Market Overview

The Israel Drone Simulation market is estimated to reach USD 300 million based on a recent historical assessment. The market’s growth is largely driven by increasing demand from defense and military sectors for high-fidelity training simulations, which allow operators to hone their skills in a safe environment. Technological advancements in simulation software, alongside growing government and military investments, are playing a key role in fueling this demand. The integration of AI and machine learning into drone simulations has further boosted the demand for more sophisticated systems.

The dominant countries in the Israel Drone Simulation market are Israel and select countries in Europe and North America. Israel leads the market due to its strong defense industry and government-backed initiatives to develop cutting-edge drone technologies. The country’s investment in advanced simulation systems for military applications, including UAVs and other drones, supports its dominance. As a global defense powerhouse, Israel’s drone simulation services are crucial to training operators for military and defense operations, contributing to its central position in the market.

Market Segmentation

By System Type

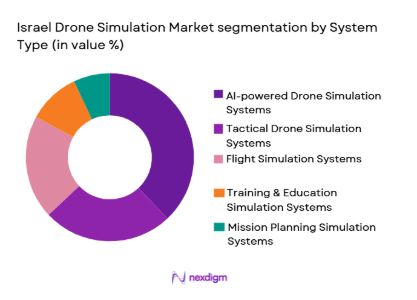

The Israel Drone Simulation market is segmented by system type into Flight Simulation Systems, Tactical Drone Simulation Systems, Training & Education Simulation Systems, Mission Planning Simulation Systems, and AI-powered Drone Simulation Systems. Recently, AI-powered drone simulation systems have captured a dominant market share due to advancements in machine learning and real-time data processing. These systems are particularly sought after in defense applications, where the integration of AI allows for adaptive training scenarios and enhanced realism, simulating unpredictable combat environments. As a result, AI-based simulations are essential for military and commercial drone operators, further driving the segment’s dominance.

By Platform Type

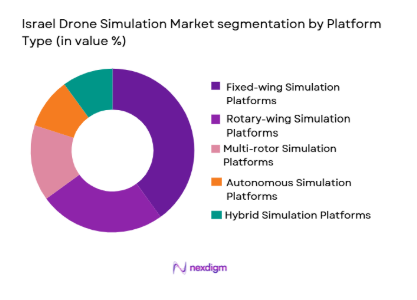

The Israel Drone Simulation market is segmented by platform type into Fixed-wing Simulation Platforms, Rotary-wing Simulation Platforms, Multi-rotor Simulation Platforms, Autonomous Simulation Platforms, and Hybrid Simulation Platforms. Fixed-wing simulation platforms hold a dominant market share due to their widespread use in both military and civilian applications, such as surveillance, reconnaissance, and long-range missions. These platforms require highly accurate simulation systems to replicate their flight dynamics and operational environments. Their versatility and relevance in the defense sector make them the preferred choice, thus solidifying their leadership in the market.

Competitive Landscape

The competitive landscape of the Israel Drone Simulation market is dominated by a mix of established players and emerging companies, with a strong focus on high-tech simulation systems and defense contracts. The influence of major players is significant, as they provide specialized solutions for both military training and commercial drone operators. Strategic partnerships, acquisitions, and technology collaborations continue to shape the market, while government defense contracts remain a central driver of innovation and market share distribution. The competitive landscape is evolving as newer entrants challenge established companies with innovative simulation techniques.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-specific Parameter |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Simlat | 1990 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Israel Drone Simulation Market Analysis

Growth Drivers

Government and Military Investment

Government and military investment remains one of the strongest drivers of growth in the Israel Drone Simulation market. Israel’s strategic defense initiatives heavily rely on drones for national security, surveillance, and reconnaissance. This reliance has translated into significant investments in drone simulation technologies to ensure effective training of drone operators and personnel. The Israeli government provides continuous support through defense contracts and funding for research and development of advanced simulation systems. This steady government funding has allowed the country to remain at the forefront of technological advancements in drone simulation. As the global security landscape evolves, the demand for highly accurate and sophisticated drone training simulators will only increase. With Israel’s emphasis on modernizing its defense infrastructure, the demand for drone simulation platforms will continue to grow, further accelerating market expansion.

Technological Advancements in Simulation

Technological advancements in simulation technology, including virtual reality (VR) and artificial intelligence (AI), are contributing to the rapid growth of the Israel Drone Simulation market. VR and AI enable the creation of highly immersive and interactive training environments that provide realistic experiences for drone operators. These technological innovations improve the training process, allowing operators to practice complex missions and scenarios without the risk of real-world consequences. The incorporation of AI into simulation platforms enhances the training systems by providing adaptive learning experiences, where the system can respond to the operator’s actions, making training more effective. Furthermore, developments in sensor integration and data analytics allow for real-time feedback, further improving the training process. The growing adoption of these advanced technologies will continue to shape the Israel Drone Simulation market, as both military and commercial sectors seek to adopt more efficient training solutions. The increasing integration of AI-powered systems into simulators is expected to be a key factor driving the growth of this market segment.

Market Challenges

High Capital Investment

One of the primary challenges facing the Israel Drone Simulation market is the high capital investment required for advanced simulation systems. Developing, manufacturing, and maintaining high-fidelity drone simulators involves significant financial resources, which can be a barrier for smaller companies and even some defense sectors. The initial cost of these systems is relatively high, as they require state-of-the-art technology, including VR capabilities, AI, and high-performance computing. Additionally, the ongoing maintenance, system updates, and training of personnel add to the overall costs. While the benefits of simulation systems, such as reducing the need for physical drone fleets and lowering the risk of accidents, are clear, the cost of implementing and maintaining these technologies remains a significant hurdle for many organizations. The high costs associated with drone simulation systems may limit market accessibility and slow down the adoption of these systems in certain regions.

Regulatory and Compliance Barriers

Another significant challenge in the Israel Drone Simulation market is navigating regulatory and compliance barriers. Drone simulation systems, particularly in the military sector, must comply with strict national and international regulations regarding defense technology, data privacy, and cybersecurity. These regulations can make it difficult for companies to quickly bring new products to market and expand their operations. In addition, ensuring that drone simulation systems accurately replicate real-world conditions for training requires compliance with various standards for accuracy, safety, and performance. The complexity of these compliance processes can slow the development and implementation of new simulation technologies. Furthermore, varying regulations across different countries and regions can create additional challenges for companies seeking to expand their market reach. Managing these regulatory requirements and maintaining compliance with evolving legal frameworks will be crucial for the continued growth of the drone simulation market in Israel and beyond.

Opportunities

Expansion in Civilian Drone Simulation

One of the key opportunities in the Israel Drone Simulation market lies in the expansion of drone simulation systems into the civilian sector. While the defense industry has historically been the primary driver of the market, the growing adoption of drones in industries such as agriculture, logistics, and entertainment presents a new avenue for simulation technology. As drones are increasingly used for commercial purposes, there is a rising demand for training solutions that ensure safety and efficiency in civilian drone operations. By adapting their simulation systems to the needs of the civilian sector, companies can tap into this emerging market and provide tailored training solutions for non-military drone operators. This shift towards civilian drone simulation will open up new opportunities for businesses, particularly as drone use becomes more widespread and regulated across various industries. The development of affordable and accessible drone simulators for commercial use is expected to be a key growth factor in the coming years.

Growth of AI and Autonomous Drone Training

The growing integration of AI and autonomous drone technologies offers a major opportunity for the Israel Drone Simulation market. As AI-driven drones become more capable and autonomous, the need for simulation platforms that can replicate the behavior of these advanced systems increases. AI-powered simulation systems allow drone operators to train in environments where they interact with autonomous drones, providing real-time feedback and adaptive learning experiences. These platforms are particularly beneficial in defense and commercial applications where high levels of precision and decision-making are required. By leveraging AI and autonomous technologies, Israel-based drone simulation companies can create advanced training systems that address the complexities of modern drone operations. This opportunity is particularly significant as the demand for highly skilled drone operators and the need for effective training methods grow in both military and civilian sectors. The integration of AI will not only improve training efficiency but also expand the range of possible training scenarios, making drone simulation platforms more versatile and appealing.

Future Outlook

The future outlook for the Israel Drone Simulation market over the next five years is positive, with expected growth driven by technological advancements, increased government and defense sector investments, and the expanding application of drones in civilian industries. The integration of AI, machine learning, and VR technologies into drone simulators will continue to enhance training experiences, offering more immersive and realistic environments. Regulatory support for drone usage, particularly in defense, will further fuel market growth, providing opportunities for both established players and new entrants. As the global demand for drones increases, particularly in commercial applications, the market for simulation systems will expand, driving innovation and shaping the future of drone training technology.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Simlat

- Boeing

- Northrop Grumman

- Lockheed Martin

- Leonardo

- Thales Group

- General Atomics

- Airbus

- Raytheon Technologies

- Textron Systems

- Kratos Defense

- AeroVironment

- L3Harris Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Drone manufacturers and developers

- Defense contractors

- Commercial drone operators

- Law enforcement agencies

- Agricultural organizations

- Logistics companies

Research Methodology

Step 1: Identification of Key Variables

We identify the key market drivers, challenges, and opportunities that influence the drone simulation market. These variables include technological advancements, government policies, and evolving market needs. The identification of these variables helps establish the scope and focus of the research.

Step 2: Market Analysis and Construction

We segment the market based on factors such as system type, platform type, and end-user segment to gain a comprehensive understanding of the market structure. Data is collected from both primary and secondary sources, including industry reports, surveys, and expert interviews.

Step 3: Hypothesis Validation and Expert Consultation

We validate the research hypothesis through consultations with industry experts, including manufacturers, regulators, and drone operators. This helps ensure the accuracy and relevance of the data used in the analysis.

Step 4: Research Synthesis and Final Output

We synthesize the findings from the analysis to create a comprehensive report that provides actionable insights into the Israel Drone Simulation market. The final output includes an in-depth market overview, growth drivers, challenges, opportunities, and a competitive landscape.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Demand for Military and Defense Training Systems

Advancements in Drone Technology and Simulation Software

Growing Focus on AI and Machine Learning for Drone Training - Market Challenges

High Initial Costs of Advanced Simulation Systems

Regulatory Challenges Around Drone Testing and Simulation

Lack of Skilled Operators and Technicians for Simulation Platforms - Market Opportunities

Expansion of Drone Simulation in Civil Aviation

Integration of AI and VR for Realistic Simulation Training

Government Support for Drone Industry and Simulation Development - Trends

Increased Adoption of Immersive Virtual Reality in Training

Integration of Real-Time Data into Drone Simulation Systems

Rise in Drone Use for Disaster Management and Emergency Response - Government Regulations & Defense Policy

Strict Regulations on Drone Testing in National Airspace

Government Funding for Drone Technology and Simulation Innovation

National Security Concerns Driving Investment in Military Drone Training - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Simulation Systems

Tactical Drone Simulation Systems

Training & Education Simulation Systems

Mission Planning Simulation Systems

AI-powered Drone Simulation Systems - By Platform Type (In Value%)

Fixed-wing Simulation Platforms

Rotary-wing Simulation Platforms

Multi-rotor Simulation Platforms

Autonomous Simulation Platforms

Hybrid Simulation Platforms - By Fitment Type (In Value%)

On-premise Simulation Solutions

Cloud-based Simulation Solutions

Hybrid Simulation Solutions

Modular Simulation Solutions

Integrated Simulation Solutions - By EndUser Segment (In Value%)

Military and Defense

Aerospace and Aviation

Public Safety & Law Enforcement

Educational Institutes

Private Drone Companies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Platforms

Third-party Distributors - By Material / Technology (In Value%)

Advanced Simulation Software

High-performance Computing Systems

Immersive Virtual Reality Platforms

Sensor Integration Technologies

Cloud-based Data Storage Solutions

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

AeroVironment

Simlat

Honeywell

Boeing

Northrop Grumman

L3Harris Technologies

Leonardo

Kratos Defense

Lockheed Martin

Thales Group

General Atomics

Airbus

Raytheon Technologies

- Military and Defense Sectors’ Growing Investment in Simulation Systems

- Educational Institutions Integrating Drones into STEM Curriculum

- Public Safety Agencies Adopting Drones for Training Simulations

- Private Drone Companies’ Increased Demand for Testing and Simulation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035