Market Overview

The Israel Electric Unmanned Aerial Vehicle Market is valued at approximately USD ~ billion, driven by increasing defense investments, technological advancements in electric propulsion, and rising demand for UAV applications in surveillance, agriculture, and search & rescue. These factors, combined with the shift towards autonomous and electric UAVs, are pushing the market toward steady growth. The technological evolution of electric propulsion systems allows for enhanced efficiency, reducing the operational cost of UAVs, further expanding their market adoption across various sectors.

Israel has established itself as a dominant player in the electric UAV market due to its strong defense infrastructure, technological innovations, and government support. The country’s leadership in UAV development is driven by collaborations between private companies and the defense sector. The high demand for military and surveillance UAVs, coupled with Israel’s strategic location and expertise in defense technologies, gives the nation a competitive edge, making it a key global player in the electric UAV market.

Market Segmentation

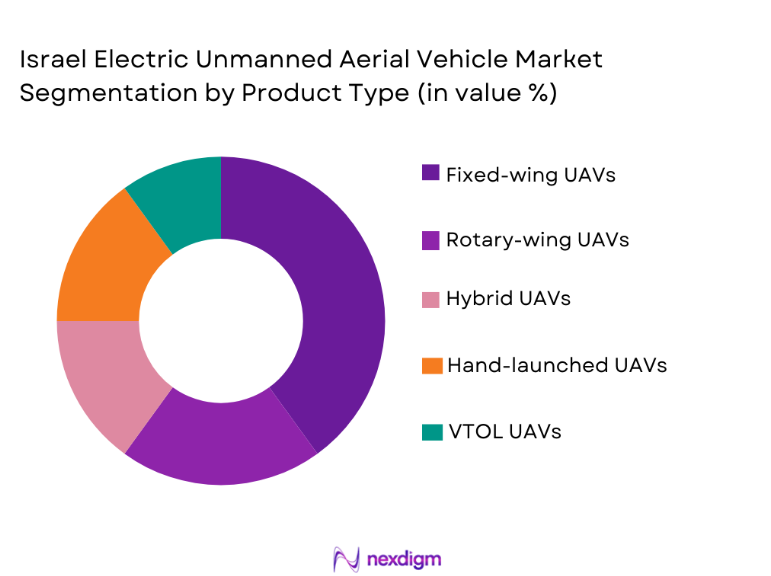

By Product Type

The Israel Electric Unmanned Aerial Vehicle market is segmented by product type into fixed-wing UAVs, rotary-wing UAVs, hybrid UAVs, hand-launched UAVs, and VTOL UAVs. Fixed-wing UAVs dominate the market share due to their long flight endurance and efficiency, making them ideal for military and surveillance applications. These UAVs are preferred for their ability to cover large areas and maintain stable flight over extended periods. Their proven performance in real-world applications, especially in defense and reconnaissance, further solidifies their dominance.

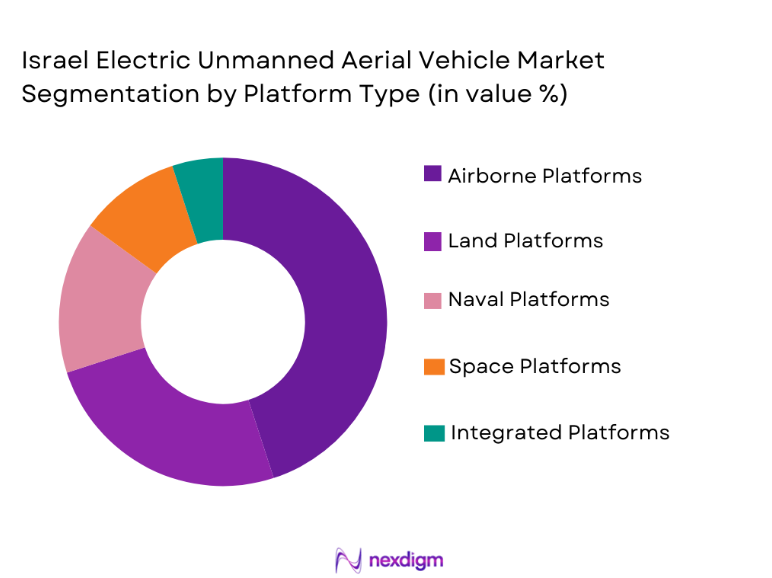

By Platform Type

The market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms currently hold the largest market share, driven by their flexibility and advanced capabilities. Airborne UAVs are particularly sought after in military applications due to their high payload capacity, extended range, and ability to operate in diverse environments. The integration of advanced sensors and AI technologies further boosts the appeal of airborne platforms, ensuring their continued dominance.

Competitive Landscape

The Israel Electric Unmanned Aerial Vehicle market is highly competitive, with major players such as Elbit Systems, IAI, and Rafael Advanced Defense Systems leading the market. These companies are investing heavily in R&D to develop cutting-edge UAV technologies and expand their global footprint. Market consolidation is visible through mergers and partnerships, aiming to leverage synergies in technology and defense infrastructure. The influence of these major players continues to shape the market’s growth trajectory, focusing on both commercial and defense applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | UAV Payload Capacity |

| Elbit Systems | 1966 | Haifa, Israel | ~

|

~

|

~

|

~

|

~

|

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~

|

~

|

~

|

~

|

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~

|

~

|

~

|

~

|

| Aeronautics Defense Systems | 1997 | Yavne, Israel | ~ | ~

|

~

|

~

|

~

|

| RT LTA Systems | 1996 | Herzliya, Israel | ~ | ~

|

~

|

~

|

~

|

Israel Electric Unmanned Aerial Vehicle Market Analysis

Growth Drivers

Government Investments in UAV Technologies

The Israeli government has significantly increased its investments in unmanned aerial vehicle technologies. This surge in funding is primarily directed towards enhancing defense capabilities, as well as exploring commercial applications such as surveillance and agriculture. The government’s support facilitates innovation in the UAV sector, making it a key growth driver. These investments have allowed Israeli companies to lead in research and development, improving the performance of electric UAVs, including greater flight duration and payload capacities, which makes them highly competitive on a global scale. Israel’s strong defense industry focus has led to an increase in the number of contracts and collaborations between the government and private sector, further fueling market growth. In turn, private companies are able to expand their production capabilities, meeting growing demand for both military and commercial UAVs. This influx of government-backed R&D is positioning Israel as a leader in UAV technology.

Technological Advancements in Electric Propulsion

The adoption of electric propulsion in UAVs is a key driver of the market. Recent advancements in battery technology and electric motors have enabled UAVs to fly longer distances with greater efficiency. Electric propulsion offers several benefits, including reduced noise and carbon emissions, which is especially important for surveillance and reconnaissance missions. The shift towards cleaner, more sustainable technology aligns with global trends towards reducing environmental footprints. As electric propulsion systems continue to improve in terms of energy density, charge times, and cost, Israel’s UAV manufacturers are able to offer more competitive and environmentally friendly products. These innovations not only boost the performance of military UAVs but also make them more attractive for commercial uses such as agriculture, environmental monitoring, and disaster relief, further increasing market demand.

Market Challenges

High Production Costs

The high production cost of electric UAVs remains a significant challenge for the market. The complex materials used in the construction of these UAVs, such as lightweight composites and advanced electric motors, contribute to their high cost. In addition, the research and development required to continually improve battery efficiency and flight capabilities adds to the financial burden. For both military and commercial applications, UAV operators must justify the higher initial cost, especially when competing with conventional fuel-powered UAVs that may have lower upfront costs. This cost factor presents a barrier to entry for many smaller companies and organizations looking to adopt UAV technologies, limiting the overall growth of the market. Furthermore, production costs affect the scalability of UAV manufacturing, making it difficult for producers to meet growing demand without passing on the cost to consumers.

Regulatory Hurdles

Another challenge faced by the Israel Electric Unmanned Aerial Vehicle market is the complex regulatory landscape surrounding the use of UAVs. These regulations vary across different regions and may limit the operational scope of UAVs, particularly for commercial uses such as agricultural monitoring or surveillance. In Israel, the civil UAV sector is governed by strict airspace and flight operational regulations, which require UAVs to meet specific safety standards. While the government has been supportive of UAV advancements, the regulatory environment can sometimes be slow to adapt to new technologies. The lack of harmonization between local and international regulations further complicates the export of UAVs, limiting the market’s global expansion. As UAV technology evolves rapidly, it is crucial for regulatory bodies to streamline rules and provide clear guidelines for both manufacturers and users, which is an ongoing challenge.

Opportunities

Integration of AI and Autonomous Systems

One of the significant opportunities for the Israel Electric Unmanned Aerial Vehicle market lies in the integration of artificial intelligence (AI) and autonomous flight systems. As AI continues to evolve, it enables UAVs to operate more independently and efficiently. This technological advancement allows for the automation of flight paths, data analysis, and mission execution, which significantly reduces the need for human intervention. The implementation of autonomous systems enhances the overall safety and operational efficiency of UAVs, making them more appealing to industries such as defense, surveillance, agriculture, and logistics. Moreover, the adoption of AI-based systems in UAVs presents the opportunity for new business models and services, particularly in sectors where automation can offer a competitive edge. As autonomous UAVs become more reliable, their adoption in commercial sectors is expected to increase, expanding the market’s reach.

Expansion into Civil and Commercial Applications

Another opportunity for the market is the expansion of electric UAVs into civil and commercial sectors. Beyond their military applications, electric UAVs are increasingly being used for civilian purposes such as agriculture, infrastructure inspection, and environmental monitoring. The ability of UAVs to operate efficiently in these sectors opens new avenues for growth. As environmental concerns continue to rise, UAVs offer a sustainable solution for industries that require aerial surveillance, crop monitoring, and disaster management. In particular, the adoption of electric UAVs in precision agriculture is seeing significant growth, driven by the increasing need for more efficient and environmentally friendly farming techniques. This trend presents a vast market opportunity for UAV manufacturers to diversify their offerings and expand their customer base into new industries, further driving market growth.

Future Outlook

Over the next five years, the Israel Electric Unmanned Aerial Vehicle market is expected to experience significant growth, driven by advancements in battery technology, government investments, and the integration of AI for autonomous flight. Regulatory support and demand from both military and civilian sectors will also play a key role in shaping the market. The continuous development of electric propulsion systems is anticipated to enhance the capabilities of UAVs, resulting in longer flight times and higher payload capacities. Additionally, expanding applications in sectors like agriculture, surveillance, and logistics will contribute to a broader market adoption, further positioning Israel as a leader in electric UAV technology.

Major Players

- Elbit Systems

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- Aeronautics Defense Systems

- RT LTA Systems

- Bluebird Aero Systems

- Airobotics

- Aerovironment

- Flytrex

- IAI Malat Division

- Skylark UAV

- General Atomics

- Lockheed Martin

- Boeing

- Northrop Grumman

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors and defense ministries

- UAV technology manufacturers

- Aerospace and defense technology suppliers

- Commercial surveillance companies

- Environmental monitoring agencies

- Agricultural technology firms

Research Methodology

Step 1: Identification of Key Variables

The identification of key variables involves understanding the factors influencing the UAV market, including technological trends, regulatory developments, and market demand drivers.

Step 2: Market Analysis and Construction

In this step, detailed data is gathered to understand the market’s size, key segments, and competitive landscape. This helps construct a model that reflects real-time market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by consulting with industry experts, including manufacturers, analysts, and stakeholders, to ensure the accuracy of the gathered data.

Step 4: Research Synthesis and Final Output

All the data collected is synthesized into a comprehensive report, which includes actionable insights and strategic recommendations for stakeholders in the UAV market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Electric Propulsion

Government Investments in Defense Technologies

Rising Demand for Surveillance and Monitoring Solutions - Market Challenges

High Capital Investment for UAV Technologies

Regulatory Challenges in UAV Deployment

Limited Battery Life for Extended Flight Times - Market Opportunities

Integration of AI for Autonomous Flight

Expansion of UAVs in Commercial Sectors

Development of Long-endurance Battery Solutions - Trends

Growth in Hybrid Electric UAV Adoption

Increased Use of UAVs for Precision Agriculture

Advancements in Energy-efficient UAV Technologies - Government Regulations

Drone Safety and Airspace Management Regulations

Government Standards for Military UAVs

Export Control Regulations on UAV Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Flight Control Systems

Payload Systems

Communication Systems

Navigation Systems - By Platform Type (In Value%)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid UAVs

Hand-launched UAVs

Vertical Take-Off and Landing (VTOL) UAVs - By Fitment Type (In Value%)

Onboard Systems

Payload Integration

Communication Integration

Autonomous Systems

Battery Systems - By EndUser Segment (In Value%)

Military & Defense

Agriculture

Surveillance & Reconnaissance

Search & Rescue

Environmental Monitoring - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Platforms

Third-party Distributors

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Battery Life, Payload Capacity, Flight Range, Cost, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Aeronautics Defense Systems

Rafael Advanced Defense Systems

IAI Malat Division

Skycore UAVs

Elbit Hermes

Bluebird Aero Systems

RT LTA Systems

Aeroscout

UTM Systems

AeroVironment Israel

Flytrex

Airobotics

Automodular

- Increasing Use of UAVs in Military Surveillance

- Rising Adoption of UAVs in Agricultural Monitoring

- Government Agencies Expanding UAV Operations

- Private Sector Interest in Commercial UAV Applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035