Market Overview

The Israel Defense Tactical Video Data Link market is valued at approximately USD ~ billion, driven by the increasing demand for secure, high-performance communication systems within defense operations. The rise in geopolitical tensions and the modernization of military infrastructure are key factors propelling the market. Technological advancements in communication, such as the integration of 5G and AI technologies, are further enhancing the demand for sophisticated data link solutions in real-time military applications.

Dominant countries in the Israel Defense Tactical Video Data Link market include Israel and the United States, with Israel being a leader due to its advanced defense capabilities and investment in innovative defense technologies. The U.S. also plays a key role, given its military spending and adoption of cutting-edge defense communication systems. These nations’ dominance is attributed to their strong defense budgets, strategic investments in R&D, and the increasing need for secure communication platforms for tactical operations.

Market Segmentation

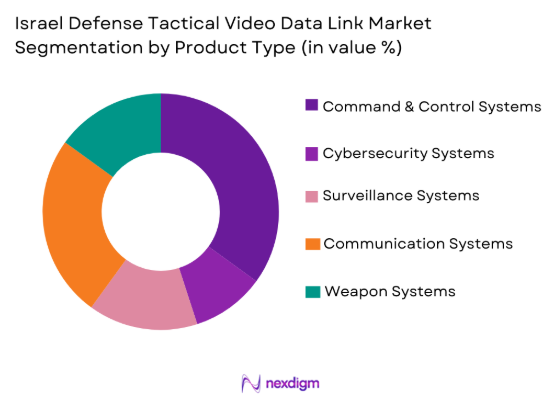

By Product Type

Israel Defense Tactical Video Data Link market is segmented by product type into command and control systems, communication systems, surveillance systems, cybersecurity systems, and weapon systems. Recently, command and control systems have a dominant market share due to the increasing reliance on real-time communication and situational awareness in military operations. These systems are pivotal for managing battlefield communications, offering secure, high-performance video and data transmission essential for modern military strategies. The growing importance of effective battlefield management has driven the demand for advanced command and control solutions, solidifying their market leadership.

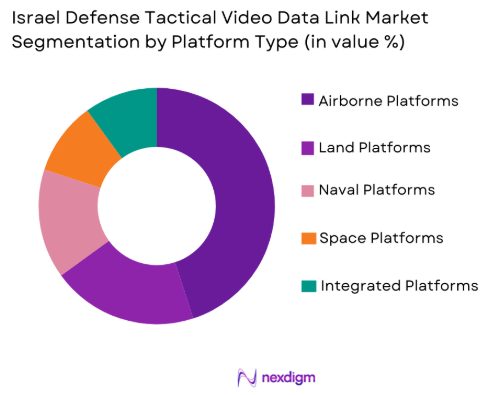

By Platform Type

Israel Defense Tactical Video Data Link market is segmented by platform type into airborne platforms, land platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms dominate the market share due to the increasing use of unmanned aerial vehicles (UAVs) and advanced aircraft in defense operations. These platforms require highly reliable and secure video data link systems for real-time surveillance, reconnaissance, and communication. With the rise in UAV usage for tactical and strategic military operations, airborne platforms have seen significant growth, thus leading in the market.

Competitive Landscape

The competitive landscape of the Israel Defense Tactical Video Data Link market is marked by significant technological advancements and high consolidation among key players. Major players are driving innovation in secure communications, with a focus on AI integration, miniaturization, and enhanced data security. The market is primarily dominated by established companies, but new entrants continue to emerge, focusing on advanced solutions such as 5G-enabled video data links and AI-powered command systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Innovation Focus |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, US | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, US | ~ | ~ | ~ | ~ | ~ |

Israel Defense Tactical Video Data Link Market Analysis

Growth Drivers

Advanced Communication Systems

The demand for advanced communication systems is a primary growth driver in the Israel Defense Tactical Video Data Link market. Military operations increasingly rely on secure, real-time video and data transmission, enabling effective command and control during missions. This shift towards more complex and secure systems has led to a higher adoption of advanced video data link solutions. Additionally, the continuous integration of new technologies such as AI and 5G into military infrastructure has created opportunities for developing more efficient and reliable systems, thus further fueling the market growth. Moreover, the need for improved situational awareness in real-time combat operations has led to a growing market for secure data links in military communications, making advanced communication systems a key enabler of tactical success. The demand for better military integration and operational efficiency has made the need for secure communication even more prominent.

Cybersecurity Enhancements

The increasing cyber threats faced by defense systems globally are pushing investments in more secure communication technologies, with a key focus on the enhancement of video data links. As military networks and communication systems are prime targets for cyber-attacks, it has become critical for defense contractors to integrate robust cybersecurity measures into tactical video data links. This includes advanced encryption, real-time monitoring, and anomaly detection, ensuring that military communications remain secure and reliable. As cyber-attacks become more sophisticated, defense contractors are focusing on developing solutions that can provide resilient communication infrastructures, driving the demand for secure tactical video data links. With the growing need to protect sensitive operational data and critical missions, cybersecurity enhancements have become an essential growth driver in the market.

Market Challenges

High Capital Costs

One of the significant challenges in the Israel Defense Tactical Video Data Link market is the high capital costs associated with the development and deployment of these systems. Defense contractors and governments must allocate substantial funds to procure the necessary hardware and software components to ensure effective communication solutions. This high cost often limits the accessibility of advanced video data link systems to smaller military units or non-state actors, narrowing the market’s scope. As a result, defense contractors are continually looking for ways to optimize production and reduce costs, without compromising system security or functionality. Despite the constant push for innovation, capital-intensive projects often face delays and financial hurdles, which can affect the pace of market adoption and technology deployment.

Technological Integration Issues:

Another challenge faced by the Israel Defense Tactical Video Data Link market is the issue of technological integration across different platforms and defense systems. The integration of video data link systems with various defense platforms such as UAVs, ground vehicles, and naval systems requires complex interfaces and compatibility checks, which can slow down the development process. As different military branches often use distinct communication standards and platforms, ensuring seamless interoperability can be challenging. The lack of standardized protocols for video data links further complicates efforts to create a unified communication system. This integration challenge requires additional time, effort, and cost to ensure that different systems can work together efficiently, slowing down the deployment of these technologies in defense operations.

Opportunities

Expansion in Autonomous Military Systems

One of the significant opportunities in the Israel Defense Tactical Video Data Link market is the expansion of autonomous military systems. With the growing use of drones, UAVs, and autonomous ground vehicles, the need for secure, high-performance data links has increased. These autonomous systems require constant real-time communication to ensure effective coordination and mission success. As militaries across the globe continue to invest in autonomous systems for surveillance, reconnaissance, and even combat missions, the demand for secure tactical video data links is expected to rise. This creates new growth prospects for companies providing specialized communication solutions capable of supporting autonomous systems’ communication requirements. The evolving role of AI in autonomous military technologies further enhances this opportunity, offering new avenues for technological advancement and innovation in the market.

Partnerships with Commercial Tech Firms

Another opportunity lies in forging partnerships between defense companies and commercial technology firms to enhance tactical video data link solutions. With the growing commercialization of advanced technologies such as 5G, AI, and IoT, the defense industry can benefit from collaborating with tech firms that specialize in these areas. This collaboration can lead to the development of cutting-edge communication solutions, offering military organizations access to next-generation technologies at a reduced cost. By integrating commercial innovations into defense systems, companies can enhance the efficiency, scalability, and security of their tactical communication solutions. Additionally, such partnerships provide access to a broader range of technologies, improving the performance of defense solutions and accelerating market growth.

Future Outlook

The future outlook for the Israel Defense Tactical Video Data Link market is optimistic, with significant advancements expected over the next five years. The growing need for secure, real-time communication in military operations will continue to drive demand for advanced video data link systems. The ongoing development of AI, 5G, and IoT technologies will play a pivotal role in enhancing communication systems, offering improved reliability, scalability, and security. Regulatory support for defense technology innovation will also help propel market growth. As militaries increasingly adopt autonomous systems and smart technology, the demand for robust communication solutions will grow, positioning the market for continued expansion.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Thales Group

- Northrop Grumman

- Raytheon Technologies

- Lockheed Martin

- BAE Systems

- L3 Technologies

- General Dynamics

- Leonardo

- Harris Corporation

- Saab Group

- Rockwell Collins

- Rheinmetall AG

- Mitsubishi Electric

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace and defense manufacturers

- Surveillance and reconnaissance agencies

- National security agencies

- Cybersecurity firms

- Autonomous system developers

Research Methodology

Step 1: Identification of Key Variables

Identify the key drivers, barriers, and growth factors influencing the market, focusing on both qualitative and quantitative aspects.

Step 2: Market Analysis and Construction

Analyze historical data, trends, and key insights to build a detailed market structure and forecast.

Step 3: Hypothesis Validation and Expert Consultation

Validate the findings through consultations with industry experts, ensuring accuracy and reliability.

Step 4: Research Synthesis and Final Output

Synthesize all collected data and insights into a final comprehensive report that outlines the market forecast and key trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Investment in Tactical Communication Systems

Advancements in Satellite and Wireless Communication Technologies

Rising Demand for Secure and Real-time Communication in Combat Operations - Market Challenges

High Capital Investment for Development and Deployment

Challenges in Interoperability Across Different Platforms

Cybersecurity Concerns and Vulnerabilities in Tactical Communication Systems - Market Opportunities

Integration of AI and Machine Learning in Tactical Data Links

Growth in Autonomous and UAV-Based Tactical Operations

Emerging Demand for Commercial-Off-the-Shelf (COTS) Tactical Solutions - Trends

Increase in Military Modernization Programs

Adoption of 5G for Tactical Communication Systems

Enhanced Use of Tactical Data Links for Real-time Surveillance and Command - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Advanced Communication Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Surveillance & Reconnaissance Systems

Communication Systems

Intelligence Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Communication Range, Security Features, Integration Capabilities, Price Sensitivity, Technology Adoption)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

Elbit Systems

Israel Aerospace Industries

Northrop Grumman

Raytheon Technologies

General Dynamics

BAE Systems

L3 Technologies

Harris Corporation

Leonardo

Saab Group

Rockwell Collins

Rheinmetall AG

Mitsubishi Electric

- Military Forces’ Increasing Demand for Advanced Tactical Systems

- Government Agencies’ Role in Regulating and Procuring Communication Solutions

- Defense Contractors’ Focus on System Integration and Innovation

- Private Sector’s Growing Role in Technology Development and Cybersecurity

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035