Market Overview

The Israel Drone Software market is valued at USD ~ billion, driven by increased government investments in defense and technological advancements. The growing demand for UAVs in military, agricultural, and commercial applications is accelerating the adoption of drone software. Advanced software for flight control, mission planning, and data analytics is seeing widespread adoption, particularly due to its application in defense systems, agriculture, and infrastructure monitoring.

Cities like Tel Aviv and Herzliya dominate the market due to their established technology infrastructure and proximity to defense and aerospace industries. Israel’s strategic initiatives in defense innovation and its support for R&D in UAV technologies have made it a global leader in drone software development. The country’s investments in cybersecurity, AI, and machine learning also play a key role in maintaining its position in the global market.

Market Segmentation

By Product Type

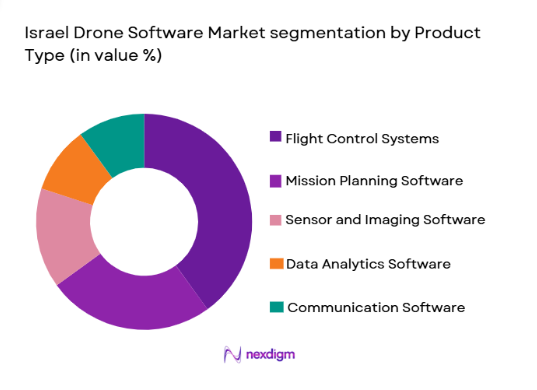

Israel Drone Software market is segmented by product type into flight control systems, mission planning software, sensor and imaging software, data analytics software, and communication software. Recently, flight control systems have a dominant market share due to their critical role in ensuring the safe and effective operation of drones. These systems are widely used in military and commercial applications, driving demand for advanced software solutions. Moreover, the rapid technological advancements in autonomous drone capabilities and real-time data integration continue to boost the adoption of flight control systems across various industries.

By Platform Type

Israel Drone Software market is segmented by platform type into fixed-wing drones, rotary-wing drones, hybrid drones, nano drones, and micro drones. Recently, fixed-wing drones have the largest market share due to their longer endurance and larger payload capacities, which make them suitable for military and surveillance applications. Fixed-wing drones require highly sophisticated software for navigation, flight control, and communication systems. This sub-segment is driven by advancements in autonomous flight capabilities, enabling drones to operate more efficiently across larger areas, such as for defense or aerial mapping purposes.

Competitive Landscape

The Israel Drone Software market is competitive, with key players consolidating market share through innovations in AI, machine learning, and advanced flight control technologies. The influence of large defense contractors like Elbit Systems and Rafael Advanced Defense Systems is prominent, as they continue to drive the development of UAV software for military applications. These players leverage Israel’s strong defense sector to integrate software solutions into advanced drone systems. Smaller firms also play a significant role in innovating software solutions for commercial and civilian drone applications, broadening the market’s overall growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1950 | Israel | ~ | ~ | ~ | ~ |

| Aeronautics Ltd. | 1997 | Israel | ~ | ~ | ~ | ~ |

| Intel Corporation | 1968 | USA | ~ | ~ | ~ | ~ |

| Skylock | 2015 | Israel | ~ | ~ | ~ | ~ |

Israel Drone Software Market Analysis

Growth Drivers

Government Investment in Defense and UAV Technology

The growth of the Israel Drone Software market is largely driven by the government’s substantial investment in defense and UAV technologies. The Israeli government has consistently allocated significant funds to enhance its defense capabilities, which includes the development and integration of advanced UAV software. With Israel’s strategic focus on maintaining technological superiority in defense and national security, demand for sophisticated drone software continues to grow. This investment allows for the integration of AI, machine learning, and real-time data analytics into UAV systems, improving their operational efficiency. Moreover, the Israeli defense industry’s focus on developing autonomous systems has created a fertile market for software solutions that support UAV navigation, flight control, and mission planning. Additionally, Israel’s role as a global leader in defense innovation positions it as a key exporter of UAV technology and software, thus boosting market demand globally.

Technological Advancements in Autonomous UAV Systems

Technological advancements in autonomous UAV systems are a significant driver of the Israel Drone Software market. The integration of AI, machine learning, and advanced sensor systems into drones has led to the development of highly autonomous systems capable of performing complex tasks without human intervention. This has increased the demand for advanced drone software solutions that can manage flight control, mission planning, and real-time data processing. Moreover, autonomous UAVs are being increasingly utilized in military, agriculture, and surveillance applications, all of which require highly sophisticated software solutions for effective operations. As drones become more autonomous, the need for software solutions that support these capabilities will continue to drive market growth.

Market Challenges

Regulatory Hurdles and Compliance

One of the significant challenges faced by the Israel Drone Software market is navigating regulatory hurdles and ensuring compliance with local and international drone operating standards. The rapid growth of the drone industry, especially in defense and commercial sectors, has led to an evolving regulatory landscape. Governments around the world are implementing strict regulations related to airspace management, flight operations, and data security for UAVs. Israel, as a leading producer of defense technology, is impacted by both domestic and international regulations on the use of UAVs. This creates uncertainty for drone software developers, who must ensure that their systems comply with these regulations to operate across borders. Furthermore, the lack of standardized regulations for drones in various regions can lead to challenges in the widespread adoption of advanced drone software technologies.

High Development and Maintenance Costs

Another challenge for the Israel Drone Software market is the high costs associated with developing and maintaining sophisticated drone software systems. Developing software that supports the complex functionalities of UAVs, such as autonomous flight control, real-time data analytics, and sensor integration, requires significant investment in R&D and specialized expertise. Additionally, the continuous need for software updates and maintenance to keep up with technological advancements increases operational costs. For companies in the market, the high cost of developing custom drone software and the need for ongoing maintenance may limit the scalability and affordability of their solutions. This is particularly challenging for smaller players or firms looking to enter the market, as they face financial barriers that hinder their ability to compete with established companies.

Opportunities

Expansion of UAV Applications in Agriculture

The expansion of UAV applications in agriculture presents a significant opportunity for the Israel Drone Software market. Drones are increasingly being used for precision agriculture, enabling farmers to monitor crop health, assess soil conditions, and optimize irrigation systems. This shift towards the use of UAVs in agriculture is driven by the need for more efficient and cost-effective farming practices. As agricultural UAVs rely heavily on advanced software for flight control, sensor integration, and data analysis, this presents a prime opportunity for software developers to create specialized solutions tailored to the needs of the agricultural sector. The demand for software that enhances crop monitoring, pest detection, and yield prediction will continue to grow, opening new avenues for growth in the drone software market.

Rising Demand for Drones in Infrastructure Inspections

Another significant opportunity in the Israel Drone Software market lies in the increasing demand for drones in infrastructure inspections. Drones are becoming a critical tool in inspecting bridges, power lines, oil rigs, and other critical infrastructure, offering a safer and more efficient alternative to traditional inspection methods. UAVs equipped with high-resolution cameras and sensors can capture detailed imagery and data from difficult-to-reach locations, while advanced software enables real-time analysis and reporting. The growing need for regular infrastructure inspections, combined with the cost-effectiveness and safety advantages offered by drones, will continue to drive demand for specialized drone software. This offers software companies an opportunity to develop tailored solutions that meet the unique requirements of the infrastructure sector, including automation, reporting, and data integration.

Future Outlook

Over the next five years, the Israel Drone Software market is expected to experience robust growth, driven by advancements in UAV technologies and increasing demand across multiple industries. Technological developments in AI, machine learning, and sensor integration will lead to more autonomous drones capable of performing complex tasks. Regulatory support for drone integration in commercial sectors, including agriculture and infrastructure, will further enhance market growth. With Israel’s strong position in the defense sector, the country is poised to continue as a global leader in the development and export of advanced drone software.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Ltd.

- Intel Corporation

- Skylock

- Aerovironment

- Thales Group

- Honeywell International

- General Atomics

- Lockheed Martin

- Boeing

- L3 Technologies

- Northrop Grumman

- Israel Aerospace Industries

- Textron Inc.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military organizations and agencies

- Aerospace and aviation companies

- Agriculture technology firms

- Infrastructure and construction companies

- Drone technology developers

- Security firms

Research Methodology

Step 1: Identification of Key Variables

Identification of critical market drivers, barriers, and technologies impacting the Israel Drone Software market.

Step 2: Market Analysis and Construction

Detailed analysis of the current market landscape, segmentation, competitive environment, and emerging trends.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with industry experts to validate findings and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesis of all research findings into a comprehensive report with actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in Drone Technologies

Technological Advancements in AI and Autonomous Systems

Growing Applications in Military and Civilian Sectors - Market Challenges

High Development Costs of Drone Software

Regulatory and Compliance Issues in Drone Operations

Interoperability and Integration Challenges - Market Opportunities

Growing Demand for Drone Software in Agriculture

Rising Adoption of Drones for Environmental Monitoring

Expansion of Drone Use in Infrastructure Inspections - Trends

Rise in AI and Machine Learning Integration

Increasing Use of Drones in Search and Rescue Operations

Technological Innovations in Autonomous Flight Software - Government Regulations & Defense Policy

Data Privacy and Protection Laws

Aerospace Regulations for Civilian Drones

Defense Sector Spending and Support - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Flight Control Systems

Mission Planning & Management Systems

Flight Path Prediction Software

Communication and Data Link Systems

Sensor and Imaging Software - By Platform Type (In Value%)

Fixed-Wing Drones

Rotary-Wing Drones

Hybrid Drones

Nano Drones

Micro Drones - By Fitment Type (In Value%)

Cloud-based Solutions

On-premise Solutions

Hybrid Solutions

Integrated Solutions

Modular Solutions - By EndUser Segment (In Value%)

Military and Defense Agencies

Aerospace and Aviation

Agriculture and Environmental Monitoring

Infrastructure and Construction

Search and Rescue Operations - By Procurement Channel (In Value%)

Direct Procurement

Private Sector Procurement

Government Tenders

Third-party Distributors

Online Bidding Platforms - By Material / Technology (in Value%)

Artificial Intelligence

Machine Learning Algorithms

Computer Vision Technologies

Cloud Computing Platforms

IoT Integration

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Product Innovation, Geographic Reach, Product Portfolio, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Ltd.

Skylock

AeroVironment

Intel Corporation

Thales Group

L3 Technologies

Honeywell International

Textron Inc.

Northrop Grumman

Boeing

Lockheed Martin

General Atomics

- Military and Defense Sectors Increasing UAV Deployments

- Aerospace Industry Adopting Advanced Drone Software

- Agriculture Sector Adopting Drone Monitoring Solutions

- Infrastructure Sector Investing in Drone Inspection Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035