Market Overview

The Israel electric propulsion satellites market is valued at approximately USD ~ million, driven primarily by technological advancements in satellite propulsion systems. Increasing demand for more efficient and sustainable satellite propulsion solutions, especially in geostationary and low Earth orbit satellites, fuels this growth. This market is significantly propelled by government and defense sector investments, as well as advancements in electric thrusters, such as Hall-effect and ion propulsion systems, offering high efficiency and long-lasting performance for satellite operations.

Israel remains a dominant player in the electric propulsion satellite sector, driven by its robust aerospace and defense industries. The country’s high-tech infrastructure, advanced research capabilities, and active government support make it a global leader in satellite technology development. Furthermore, Israel’s strong partnerships with international space agencies and private sector companies have bolstered its leadership in satellite propulsion systems, making it a key hub for innovation in this field.

Market Segmentation

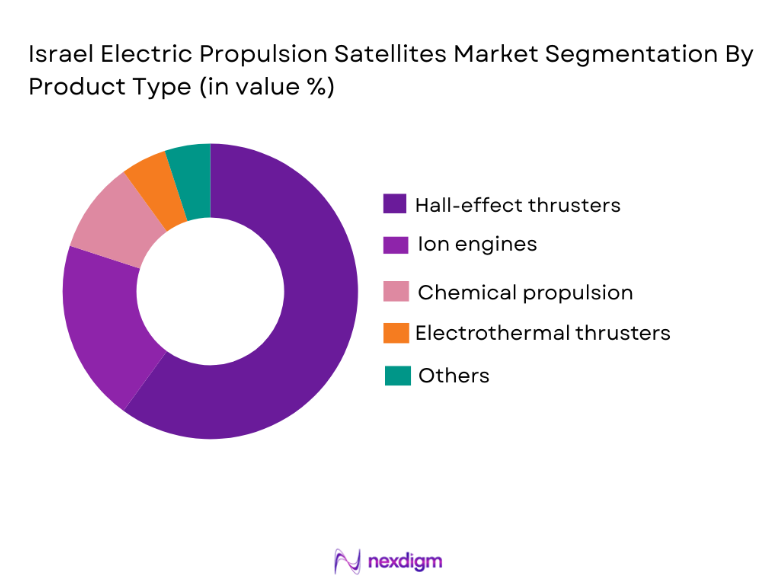

By Product Type

The Israel electric propulsion satellites market is segmented by product type into Hall-effect thrusters, ion engines, electrothermal thrusters, chemical propulsion systems, and others. Hall-effect thrusters dominate the market due to their high efficiency and longer operational lifespans. Ion engines are also gaining popularity for their superior fuel efficiency and precise thrust control. Electrothermal thrusters offer a balance of cost and performance, while chemical propulsion systems, though less efficient, remain relevant for certain satellite applications. Other propulsion types are in the development phase and cater to niche applications.

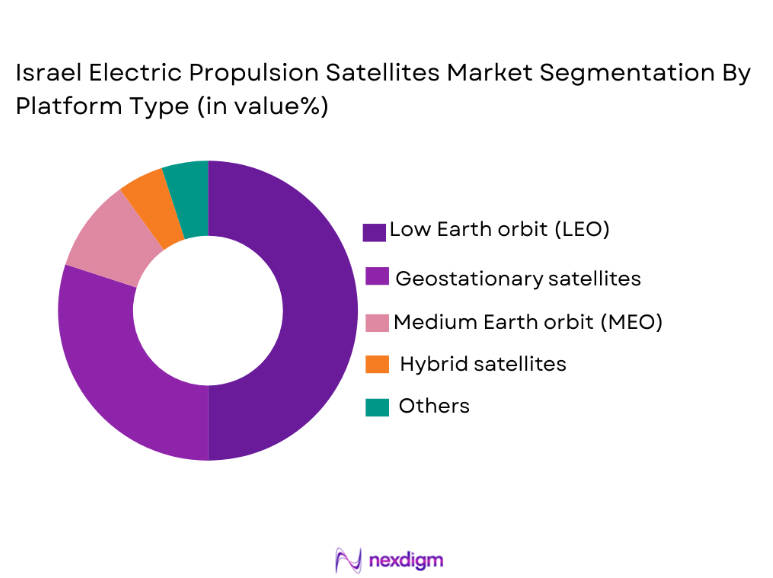

By Platform Type

The market is segmented by platform type into geostationary satellites, low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, hybrid satellites, and others. Low Earth orbit (LEO) satellites lead the market due to the growing demand for communication, Earth observation, and internet services. Geostationary satellites are still relevant for communication applications, while medium Earth orbit (MEO) satellites offer better coverage and reduced latency for certain communication needs. Hybrid platforms combine the benefits of LEO and MEO systems, catering to specific communication and data transmission requirements. The “Others” category includes emerging satellite platforms with specialized functions.

Competitive Landscape

The Israel electric propulsion satellite market is competitive, with significant consolidation taking place as large players continue to expand their capabilities. Major satellite manufacturers, aerospace companies, and government agencies have been driving market growth through strategic collaborations, mergers, and acquisitions. The competition remains intense, especially among companies specializing in advanced propulsion technologies, while governments continue to support innovation through funding and research initiatives.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Rafael Advanced Defense Systems | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Spacecom | 1999 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

| MDA (MacDonald, Dettwiler and Associates) | 1969 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

Israel Electric Propulsion Satellites Market Analysis

Growth Drivers

Technological Advancements in Electric Propulsion

The primary growth driver for the Israel electric propulsion satellite market is the continuous advancements in electric propulsion technology. These developments are being driven by the demand for more fuel-efficient, cost-effective propulsion solutions for satellites, as electric propulsion systems, such as Hall-effect and ion engines, offer significant advantages in terms of fuel savings and longevity. The ability of these systems to provide high thrust efficiency, especially in geostationary orbit and low Earth orbit, has been a significant factor in their growing popularity. Furthermore, the integration of electric propulsion systems allows for more flexible satellite design and efficient management of orbital adjustments, significantly extending the operational lifespan of satellites. The increased use of electric propulsion systems is especially evident in commercial satellite constellations, where cost reductions and improved efficiency are paramount. As satellite manufacturers continue to focus on cost-effective solutions, the adoption of these advanced propulsion technologies is expected to accelerate, driving the market forward.

Government Investments in Space and Defense

Another critical growth driver for the Israel electric propulsion satellite market is the significant investment from the government and defense sectors. The Israeli government has long been a leader in space innovation, with its defense industry heavily involved in the development of satellite technologies. With Israel’s strong focus on security and defense, the need for reliable and efficient satellite systems, particularly those capable of enhancing military and intelligence-gathering capabilities, has spurred investments in advanced propulsion technologies. This investment is particularly important for electric propulsion systems, as they enable more sustainable and long-lasting satellite missions, aligning with national security objectives. Furthermore, Israel’s strategic partnerships with international space agencies and its collaborations with private sector players have helped it remain at the forefront of satellite technology development. Government funding has enabled companies to develop more advanced propulsion solutions, further driving market expansion and ensuring Israel’s continued leadership in satellite technology.

Market Challenges

High Development Costs

One of the significant challenges facing the Israel electric propulsion satellite market is the high development and production costs associated with electric propulsion systems. While these systems offer long-term cost savings, the initial investment required for research, development, and manufacturing remains substantial. The complex technology involved in the development of Hall-effect thrusters and ion engines, coupled with the need for highly specialized materials and components, results in high upfront costs. These high development costs pose a barrier for smaller satellite manufacturers and space startups, limiting their ability to adopt electric propulsion systems. The need for continuous innovation in propulsion technology to ensure that systems remain competitive further adds to the financial burden. While advancements are being made to reduce the cost of production, the challenge of managing high costs remains a critical factor that could slow the adoption of electric propulsion systems in the satellite market.

Technological Integration and Standardization

Another challenge facing the market is the complexity of integrating electric propulsion systems with existing satellite architectures. Unlike traditional chemical propulsion systems, electric propulsion systems require a different approach to system integration, which can result in technical challenges during the design, testing, and deployment stages. Additionally, the lack of standardization across the industry further complicates integration. Manufacturers and operators must ensure compatibility between propulsion systems, satellite payloads, and other subsystems, which often require customized solutions. This lack of uniformity not only increases the time and costs associated with system integration but also poses risks during satellite operations, such as the potential for system failures or inefficiencies. The industry must work towards standardizing propulsion systems to streamline the integration process and reduce costs.

Opportunities

Expansion of Small Satellite Constellations

The rise in demand for small satellite constellations, especially in low Earth orbit (LEO), presents significant opportunities for the Israel electric propulsion satellite market. These constellations, which offer a wide range of services from global communications to Earth observation, require highly efficient propulsion systems to manage the operational demands of large fleets of satellites. Electric propulsion systems are particularly well-suited for these missions due to their fuel efficiency and extended lifespan, making them ideal for managing the frequent orbital maneuvers required by small satellite constellations. As more private companies and government agencies invest in satellite constellations, the need for reliable electric propulsion systems is expected to grow. This growing demand provides significant opportunities for Israeli companies specializing in electric propulsion technology to expand their market presence and capture new business from both commercial and government sectors.

International Collaboration in Space Missions

Another opportunity lies in the increasing collaboration between Israel and other countries in international space missions. As countries around the world invest in space exploration and satellite communication, Israel’s expertise in satellite propulsion systems has made it a valuable partner. The ability to offer advanced electric propulsion systems positions Israeli companies as key players in global space initiatives, particularly those focused on satellite communication, Earth observation, and defense. These partnerships enable Israeli firms to expand their market reach beyond national borders, opening up new revenue streams and opportunities for technological innovation. Moreover, collaborations often bring in funding from international organizations, further supporting the growth of Israel’s electric propulsion satellite industry.

Future Outlook

The future outlook for the Israel electric propulsion satellites market is highly promising, driven by increasing global demand for efficient satellite propulsion technologies. As satellite constellations expand and the demand for more reliable, sustainable propulsion systems grows, electric propulsion is expected to play a central role in satellite development. Advances in technology, coupled with continued investments in the aerospace sector, will ensure that Israel remains at the forefront of electric propulsion innovations, with increasing opportunities for collaboration with international partners.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elbit Systems

- Spacecom

- MDA (MacDonald, Dettwiler and Associates)

- Boeing

- Lockheed Martin

- Northrop Grumman

- Airbus

- Thales Alenia Space

- Rocket Lab

- Virgin Galactic

- Maxar Technologies

- Planet Labs

- Arianespace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Satellite operators

- Defense contractors

- Space agencies

- Private satellite communication providers

- Commercial satellite developers

Research Methodology

Step 1: Identification of Key Variables

Identifying the key variables driving the market, including technological innovations, government regulations, and market trends.

Step 2: Market Analysis and Construction

Analyzing historical data and current trends to construct a market framework, evaluating supply and demand dynamics, and segmenting the market by key criteria.

Step 3: Hypothesis Validation and Expert Consultation

Validating the developed hypotheses through consultations with industry experts, ensuring that the insights gathered align with real-world market behaviors.

Step 4: Research Synthesis and Final Output

Synthesize all collected data, finalize insights, and produce a comprehensive report that outlines key findings, market opportunities, and growth strategies.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Propulsion Systems

Demand for Lower Launch Costs in Satellite Industry

Advances in Space Exploration Technologies

Integration of Green Propulsion in Space Missions

Rising Space-Based Data Transmission Requirements - Market Challenges

High Initial Development Costs of Electric Propulsion

Technical Challenges in Efficiency and Reliability

Regulatory Barriers in Space Propulsion Development

Limited Availability of Experienced Workforce

Dependency on Government and Military Funding - Market Opportunities

Growth in Commercial Space Ventures

Emerging Demand for Small Satellites

Adoption of Electric Propulsion in Mars Exploration - Trends

Increasing Use of Hybrid Propulsion Systems

Shifting from Chemical Propulsion to Electric Systems

Advances in Autonomous Satellite Operations

Integration of AI for Satellite Efficiency

Growing Focus on Sustainable Space Exploration - Government Regulations & Defense Policy

International Space Law and Compliance

Increased Government Funding for Satellite Propulsion

Regulations on Sustainable Propulsion Systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Thrusters

Hybrid Propulsion Systems

Plasma-Based Propulsion Systems

Ion Engines

Hall Effect Thrusters - By Platform Type (In Value%)

Low Earth Orbit Satellites

Geostationary Orbit Satellites

Medium Earth Orbit Satellites

Interplanetary Spacecraft

CubeSats - By Fitment Type (In Value%)

On-Orbit Propulsion

Mission-Critical Propulsion

Small Satellite Propulsion

Space-Based Propulsion

Modular Propulsion Systems - By EndUser Segment (In Value%)

Space Agencies

Commercial Satellite Operators

Military Defense

Telecommunications Companies

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Plasma Propulsion Technology

Electric Thrusters

Magnetic Field-Assisted Technology

Hall Effect Technology

Turbopump Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

SpaceX

Blue Origin

Israel Aerospace Industries

Rocket Lab

Thales Alenia Space

Lockheed Martin

Airbus Defence and Space

Boeing

Northrop Grumman

Maxar Technologies

Orbital Sciences Corporation

Sierra Nevada Corporation

Relativity Space

Momentus Space

ExPace Technologies

- Space Agencies’ Drive for Cost-Effective Missions

- Military Interest in Propulsion Systems for Security

- Commercial Satellite Operators’ Demand for Long-Term Operational Satellites

- Telecommunications Companies’ Need for Efficient Data Transmission

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035