Market Overview

The Israel drone services market has witnessed substantial growth in recent years, driven by technological advancements and increased applications in defense, agriculture, logistics, and other commercial sectors. Based on a recent historical assessment, the market size is valued at USD ~ billion, reflecting an ongoing demand for both military and commercial drone services. The market is expected to expand as more industries adopt drones for various operational needs, ranging from surveillance and inspection to delivery services and crop monitoring. This surge in demand is further supported by continuous advancements in drone technology, including improved flight endurance, AI-based automation, and enhanced communication systems, driving market growth.

In terms of dominant regions, Israel leads the market, thanks to its advanced defense sector and significant investments in unmanned aerial vehicle (UAV) technologies. The country’s emphasis on technological innovation and security applications for drones contributes to its leadership in the market. Additionally, regions such as North America and Europe are also prominent players due to their robust drone adoption, driven by governmental support for aerial surveillance, logistics, and smart agriculture. Israel’s favorable regulatory environment and cutting-edge drone technology create a solid foundation for its market dominance in the global drone services sector.

Market Segmentation

By Product Type

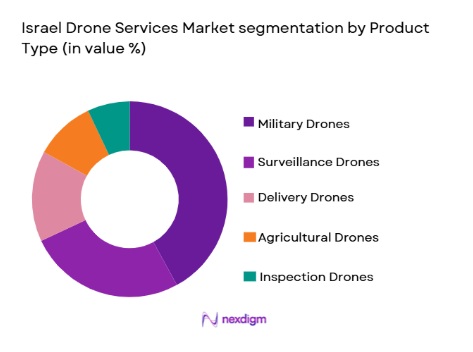

The Israel drone services market is segmented by product type into military drones, surveillance drones, delivery drones, agricultural drones, and inspection drones. Recently, military drones have taken a dominant market share due to factors such as the increased demand for UAVs in defense applications, government contracts, and a robust security infrastructure. The government and defense sectors are major adopters of drones, with military UAVs being used for reconnaissance, intelligence gathering, and border security. Technological advancements in autonomous systems and increased funding from military agencies further fuel the dominance of military drones in the market.

By Platform Type

The market is segmented by platform type into fixed-wing drones, rotary-wing drones, hybrid drones, multi-rotor drones, and nano drones. Fixed-wing drones dominate the market due to their long flight range and ability to cover large areas, making them suitable for both military and civilian applications. Fixed-wing drones are widely used in surveillance, agriculture, and mapping due to their higher endurance compared to other drone types. Their capacity to carry heavier payloads and perform long-duration missions makes them the preferred choice for many sectors, ensuring their continued dominance in the market.

Competitive Landscape

The competitive landscape of the Israel drone services market is characterized by the presence of several major players who have solidified their positions through technological innovation, strategic partnerships, and government contracts. Companies like Israel Aerospace Industries and Elbit Systems have gained significant influence in the defense sector, while startups such as Percepto and Airobotics are reshaping the commercial landscape. The market is seeing increasing consolidation, with larger defense companies acquiring smaller players to expand their portfolios and integrate drones into broader technological ecosystems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Percepto | 2014 | Petah Tikva, Israel | ~ | ~ | ~ | ~ | ~ |

| Airobotics | 2014 | Petah Tikva, Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Defense Systems | 1997 | Yavne, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Drone Services Market Analysis

Growth Drivers

Government Investment in UAV Technology

Government investment in unmanned aerial vehicle (UAV) technology has been a key growth driver in the Israel drone services market. With a strong focus on defense and security, the Israeli government has allocated substantial funding to research, development, and deployment of drones, resulting in advanced military-grade UAVs. Additionally, government support extends to the commercialization of drone technology for industries such as agriculture and logistics, fostering the growth of drone services across various sectors. This investment has accelerated the adoption of drones for critical national security operations, including border control, reconnaissance, and counterterrorism, further bolstering the demand for military drones. As UAV technology continues to evolve, it is expected that government investment will remain a key driver, expanding the market to new applications and use cases. The growing interest in drones within the public sector also opens new avenues for non-defense applications, including environmental monitoring and infrastructure inspection, contributing to the market’s expansion.

Technological Advancements in Drone Capabilities

The rapid pace of technological advancements in drone capabilities has been a significant growth driver in the Israel drone services market. The introduction of AI-driven drones, longer battery lives, enhanced payload capacities, and improved communication systems has expanded the operational range and effectiveness of drones across various industries. Advances in autonomous flight systems and machine learning algorithms have enabled drones to perform complex tasks, such as precision agriculture, environmental monitoring, and infrastructure inspection, with minimal human intervention. These advancements have made drones more reliable, efficient, and cost-effective, further encouraging their adoption across commercial and military sectors. With Israel being a hub for cutting-edge technologies in robotics, AI, and aerospace, these innovations position Israeli drone services at the forefront of the global market, enabling the country to remain a leader in the drone industry. The integration of drones into more industry verticals, including smart cities, logistics, and disaster management, will continue to drive demand and stimulate market growth.

Market Challenges

Regulatory Barriers and Airspace Restrictions

Regulatory barriers and airspace restrictions pose significant challenges to the growth of the Israel drone services market. Although Israel has a favorable regulatory environment for drones, challenges arise when it comes to integrating drones into commercial airspace. Issues such as air traffic control, safety concerns, and privacy violations have led to strict regulations that limit the operational range and applications of drones, particularly in urban areas. Additionally, the lack of a standardized global framework for drone operations has created inconsistencies in regulations across different countries, complicating international market expansion. While Israel’s military UAVs enjoy regulatory leniency for national security purposes, commercial drones face more stringent oversight, which could impede the pace of innovation and limit market opportunities in the civilian sector. To overcome these barriers, more collaborative efforts are needed between governments, regulatory bodies, and industry stakeholders to create standardized regulations that ensure safety while promoting innovation in the drone services market.

High Cost of Advanced Drone Technology

The high cost of advanced drone technology is another challenge facing the Israel drone services market. While drones have become more accessible over the years, the development and deployment of cutting-edge UAV systems remain expensive. The high costs of research, development, and manufacturing of military-grade drones have limited their availability, particularly for small and medium-sized enterprises (SMEs). This financial barrier also extends to commercial drones, where the expenses involved in purchasing, maintaining, and operating advanced drone systems are significant. Furthermore, industries that have traditionally not used drones, such as logistics and agriculture, may struggle to adopt the technology due to high upfront costs. Despite ongoing efforts to reduce the costs of drone systems, such as through mass production and the integration of off-the-shelf components, the high cost of cutting-edge drones may slow down the widespread adoption of drone services across all sectors.

Opportunities

Expansion of Drone Delivery Services

The expansion of drone delivery services presents a major opportunity in the Israel drone services market. Drones have already proven to be effective in short-range delivery applications, particularly for pharmaceuticals, food, and retail products, where speed and efficiency are crucial. With Israel’s technological expertise in UAV systems and regulatory framework supporting drone operations, the country is well-positioned to capitalize on the rapidly growing drone delivery sector. By enabling faster delivery times and reducing operational costs, drone delivery services could revolutionize logistics and supply chain management, providing a competitive advantage to companies adopting this technology. Additionally, as demand for contactless services grows, especially in urban areas, drones offer a convenient and efficient alternative to traditional delivery methods. This trend is expected to drive substantial growth in the Israeli drone services market, particularly in last-mile delivery solutions, offering opportunities for startups and established logistics companies alike.

Integration with AI for Autonomous Operations

The integration of artificial intelligence (AI) into drone systems presents a promising opportunity for the Israel drone services market. With advancements in AI, drones can perform complex tasks autonomously, reducing the need for human intervention and enabling more efficient operations in a variety of sectors. AI-powered drones are capable of learning from their environment, adapting to changing conditions, and making real-time decisions, making them ideal for applications in agriculture, surveillance, and infrastructure inspection. In Israel, where AI and machine learning technologies are at the forefront of innovation, the integration of AI into drone systems can open up new use cases, such as autonomous inspection of critical infrastructure, real-time surveillance in urban areas, and precision farming techniques. This opportunity not only enhances the capabilities of drones but also fosters the development of intelligent and autonomous systems that can operate with minimal supervision, improving productivity and reducing costs across various industries.

Future Outlook

The future outlook for the Israel drone services market is promising, with significant growth expected over the next few years. Technological advancements, including the integration of AI and machine learning, will continue to enhance the capabilities of drones, enabling them to perform more complex tasks autonomously. Additionally, the regulatory landscape is expected to evolve, creating more opportunities for drone services in commercial sectors such as logistics, agriculture, and infrastructure. With continued government support and the growing adoption of drones in both military and civilian applications, the market is poised to expand, offering new business opportunities for drone service providers and users alike.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Percepto

- Airobotics

- Aeronautics Defense Systems

- Rafael Advanced Defense Systems

- Flytrex

- SkyX

- Urban Aeronautics

- Bluebird Aero Systems

- FlyTech UAV

- CopterPix

- Eviation Aircraft

- Advanced Aircraft Company

- Orbital UAV

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense organizations

- Logistics and delivery companies

- Infrastructure and construction firms

- Agriculture and farming industries

- Drone service providers

- Technology developers and suppliers

Research Methodology

Step 1: Identification of Key Variables

‘The identification of key variables involves determining the essential factors that influence the drone services market, such as technology trends, regulatory frameworks, and economic factors that drive demand for UAV systems.

Step 2: Market Analysis and Construction

In this step, a comprehensive analysis of the drone services market is conducted, including segmentation by product type, platform type, and geographical regions. Market size and growth trends are estimated using historical data and industry reports.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry leaders, academics, and professionals in the field of drone services are conducted to validate hypotheses and gain insights into the market’s growth drivers and challenges.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all the collected data, validating findings, and producing a detailed report that includes market forecasts, key findings, and strategic recommendations for stakeholders in the Israel drone services market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Adoption in Military & Defense

Technological Advancements in Drones

Supportive Government Regulations and Initiatives - Market Challenges

High Operational Costs

Regulatory and Airspace Management Issues

Data Privacy and Security Concerns - Market Opportunities

Expansion of Drone Delivery Services

Integration of AI and Automation

Growth of Drone-based Agricultural Monitoring - Trends

Increased Demand for Surveillance and Monitoring

Growth in Autonomous Drone Operations

Development of Eco-friendly Drones

Advancements in Drone Communication Technology

Integration of Drone Services in Supply Chains - Government Regulations & Defense Policy

Regulation of Airspace for Commercial Drones

Government Funding for Drone R&D

Privacy Protection and Data Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By Service Type (In Value%)

Aerial Surveillance

Package Delivery Services

Inspection and Monitoring Services

Agricultural Monitoring

Surveying and Mapping Services - By Platform Type (In Value%)

Fixed-Wing Drones

Multirotor Drones

Hybrid Drones

Solar-powered Drones

Autonomous Drones - By EndUser Segment (In Value%)

Military & Defense

Agriculture

Logistics & E-commerce

Construction & Infrastructure

Energy & Utilities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

LiDAR Technology

Thermal Imaging Technology

Radar Technology

Multispectral Sensors

AI-driven Navigation Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Service Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology, Product Performance, Service Quality, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

AeroVironment

Matternet

Flytrex

DroneUp

Zipline

AeroX

Skydio

Teledyne FLIR

Skyports

General Atomics

Thales Group

Harris Corporation

- Growing Military Demand for Drones

- Agriculture’s Adoption of Precision Drone Technology

- E-commerce’s Need for Fast Delivery Solutions

- Energy and Infrastructure Companies Using Drones for Inspections

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by Service Tier, 2026-2035

- Future Demand by Platform, 2026-2035