Market Overview

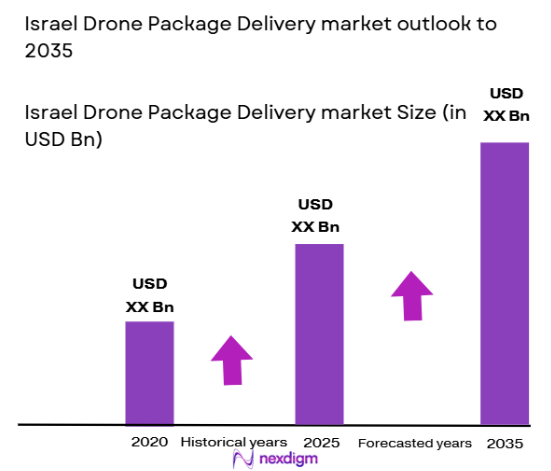

The Israel Drone Package Delivery market is valued at approximately USD ~ billion based on a recent historical assessment. This growth is primarily driven by the rising demand for faster and more efficient delivery solutions, particularly in urban areas. Technological advancements in drone autonomy, battery life, and payload capacity are significant factors contributing to the expansion. Additionally, regulatory support for commercial drone use and growing e-commerce demand have made drones an attractive solution for last-mile delivery challenges.

Israel stands out in the drone package delivery market due to its well-established technological infrastructure and a strong focus on innovation. Cities such as Tel Aviv and Jerusalem have been at the forefront of adopting drone technologies due to their dense urban environments and robust digital ecosystems. The country’s favorable regulatory landscape and its continuous investment in advanced technologies further solidify its position as a leader in the drone logistics space, enabling rapid deployment of drone-based services.

Market Segmentation

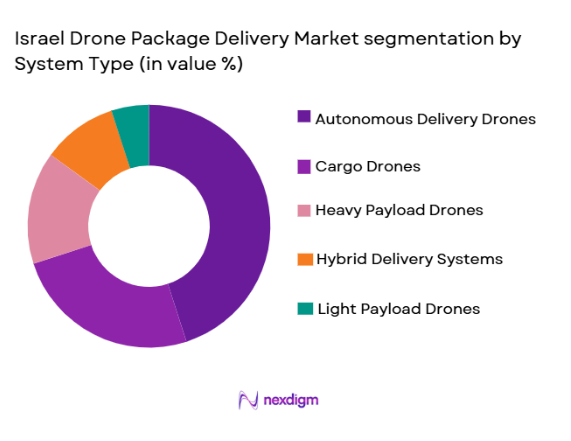

By System Type:

The Israel Drone Package Delivery market is segmented by system type into several categories. Recently, autonomous delivery drones have gained dominance due to their ability to operate without human intervention, offering faster, more reliable delivery solutions. These drones are particularly suited for urban environments, where quick delivery is essential. The advancements in artificial intelligence (AI) and machine learning have also made autonomous drones more efficient, allowing them to navigate complex environments. Their growing presence is due to their ability to reduce labor costs and increase operational efficiency.

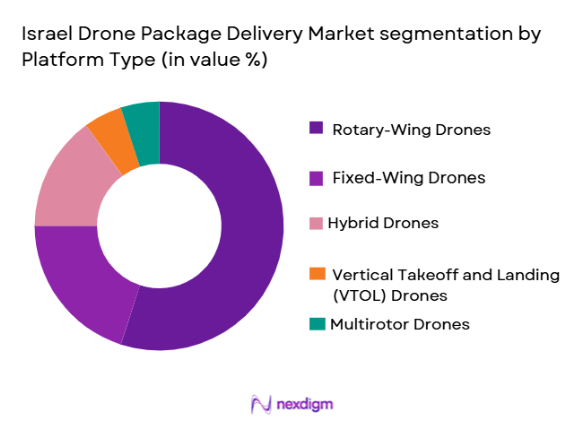

By Platform Type:

The Israel Drone Package Delivery market is also segmented by platform type. Rotary-wing drones, particularly quadcopters, are dominating the market. Their ability to take off and land vertically makes them ideal for urban delivery applications, where space constraints and high population density present challenges. These drones are increasingly used in last-mile deliveries, as they can efficiently navigate urban environments, including tight spaces and congested areas. Their agility and ability to carry varying payloads make them the most practical solution for city-based deliveries.

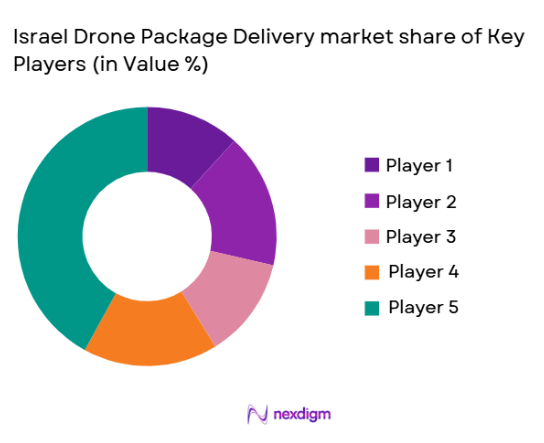

Competitive Landscape

The Israel Drone Package Delivery market is characterized by high competition among both local and international players. Consolidation has occurred in recent years as companies strive to capture market share in the fast-growing logistics and delivery sector. The major players in the market are heavily investing in R&D to advance drone capabilities, including enhancing payload capacity, increasing flight range, and reducing operational costs. Partnerships with e-commerce platforms and logistic companies are also pivotal in strengthening the market position of these players.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Flytrex | 2013 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Matternet | 2011 | USA | ~ | ~ | ~ | ~ | ~ |

| UPS Flight Forward | 2019 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Drone Package Delivery Market Analysis

Growth Drivers

Technological Advancements in Drone Systems:

The primary growth driver for the Israel Drone Package Delivery market is the continuous advancements in drone technology. Over the years, the development of autonomous systems, improved battery technologies, and better AI algorithms have significantly boosted drone efficiency and reliability. These improvements enable drones to carry heavier payloads, operate longer distances, and navigate complex urban environments more effectively. Autonomous drones, in particular, are becoming more sophisticated, allowing for completely hands-off deliveries. This technology is driving costs down, making drone delivery more economically feasible for companies. Furthermore, the development of autonomous navigation systems, which use machine learning and AI to adapt to various environments, ensures that drones can handle increasingly complex tasks. The proliferation of advanced sensors, enhanced stability, and improved weather resistance has also made drones more reliable, even in adverse conditions. The combination of these technological advances is making drones a highly attractive solution for logistics companies looking to improve delivery speed and efficiency. Consequently, as these technological improvements continue, more industries will likely adopt drones for their delivery services, further fueling market growth.

E-commerce Growth and Last-Mile Delivery Demand:

Another significant growth driver for the Israel Drone Package Delivery market is the increasing demand for efficient last-mile delivery services, particularly due to the rapid growth of e-commerce. With the rise of online shopping, consumers now expect faster delivery times, often within the same day or next-day delivery. Traditional delivery methods, such as trucks or vans, are becoming less effective in meeting these demands due to traffic congestion, high fuel costs, and environmental concerns. Drones, with their ability to bypass road traffic and deliver packages directly to consumers’ doors, provide a highly effective solution for last-mile delivery. This shift is particularly evident in urban areas, where traffic jams and narrow roads pose challenges for traditional delivery methods. Drones can also reduce delivery costs for e-commerce businesses, as they are typically cheaper to operate than traditional delivery vehicles. As e-commerce continues to grow, the demand for drone deliveries is expected to increase, with more companies in Israel exploring drone solutions to meet the need for faster, more efficient logistics. The combined pressures of increasing consumer expectations and the need for more sustainable delivery methods will continue to drive the adoption of drones in the logistics sector.

Market Challenges

Regulatory Barriers and Airspace Management:

One of the key challenges facing the Israel Drone Package Delivery market is navigating the complex regulatory environment surrounding drone operations. Israel, like many other countries, has strict regulations governing the use of drones, especially for commercial purposes. These regulations include restrictions on flying drones in certain areas, such as near airports or crowded urban centers, and requirements for drone operators to obtain licenses. Additionally, airspace management remains a significant issue, as drones need to share airspace with manned aircraft, which poses potential risks. While Israel’s Civil Aviation Authority has taken steps to create a framework for drone operations, ongoing regulatory challenges may slow the widespread adoption of drones in package delivery services. Furthermore, international regulations differ, making it difficult for companies to scale operations across borders. As a result, drone operators in Israel must ensure they comply with a constantly evolving regulatory landscape, which can result in delays or additional costs.

High Operational Costs and Infrastructure Requirements:

Another challenge facing the Israel Drone Package Delivery market is the high initial cost of drone fleets and the infrastructure required to support them. While drones can reduce operational costs in the long term, the upfront investment in acquiring drones, setting up distribution hubs, and creating charging stations is substantial. Additionally, maintenance costs, including repairs and software updates, can add up over time. Small and medium-sized businesses may find it difficult to invest in such infrastructure, limiting the adoption of drones in the logistics sector. Moreover, drones require ongoing investment in training personnel to operate them and manage delivery processes. Even though drone delivery offers long-term savings, the high operational costs associated with starting a drone delivery service can deter potential entrants. Without the right infrastructure and financial backing, some companies may struggle to make the transition to drone-based deliveries.

Opportunities

Integration with E-commerce and Retail:

One of the key opportunities in the Israel Drone Package Delivery market lies in integrating drone solutions with e-commerce and retail businesses. As online shopping continues to surge, there is an increasing need for faster and more cost-effective delivery solutions. Drones provide an ideal opportunity for e-commerce companies to meet this demand by reducing delivery times and cutting transportation costs. Retailers can leverage drones to offer same-day or next-day delivery services, providing a competitive advantage in a market where consumers are demanding faster fulfillment. Furthermore, drones are particularly well-suited for urban environments where road congestion and narrow streets can delay traditional delivery vehicles. Retailers that adopt drones for last-mile delivery will not only enhance customer satisfaction but also reduce their environmental footprint, as drones generate fewer emissions compared to traditional delivery vehicles. This integration could also lead to new business models, such as drone delivery as a service, where third-party companies provide drone logistics solutions to e-commerce retailers.

Government and Military Sector Collaborations:

The Israeli government and military sectors present significant opportunities for the Israel Drone Package Delivery market. Israel has a strong defense industry and is one of the world’s leaders in drone technology. The government’s continued investment in drone research and development, particularly for surveillance and defense purposes, can drive innovation in commercial drone systems. In turn, these advanced technologies can be adapted for use in logistics and package delivery, providing businesses with access to cutting-edge drone systems. Furthermore, collaboration with the government can lead to greater regulatory support and incentives for drone adoption. Military-grade drones offer high levels of reliability, endurance, and security, which can be leveraged for civilian delivery applications. By working closely with government agencies, private companies can gain access to technology, funding, and infrastructure, accelerating the commercialization of drone package delivery services.

Future Outlook

The Israel Drone Package Delivery market is expected to see steady growth over the next five years, driven by technological innovations, expanding regulatory frameworks, and increasing demand for faster delivery solutions. Key factors such as the rise of e-commerce, urbanization, and environmental concerns will continue to fuel the adoption of drones in logistics. Furthermore, advancements in AI, machine learning, and battery technology will enhance drone efficiency and reliability, enabling them to take on more complex delivery tasks. As regulatory landscapes evolve and infrastructure for drone operations improves, the market will see increased adoption across various sectors, creating new opportunities for businesses to expand their operations and reach new customers.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Flytrex

- Matternet

- UPS Flight Forward

- Zipline

- Parrot

- Amazon Prime Air

- AeroVironment

- Boeing Insitu

- General Atomics

- Thales Group

- Intel Corporation

- DJI Innovations

- Urban Aeronautics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- E-commerce and logistics companies

- Healthcare and pharmaceuticals

- Drone manufacturers and distributors

- Defense contractors

- Agricultural firms

- Environmental organizations

Research Methodology

Step 1: Identification of Key Variables

The process begins by identifying key factors such as market trends, technological drivers, and regulatory influences that will shape the drone delivery sector.

Step 2: Market Analysis and Construction

Market data is gathered from reliable sources and a model is constructed to represent the current market dynamics, future projections, and industry behaviors.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, stakeholders, and regulatory bodies are consulted to validate hypotheses and to gain insights into potential changes in the market.

Step 4: Research Synthesis and Final Output

All findings are synthesized, and the final research report is prepared, incorporating actionable insights, recommendations, and forecasts for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in Drone Technology

E-commerce Growth and Demand for Faster Deliveries

Government Support for Drone Infrastructure Development - Market Challenges

Regulatory Hurdles in Drone Operations

High Initial Investment Costs and Maintenance

Security and Privacy Concerns in Drone Deliveries - Market Opportunities

E-commerce Logistics Integration

Expansion of Drone Services in Healthcare

Government and Military Sector Collaborations - Trends

Increased Adoption of AI and Machine Learning

Focus on Sustainable and Eco-friendly Drone Solutions

Growth in Urban Air Mobility Solutions

Advancements in Autonomous Drone Operations

Expansion of Drone Delivery in Rural Areas - Government Regulations & Defense Policy

Drone Certification and Airspace Management Regulations

Data Privacy and Security Policies

Government Funding for UAV Technology Development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Delivery Drones

Cargo Drones

Heavy Payload Drones

Light Payload Drones

Hybrid Delivery Systems - By Platform Type (In Value%)

Fixed-Wing Drones

Rotary-Wing Drones

Multirotor Drones

Vertical Takeoff and Landing (VTOL) Drones

Hybrid Drones - By Fitment Type (In Value%)

Drone-as-a-Service (DaaS)

On-Premise Drone Solutions

Fleet Management Solutions

Integrated Drone Systems

Stand-Alone Drones - By EndUser Segment (In Value%)

E-commerce & Retail

Healthcare & Pharmaceuticals

Logistics Providers

Government & Military

Agriculture & Forestry - By Procurement Channel (In Value%)

Direct Procurement

Public Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Carbon Fiber Materials

Lithium-Polymer Batteries

AI and Machine Learning Technology

Autonomous Navigation Systems

Internet of Things (IoT) Integration

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, End-User Segment, Procurement Channel, Material/Technology, Fitment Type, Technology Adoption, Cost Efficiency, Payload Capacity, Regulatory Compliance)

SWOT Analysis of Key Players

Pricing & Procurement Analysis - Key Players

Israel Aerospace Industries

Elbit Systems

Flytrex

Urban Aeronautics

Prime Air (Amazon)

Parrot Drones

Drone Volt

AeroVironment

Thales Group

UPS Flight Forward

Wing Aviation

Zipline

Boeing Insitu

Matternet

Autonomous Flight Technologies

- E-commerce demand for last-mile delivery solutions

- Healthcare sector’s need for urgent deliveries

- Logistics companies seeking efficiency improvements

- Government agencies exploring drones for surveillance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035