Market Overview

The Israel and Eastern Europe C4ISR market is valued based on recent historical assessments, with the demand driven by advancements in communications, surveillance, and intelligence systems. These systems play a critical role in improving military operations and ensuring national security, with governments prioritizing modernization efforts and defense budgets allocated toward enhancing C4ISR capabilities. The increasing geopolitical tensions and the need for more sophisticated defense mechanisms have also contributed to the market’s growth. Data from trusted sources indicate a strong market value of approximately USD ~ billion in the region. The key countries driving the C4ISR market in this region are Israel, Poland, and Romania, where military modernization programs are heavily focused. Israel, known for its advanced defense technology, leads the region with a significant share due to its robust defense industry and innovation in military technology. Poland and Romania are also critical players, as they continue to invest in defense upgrades due to their strategic locations and regional security concerns. These countries are accelerating defense system procurement, heavily supported by governmental initiatives and defense spending.

Market Segmentation

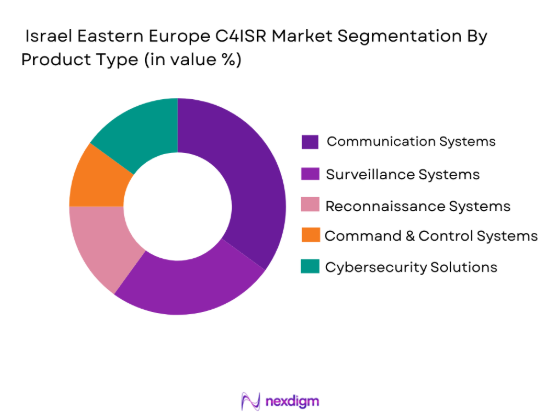

By Product Type

The Israel and Eastern Europe C4ISR market is segmented by product type into communication systems, surveillance systems, reconnaissance systems, command & control systems, and cybersecurity solutions. Recently, communication systems have held the dominant market share due to their vital role in real-time data exchange, mission-critical communication, and interoperability in defense forces. Their ability to ensure seamless operations in multi-platform, multi-domain environments has driven their dominance in the region’s defense sector. Moreover, investments in the latest communication technologies, such as satellite and secure network communications, are pivotal in supporting military operations across the borders of these nations.

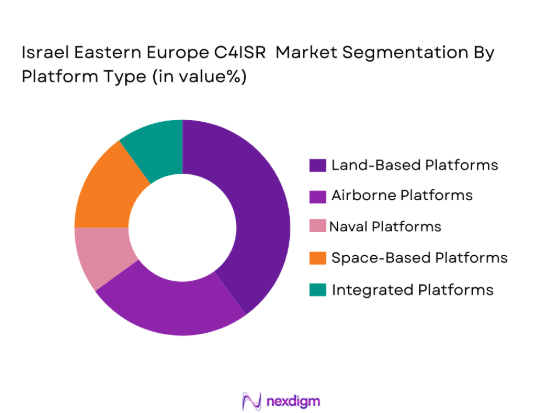

By Platform Type

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space-based platforms, and integrated platforms. The dominance of land-based platforms in the C4ISR market is attributed to their extensive use in defense operations, such as border security and ground operations. These platforms often serve as the backbone of national defense infrastructures, with advanced command centers, communication systems, and reconnaissance capabilities. The integration of these platforms with other systems enhances their overall operational effectiveness, making them indispensable to modern military forces in the region.

Competitive Landscape

The Israel and Eastern Europe C4ISR market has witnessed consolidation through mergers and collaborations between defense contractors and government defense agencies. Major players influence the market with their technological innovations and robust product portfolios, driving the sector’s evolution. Companies like Elbit Systems, Thales Group, and Lockheed Martin lead the competition by introducing cutting-edge solutions in surveillance, communication, and defense systems. The collaboration between private and public entities strengthens market growth, with high demand for advanced C4ISR capabilities.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

Israel Eastern Europe C4ISR Market Analysis

Growth Drivers

Government Investment in Defense Modernization

The substantial government investment in national defense modernization plays a pivotal role in the growth of the C4ISR market. As countries in Israel and Eastern Europe prioritize the modernization of their military forces, C4ISR systems have become essential for enhancing defense operations and national security. Governments have significantly increased their defense budgets to ensure that their forces are equipped with the latest technology, especially to counter emerging threats. This investment is expected to continue as geopolitical instability in neighboring regions further increases the demand for robust defense systems. The modernization of defense infrastructure, including communication, surveillance, and command & control systems, has resulted in a growing reliance on these advanced technologies for real-time data exchange and intelligence gathering. Defense sectors in Israel, Poland, and Romania are especially focused on improving their C4ISR capabilities, thereby fostering market growth. Moreover, the increasing demand for interoperable systems has created a favorable environment for the adoption of cutting-edge C4ISR solutions across the region. These systems enable seamless coordination across different military branches, enhancing operational efficiency and response times. This trend toward modernization and increased government investment in defense continues to push the demand for advanced C4ISR solutions. The focus on technological upgrades and increased security spending reflects the growing priority of military modernization in these nations.

Technological Advancements in C4ISR Systems

Another significant growth driver in the C4ISR market is the continuous technological advancement in systems such as artificial intelligence (AI), machine learning (ML), and cybersecurity. These technologies are revolutionizing how information is processed, analyzed, and acted upon in real-time, leading to more efficient and accurate defense operations. AI and ML are particularly beneficial in enhancing surveillance systems and command & control operations, offering autonomous decision-making capabilities that reduce human error and response time. Moreover, advancements in cybersecurity have become essential to safeguard sensitive military data and communication channels. With cyber threats on the rise, particularly in the context of international conflicts, the demand for secure and resilient C4ISR systems has increased. Furthermore, emerging technologies such as the Internet of Things (IoT) are enabling more connected systems, providing real-time data from various sensors and platforms. This interconnectedness enhances situational awareness, decision-making, and operational success in defense missions. Additionally, the rapid evolution of satellite communication and data encryption technologies further bolsters the effectiveness of C4ISR systems. As these technologies continue to advance, the market for C4ISR systems will see further growth, especially in Eastern Europe, where security concerns continue to rise.

Market Challenges

High Costs of C4ISR System Integration

One of the key challenges in the C4ISR market is the high cost associated with integrating advanced systems. The development and deployment of integrated systems, including communication, surveillance, and command & control technologies, require significant financial resources. For many countries in Israel and Eastern Europe, defense budgets are limited, and allocating substantial portions for the procurement of advanced C4ISR systems presents a challenge. While governments recognize the importance of enhancing defense capabilities, they must balance these investments with other defense priorities, such as personnel training and basic military infrastructure. Moreover, integrating new technologies into existing military frameworks often requires significant infrastructure upgrades, which further adds to the overall cost. These high upfront costs can deter smaller countries or those with limited budgets from adopting the latest C4ISR technologies. In addition, the complexity of system integration presents a barrier, as it requires specialized expertise and long implementation timelines. The integration process also comes with operational risks, including the potential for system failures or miscommunications, which could have serious consequences during critical missions. The cost of long-term maintenance and updates of these systems adds to the financial burden, further complicating the decision-making process for defense agencies.

Regulatory and Compliance Challenges

Regulatory and compliance barriers present another challenge for the C4ISR market. As C4ISR systems involve sensitive data and are essential for national security, these systems must adhere to strict regulations concerning data protection, privacy, and military operations. Each country in the region has its own regulatory framework for defense procurement, which can create complexities for international collaborations and procurement. In particular, the export of C4ISR technologies and systems is often subject to stringent controls and export regulations. For example, Israel’s Defense Export Control Law and the European Union’s export control regulations place limitations on the transfer of advanced defense technologies to non-allied nations. These regulations can delay the procurement and integration of C4ISR systems and increase costs due to the need for compliance with international treaties and agreements. Moreover, the evolving nature of cybersecurity laws and data protection requirements adds further layers of complexity. As a result, defense contractors must navigate an intricate regulatory landscape, which can slow down the development and deployment of C4ISR systems. This challenge is particularly relevant in Eastern Europe, where geopolitical tensions often require swift defense responses that may be hindered by regulatory barriers.

Opportunities

Growing Demand for Autonomous Systems in Defense

The growing demand for autonomous systems presents a significant opportunity for the C4ISR market. With advancements in robotics, drones, and artificial intelligence, there is an increasing need for autonomous systems that can operate without direct human intervention. These systems are becoming critical for surveillance, reconnaissance, and even combat operations, providing a strategic advantage in military operations. In Israel and Eastern Europe, defense agencies are exploring autonomous technologies to enhance their operational capabilities while reducing the risks to human soldiers. These systems can be integrated with C4ISR platforms to improve situational awareness and response times, making them an essential part of modern military operations. Furthermore, autonomous systems can reduce operational costs by replacing human-operated systems and enhancing efficiency. The military’s focus on autonomous platforms, such as drones for surveillance and reconnaissance missions, will drive further investments in C4ISR technologies that enable seamless integration between these platforms. This growing demand for autonomous systems aligns with the broader trend of military modernization in these regions, offering substantial growth potential for the C4ISR market.

Increased Cybersecurity Focus in Military Operations

The increasing focus on cybersecurity within military operations represents another opportunity for the C4ISR market. With the rise of cyber warfare and the growing threat of cyberattacks on critical defense infrastructure, protecting sensitive military data has become a top priority for governments worldwide. In Israel, a global leader in cybersecurity, there is a continued emphasis on developing advanced cybersecurity solutions for defense systems, ensuring the integrity of communication and command networks. Eastern European nations, particularly those in close proximity to potential adversaries, are also ramping up their cybersecurity initiatives. As defense systems become more connected through C4ISR technologies, they become more vulnerable to cyber threats. As a result, the demand for robust cybersecurity solutions tailored for C4ISR systems is expected to grow significantly. This offers a lucrative opportunity for companies specializing in cybersecurity technologies to collaborate with defense agencies in these regions. By integrating advanced cybersecurity measures into C4ISR platforms, these companies can play a key role in enhancing the security and resilience of military networks, which is essential for maintaining national defense capabilities. The growing need for cybersecurity will drive further investments in C4ISR systems, contributing to market expansion.

Future Outlook

The future outlook for the Israel and Eastern Europe C4ISR market over the next five years appears promising, with continuous advancements in technology and significant investments in defense modernization. The integration of AI, machine learning, and advanced cybersecurity solutions into C4ISR systems will continue to enhance operational efficiency and strengthen national security. Moreover, increased government funding and defense spending in these regions, coupled with rising geopolitical tensions, will contribute to the growth of the market. Demand for advanced communication, surveillance, and reconnaissance systems will remain high, with autonomous and integrated platforms becoming more prevalent in military operations. Regulatory support and technological innovations will drive further adoption of cutting-edge solutions in the defense sector.

Major Players

- Elbit Systems

- Thales Group

- Lockheed Martin

- BAE Systems

- Leonardo

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Saab Group

- General Dynamics

- Boeing

- Airbus Defense and Space

- Rheinmetall AG

- Israel Aerospace Industries

- Rockwell Collins

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Technology firms

- Research and development institutions

- Private sector companies

- Aerospace and defense analysts

Research Methodology

Step 1: Identification of Key Variables

Identification of the variables that influence the C4ISR market, including technological advancements, geopolitical risks, and market demand.

Step 2: Market Analysis and Construction

Analysis of the market’s current state and construction of a framework that includes historical data and emerging trends.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with defense experts and stakeholders to validate hypotheses and refine market models.

Step 4: Research Synthesis and Final Output

Synthesis of all collected data into a comprehensive market report, followed by review and final adjustments.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Rising Geopolitical Tensions

Growing Military Modernization Programs

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems

Growing Use of Commercial Off-the-Shelf (COTS) Components

Focus on Data-Driven Defense Decision-Making - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Surveillance Systems

Reconnaissance Systems

Communication Systems

Cybersecurity Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Radar Systems

Optical Systems

Electronic Warfare Systems

Satellite Communication Systems

Cybersecurity Technologies

- Market share snapshot of major players

- Cross Comparison Parameters (Command & Control Systems, Surveillance Systems, Procurement Channel, Fitment Type, Technology Focus, End User, Platform Type, Market Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Thales Group

Lockheed Martin

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035