Market Overview

The Israel Digital Forensic Laboratory as a Service market is experiencing significant growth, driven by the rising need for advanced solutions to investigate digital crimes and ensure data integrity. Based on a recent historical assessment, the market is valued at approximately USD ~ billion. Increasing reliance on digital devices for both personal and business activities has escalated the demand for specialized forensic tools and services, with law enforcement agencies being the key drivers of this demand. The market is further boosted by technological advancements in forensic tools, cloud-based services, and data security solutions, which continue to evolve and address modern digital crime complexities.

Israel’s dominance in the digital forensic services sector is largely attributed to its robust cybersecurity infrastructure and innovation hubs, particularly in cities like Tel Aviv and Jerusalem. These cities have become epicenters for technological advancement, driven by strong public-private partnerships and government support. Israel’s well-established defense industry, regulatory frameworks, and high investment in digital forensics provide a solid foundation for the growth of this market. The country’s reputation for excellence in cybersecurity and digital innovation further strengthens its position as a global leader in digital forensic services.

Market Segmentation

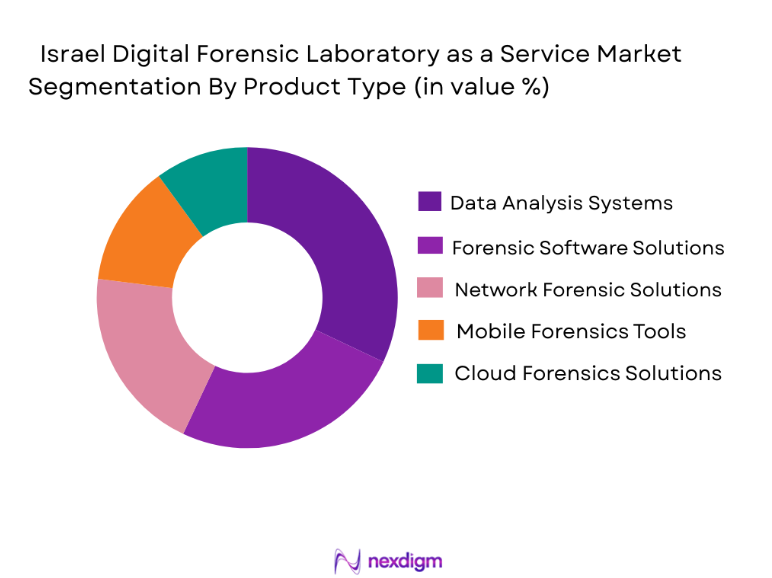

By Product Type

The Israel Digital Forensic Laboratory as a Service market is segmented by product type into mobile forensic services, network forensic services, cloud forensic services, computer forensic services, and incident response services. Mobile forensic services currently hold the dominant market share, driven by the widespread use of smartphones and other mobile devices in criminal activities. With the growing frequency of mobile device-related crimes, law enforcement and private organizations increasingly rely on mobile forensic tools to recover critical evidence, making mobile forensic services essential for digital investigations.

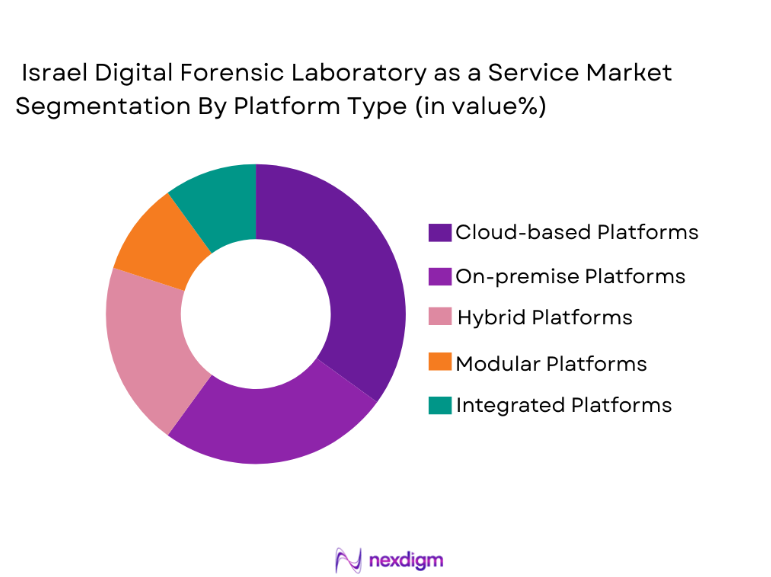

By Platform Type

The Israel Digital Forensic Laboratory as a Service market is segmented by platform type into cloud-based, on-premises, hybrid, mobile-based, and server-based platforms. Cloud-based platforms dominate due to their scalability and cost-effectiveness, enabling remote data analysis. On-premises platforms are preferred by organizations prioritizing data security. Hybrid platforms combine the flexibility of clouds with the security of on-premises solutions. Mobile-based platforms are growing due to the rise in mobile device-related crimes, while server-based platforms are used for large-scale data analysis, primarily by government agencies.

Competitive Landscape

The Israel Digital Forensic Laboratory as a Service market is characterized by a competitive landscape where several key players drive innovation and maintain a strong market presence. Companies such as Cellebrite, Magnet Forensics, and Access Data are major contributors to market growth, offering cutting-edge forensic tools and solutions. The competitive environment is marked by consolidation, with larger players often acquiring smaller firms to expand their technological capabilities. These industry leaders continuously innovate to stay ahead of emerging cybercrime threats, ensuring that the market remains dynamic and competitive.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Client Base |

| Cellebrite | 2007 | Petah Tikva | ~ | ~ | ~ | ~ | ~ |

| Magnet Forensics | 2004 | Ontario, Canada | ~ | ~ | ~ | ~ | ~ |

| AccessData | 1987 | Utah, USA | ~ | ~ | ~ | ~ | ~ |

| OpenText | 1989 | Waterloo, Canada | ~ | ~ | ~ | ~ | ~ |

| KPMG Forensic | 1987 | London, UK | ~ | ~ | ~ | ~ | ~ |

Israel Digital Forensic Laboratory-as-a-Service Market Analysis

Growth Drivers

Government Support for Cybersecurity Infrastructure

Israel’s strong commitment to enhancing its cybersecurity infrastructure has been a significant driver in the growth of the digital forensic laboratory market. The government’s substantial investments in national security initiatives, particularly in the field of cybersecurity, have increased the demand for specialized forensic services, especially in law enforcement and defense sectors. These investments are aimed at addressing rising concerns about cybercrime, with law enforcement agencies requiring advanced forensic tools to support their investigations. Furthermore, Israel’s position as a leader in cybersecurity has led to the development of public-private partnerships, enabling the continuous enhancement of forensic capabilities. As cyber threats become more sophisticated, government-backed initiatives are expected to continue driving the demand for digital forensic services, particularly those focused on preventing and solving high-tech crimes such as cyber espionage, data breaches, and identity theft.

Technological Advancements in Digital Forensics

The rapid pace of technological advancements is one of the primary drivers of the Israel Digital Forensic Laboratory as a Service market. Innovations in mobile forensics, cloud computing, and artificial intelligence have transformed the way digital evidence is collected and analyzed. These advancements enable faster and more accurate investigations, allowing forensic professionals to manage larger volumes of data and complex evidence. For example, AI-driven tools now enable automated data triage, which speeds up the analysis process and reduces human error. As technology continues to evolve, digital forensic services are becoming more sophisticated, making them an indispensable part of criminal investigations. The growing adoption of cloud-based forensic solutions is also a major factor, as it allows forensic experts to access tools and data remotely, improving response times, and expanding the scope of forensic investigations.

Market Challenges

High Cost of Advanced Forensic Solutions

One of the most significant challenges facing the Israel Digital Forensic Laboratory as a Service market is the high cost associated with advanced forensic tools and technologies. The development and maintenance of cutting-edge forensic solutions, including mobile and cloud-based forensics, come with substantial costs, making them inaccessible to smaller law enforcement agencies and businesses with limited budgets. While larger institutions and government agencies may have the resources to adopt such solutions, smaller entities face budget constraints that limit their access to these advanced services. This cost barrier also extends to the procurement and training of skilled personnel capable of operating these sophisticated tools. As a result, the high cost of advanced forensic solutions is a critical challenge that must be addressed to ensure broader adoption and effectiveness in the market.

Shortage of Skilled Forensic Professionals

The shortage of skilled professionals in the field of digital forensics is another major challenge for the Israel Digital Forensic Laboratory as a Service market. Despite the growing demand for forensic services, there is a significant gap in the number of qualified forensic experts available to meet this demand. As cybercrimes become more sophisticated and the need for digital evidence analysis increases, law enforcement agencies and businesses alike are struggling to recruit professionals with the necessary expertise. This shortage of skilled professionals can lead to delays in investigations and the ineffective application of forensic tools. Furthermore, the rapidly evolving nature of cybercrime means that existing forensic professionals must continually update their skills to keep pace with emerging threats, further exacerbating the shortage. Bridging this gap will be essential for the continued growth and success of the market.

Opportunities

Expansion into Small and Medium Enterprises (SMEs)

Small and medium enterprises (SMEs) present a significant opportunity for growth in the Israel Digital Forensic Laboratory as a Service market. While large organizations have the resources to invest in in-house digital forensic capabilities, SMEs often lack the financial capacity to implement such solutions. As cybercrime becomes more prevalent, SMEs are increasingly recognizing the need for digital forensic services to protect their data and address security incidents. This presents a unique opportunity for forensic service providers to offer managed forensic solutions tailored to the needs of SMEs. By providing scalable, cost-effective solutions, digital forensic service providers can help SMEs handle digital evidence and address cybersecurity threats without the need for substantial capital investment. The adoption of cloud-based forensic solutions will be particularly beneficial in serving this segment, as these platforms offer flexibility and lower upfront costs.

Partnerships with Global Cybersecurity Providers

Another key opportunity in the Israel Digital Forensic Laboratory as a Service market lies in the potential for partnerships with global cybersecurity providers. As cyber threats continue to evolve, businesses and government agencies are increasingly seeking integrated solutions that combine cybersecurity and digital forensics. By collaborating with established cybersecurity companies, forensic service providers can offer more comprehensive solutions that enhance both the prevention and investigation of cybercrimes. These partnerships can also provide access to new markets, improve the service offerings available to clients, and enhance the technological capabilities of forensic tools. Integrating digital forensic services with cybersecurity solutions will create a more robust and effective approach to tackling cybercrime, presenting significant growth opportunities for service providers in the market.

Future Outlook

The Israel Digital Forensic Laboratory as a Service market is expected to continue its upward trajectory, driven by technological advancements, increasing cybercrime, and government support. The growing integration of artificial intelligence and machine learning in forensic tools will further enhance the capabilities of digital forensic services, enabling faster, more accurate investigations. As cybercrime threats evolve, the demand for specialized forensic services will remain high, with SMEs emerging as a key target market. Additionally, regulatory support for digital forensics will play a crucial role in market growth over the next five years.

Major Players

- Cellebrite

- Magnet Forensics

- AccessData

- OpenText

- KPMG Forensic

- PwC Cyber Forensics

- Deloitte Cyber Forensic Services

- EY Forensic & Integrity Services

- FTI Consulting

- FireEye

- CrowdStrike

- IBM Security

- Mandiant

- Amentum

- SAIC

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Law enforcement agencies

- Private security firms

- Digital forensics solution providers

- Cybersecurity firms

- Corporate enterprises

- Defense contractors

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying the key variables affecting the Israel Digital Forensic Laboratory as a Service market. This includes determining the major drivers, challenges, opportunities, and key trends influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, data is gathered from primary and secondary sources, and market models are built to understand the market structure and size, and to forecast potential growth.

Step 3: Hypothesis Validation and Expert Consultation

This step validates the hypotheses developed during the market analysis phase through consultations with industry experts, key stakeholders, and thought leaders.

Step 4: Research Synthesis and Final Output

The final step synthesizes all findings into a comprehensive report that includes detailed analysis, forecasts, and strategic recommendations for stakeholders in the Israel Digital Forensic Laboratory as a Service market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Cybercrime Incidents and Digital Evidence Needs

Government Initiatives for Cyber and Digital Investigation Capabilities

Adoption of Cloud and Remote Forensic Services

Regulatory Requirements for Digital Evidence Handling - Market Challenges

High Cost of Advanced Forensic Solutions

Shortage of Skilled Digital Forensic Experts

Data Privacy and Cross-Border Data Access Issues

Integration with Legacy IT Systems - Market Opportunities

Expansion of Managed Forensic Services for SMEs

Partnerships with Global Cybersecurity Vendors

AI and Automation in Digital Evidence Analysis - Trends

Shift Toward Cloud-Native Forensic Platforms

Increased Use of AI/ML for Data Triage

Integration of Forensic Services with Incident Response - Government Regulations

Data Protection and Privacy Regulations

Law Enforcement Digital Evidence Protocols

Cybersecurity Standards and Compliance Mandates

- By Market Value 2020-2025

- By Service Volume 2020-2025

- By Average Pricing Model 2020-2025

- By Client Segment 2020-2025

- By Service Type (In Value%)

Mobile Forensic Services

Network Forensic Services

Cloud Forensic Services

Computer Forensic Services

Incident Response Services - By Deployment Model (In Value%)

Cloud-Based Services

On-Premise Managed Services

Hybrid Services - By EndUser Segment (In Value%)

Law Enforcement Agencies

Government Institutions

Corporate Enterprises

Legal and Consulting Firms

Security Service Providers - By Procurement Channel (In Value%)

Direct Contracts

Government Tenders

Third-Party Resellers

Online Service Platforms

- Market Share Analysis

- Cross Comparison Parameters (Service Type, Deployment Model, Procurement Channel, End User Segment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Magnet Forensics

Cellebrite

AccessData

Guidance Software (OpenText)

KPMG Forensic

PwC Cyber Forensics

Deloitte Cyber Forensic Services

EY Forensic & Integrity Services

- Law Enforcement Agencies’ Demand for Managed Forensic Support

- Government Institutions’ Role in Standardizing Forensic Services

- Corporate Enterprises’ Adoption for Internal Investigations

- Consulting and Legal Services Need for Forensic Expertise

- Forecast Market Value 2026-2035

- Forecast Service Volume 2026-2035

- Price Forecast by Service Type 2026-2035

- Future Demand by End User Segment 2026-2035