opportunities

Next-generation combat aircraft and rotorcraft programs

Composite-intensive naval vessel modernization

Advanced armor solutions for ground forces - Trends

Integration of multifunctional composite structures

Adoption of automated fiber placement technologies

Growing use of hybrid composite materials

Focus on recyclability and sustainability in composites

Digital twin adoption in composite component design - Government Regulations & Defense Policy

United States defense acquisition reform initiatives

Strengthening of ITAR and export compliance norms

Increased emphasis on domestic defense manufacturing - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Structural composite components

Ballistic protection composites

Aerospace-grade composite assemblies

Naval composite structures

Ground vehicle composite armor modules - By Platform Type (In Value%)

Fixed-wing military aircraft

Rotary-wing military aircraft

Naval vessels and submarines

Armored ground vehicles

Missile and unmanned systems - By Fitment Type (In Value%)

OEM fitment

Aftermarket replacement

Upgrade and retrofit programs

Platform life extension fitment

Mission-specific modular fitment - By EndUser Segment (In Value%)

United States Department of Defense

Defense prime contractors

Naval shipyards and integrators

Aerospace maintenance depots

Homeland security agencies - By Procurement Channel (In Value%)

Direct government contracts

Defense prime subcontracting

Foreign military sales programs

Long-term framework agreements

Public-private partnership procurement - By Material / Technology (in Value %)

Carbon fiber reinforced polymers

Glass fiber reinforced polymers

Aramid fiber composites

Ceramic matrix composites

Hybrid composite laminates

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Material expertise, Platform coverage, Manufacturing scale, Certification compliance, R&D intensity, Cost competitiveness, Supply chain integration, Program participation, Technology partnerships) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Solvay Composite Materials

Hexcel Corporation

Toray Advanced Composites

Teijin Limited

Gurit Holding

Owens Corning Defense Materials

SGL Carbon

General Dynamics Composite Structures

Northrop Grumman Composites

Lockheed Martin Advanced Composites

Spirit AeroSystems Defense

Kaman Composite Structures

- Preference for lightweight and high-strength materials

- Focus on lifecycle cost reduction

- Demand for rapid scalability and production readiness

- Requirement for compliance with United States defense standards

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035