Market Overview

The Israel Eastern Europe defense market is valued at approximately USD ~ billion, driven by growing military spending in Eastern Europe and increasing demand for advanced defense systems. This market is primarily influenced by geopolitical tensions, technological advancements, and the strengthening of defense alliances between Israel and Eastern European nations. The demand for integrated defense solutions such as cybersecurity, surveillance, and weapon systems is rising, with governments seeking modernization of their military capabilities and infrastructure.

Dominant countries in this market include Israel, Poland, and Hungary, with Israel leveraging its advanced defense technology and expertise to enhance military capabilities in Eastern Europe. Israel’s robust defense exports, alongside Eastern European nations’ strategic positioning near conflict zones, further bolster their dominance. Poland’s significant defense investments and Hungary’s growing military modernization plans contribute to regional defense growth. These nations are prioritizing collaborations and co-development with Israel to enhance their defense infrastructure.

Market Segmentation

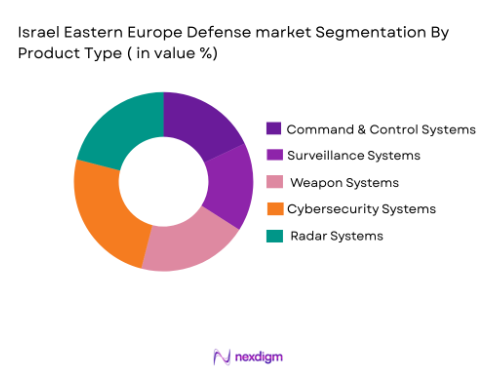

By Product Type

The Israel Eastern Europe defense market is segmented by product type into command & control systems, surveillance systems, weapon systems, cybersecurity systems, and radar systems. Recently, cybersecurity systems have a dominant market share due to increasing cyber threats and the need for robust defense mechanisms. Governments in Eastern Europe are prioritizing cybersecurity to safeguard military data and critical infrastructure, driving the growth of this sub-segment.

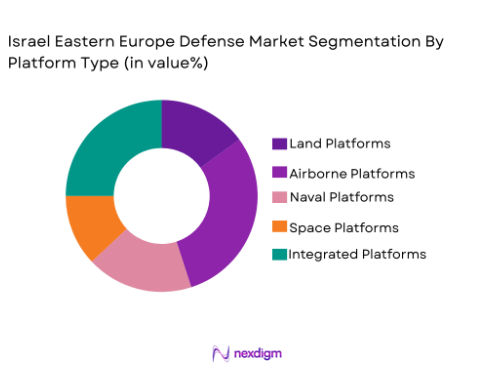

By Platform Type

The Israel Eastern Europe defense market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms are currently leading the market share, as countries in Eastern Europe are focusing on enhancing their air defense capabilities. The rising need for advanced radar and surveillance systems for defense against aerial threats has made airborne platforms the dominant segment in the region.

Competitive Landscape

The competitive landscape of the Israel Eastern Europe defense market is characterized by a mix of established defense giants and specialized defense tech providers. Israel’s dominant defense firms are expanding their presence in Eastern Europe through direct sales and partnerships. Additionally, local manufacturers in Eastern Europe are focusing on modernization efforts, strengthening their product portfolios. Major players in this market include Elbit Systems, Rafael Advanced Defense Systems, and IAI, which are heavily influencing market consolidation through innovation and strategic collaborations.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Regional Partnership |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Eastern Europe defense Market Analysis

Growth Drivers

Increased Government Defense Budgets

Government defense spending in Eastern Europe is significantly driving market growth. As regional security concerns rise, countries like Poland, Romania, and Hungary have substantially increased their defense budgets to modernize and equip their military forces. The shift in defense priorities is focusing on advanced technologies like artificial intelligence, drones, and missile defense systems to address emerging threats from cyber warfare and neighboring geopolitical instability. Moreover, NATO’s presence in the region has been a catalyst for such increased investments. By aligning with NATO standards, Eastern European countries are bolstering their defense systems, leading to an acceleration of procurement and technology adoption. Countries like Poland are expected to continue increasing their defense budgets over the next decade, ensuring sustained growth for the market. Defense budgets not only improve military capabilities but also stimulate growth in the defense-related technology and innovation sectors.

Technological Advancements and Innovation

The continuous development of advanced technologies in Israel is a major growth driver for the Israel Eastern Europe defense market. Israel has been at the forefront of cutting-edge defense technologies, particularly in cybersecurity, UAVs (Unmanned Aerial Vehicles), and C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance). These technologies are seeing rapid adoption in Eastern Europe as nations seek to modernize their defense systems to meet evolving threats. Israel’s ability to develop highly sophisticated yet cost-effective defense solutions has made it a trusted partner for several Eastern European countries. Countries such as Poland and the Czech Republic are leveraging these technologies to enhance their military capabilities, ensuring superior defense systems that are more integrated and responsive. The innovation in unmanned systems and missile defense technologies is pivotal in transforming the defense landscape in Eastern Europe. This trend is expected to continue as both governmental and private sector investments in defense technology grow.

Market Challenges

Political and Economic Instability in Eastern Europe

Political instability and economic challenges in Eastern Europe pose significant hurdles for the defense market. While defense budgets are increasing, several countries in the region face political turbulence, including tensions with neighboring Russia. This instability creates uncertainty around long-term defense procurement strategies, potentially delaying contracts and creating budgetary challenges. Moreover, inconsistent economic growth across the region makes it difficult for certain countries to maintain sustained investments in defense technologies. Countries like Ukraine and Moldova, currently facing external conflicts, have limited resources to allocate toward defense modernization, limiting their ability to procure advanced systems. Political shifts also influence procurement decisions, sometimes leading to inconsistent defense strategies across different Eastern European countries. The lack of political consensus and regional instability may deter foreign investment in defense projects, which could inhibit overall market growth.

Regulatory Compliance and Procurement Barriers

Regulatory hurdles in the defense industry are significant barriers for the Israel Eastern Europe defense market. Defense procurement in Eastern Europe often involves complex legal frameworks and slow decision-making processes. Several countries face challenges with integrating new technologies due to stringent national regulations and compliance requirements. Moreover, export controls and international regulations on defense sales create delays in the transfer of key defense technologies. Countries looking to modernize their defense systems often struggle with navigating these barriers, causing a slowdown in the market. These regulatory challenges, combined with bureaucratic inefficiencies, contribute to delayed procurement timelines, impacting the overall pace of defense modernization. The fragmentation in legal and regulatory standards across Eastern Europe complicates collaboration between countries, leading to inconsistent adoption of advanced defense systems.

Opportunities

Expansion of Israel’s Defense Exports to Eastern Europe

One of the significant opportunities in the Israel Eastern Europe defense market lies in the expansion of Israel’s defense exports. Israel’s established reputation in the defense sector, particularly in the areas of advanced defense systems, cybersecurity, and unmanned systems, positions the country as a crucial supplier to Eastern European nations. As Eastern European countries modernize their military forces and improve infrastructure, Israel is increasingly seen as a key partner for providing advanced defense technologies. The growing security concerns in the region, driven by geopolitical instability, have prompted countries such as Poland and the Baltic States to seek out Israel for advanced defense technologies. This trend is expected to continue as defense contracts expand, creating substantial opportunities for Israeli defense firms. By strengthening partnerships and expanding its technology base, Israel can play an integral role in shaping the future of defense systems in Eastern Europe.

Increasing Demand for Autonomous Defense Systems

Autonomous systems are emerging as a significant opportunity in the Israel Eastern Europe defense market. Unmanned systems, including drones and robotic platforms, are gaining momentum as countries seek to enhance military capabilities while minimizing human risk. Eastern European nations, especially those with limited manpower, are investing in autonomous defense technologies to bolster their military strength. Israel’s leadership in autonomous defense systems presents a prime opportunity for growth, as these technologies are not only cost-effective but also offer superior operational efficiency. Countries like Poland are increasingly investing in UAVs and autonomous weapon systems, which can be deployed in high-risk environments. With the evolution of AI, autonomous systems are becoming more integrated into defense strategies, offering new ways to counter threats while enhancing strategic operations. This trend is expected to expand across the region, providing Israel with increased export opportunities for autonomous defense technologies.

Future Outlook

The future outlook for the Israel Eastern Europe defense market is positive, with continued growth driven by increased defense spending and technological advancements. As countries in Eastern Europe continue to modernize their military forces, Israel’s role as a leading defense technology provider will expand. Technological developments, particularly in the fields of cybersecurity, UAVs, and integrated defense systems, will play a crucial role in shaping the market. Additionally, the strategic importance of Eastern Europe, coupled with continued geopolitical tensions, will ensure that defense remains a high priority for the region. Increased collaboration between Israel and Eastern European nations will foster a robust defense ecosystem, with opportunities for joint development, technology transfer, and long-term contracts.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- BAE Systems

- Northrop Grumman

- General Dynamics

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace and defense companies

- Defense technology providers

- International defense buyers

- Research institutions

Research Methodology

Step 1: Identification of Key Variables

Identify critical market drivers, constraints, and technological trends impacting the Israel Eastern Europe defense market.

Step 2: Market Analysis and Construction

Analyze historical data, industry reports, and interviews with key stakeholders to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Validate key hypotheses regarding market growth through consultations with industry experts and defense analysts.

Step 4: Research Synthesis and Final Output

Synthesize collected data, expert opinions, and market trends into a comprehensive report on the Israel Eastern Europe defense market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Government Defense Budgets

Technological Advancements in Defense Equipment

Rising Geopolitical Tensions in Eastern Europe

Collaborations Between Israel and Eastern European Nations

Growing Threats from Cybersecurity Vulnerabilities - Market Challenges

Political and Economic Instability in Eastern Europe

High Costs of Advanced Defense Systems

Regulatory Compliance and Procurement Barriers

Challenges in Integrating Advanced Technologies

Shortage of Skilled Workforce in Advanced Defense Technologies - Market Opportunities

Expansion of Israel’s Defense Exports to Eastern Europe

Partnerships with Eastern European Nations for Co-Development

Emerging Demand for Autonomous and AI-Driven Systems - Trends

Increased Investment in Cybersecurity for Defense

Integration of AI and Automation in Military Platforms

Rise of Unmanned Aerial Systems in Defense Applications

Shift Toward Modular and Flexible Defense Systems

Growing Interest in Advanced Missile Defense Systems - Government Regulations & Defense Policy

Changes in Export Control Policies

Regulations on the Use of AI in Defense Systems

Government Funding for Defense Innovation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Surveillance Systems

Weapon Systems

Cybersecurity Systems

Radar Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Security Firms

Research Institutes - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Electronic Warfare Technology

Artificial Intelligence Systems

Autonomous Systems

Weaponized Drones

Advanced Materials for Defense

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, End User Segment, Fitment Type, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Lockheed Martin

Thales Group

BAE Systems

Northrop Grumman

Raytheon Technologies

General Dynamics

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Boeing

- Increasing Demand for Advanced Defense Technologies

- Growing Role of Private Contractors in Defense Projects

- Shift Towards Modernization of Armed Forces

- Focus on Cybersecurity in Military Operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035