Market Overview

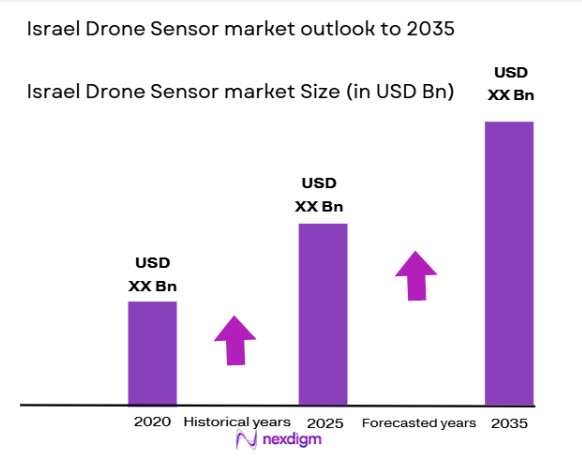

The Israel Drone Sensor market is valued at approximately USD ~ billion based on a recent historical assessment. The market is driven by technological advancements in sensor systems, including the development of LiDAR, radar, and thermal imaging sensors that are increasingly being integrated into drones for enhanced functionality. Growing demand from industries like defense, agriculture, and environmental monitoring, as well as government initiatives promoting the use of drones, are further accelerating the market’s expansion.

Israel is a leader in the drone sensor market, with cities like Tel Aviv and Herzliya being key innovation hubs. The country’s robust defense sector and the high demand for advanced surveillance and reconnaissance technologies have contributed to the adoption of drone sensors. Israel’s regulatory environment also facilitates the testing and deployment of new drone technologies, making it an attractive market for both domestic and international players. The country’s position in the Middle East further enhances its strategic importance for drone-related defense applications.

Market Segmentation

By Product Type:

The Israel Drone Sensor market is segmented by product type into various sub-segments. Recently, radar sensors have a dominant market share due to their superior capabilities in detecting objects in challenging environments such as low visibility or adverse weather conditions. Radar sensors are crucial for surveillance, security, and military applications, where accurate, real-time information is essential. As these sensors offer higher reliability and versatility than traditional optical sensors, their demand is growing across a range of industries, including defense and environmental monitoring, where robustness is paramount.

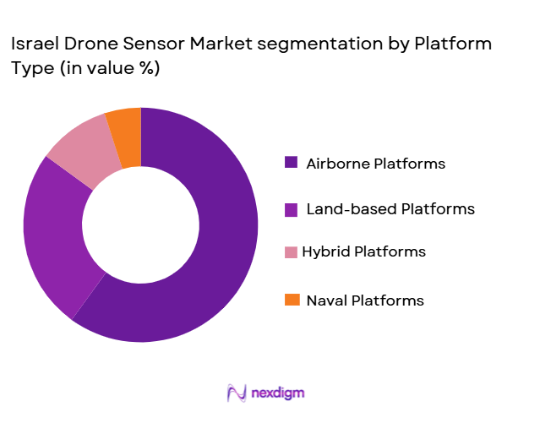

By Platform Type:

The Israel Drone Sensor market is segmented by platform type into airborne and land-based platforms. Airborne platforms dominate the market due to their ability to cover large areas quickly and efficiently. Drones equipped with sensors for aerial surveillance are particularly valuable in military and defense applications, where real-time data is critical. Airborne drones are also used in agriculture and environmental monitoring, allowing for precise data collection over extensive terrains. Their versatility, especially in ISR (Intelligence, Surveillance, and Reconnaissance) applications, has solidified their market dominance.

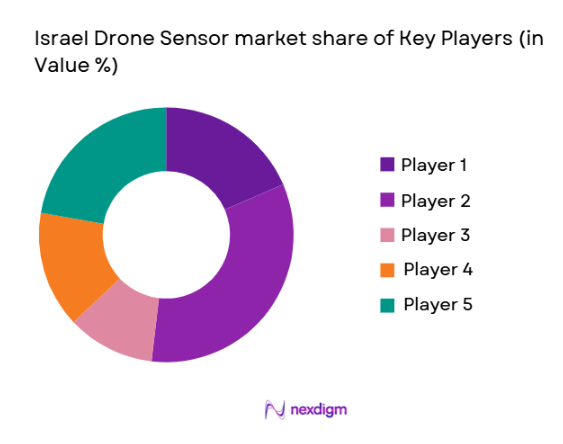

Competitive Landscape

The Israel Drone Sensor market is highly competitive, with a mix of established defense contractors and emerging technology firms. Major players are actively engaging in partnerships and acquisitions to expand their capabilities and product portfolios. The market is witnessing significant consolidation as companies aim to integrate advanced sensor technologies with drones to cater to the growing demand in defense, agriculture, and environmental monitoring sectors. Israel’s established defense ecosystem and technological expertise make it a focal point for global players seeking to innovate in the drone sensor space.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1985 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Matternet | 2011 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Flight Plan | 2015 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Drone Sensor Market Analysis

Growth Drivers

Technological Advancements in Sensor Systems:

The Israel Drone Sensor market is experiencing rapid growth due to the continuous advancements in sensor technologies such as radar, LiDAR, and thermal imaging. These sensors are becoming increasingly essential for drones used in defense, surveillance, agriculture, and environmental monitoring. The improvement in sensor accuracy, range, and miniaturization allows drones to gather more precise data, which enhances the decision-making capabilities of end-users. The integration of advanced sensors with autonomous drones enables higher efficiency and effectiveness in operations, especially in complex and dynamic environments. As Israel’s defense sector continues to innovate, sensor technologies are expected to play a crucial role in enhancing the capabilities of drones for both military and commercial applications. This trend is bolstered by the government’s supportive policies and investments in drone research and development, positioning Israel as a global leader in the drone sensor market. The rise in the adoption of drone-based solutions across various industries is a significant factor contributing to the market’s growth, as it drives demand for high-performance sensors capable of operating under diverse conditions. Additionally, these advancements are expanding the use of drones for tasks such as precision agriculture, disaster response, and border surveillance, which further boosts market expansion.

Government Support and Regulatory Frameworks:

Government support and favorable regulatory frameworks are driving the growth of the Israel Drone Sensor market. Israel’s government has played a pivotal role in creating a conducive environment for the development and deployment of drones, especially in defense and security. The regulatory environment in Israel is one of the most progressive in the world, with clear guidelines for drone operations, airspace management, and sensor integration. This regulatory clarity encourages businesses to invest in drone technology and sensor systems, knowing that their operations will be legally supported. Furthermore, the Israeli government’s focus on defense innovation and technology commercialization has led to increased funding for drone research and development. This has directly impacted the growth of the drone sensor market, as the country’s defense contractors develop cutting-edge sensors for military applications, which are later adapted for commercial use. As regulations continue to evolve and become more inclusive of commercial drone activities, this will further spur market growth. The ongoing collaboration between Israel’s defense sector and private companies also fosters the creation of more advanced sensor systems that meet the stringent demands of military, law enforcement, and commercial sectors. This collaboration positions Israel as a prime hub for innovation in the global drone sensor market.

Market Challenges

High Manufacturing Costs:

One of the significant challenges facing the Israel Drone Sensor market is the high manufacturing costs associated with advanced sensors. While Israel is known for its innovation in defense and aerospace technologies, the cost of developing and producing high-performance drone sensors, such as LiDAR and radar, remains substantial. These sensors require specialized materials, sophisticated manufacturing processes, and extensive testing, which increase the overall cost. As a result, smaller companies and emerging markets may find it difficult to afford or integrate such advanced sensors into their drone systems. The high cost of these sensors also restricts the widespread adoption of drone technologies in sectors such as agriculture, environmental monitoring, and logistics, where cost-efficiency is a key factor. Additionally, the high price point may limit the ability of some players to scale their operations, as they must invest heavily in sensor systems, which could impede their market entry or growth. Although technological advancements are expected to gradually reduce sensor costs, the high manufacturing expenses remain a significant barrier to the growth of the market. Companies must find innovative ways to reduce costs through economies of scale, technological innovation, or partnerships with other market players to overcome this challenge.

Regulatory and Airspace Management Issues:

Regulatory and airspace management issues represent another major challenge for the Israel Drone Sensor market. While Israel’s regulatory environment has been relatively progressive, airspace management remains a critical issue, particularly as the number of drones operating in the national airspace increases. The integration of drones with existing air traffic control systems is a complex challenge that requires coordination between government agencies, military authorities, and private companies. In addition, there are concerns related to privacy, security, and the safe operation of drones in crowded urban areas. As drone operations expand, managing airspace to ensure safe, efficient, and compliant flight paths becomes increasingly difficult. The potential for drone-related accidents or interference with manned aircraft also raises safety concerns, necessitating stricter regulations and better management frameworks. The challenge of establishing safe zones for drone operations while also facilitating their integration into civilian airspace is a major barrier to the broader adoption of drone sensors and their applications. Additionally, as drones become more autonomous, ensuring that they adhere to regulatory requirements and operate safely without constant human oversight adds further complexity to the issue. Addressing these challenges requires continued collaboration between the government, regulators, and drone operators to develop comprehensive and adaptive airspace management solutions.

Opportunities

Integration of Artificial Intelligence and Machine Learning:

The integration of artificial intelligence (AI) and machine learning (ML) technologies with drone sensors presents a significant opportunity in the Israel Drone Sensor market. AI and ML algorithms can enhance the performance of sensors by enabling them to process and analyze data in real-time, allowing for faster and more accurate decision-making. This integration improves the drone’s ability to detect and identify objects, track movements, and navigate complex environments autonomously. AI-powered sensors can be particularly useful in applications such as surveillance, where real-time data analysis is critical for identifying potential threats or monitoring large areas. Additionally, machine learning algorithms can improve sensor calibration, making them more adaptable and efficient across different operational conditions. As AI and ML technologies evolve, they will enable more sophisticated drone systems that can handle a wider range of tasks, from agricultural monitoring to environmental protection. This opportunity is particularly relevant to Israel, where innovation in AI and defense technologies is already a focal point. As AI and ML become more integrated into sensor systems, the demand for high-performance sensors is expected to grow, providing significant growth opportunities for market players. This trend will also drive the development of new applications for drones, further expanding the market for sensor technologies.

Expansion of Drone Applications in Non-defense Sectors:

The expansion of drone applications in non-defense sectors presents another significant opportunity for the Israel Drone Sensor market. While Israel has historically focused on military and defense applications for drones, there is increasing demand for drone sensor systems in sectors such as agriculture, logistics, and environmental monitoring. Drones equipped with sensors can monitor crop health, conduct soil analysis, and help optimize farming practices, making them essential tools for precision agriculture. In the logistics sector, drones can improve the efficiency of package delivery, especially in remote or hard-to-reach areas, by providing faster and more cost-effective transportation solutions. Additionally, drones are increasingly being used for environmental monitoring, where they can collect data on air and water quality, detect pollutants, and track wildlife. The growth of these non-defense applications presents a vast untapped market for drone sensor technologies, particularly in emerging industries that are looking to integrate drone solutions into their operations. As these sectors continue to adopt drone technology, the demand for advanced sensors will rise, providing new revenue streams for companies in the drone sensor market. The opportunity for diversification into these sectors is significant, as it allows market players to expand their customer base and reduce reliance on the defense sector.

Future Outlook

Over the next five years, the Israel Drone Sensor market is expected to continue its strong growth trajectory, driven by technological advancements in AI, machine learning, and sensor technologies. As drone applications expand beyond defense and into agriculture, logistics, and environmental monitoring, the demand for advanced sensor systems is expected to rise significantly. Government support for drone innovation and regulatory frameworks will play a crucial role in enabling the safe integration of drones into civilian airspace. The market will also benefit from ongoing advancements in autonomous drone capabilities, providing greater efficiency and versatility in various industries.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Matternet

- Flight Plan

- Skydex

- Pegasus Aerospace

- Aeronautics

- Teledyne FLIR

- Alpha Unmanned Systems

- Insitu

- GeoWing Technologies

- Aerovironment

- PX4 Robotics

- SensoLogic

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Agricultural companies

- Logistics and delivery firms

- Environmental monitoring agencies

- Defense contractors

- Drone manufacturers

- AI and machine learning companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the market, such as sensor types, drone applications, and technological advancements in the sector.

Step 2: Market Analysis and Construction

A comprehensive analysis of the market dynamics, trends, and demand patterns is conducted, using both primary and secondary research methods to develop an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are held with industry professionals, stakeholders, and market participants to validate the market model and ensure the accuracy of the forecast.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a detailed report, including market forecasts, segmentation analysis, and strategic insights for key players in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Autonomous Drones

Advancements in Sensor Technologies

Regulatory Support for Drone Adoption - Market Challenges

High Cost of Drone Sensors

Regulatory and Airspace Management Issues

Privacy and Security Concerns - Market Opportunities

Integration of AI and Machine Learning in Drone Sensors

Growth of Drone-based Environmental Monitoring

Rising Investment in Drone Technologies by the Military - Trends

Increased Adoption of LiDAR Sensors

Growth in Autonomous Drones for Commercial Use

Focus on Enhancing Sensor Accuracy and Range

Integration of Drones in Industrial Inspections

Technological Advancements in Miniaturization of Sensors - Government Regulations & Defense Policy

Regulation of Airspace for Drone Operations

Data Protection and Privacy Regulations

Government Funding for Drone Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Vision-based Sensors

LiDAR Sensors

Radar Sensors

Infrared Sensors

Gas and Chemical Sensors - By Platform Type (In Value%)

Airborne Platforms

Land-based Platforms

Naval Platforms

Hybrid Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Integrated Solutions

Modular Solutions

Custom-built Solutions - By EndUser Segment (In Value%)

Military & Defense

Agriculture & Forestry

Energy & Utilities

Environmental Monitoring

Logistics & Delivery - By Procurement Channel (In Value%)

Direct Procurement

Private Sector Procurement

Government Tenders

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

LiDAR Technology

Radar Technology

Thermal Imaging

Multispectral Sensors

AI-driven Sensors

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Market Share, Product Performance, Service Quality, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

AeroVironment

Honeywell Aerospace

SKYEXPO

Flight Plan

Matternet

Raytheon Technologies

Thales Group

L3 Technologies

Leidos

Boeing

Northrop Grumman

General Atomics

- Military and defense agencies’ increasing reliance on drones for surveillance

- Agricultural firms adopting drones for precision farming

- Energy companies leveraging drones for infrastructure inspection

- Logistics and delivery companies integrating drones for efficiency

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035