Market Overview

The Israel drone logistics and transportation market is valued at approximately USD ~ million, driven by advancements in unmanned aerial vehicle (UAV) technology and growing demand for efficient transportation solutions. The market is bolstered by Israel’s leadership in defense technology and strong government support for drone innovation. Drone logistics, particularly in military, e-commerce, and infrastructure sectors, continues to gain momentum due to improved drone capabilities and regulatory support for UAV operations.

Israel remains a dominant player in the global drone logistics market due to its advanced defense industry, research infrastructure, and government-backed initiatives. Cities such as Tel Aviv and Haifa are key centers for drone development and deployment. Israel’s expertise in security and defense applications has seamlessly translated into civilian sectors, where drones are increasingly used for deliveries, surveillance, and logistical services.

Market Segmentation

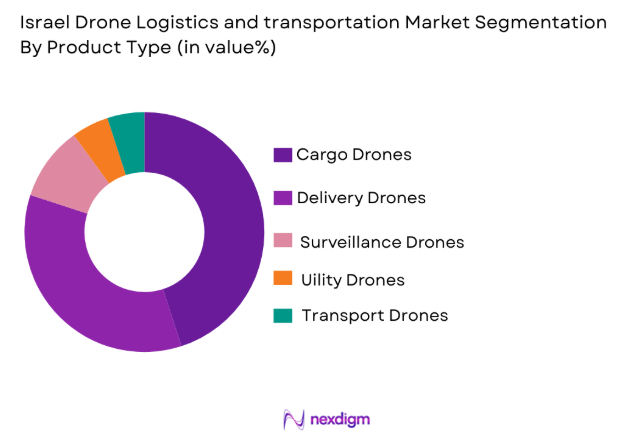

By Product Type:

The Israel drone logistics and transportation market is segmented by product type into cargo drones, delivery drones, surveillance drones, utility drones, and transport drones. Recently, cargo drones have taken a dominant market share due to their ability to efficiently carry large payloads over long distances, which is essential for the transportation of goods in remote or urban environments. These drones have gained popularity due to their reduced operational costs compared to traditional vehicles and their ability to bypass road traffic, enabling faster and more reliable delivery. The increasing demand for cargo drones is driven by the growing need for rapid delivery services in e-commerce and logistics. Additionally, the improved technology in cargo drones, including enhanced battery life and payload capacity, has made them more suitable for both commercial and military applications, which continues to drive market growth.

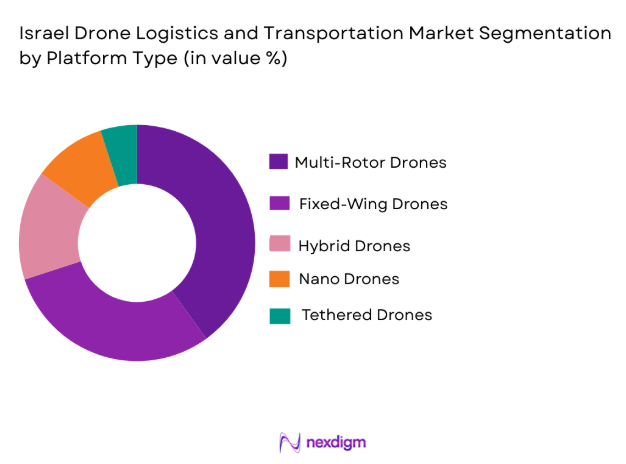

By Platform Type:

The Israel drone logistics and transportation market is also segmented by platform type into fixed-wing drones, multi-rotor drones, hybrid drones, nano drones, and tethered drones. Recently, multi-rotor drones have dominated the market share due to their versatility and ability to operate in confined spaces, making them ideal for urban areas and short-range deliveries. Their stability, ease of operation, and capability to carry a range of payloads make them a preferred choice for surveillance and delivery tasks. Multi-rotor drones can be used for a wide variety of applications, from cargo transport to military surveillance, further fueling their market dominance. Their widespread use, combined with technological advancements, positions them as a dominant platform type in the market.

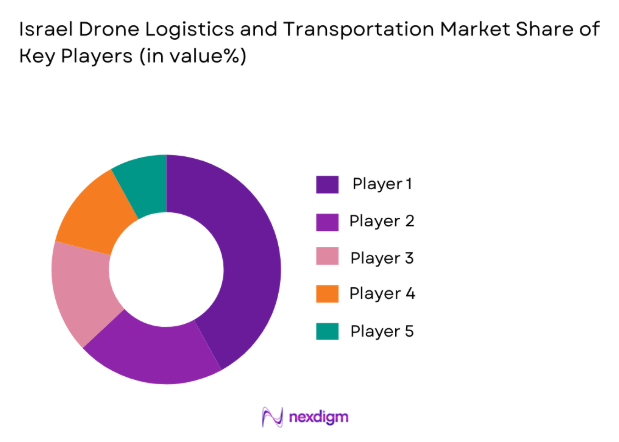

Competitive Landscape

The Israel drone logistics and transportation market is competitive, with several key players focused on technological innovations and partnerships with international firms. Major companies continue to push for advancements in drone performance, focusing on enhancing payload capacity, flight duration, and integration of AI. Strong governmental backing, along with Israel’s expertise in military-grade drone technologies, has enabled local firms to lead the charge in global markets.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Technology |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics | 1997 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Flytrex | 2013 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Urban Aeronautics | 2005 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| ZenaDrone | 2015 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Drone Logistics and Transportation Market Analysis

Growth Drivers

Government Investment in Drone Infrastructure:

Israel’s government plays a vital role in the growth of the drone logistics and transportation market by investing in research, development, and infrastructure projects. The Israeli government has made drone technology a priority, fostering innovation in military and civilian sectors. As the global demand for drone services increases, Israel’s focus on strengthening its drone capabilities has positioned the country as a leader in the market. The government’s financial support, such as funding for defense technology and public safety applications, accelerates the deployment of drone systems for logistics and transportation. Additionally, regulatory changes that allow for the testing and integration of drones in both urban and rural settings have created a conducive environment for businesses in the drone logistics sector. The combination of government backing and regulatory support enables companies in Israel to develop cutting-edge solutions and maintain their competitive advantage globally.

Technological Advancements in Drone Design:

Another key growth driver is the continuous technological advancements in drone design, particularly in flight time, payload capacity, and automation. The rapid evolution of drone technology has enabled more efficient, cost-effective logistics solutions, particularly for last-mile delivery. Drones are increasingly being equipped with autonomous systems, reducing the need for human intervention and improving operational efficiency. In Israel, technological innovation is supported by a strong network of research institutions and tech companies, making it a hub for UAV development. These advancements in camera systems, sensors, and AI integration have significantly enhanced the functionality of drones, allowing them to serve a broader range of applications, from e-commerce delivery to surveillance and security. With further advancements expected in drone technology, the logistics and transportation market in Israel will continue to thrive as businesses seek to adopt smarter, faster, and more reliable transportation methods.

Market Challenges

Regulatory and Compliance Barriers:

The primary challenge faced by the Israel drone logistics and transportation market is the complex regulatory framework surrounding drone operations. While Israel is a global leader in drone technology, the regulatory landscape for civilian drone use remains restrictive. Drone operations in urban areas, particularly for commercial delivery services, face regulatory hurdles, such as restricted airspace and safety protocols. Compliance with these regulations requires significant investment in certifications, approvals, and operational guidelines. As drone use expands, there is a growing need for clearer and more flexible regulations that balance safety with operational efficiency. Moreover, varying regulations across regions within Israel further complicate the implementation of a uniform drone logistics infrastructure. These challenges could slow the pace at which drones are integrated into the broader logistics network, limiting market growth in the short term.

Security and Data Privacy Risks:

Security concerns related to drone operations, especially in the logistics and transportation sector, are another significant challenge for the market. Drones are frequently used for collecting sensitive data, such as geospatial information, surveillance footage, and delivery details, which could be vulnerable to cyber-attacks. Ensuring the security of data collected and transmitted by drones is essential for building trust among users and regulators. In Israel, where drone operations are widely used for defense and intelligence purposes, data protection and cybersecurity are particularly critical. The lack of robust cybersecurity measures could undermine the public’s confidence in drone technology, particularly in sectors like defense and government applications. As drones become more integrated into commercial applications, addressing security and privacy concerns will be crucial to sustaining the market’s growth. Companies will need to invest in secure communication protocols, encryption technologies, and secure data storage solutions to safeguard against cyber threats.

Opportunities

Integration of Drones for Last-Mile Delivery:

One of the most significant opportunities for the Israel drone logistics and transportation market lies in last-mile delivery. With the rise of e-commerce and consumer demand for fast delivery times, drones offer an efficient and cost-effective solution. Drones are particularly well-suited for urban environments, where traffic congestion can delay traditional delivery methods. The Israeli government’s regulatory support for drone testing and its advanced infrastructure for UAV operations make it an ideal environment for developing and scaling drone-based delivery systems. Companies in Israel are already testing drone delivery systems in urban areas, and the market is expected to expand rapidly as technology advances and regulations evolve. The ability to offer quick, on-demand deliveries without the need for ground transportation will drive the adoption of drones for last-mile logistics.

Expansion of Drone Use in Environmental Monitoring:

Another key opportunity is the growing demand for drones in environmental monitoring and conservation efforts. Drones equipped with advanced sensors and camera systems are being increasingly used for monitoring wildlife, tracking environmental changes, and assessing natural resources. In Israel, drones are already being deployed for environmental management and agricultural applications. This trend is expected to expand as the country’s commitment to sustainability and environmental protection grows. Drones provide an effective tool for gathering data on difficult-to-reach areas, allowing for more accurate and timely monitoring of environmental conditions. As environmental concerns become more prominent globally, Israel has the opportunity to lead the market in developing drone-based solutions for sustainable practices. This creates new growth avenues for drone manufacturers and service providers focused on environmental monitoring.

Future Outlook

The future outlook for Israel’s drone logistics and transportation market is positive, with continued growth expected over the next five years. Technological advancements in drone capabilities, coupled with strong government support, are set to fuel the market’s expansion. Demand for drone-based delivery services, particularly for e-commerce, will increase as businesses seek faster and more efficient methods of transportation. The integration of drones in urban air mobility and environmental monitoring presents additional growth opportunities, making Israel a key player in the global drone logistics market.

Major Players

- Elbit Systems

- Aeronautics

- Flytrex

- Urban Aeronautics

- ZenaDrone

- Skyfi Labs

- Rafael Advanced Defense Systems

- Airobotics

- FlytBase

- Drone Delivery Canada

- Israel Aerospace Industries

- Parrot SA

- Hoverfly Technologies

- Zipline

- American Robotics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- E-commerce and logistics companies

- Drone technology manufacturers

- Aerospace firms

- Urban air mobility developers

- Smart city planners

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as technological advancements, market trends, regulatory factors, and demand across sectors.

Step 2: Market Analysis and Construction

Detailed analysis is conducted on market trends, drivers, and challenges to develop a robust model of the drone logistics and transportation market.

Step 3: Hypothesis Validation and Expert Consultation

The research hypotheses are validated through consultations with industry experts and key stakeholders to ensure the findings’ accuracy and relevance.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report, providing actionable insights and strategic recommendations for market participants.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government Investment in Drone Infrastructure

Technological Advancements in Drone Design

Increase in E-Commerce and Delivery Demands

Strategic Partnerships with Global Firms

Expansion of Drone Applications in Defense and Logistics - Market Challenges

Regulatory Barriers in Urban Areas

Cybersecurity Concerns

High Initial Capital Investment

Limited Integration with Existing Infrastructure

Operational Safety Risks - Market Opportunities

Adoption of Drones for Last-Mile Delivery

Growth in Urban Air Mobility Solutions

Expansion of Drone Use in Environmental Monitoring - Trends

Integration of AI for Autonomous Drone Operations

Rise of Drone Fleet Management Software

Increased Demand for Sustainable Drone Solutions

Development of Urban Air Mobility Infrastructure

Growth of Drone Delivery Networks - Government Regulations & Defense Policy

Regulations for Drone Operations in Civilian Airspace

Drone Safety Standards

Government Support for UAV Development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cargo Drones

Delivery Drones

Surveillance Drones

Utility Drones

Transport Drones - By Platform Type (In Value%)

Fixed-Wing Drones

Multi-Rotor Drones

Hybrid Drones

Nano Drones

Tethered Drones - By Fitment Type (In Value%)

On-Premise Solutions

Cloud-Based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military and Defense

Commercial Enterprises

Government Agencies

Agriculture

Energy and Utilities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors - By Material / Technology (In Value%)

Carbon Fiber Materials

Aluminum Alloys

Lithium Batteries

AI and Machine Learning

Communication Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Aeronautics

Flytrex

Urban Aeronautics

ZenaDrone

Skyfi Labs

Rafael Advanced Defense Systems

Airobotics

FlytBaseD

Drone Delivery Canada

Israel Aerospace Industries

Parrot SA

Hoverfly Technologies

Zipline

American Robotics

- Demand for Drones in Agricultural Monitoring

- Military and Defense Applications of Drones

- Demand for Drones in Surveillance and Logistics

- Government Initiatives Supporting Drone Infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035