Market Overview

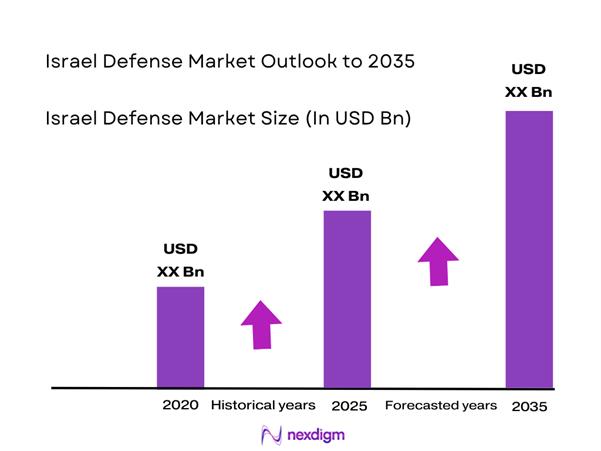

The Israel Defense market current size stands at around USD ~ million, reflecting sustained procurement of multi-domain platforms, continuous modernization of legacy systems, and expanding integration of digital command architectures across operational units. Demand is reinforced by layered defense postures, high operational readiness cycles, and ongoing lifecycle sustainment requirements. Domestic industrial participation anchors systems engineering, software-defined capabilities, and mission system upgrades, while cross-domain interoperability requirements shape procurement specifications and testing regimes across land, air, maritime, space, and cyber domains.

Demand concentrates around major operational hubs and industrial clusters where defense manufacturing, integration, testing, and sustainment infrastructure is dense. Urban technology corridors host R&D centers, system integrators, and digital engineering teams supporting mission software, sensors, and secure communications. Coastal naval bases and air force installations drive platform sustainment and upgrade activity, while intelligence and cyber directorates concentrate demand for advanced analytics and secure networks. Policy emphasis on indigenous capability, export controls, and allied interoperability reinforces ecosystem maturity and coordinated procurement cycles.

Market Segmentation

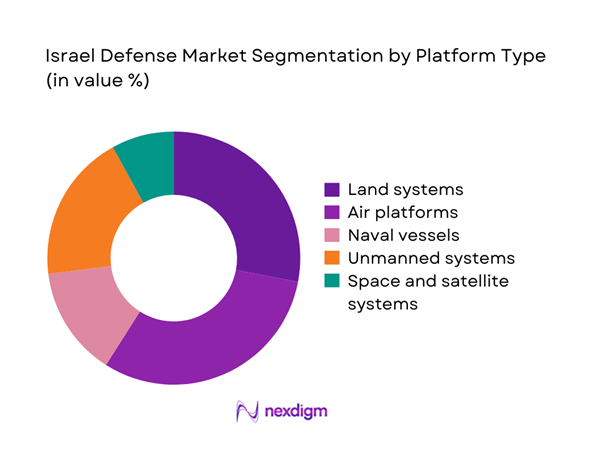

By Platform Type

Platform demand is dominated by air and missile defense systems, unmanned aerial platforms, and networked ground systems due to persistent multi-domain threat exposure and rapid response requirements. Air platforms benefit from continuous sensor and avionics upgrades to sustain operational readiness, while unmanned systems gain traction for ISR persistence and force protection. Naval platforms concentrate around coastal security and critical infrastructure protection, with modernization programs emphasizing sensors and combat management systems. Space and satellite systems expand mission resilience and redundancy. Interoperability requirements and lifecycle sustainment drive cross-platform integration spending across operational units and support organizations.

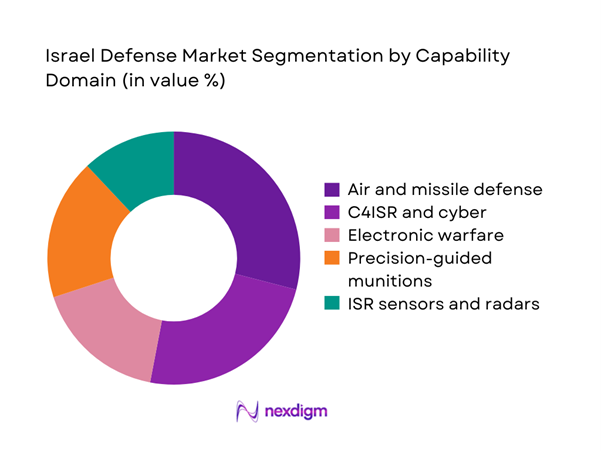

By Capability Domain

Spending concentrates on air and missile defense, C4ISR, and electronic warfare as force planners prioritize layered protection, situational awareness, and spectrum dominance. Precision-guided munitions remain central to deterrence and operational effectiveness, supported by continuous seeker and guidance upgrades. ISR sensors and radars expand coverage and persistence across contested environments, while cyber integration strengthens network resilience. Capability convergence across domains accelerates software-defined architectures and modular payload adoption. Cross-domain data fusion and secure connectivity increasingly shape procurement criteria, favoring interoperable solutions with rapid upgrade pathways and strong lifecycle support.

Competitive Landscape

Competition centers on system integration depth, domestic content, export-readiness, and lifecycle support capability aligned with stringent operational certification requirements and allied interoperability standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Defense Market Analysis

Growth Drivers

Rising regional security threats and multi-front readiness requirements

Persistent cross-border incidents and multi-domain threats continue to elevate readiness postures across land, air, maritime, space, and cyber domains. In 2024, operational tempo required sustained deployment of 5 layered defense formations across northern and southern theaters, with 12 major readiness exercises executed across services. Airspace monitoring hours exceeded 8000 monthly, while maritime patrol days reached 240 across littoral zones. Secure communications nodes expanded by 46 facilities since 2022 to support joint operations. Defense mobilization cycles shortened from 21 to 14 days, driving demand for rapid integration, testing, and sustainment of interoperable systems.

Acceleration of air and missile defense deployments

Layered air and missile defense expansion accelerated as interception activity increased across multiple threat vectors. In 2025, interceptor batteries maintained 24 hour readiness across 9 high-priority regions, supported by 18 radar modernization projects initiated since 2023. Sensor coverage density expanded to 3 overlapping detection layers across critical corridors. Command centers increased simultaneous track management capacity from 120 to 260 objects per cycle. Interoperability testing across 7 allied communication protocols intensified integration workloads. Fielded system uptime targets moved from 92 to 97 across batteries, driving maintenance automation, spare optimization, and predictive diagnostics adoption.

Challenges

Budget volatility linked to macroeconomic and fiscal constraints

Defense appropriations faced volatility as fiscal reallocations supported domestic stabilization measures. In 2024, mid-year revisions deferred 6 procurement tranches across modernization programs, shifting delivery windows by 9 to 14 months. Capital allocation cycles compressed from 24 to 12 months, increasing contract uncertainty for long-lead components with 36 month production timelines. Currency exposure across 4 major supplier currencies introduced procurement planning friction. Public debt servicing pressures constrained multi-year commitments, while emergency reserve activation during 2 escalation periods redirected sustainment resources, stressing inventory buffers and depot throughput capacity across maintenance facilities.

Export license restrictions and geopolitical sensitivities

Export approvals tightened across multiple destination categories, extending review cycles from 90 to 180 days during 2023 and 2024. End-user verification requirements expanded to 5 additional compliance checkpoints, increasing documentation workloads for integrators. Program delays emerged for 7 international co-development initiatives as technology transfer reviews intensified. Divergent regulatory standards across 3 allied blocs complicated certification for sensors and secure communications modules. Re-export limitations constrained component sourcing strategies, requiring redesign of 14 subsystem interfaces to substitute restricted parts, elevating qualification testing cycles and delaying field integration schedules across multi-platform programs.

Opportunities

Next-generation air and missile defense interceptors and sensors

Advancements in seeker technologies and multi-spectral sensors create scope for next-generation interceptors optimized for dense threat environments. In 2025, test ranges logged 420 live-fire events validating new guidance algorithms, while sensor refresh programs upgraded 11 radar sites with dual-band coverage. Track processing capacity rose from 260 to 410 objects per cycle following compute node upgrades. Cross-domain cueing pilots connected 4 space-based feeds with ground radars, improving detection timelines by 6 seconds in trials. Expanded training throughput across 3 simulator centers supports accelerated operationalization of advanced interceptor variants.

Growth in space-based ISR and satellite constellations

Space-based ISR programs expanded to enhance persistence, resilience, and cross-domain cueing. In 2024, 3 new payload classes entered qualification, enabling multi-spectral collection across 2 orbital regimes. Ground segment modernization added 14 secure downlink terminals across operational hubs, reducing latency in dissemination workflows. Analytics pipelines processed 9 million frames monthly, supporting near-real-time tasking for joint units. Integration pilots linked space feeds with maritime and air operations centers across 5 command nodes. Workforce training expanded to 220 certified operators, strengthening sustainment and rapid tasking capabilities for expanded constellations.

Future Outlook

Over the coming decade, procurement will prioritize interoperable, software-defined systems across air, land, maritime, space, and cyber domains. Policy emphasis on indigenous capability, allied interoperability, and rapid upgrade pathways will shape program design. Multi-year modernization cycles will expand lifecycle services, sustainment automation, and digital engineering. Export controls and compliance regimes will continue influencing sourcing strategies. Force planners will emphasize resilience, redundancy, and cross-domain data fusion to sustain operational readiness through evolving threat environments.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- RTX

- Boeing Defense, Space & Security

- BAE Systems

- Thales Group

- Leonardo

- Northrop Grumman

- L3Harris Technologies

- General Dynamics

- Saab

- MBDA

- HENSOLDT

Key Target Audience

- Israel Ministry of Defense procurement directorates

- Israel Defense Forces capability development units

- Air force and naval acquisition commands

- Intelligence and cyber directorates procurement teams

- Defense system integrators and platform OEMs

- Maintenance, repair, and overhaul service providers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Program portfolios, platform lifecycles, and capability roadmaps are mapped across domains to define scope. Procurement cycles, certification pathways, and sustainment requirements are structured to reflect operational workflows. Regulatory constraints and interoperability standards frame system requirements. Data points are normalized across land, air, maritime, space, and cyber domains.

Step 2: Market Analysis and Construction

Demand centers, infrastructure readiness, and industrial capacity are analyzed to construct domain-specific frameworks. Program dependencies across sensors, effectors, and C2 nodes are modeled. Supply chain constraints and certification lead times are incorporated. Scenario matrices reflect operational tempo, readiness cycles, and modernization cadence.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions are validated through structured consultations with procurement, sustainment, and integration stakeholders. Technical feasibility is stress-tested against certification pathways and testing throughput. Interoperability and compliance constraints are cross-checked across allied standards. Iterative reviews refine domain linkages and deployment readiness assumptions.

Step 4: Research Synthesis and Final Output

Findings are synthesized into integrated domain narratives with cross-platform linkages. Evidence is triangulated across operational indicators, infrastructure readiness, and lifecycle requirements. Strategic implications are distilled for procurement planning and capability development. Outputs are structured for decision use across policy, acquisition, and sustainment functions.

- Executive Summary

- Research Methodology (Market Definitions and defense platform scope mapping, Primary interviews with Israeli MoD procurement officials and IDF program managers, Analysis of SIPRI transfers and Israeli export license disclosures, Tracking of multi-year IDF force build-up plans and budget lines, OEM program data from Rafael IAI Elbit and defense primes, Competitive intelligence from international tenders and offset agreements)

- Definition and Scope

- Market evolution

- Force structure and operational doctrines

- Defense industrial ecosystem structure

- Procurement and sustainment supply chain

- Regulatory and export control environment

- Growth Drivers

Rising regional security threats and multi-front readiness requirements

Acceleration of air and missile defense deployments

Expansion of unmanned and autonomous systems across domains

Increased investment in cyber and electronic warfare capabilities

Continuous modernization of legacy platforms and MLU programs

Defense export momentum supporting domestic industrial scale - Challenges

Budget volatility linked to macroeconomic and fiscal constraints

Export license restrictions and geopolitical sensitivities

Supply chain dependencies on foreign subsystems and semiconductors

Talent competition in cyber and advanced engineering fields

Program delays due to testing and certification cycles

Integration complexity across multi-domain C4ISR architectures - Opportunities

Next-generation air and missile defense interceptors and sensors

Growth in space-based ISR and satellite constellations

AI-enabled decision support and autonomous mission systems

Naval platform upgrades for littoral and offshore asset protection

International co-development programs with allied forces

Lifecycle services and performance-based logistics contracts - Trends

Rapid adoption of multi-layer integrated air and missile defense

Convergence of cyber EW and kinetic operations

Proliferation of loitering munitions and counter-UAS solutions

Software-defined platforms and open-architecture systems

Increased use of digital twins and simulation for force readiness

Shift toward modular payloads and rapid capability insertion - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Land systems

Air platforms

Naval vessels

Unmanned systems

Space and satellite systems - By Capability Domain (in Value %)

Air and missile defense

C4ISR and cyber

Electronic warfare

Precision-guided munitions

ISR sensors and radars - By System Lifecycle (in Value %)

New procurement

Mid-life upgrade and modernization

Maintenance repair and overhaul

Software and mission system updates - By Sourcing Model (in Value %)

Domestic OEM procurement

Foreign military sales and imports

Joint development programs

Offsets and industrial cooperation - By End Force Branch (in Value %)

Israel Defense Forces Ground Forces

Israeli Air Force

Israeli Navy

Intelligence and cyber directorates

Home Front Command

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform portfolio breadth, indigenous content share, export market reach, R&D intensity, systems integration capability, program delivery track record, sustainment footprint, pricing competitiveness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Lockheed Martin

RTX

Boeing Defense Space & Security

BAE Systems

Thales Group

Leonardo

Northrop Grumman

L3Harris Technologies

General Dynamics

Saab

MBDA

HENSOLDT

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035