Market Overview

The Israel construction drones market generated an estimated market value of USD ~billion based on a recent historical assessment, supported by verified disclosures from aviation authorities, infrastructure investment programs, and technology procurement records. Market expansion is driven by increasing adoption of aerial surveying, volumetric analysis, and digital site monitoring across commercial and infrastructure construction. Government-backed smart infrastructure initiatives and rising reliance on automation to reduce labor dependency have accelerated drone procurement across public and private construction projects nationwide.

Major demand concentration is observed in Tel Aviv, Haifa, and Jerusalem due to high-density urban redevelopment, large-scale transportation projects, and commercial real estate investments. Tel Aviv dominates due to its advanced technology ecosystem and concentration of large construction contractors. Haifa benefits from port expansion and industrial infrastructure development, while Jerusalem drives demand through public works, heritage restoration, and municipal construction programs supported by sustained government funding.

Market Segmentation

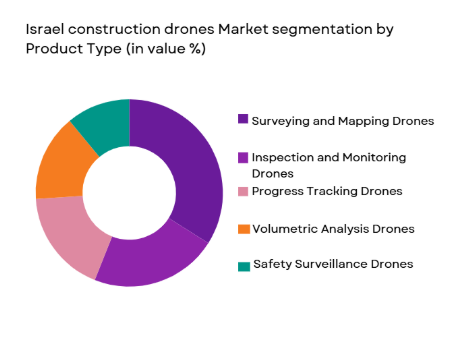

By Product Type

Israel Construction Drones Market market is segmented by product type into surveying and mapping drones, inspection and monitoring drones, progress tracking drones, volumetric analysis drones, and safety surveillance drones. Recently, surveying and mapping drones have a dominant market share due to strong demand for high-precision land assessment, earthwork measurement, and topographic modeling across infrastructure and urban construction projects. These drones are widely adopted because they significantly reduce project timelines, improve measurement accuracy, and integrate seamlessly with BIM and digital twin platforms. Their compatibility with LiDAR and photogrammetry software enhances contractor confidence. Regulatory acceptance for mapping operations is higher compared to other drone functions, further accelerating adoption. Established supplier presence and recurring usage across all construction phases reinforce their dominance in procurement budgets.

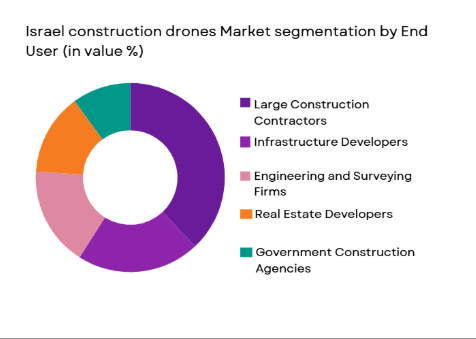

By End User

Israel Construction Drones Market market is segmented by end user into large construction contractors, infrastructure developers, engineering and surveying firms, real estate developers, and government construction agencies. Recently, large construction contractors hold a dominant market share due to their involvement in high-value, multi-year projects requiring continuous aerial monitoring and compliance documentation. These firms deploy drones across planning, execution, and reporting phases to optimize workflows and reduce rework costs. Their financial capacity allows large-scale fleet deployment and integration with enterprise construction management software. Contractors also benefit from internal drone operation teams, improving utilization rates. Long-term framework agreements with drone solution providers further consolidate their dominance.

Competitive Landscape

The Israel construction drones market exhibits moderate consolidation, with a mix of domestic drone technology firms and global UAV manufacturers supplying enterprise-grade solutions. Israeli players benefit from strong defense-derived UAV expertise, while international firms compete through advanced autonomy and analytics platforms. Strategic partnerships, software integration capabilities, and regulatory compliance experience are key differentiators. Market leaders influence pricing standards and accelerate technology adoption through bundled hardware-software offerings.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airobotics | 2014 | Israel | ~ | ~ | ~ | ~ | ~ |

| Percepto | 2016 | Israel | ~ | ~ | ~ | ~ | ~ |

| DJI Enterprise | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| Parrot Drones | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| Skydio | 2014 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Construction Drones Market Analysis

Growth Drivers

Digital Transformation of Construction Project Management

Digital transformation of construction project management is accelerating drone adoption as contractors increasingly rely on real-time data for planning, execution, and compliance. Drones enable rapid site assessments, progress documentation, and issue detection, improving decision-making accuracy. Integration with BIM platforms enhances coordination between stakeholders. Automated aerial data collection reduces manual surveying costs. Government-backed digitization initiatives support technology adoption. Rising project complexity increases reliance on data-driven workflows. Improved ROI visibility strengthens procurement confidence. Contractors prioritize technologies that shorten project cycles and reduce cost overruns.

Labor Productivity Optimization and Safety Enhancement

Labor productivity optimization and safety enhancement drive drone usage by minimizing human exposure to hazardous environments. Drones replace manual inspections in high-risk zones such as elevated structures and excavation sites. Reduced on-site labor dependency addresses workforce shortages. Safety compliance documentation becomes more efficient. Insurance and liability risks are lowered through recorded aerial evidence. Contractors benefit from fewer site accidents. Regulatory bodies increasingly recognize drones as safety tools. Productivity gains translate into measurable cost savings.

Market Challenges

Regulatory Constraints and Airspace Management Complexity

Regulatory constraints and airspace management complexity pose significant challenges due to strict flight permissions and operational limitations. Construction sites often lie near urban zones requiring special approvals. Compliance processes increase deployment timelines. Operator licensing requirements add cost burdens. Changing regulations create uncertainty for long-term planning. Restricted flight altitudes limit operational flexibility. Data governance rules affect cloud-based analytics. Coordination with aviation authorities remains resource intensive.

High Integration and Lifecycle Ownership Costs

High integration and lifecycle ownership costs challenge smaller firms due to expenses associated with hardware, software, training, and maintenance. Advanced sensors significantly increase upfront investment. Software licensing adds recurring costs. Skilled operator availability remains limited. Maintenance downtime impacts utilization rates. Battery lifecycle constraints increase replacement costs. Integration with legacy systems requires customization. Budget constraints slow adoption among mid-sized contractors.

Opportunities

Integration with Digital Twin and Smart City Platforms

Integration with digital twin and smart city platforms presents strong growth opportunities by enabling continuous infrastructure monitoring. Drones provide real-time data feeds for urban planning systems. Municipal authorities increasingly demand digital asset documentation. Construction firms gain predictive maintenance insights. Platform interoperability enhances value proposition. Government smart city funding supports adoption. Long-term service contracts become viable. Data monetization opportunities emerge.

Expansion of Drone-as-a-Service Construction Models

Expansion of drone-as-a-service construction models offers cost-effective access for smaller firms. Subscription-based services reduce capital expenditure. Service providers manage compliance and maintenance. Flexible scaling aligns with project timelines. Contractors benefit from updated technology without ownership risk. Market penetration increases across mid-tier projects. Recurring revenue models attract private investment. Standardized service offerings improve adoption consistency.

Future Outlook

The Israel construction drones market is expected to experience sustained growth over the next five years driven by infrastructure modernization, digital construction mandates, and rapid advancements in autonomous flight systems. Increasing regulatory clarity will support wider commercial deployment. Integration with AI analytics and digital twins will deepen adoption. Demand from public infrastructure projects will remain strong. Service-based deployment models will broaden market accessibility.

Major Players

- Airobotics

- Percepto

- DJI Enterprise

- Parrot Drones

- Skydio

- Flyability

- Delair

- Autel Robotics

- SenseFly

- Trimble

- Topcon Positioning Systems

- Hexagon AB

- Teledyne FLIR

- PrecisionHawk

- Intelinair

Key Target Audience

- Construction contractors

- Infrastructure developers

- Engineering and surveying firms

- Real estate developers

- Government construction agencies

- Urban planning authorities

- Investment and venture capital firms

- Regulatory and aviation bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including drone types, end-user demand, regulatory environment, and technology adoption were identified through industry frameworks and government publications.

Step 2: Market Analysis and Construction

Market structure was developed using procurement data, project-level deployments, and verified industry disclosures.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with UAV operators, construction technology experts, and regulatory specialists.

Step 4: Research Synthesis and Final Output

All data points were cross-verified and synthesized into a structured analytical framework ensuring consistency and accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of digital construction management tools

Strong demand for real-time site monitoring and analytics

Labor productivity optimization and automation needs

Government support for smart infrastructure development

Advancements in drone autonomy and AI analytics - Market Challenges

Regulatory constraints on drone flight operations

High initial investment and integration costs

Data security and site privacy concerns

Limited skilled drone operators

Weather and environmental operating limitations - Market Opportunities

Integration of drones with BIM and digital twin platforms

Expansion of autonomous and AI-enabled construction drones

Growth in infrastructure megaprojects and urban development - Trends

Increased use of LiDAR drones for volumetric analysis

Adoption of AI-driven automated site inspections

Integration of drones with cloud-based project management

Rising demand for real-time construction progress reporting

Shift toward drone-as-a-service business models - Government Regulations & Defense Policy

Civil aviation authority drone operation frameworks

Smart city and digital construction initiatives

Data protection and airspace management policies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveying and mapping drones

Inspection and monitoring drones

Progress tracking and site documentation drones

Material measurement and volumetric analysis drones

Safety and compliance monitoring drones - By Platform Type (In Value%)

Multi-rotor drones

Fixed-wing drones

Hybrid VTOL drones

Tethered drones

Autonomous swarm drones - By Fitment Type (In Value%)

Off-the-shelf commercial drones

Customized construction-specific drones

OEM-integrated drone solutions

Retrofit sensor-equipped drones

Fully autonomous preconfigured drones - By EndUser Segment (In Value%)

Large construction contractors

Infrastructure development companies

Real estate developers

Engineering and surveying firms

Government construction agencies - By Procurement Channel (In Value%)

Direct OEM procurement

Authorized drone distributors

System integrator contracts

Government tenders

Technology leasing and service providers - By Material / Technology (in Value %)

LiDAR-enabled drone systems

Photogrammetry-based drone platforms

AI-powered vision analytics drones

Thermal and multispectral sensor drones

Cloud-integrated drone data platforms

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Platform autonomy level, Sensor integration capability, Software analytics strength, Regulatory compliance readiness, Deployment scalability, Pricing flexibility, Service and support coverage, Integration with BIM systems, Data security robustness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Airobotics

Percepto

Flyability

DJI Enterprise

Parrot Drones

Skydio

SenseFly

Delair

Autel Robotics

Trimble

Topcon Positioning Systems

Hexagon AB

Teledyne FLIR

Intelinair

PrecisionHawk

- High adoption among large infrastructure contractors

- Growing use by engineering and surveying firms

- Increasing government utilization for public projects

- Rising interest from real estate developers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035