Market Overview

The Israel Defense Electronics market is valued at approximately USD ~ billion based on a recent historical assessment. The market is driven by technological advancements, a surge in defense spending, and the growing need for robust defense systems in response to regional security threats. Israel’s strategic emphasis on developing cutting-edge military technologies, including advanced radar, cybersecurity, and communication systems, fuels market growth. Additionally, the increasing demand for unmanned systems and electronic warfare technologies contributes significantly to the market’s expansion.

Dominant players in the Israel Defense Electronics market are primarily located in cities like Tel Aviv and Herzliya, owing to their strong infrastructure, skilled workforce, and access to government defense contracts. These cities host defense giants such as Elbit Systems and Rafael Advanced Defense Systems, which are at the forefront of technological innovation in military electronics. Their dominance is supported by Israel’s robust defense policies, significant R&D investments, and a well-established defense ecosystem that facilitates the integration of state-of-the-art electronics in military applications.

Market Segmentation

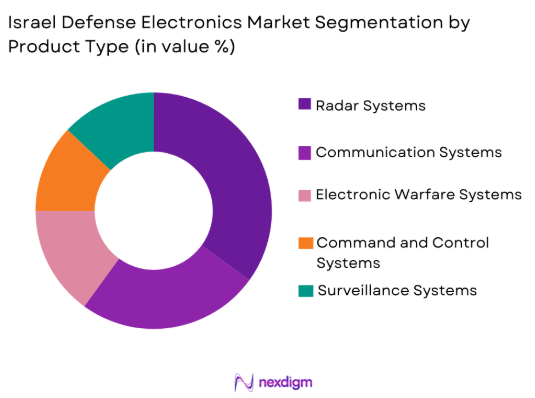

By Product Type

The Israel Defense Electronics market is segmented by product type into radar systems, communication systems, electronic warfare systems, command and control systems, and surveillance systems. Among these, radar systems have a dominant market share due to Israel’s focus on developing advanced radar technologies for both defense and civilian applications. Israel’s expertise in radar systems, particularly in air defense and border protection, has led to widespread adoption across military forces worldwide. The high demand for real-time surveillance and tracking systems, along with continuous technological advancements, bolsters the dominance of radar systems in the market.

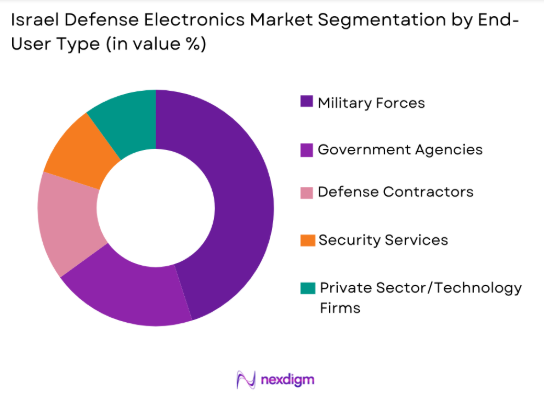

By End-User Segment

The Israel Defense Electronics market is segmented by end-user into military forces, government agencies, defense contractors, security services, and private sector/technology firms. Military forces are the dominant end-user segment, driven by Israel’s defense needs and its robust defense spending. The country’s military infrastructure places high demand on advanced electronic systems for land, air, and sea operations. Continuous advancements in defense technologies, supported by government contracts and military modernization programs, ensure the dominance of this segment in the market.

Competitive Landscape

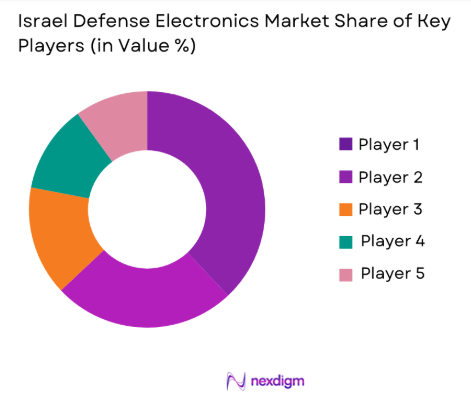

The competitive landscape of the Israel Defense Electronics market is shaped by both established players and new entrants who bring innovation and cutting-edge technologies. The market is heavily influenced by consolidation, with major players such as Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries commanding significant market shares. These companies are known for their high R&D investments, technological innovations, and strong relationships with the Israeli government. The competitive intensity is further heightened by international collaborations and strategic partnerships with global defense organizations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| IAI ELTA Systems | 1982 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Defense Electronics Market Analysis

Growth Drivers

Increasing Geopolitical Tensions

The escalating geopolitical tensions in the Middle East are a key driver of the Israel Defense Electronics market. Israel’s strategic positioning and its ongoing security concerns have led to increased demand for advanced defense technologies. To counter emerging threats, the Israeli government continues to invest in state-of-the-art defense systems, which include radar, communication systems, and electronic warfare technologies. Additionally, the rapid technological evolution in defense systems has made it essential for Israel to maintain its technological superiority, thus further fueling demand in the defense electronics sector. The government’s defense expenditure has significantly risen in recent years, as Israel looks to strengthen its defense capabilities amid growing threats from neighboring countries and international political instability. The Israel Defense Forces (IDF) have been at the forefront of adopting cutting-edge technologies, creating a high demand for next-generation defense electronics.

Technological Advancements in Electronics

Technological advancements in defense electronics, particularly in radar, communication, and cybersecurity systems, play a crucial role in driving the market. Israel has positioned itself as a global leader in military technology innovation, with a strong focus on integrating cutting-edge electronics into defense applications. The country’s defense sector is known for rapid development and adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and unmanned systems. This enables the Israeli military to gain real-time intelligence and maintain superior defense capabilities, ensuring its edge over potential adversaries. Furthermore, Israel’s defense electronics industry continues to see breakthroughs in electronic warfare systems, which help in disrupting adversarial communication networks. This continuous evolution of defense technologies helps meet Israel’s growing defense needs while also offering export opportunities, especially in regions like Asia-Pacific, Europe, and North America.

Market Challenges

High Cost of Advanced Defense Systems

One of the significant challenges faced by the Israel Defense Electronics market is the high cost of advanced defense systems. These systems often require significant investments in R&D, manufacturing, and integration, which drives up the overall price. The high cost can limit the accessibility of these technologies for some countries, especially those with budget constraints. Despite Israel’s advanced technology and manufacturing capabilities, the financial burden associated with developing and maintaining state-of-the-art defense systems poses a barrier to expansion. As Israel’s defense needs continue to evolve, the cost of upgrading existing systems and developing new solutions will further strain budgets, particularly in a global economic environment that is not always conducive to high defense spending. While government funding helps mitigate this challenge in Israel, foreign governments and organizations may face difficulties in meeting the cost demands, which can slow down global adoption.

Cybersecurity Threats

Cybersecurity remains a critical challenge for Israel’s defense electronics market, especially as military systems become increasingly connected to digital networks. Cyberattacks targeting defense infrastructure pose a substantial risk to national security, and Israel’s defense electronics must be continuously updated to address emerging cyber threats. The interconnected nature of modern defense systems makes them vulnerable to cyberattacks, which could compromise sensitive data and disrupt critical operations. While Israel is a global leader in cybersecurity, the constant evolution of cyber threats demands ongoing innovation and investment in secure technologies. Ensuring the security and resilience of defense electronics against cyber threats is essential to maintaining operational readiness and protecting military assets from hostile cyber activities.

Opportunities

Collaboration with Private Tech Firms

Collaboration with private tech firms presents a significant opportunity for the Israel Defense Electronics market. Israel has a well-established ecosystem of high-tech companies that specialize in various sectors, including cybersecurity, AI, and advanced materials. By collaborating with these firms, defense electronics companies can leverage cutting-edge technologies and integrate them into defense systems, enhancing the capabilities of military platforms. For example, collaborations in AI and machine learning can significantly improve the efficiency of defense systems, enabling predictive analytics, autonomous systems, and improved situational awareness. Additionally, partnerships with private tech firms allow for cost-sharing in R&D efforts, which can help mitigate the financial burden of developing complex defense technologies. As the global defense market grows, private-public partnerships can enable Israel to expand its defense electronics offerings and strengthen its position as a technological leader.

Emerging Markets in Asia and Africa

Emerging markets in Asia and Africa offer substantial growth opportunities for the Israel Defense Electronics market. As these regions modernize their defense capabilities, there is a rising demand for advanced technologies, including radar systems, surveillance equipment, and electronic warfare tools. Israel’s established expertise in defense electronics, combined with its reputation for developing reliable and efficient defense systems, positions it as a key player in these regions. Many countries in Asia, such as India, Japan, and South Korea, are investing heavily in defense modernization programs and are seeking advanced technologies to strengthen their military infrastructure. Similarly, in Africa, nations are increasingly prioritizing defense and security to address regional instability, which presents a significant opportunity for Israeli defense contractors to expand their footprint.

Future Outlook

The Israel Defense Electronics market is expected to grow steadily over the next five years, driven by technological advancements, increasing defense budgets, and geopolitical developments. As defense priorities shift towards advanced electronic warfare, surveillance, and cybersecurity, Israel is poised to maintain its position as a leader in military technology. The continued investment in AI and autonomous systems will likely drive further market innovation. With growing international demand for sophisticated defense solutions, especially in Asia-Pacific and Europe, the market outlook remains positive, supported by strategic collaborations and government funding.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- IAI ELTA Systems

- IMI Systems

- Lockheed Martin

- Thales Group

- General Dynamics

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- Leonardo

- Saab Group

- Rheinmetall AG

- L3 Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military agencies and defense ministries

- Defense contractors

- Security services

- Aerospace and defense manufacturers

- Technology firms specializing in defense electronics

- Commercial and industrial sectors in need of advanced defense systems

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology is to identify the key variables that impact the Israel Defense Electronics market. This involves analyzing macroeconomic factors, technological trends, and geopolitical influences to build a framework for market assessment.

Step 2: Market Analysis and Construction

The market analysis and construction phase involves collecting primary and secondary data to estimate the market size and forecast trends. This includes evaluating key players, understanding the competitive landscape, and assessing market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The third step involves validating market hypotheses through consultations with industry experts, government bodies, and key stakeholders in the defense sector. This helps ensure the accuracy and relevance of the market predictions.

Step 4: Research Synthesis and Final Output

Finally, the research findings are synthesized into a comprehensive report, highlighting market trends, challenges, opportunities, and strategic insights. This output is presented to stakeholders for decision-making and investment planning.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Radar Systems

Electronic Warfare Systems

Communication Systems

Surveillance Systems - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology Integration, Regulatory Compliance, Pricing Strategy, Market Penetration, R&D Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035