Market Overview

The Israel defense gyroscope market is valued at approximately USD ~ million, based on a recent historical assessment. This market is driven by the growing demand for precise navigation and guidance systems in military and defense applications. The increasing adoption of gyroscopes for missile guidance, UAVs, and surveillance systems further fuels market growth. Advancements in MEMS (Micro-Electro-Mechanical Systems) gyroscopes are also enhancing performance while reducing size and power consumption, making them a key factor in the market’s expansion.

Israel has long been a leader in defense technology, with several cities like Tel Aviv and Haifa hosting cutting-edge defense contractors and R&D centers. The country’s geopolitical situation and emphasis on military innovation drive the dominance of local players in the defense sector. Additionally, government support for defense technologies and strong collaboration between defense agencies and private tech firms play a pivotal role in maintaining Israel’s leadership in the defense gyroscope market.

Market Segmentation

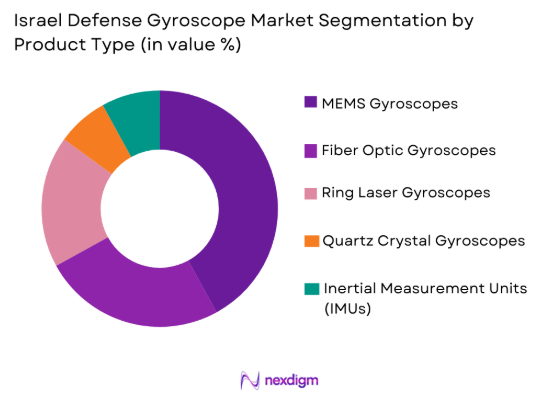

By Product Type

The Israel defense gyroscope market is segmented by product type into MEMS Gyroscopes, Fiber Optic Gyroscopes, Ring Laser Gyroscopes, Quartz Crystal Gyroscopes, and Inertial Measurement Units (IMUs). Among these, MEMS gyroscopes dominate the market share due to their compact size, low power consumption, and cost-effectiveness, making them ideal for various military applications, including drones, unmanned vehicles, and smart weapons. Their increasing adoption across multiple platforms for navigation and stabilization systems ensures their continued market leadership.

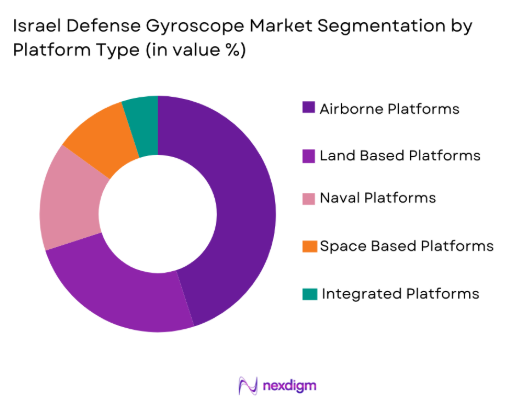

By Platform Type

The Israel defense gyroscope market is segmented by platform type into Land Platforms, Airborne Platforms, Naval Platforms, Space Platforms, and Integrated Platforms. Airborne platforms, including UAVs, fighter jets, and surveillance drones, have a dominant market share. This dominance is attributed to the increasing demand for precise navigation and guidance systems in defense aviation. Israel’s expertise in UAV technologies and its strategic importance in military air operations solidify airborne platforms as the largest segment in the market.

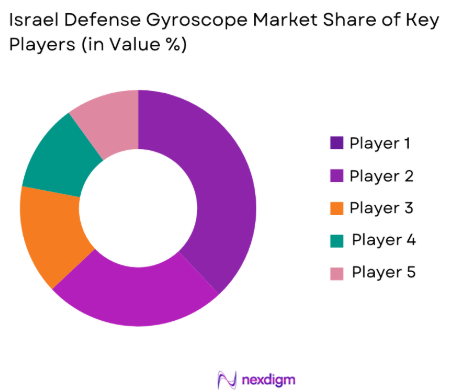

Competitive Landscape

The competitive landscape of the Israel defense gyroscope market is characterized by the presence of several prominent defense contractors and technology companies. These companies play a significant role in the consolidation of the market, where partnerships and collaborations between government bodies and private entities are common. Major players focus on technological advancements, such as miniaturization, AI integration, and enhanced durability to meet defense needs. This dynamic fosters a competitive environment in which innovation, product differentiation, and strategic alliances are key competitive advantages.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Israel Defense Gyroscope Market Analysis

Growth Drivers

Increased Demand for Precision Guidance Systems

The growing need for precise and reliable navigation systems across military platforms is a significant driver for the defense gyroscope market. As defense systems become more complex, the demand for gyroscopes to enhance the accuracy of missile guidance, drone navigation, and unmanned vehicle operations grows. The integration of gyroscopes in both existing and new military platforms allows for improved operational efficiency, leading to greater military performance. This shift towards precision navigation is essential in modern warfare, where split-second decisions can impact the outcome of operations. As a result, the demand for gyroscopes is expected to increase as military forces globally continue to prioritize technological advancements in defense systems. This trend is driven by the continuous efforts to modernize military capabilities, ensuring that gyroscopes remain a critical component of high-tech defense systems.

Technological Advancements in MEMS Gyroscopes

Another growth driver for the defense gyroscope market is the continuous development of MEMS (Micro-Electro-Mechanical Systems) gyroscopes, which are becoming increasingly popular due to their small size, low cost, and high performance. MEMS gyroscopes offer the necessary precision for defense systems such as missiles, drones, and military vehicles, while also reducing size, weight, and power consumption. These advancements in MEMS technology enable more versatile, compact, and cost-effective solutions for defense applications. The growing trend of deploying smaller, lighter systems that require advanced gyroscopic technology aligns perfectly with the market demand for MEMS-based solutions. As MEMS technology continues to evolve, its adoption is expected to increase, driving further growth in the market for defense gyroscopes.

Market Challenges

High Development and Maintenance Costs

One of the key challenges facing the defense gyroscope market is the high cost associated with the development, production, and maintenance of advanced gyroscopic systems. While advancements in technology continue to improve performance and reduce costs in some areas, high-quality defense gyroscopes require extensive research and development efforts. These costs are often passed down the supply chain, leading to increased prices for defense contractors and governments. The high costs of research, testing, and maintaining these advanced systems can limit the budget available for other defense technologies. In a market that is highly competitive and where cost-efficiency is critical, this financial burden poses a significant challenge, particularly for smaller players attempting to enter the market.

Supply Chain and Production Challenges

The defense gyroscope market also faces challenges related to the supply chain, particularly in terms of sourcing high-quality raw materials, components, and advanced technologies. The complexity of gyroscopic systems, combined with the need for stringent quality control and testing, means that manufacturers must rely on a highly specialized supply chain. Delays in production, shortages of critical materials, or disruptions due to geopolitical events can severely affect production timelines and costs. The market’s reliance on a few key suppliers for high-performance components increases vulnerability to supply chain disruptions, which can have a cascading impact on the entire defense sector.

Opportunities

Expansion of Unmanned Aerial Vehicles (UAVs) in Military Operations

The rise in the use of UAVs (Unmanned Aerial Vehicles) for military reconnaissance, surveillance, and combat missions presents a significant opportunity for the defense gyroscope market. UAVs require advanced gyroscopic systems for stable flight control, navigation, and target tracking. As the demand for UAVs in defense operations increases, the need for reliable gyroscopic systems is expected to grow substantially. The ongoing development of UAVs with enhanced capabilities such as autonomy, artificial intelligence, and long-endurance missions further fuels this opportunity. As military forces seek to integrate these systems into their operational strategies, the demand for gyroscopes will continue to rise, offering growth prospects for manufacturers in the defense gyroscope space.

Technological Integration with AI and Autonomous Systems

Another opportunity in the defense gyroscope market is the increasing integration of artificial intelligence (AI) and autonomous systems. The need for autonomous systems in defense applications such as autonomous vehicles, robots, and missile defense systems is expanding. These systems rely on gyroscopes for precise navigation and stabilization. As AI technology improves, it enables more complex decision-making processes and enhances the performance of autonomous systems. The synergies between gyroscopes and AI-powered technologies present significant growth opportunities. With defense agencies around the world investing in automation, the demand for gyroscopes integrated with AI will see significant growth in the coming years.

Future Outlook

The future of the Israel defense gyroscope market looks promising, with continued growth driven by technological advancements, increased military expenditure, and expanding defense capabilities. The adoption of smaller, more efficient MEMS gyroscopes, along with the integration of AI into defense systems, will play a key role in shaping the market’s future. Over the next five years, the demand for precise navigation and guidance systems across a variety of military platforms, including UAVs and missile systems, will drive the market forward. As technological developments reduce costs and improve gyroscope performance, new opportunities will arise for manufacturers and defense contractors.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Honeywell International

- Northrop Grumman

- Rockwell Collins

- General Electric

- L3 Technologies

- Moog Inc.

- BAE Systems

- Curtiss-Wright Corporation

- Safran Electronics & Defense

- Opto Sigma Corporation

- SICK AG

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace manufacturers

- UAV technology developers

- System integrators

- Technology providers for defense systems

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables affecting the market, including product types, technologies, applications, and key players.

Step 2: Market Analysis and Construction

The market analysis is carried out using both primary and secondary data sources to construct a comprehensive view of the market’s size, trends, and key drivers.

Step 3: Hypothesis Validation and Expert Consultation

Validating the hypotheses through consultations with industry experts and stakeholders ensures the accuracy of the findings.

Step 4: Research Synthesis and Final Output

The final output synthesizes all the data and insights to create a detailed report that highlights key trends, challenges, and opportunities in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets in Israel

Advancements in Navigation and Guidance Systems

Rising Demand for Precision in Military Applications - Market Challenges

High Capital Investment in Advanced Gyroscopic Systems

Technological Limitations in Miniaturization

Complex Regulatory and Certification Requirements - Market Opportunities

Integration of AI and Machine Learning in Gyroscopes

Expanding Military Modernization Programs

Growth of Space Exploration Programs - Trends

Adoption of Fiber Optic Gyroscopes

Miniaturization of Gyroscopic Systems

Integration of Gyroscopes in Autonomous Systems - Government Regulations

Export Control and Compliance Policies

Regulations on Military Technology Development

Government Funding for Defense Technology Innovation

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Inertial Measurement Units

Fiber Optic Gyroscopes

Ring Laser Gyroscopes

Microelectromechanical Systems Gyroscopes

Quartz Crystal Gyroscopes - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Aerial Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

Embedded Systems

Standalone Units

Modular Systems

Hybrid Systems

Integrated Systems - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Aerospace & Aviation - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End-User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

General Electric

Rockwell Collins

Honeywell International

Thales Group

Northrop Grumman

L3 Technologies

Moog Inc.

BAE Systems

Curtiss-Wright Corporation

Safran Electronics & Defense

SICK AG

OptoSigma Corporation

- Military Forces’ Increasing Dependence on Gyroscopes for Precision

- Growth of Defense Contractors’ Role in Technology Integration

- Government Agencies Focusing on Enhanced National Security

- Security Services Adopting Advanced Gyroscopic Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035