Market Overview

The Israel Defense Manned Unmanned Teaming Systems market is driven by a strong demand for advanced military technologies in the defense sector. Based on a recent historical assessment, the market is valued at approximately USD ~ billion. Key drivers include advancements in artificial intelligence, autonomous systems, and rising defense budgets from Israel’s government. The market is expected to continue growing due to increasing geopolitical tensions and the need for enhanced operational capabilities in defense strategies.

Israel, known for its cutting-edge defense industry, has emerged as a leader in the development of manned unmanned teaming systems. The country’s dominance in the market is driven by its world-class technological infrastructure and continuous investments in defense innovation. Additionally, Israel’s strategic location in the Middle East has made it a hub for defense technologies, with a robust network of government and military collaborations that fosters rapid development and deployment of such systems.

Market Segmentation

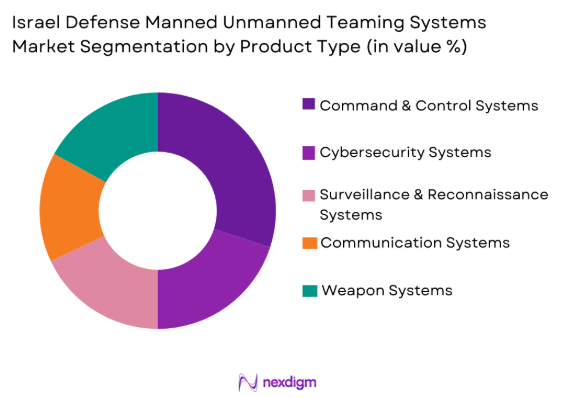

By Product Type

The Israel Defense Manned Unmanned Teaming Systems market is segmented by product type into command & control systems, cybersecurity systems, surveillance & reconnaissance systems, communication systems, and weapon systems. Command & control systems have emerged as a dominant sub-segment due to their crucial role in coordinating operations between manned and unmanned systems. These systems are essential for real-time data processing and decision-making, which are pivotal in modern warfare. The increasing demand for sophisticated command & control systems in military operations, combined with technological advancements in automation and AI, has reinforced their market dominance.

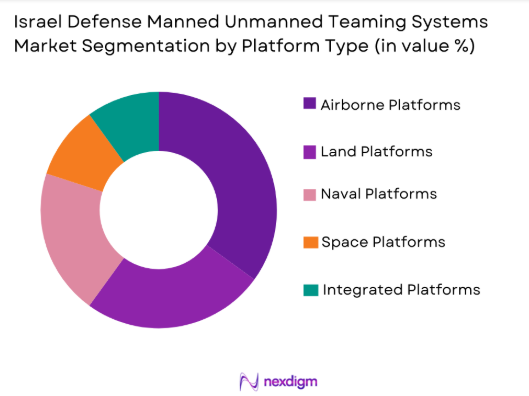

By Platform Type

The market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms dominate the market due to their flexibility and effectiveness in tactical operations. These platforms are often used in diverse environments, providing extensive surveillance and reconnaissance capabilities. Israel’s emphasis on air superiority and its advanced drone technologies contribute to the dominance of airborne platforms in the Israel Defense Manned Unmanned Teaming Systems market.

Competitive Landscape

The Israel Defense Manned Unmanned Teaming Systems market is highly competitive, with several prominent defense contractors and technology companies leading the charge. Consolidation in the sector has been driven by the need to integrate advanced technologies such as artificial intelligence, autonomous systems, and cybersecurity measures. Major players like Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries (IAI) have significantly influenced market trends with their innovative solutions and strategic partnerships. These companies, supported by government funding and a strong technological infrastructure, continue to drive the growth of manned unmanned teaming systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | R&D Investment (%) |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Israel Defense Manned Unmanned Teaming Systems Market Analysis

Growth Drivers

Increased Government Investment in National Security

The Israeli government has significantly boosted its defense budget in recent years, recognizing the need for advanced systems to maintain national security. This increase in funding directly supports the development and deployment of manned and unmanned teaming systems. Israel’s strategic position in the Middle East, facing multiple security challenges, necessitates cutting-edge defense technologies to safeguard its borders. The Israeli Defense Forces (IDF) are continuously investing in improving defense technologies, with an emphasis on integrating autonomous and manned systems to enhance operational efficiency and effectiveness. These advancements are expected to further strengthen Israel’s position as a leader in military technologies. Furthermore, international partnerships and collaborations with defense contractors worldwide have helped Israel maintain its defense technology edge. The country’s robust infrastructure also enables quick adaptation and implementation of new technologies, ensuring the continuous development of manned unmanned teaming systems. Consequently, this consistent government investment in national security fuels the market’s growth by increasing demand for sophisticated defense solutions.

Technological Advancements in AI and Cybersecurity

The integration of artificial intelligence (AI) and cybersecurity measures into unmanned systems has become a critical growth driver in the Israel Defense Manned Unmanned Teaming Systems market. AI-powered systems offer enhanced decision-making capabilities, enabling unmanned platforms to operate autonomously and seamlessly alongside manned units. This integration not only improves operational efficiency but also enhances the precision of military operations in dynamic and complex environments. Additionally, the rise in cybersecurity threats in the defense sector has led to a growing need for advanced cybersecurity measures to protect sensitive data and systems. Israel’s leadership in cybersecurity, particularly in defense, has driven the development of secure, intelligent systems capable of withstanding cyber-attacks while ensuring the safety of military operations. These advancements in AI and cybersecurity are expected to fuel the growth of manned unmanned teaming systems by ensuring their effectiveness and resilience in modern warfare.

Market Challenges

High Capital Expenditure in Defense Projects

One of the major challenges faced by the Israel Defense Manned Unmanned Teaming Systems market is the high capital expenditure associated with developing and deploying advanced defense technologies. The complex nature of unmanned systems integration and the continuous need for research and development to stay ahead of global competitors demand substantial investments. These high costs can limit the accessibility of advanced manned unmanned teaming systems for some entities, especially smaller defense contractors and countries with limited defense budgets. Moreover, the long development cycles and extensive testing required for these systems further contribute to the high financial burden. While the Israeli government’s substantial funding supports the market, the reliance on significant investment in R&D and technology development remains a key challenge. Additionally, the potential for economic downturns and shifts in defense priorities can further complicate funding for such large-scale projects, potentially slowing the adoption and growth of these systems in the defense sector.

Technological Integration and Interoperability Issues

Another key challenge faced by the Israel Defense Manned Unmanned Teaming Systems market is the complexity of integrating various technologies across multiple platforms. These systems must work seamlessly with manned and unmanned vehicles, sensors, and communication networks, which can be difficult to achieve due to the differences in system architectures, software, and hardware. The challenge lies in ensuring that all components—whether airborne, land-based, or naval—are interoperable and can communicate efficiently during real-time operations. As defense systems become increasingly complex, achieving this level of integration without compromising on performance or security remains a significant hurdle. Moreover, new technologies, such as artificial intelligence and machine learning, require continual updates to ensure their compatibility with existing infrastructure, further complicating the integration process. As a result, defense contractors must invest considerable resources in developing solutions to address these interoperability issues, which can slow the development and deployment of manned unmanned teaming systems.

Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

One of the key opportunities for the Israel Defense Manned Unmanned Teaming Systems market lies in the expansion of artificial intelligence (AI) capabilities in defense solutions. AI offers the potential to revolutionize military operations by enhancing the autonomy of unmanned systems, enabling them to make decisions in real-time without direct human intervention. This expansion could lead to more effective and responsive manned unmanned teaming systems that can operate in complex and dynamic environments. Israel’s leadership in AI technology and its growing expertise in autonomous defense solutions position it to capitalize on this opportunity. The integration of AI into unmanned systems can enhance capabilities such as autonomous navigation, real-time data analysis, and predictive maintenance, all of which are vital for modern military operations. As demand for advanced AI-driven defense technologies increases globally, Israel’s established reputation for innovation in AI-driven defense solutions provides a significant opportunity for growth in this sector.

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Another promising opportunity for the Israel Defense Manned Unmanned Teaming Systems market is the potential for partnerships with private technology firms to enhance cybersecurity measures. As cybersecurity threats in the defense sector grow more sophisticated, there is an increasing demand for highly secure systems that can protect critical military infrastructure from cyber-attacks. Israel’s world-renowned cybersecurity expertise positions its defense sector to collaborate with leading technology firms to integrate advanced cybersecurity solutions into unmanned systems. These partnerships can lead to the development of robust defense solutions that offer both physical and cyber protection, ensuring that manned unmanned teaming systems remain resilient against emerging threats. With the growing importance of cybersecurity in global defense strategies, Israel’s emphasis on strengthening its cybersecurity capabilities presents a significant opportunity for growth in the manned unmanned teaming systems market.

Future Outlook

The future of the Israel Defense Manned Unmanned Teaming Systems market is expected to witness continued growth over the next five years. Advancements in AI, autonomous systems, and cybersecurity are likely to play a crucial role in shaping market trends. As defense budgets continue to rise globally, Israel’s position as a leader in unmanned systems integration will likely result in increased demand for its products. Technological developments, coupled with ongoing regulatory support for defense innovation, will further fuel market expansion. Additionally, the increasing complexity of modern warfare and rising geopolitical tensions are expected to further drive the adoption of manned unmanned teaming systems in Israel and abroad.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- General Dynamics

- Thales Group

- Honeywell Aerospace

- Boeing

- Raytheon Technologies

- L3 Harris Technologies

- Leonardo

- Saab Group

- Textron Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Defense technology suppliers

- Aerospace and defense manufacturers

- National security agencies

- Defense equipment distributors

- Large-scale defense integrators

Research Methodology

Step 1: Identification of Key Variables

This step involves determining the key market factors that influence the Israel Defense Manned Unmanned Teaming Systems market. This includes technological advancements, government defense spending, and geopolitical factors. Researchers focus on variables that will impact the market size and growth trends in the coming years.

Step 2: Market Analysis and Construction

In this step, market analysts study historical data to understand the trends shaping the market. They construct market models that reflect the growth drivers, challenges, and opportunities within the Israel Defense Manned Unmanned Teaming Systems sector.

Step 3: Hypothesis Validation and Expert Consultation

The market hypothesis is validated through expert consultations with industry leaders, defense contractors, and technology experts. This step ensures that the findings are credible and based on real-world data and insights from key stakeholders in the industry.

Step 4: Research Synthesis and Final Output

The final output synthesizes the data collected and analyzed in the previous steps. Researchers present a comprehensive market report detailing trends, market sizing, and forecasts, helping stakeholders make informed decisions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Technological Integration and Interoperability Issues - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Cybersecurity Systems

Surveillance & Reconnaissance Systems

Communication Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035