Market Overview

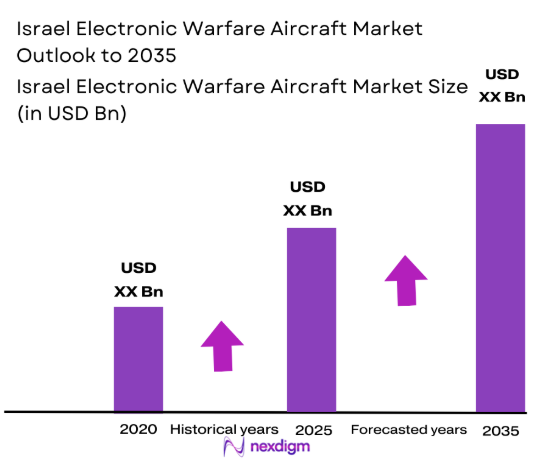

The Israel Electronic Warfare Aircraft Market is valued at approximately USD ~ billion based on a recent historical assessment. This market is driven by the increasing demand for advanced electronic warfare capabilities, heightened security concerns, and the rising geopolitical tensions in the region. With rapid technological advancements in electronic warfare systems, Israel remains a leader in the development and deployment of these systems, addressing both national security requirements and global military partnerships. The growth of the defense sector is supported by robust government spending on military modernization and technology integration.

Israel, the dominant player in the Electronic Warfare Aircraft Market, benefits from its strategic geopolitical position and strong defense infrastructure. The country’s defense policies are reinforced by its partnerships with global defense powers, contributing to its dominance. Israel’s defense industry is highly advanced, with continuous investment in cutting-edge technologies, including cyber defense and electronic warfare. This focus has positioned Israel as a key player, catering to both national defense needs and international demand for sophisticated military solutions.

Market Segmentation

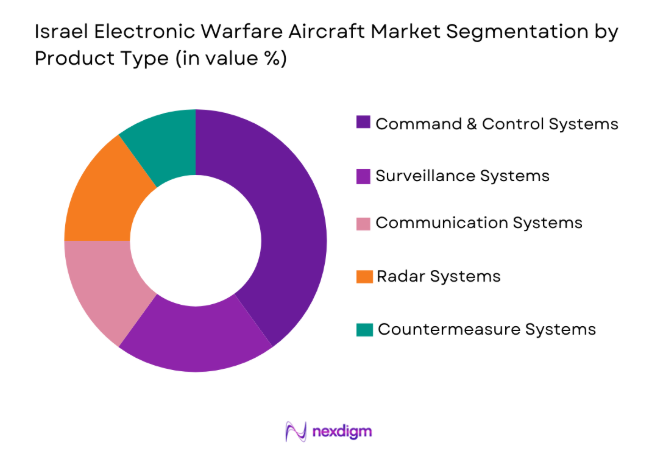

By Product Type:

Israel Electronic Warfare Aircraft Market is segmented by product type into various systems such as command & control systems, surveillance systems, communication systems, radar systems, and countermeasure systems. Recently, countermeasure systems have a dominant market share due to the growing demand for protection against emerging threats such as anti-aircraft missiles and electronic jamming technologies. The increasing sophistication of warfare strategies and the necessity for advanced defense solutions have fueled the demand for these systems. Countermeasures are critical in safeguarding both manned and unmanned aerial platforms, contributing significantly to market growth.

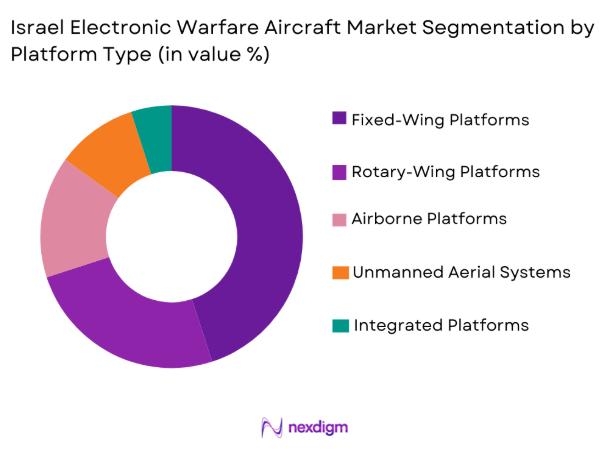

By Platform Type:

The market is segmented by platform type, including airborne platforms, fixed-wing platforms, rotary-wing platforms, unmanned aerial systems (UAS), and integrated platforms. Airborne platforms hold a dominant share, primarily due to the extensive use of electronic warfare aircraft in defense and surveillance operations. The ability to operate across multiple terrains, the reliability of these platforms in combat, and the continuous technological advancements in sensor integration and real-time data analysis make airborne platforms a preferred choice for defense forces globally.

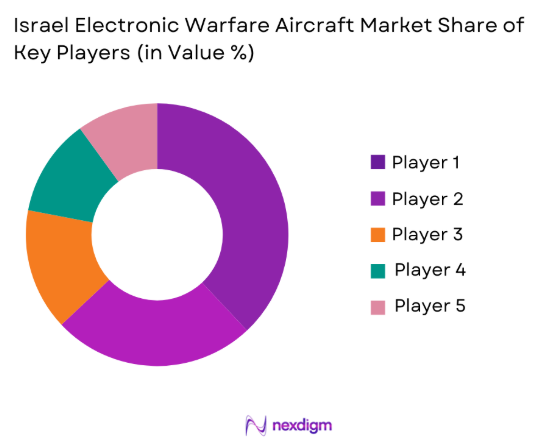

Competitive Landscape

The Israel Electronic Warfare Aircraft Market is characterized by a competitive landscape dominated by a few major players with advanced technological capabilities. Consolidation in the market has led to significant advancements in system integration, with major players expanding their portfolios to offer comprehensive defense solutions. Israel’s focus on cutting-edge technologies and military innovation drives this competition, creating opportunities for both local and international firms to cater to defense needs globally.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Strategic Partnerships |

| Elbit Systems | 1966 | Israel | ~

|

~

|

~

|

~

|

~

|

| Israel Aerospace Industries | 1953 | Israel | ~ | ~

|

~

|

~

|

~

|

| Rafael Advanced Defense Systems | 1984 | Israel | ~ | ~

|

~

|

~

|

~

|

| Lockheed Martin | 1912 | USA | ~ | ~

|

~

|

~

|

~

|

| Northrop Grumman | 1939 | USA | ~ | ~

|

~

|

~

|

~

|

Israel Electronic Warfare Aircraft Market Analysis

Growth Drivers

Technological Advancements in Electronic Warfare:

Technological advancements in electronic warfare are a crucial driver of the Israel Electronic Warfare Aircraft Market. As military strategies continue to evolve, there is a growing demand for more sophisticated systems that can effectively address modern threats. Innovations in radar, communication jamming, and cyber defense technologies have allowed electronic warfare aircraft to offer enhanced protection and operational capabilities. The integration of artificial intelligence (AI) and machine learning in these systems is enabling faster decision-making and more precise countermeasures. Furthermore, the ability to integrate these advancements into existing platforms has made it easier for defense forces to upgrade their systems without requiring a complete overhaul of infrastructure. Israel’s leadership in these technologies has solidified its role as a key player in global defense markets, where the demand for advanced electronic warfare solutions is growing. The continuous investment in research and development (R&D) ensures that the country remains at the forefront of these technological advancements.

Rising Geopolitical Tensions:

Geopolitical tensions and regional instability are driving the demand for advanced electronic warfare capabilities, significantly contributing to the Israel Electronic Warfare Aircraft Market. Israel, strategically located in the Middle East, faces ongoing security challenges, making electronic warfare aircraft essential for its defense strategy. With neighboring countries experiencing instability and technological advancements in military weaponry, there is an increasing need for robust defense systems capable of intercepting, neutralizing, or disrupting enemy technologies. As global conflicts and regional tensions persist, the demand for electronic warfare solutions to defend against electronic attacks, cyber warfare, and missile threats is rising. Countries in volatile regions, including Israel, require advanced systems to secure their airspace, communications, and military infrastructure. The growing recognition of electronic warfare as a critical component of modern military operations further fuels market growth. This geopolitical landscape ensures that countries will continue investing heavily in electronic warfare capabilities, with Israel playing a leading role in supplying such systems globally.

Market Challenges

High Capital Expenditure in Defense Projects:

One of the primary challenges faced by the Israel Electronic Warfare Aircraft Market is the high capital expenditure required for defense projects. Developing, manufacturing, and deploying electronic warfare aircraft demands significant financial investments due to the complexity and high-tech nature of the systems involved. The cost of acquiring cutting-edge components, advanced sensors, and specialized equipment adds to the financial burden. Additionally, long-term maintenance and operational costs further escalate the overall expenditure for governments and military forces. For many countries, these financial constraints can limit their ability to adopt the latest electronic warfare technologies, especially if they are already investing in other defense initiatives. While Israel’s defense budget enables it to continue innovating and producing these advanced systems, international customers, particularly those with smaller defense budgets, may find it difficult to afford the necessary solutions. This high cost presents a barrier to entry for many potential customers in the global market, restricting market growth.

Cybersecurity Threats and Vulnerabilities:

As electronic warfare systems become more integrated with communication networks and data systems, the risk of cybersecurity threats increases, posing a significant challenge to the Israel Electronic Warfare Aircraft Market. The increasing reliance on interconnected systems makes these platforms vulnerable to hacking, cyber-attacks, and data breaches. The potential for adversaries to compromise electronic warfare capabilities or interfere with critical systems heightens concerns among military forces worldwide. To mitigate these risks, robust cybersecurity measures are essential, but implementing these protections can be complex and costly. Additionally, as adversaries improve their cyber capabilities, defense systems must constantly evolve to stay ahead of potential threats. Israel, known for its strong cybersecurity capabilities, faces the challenge of ensuring that its advanced electronic warfare aircraft remain secure from cyber threats. As cyber vulnerabilities continue to grow, military forces will need to invest not only in electronic warfare systems but also in cybersecurity infrastructure to safeguard against evolving risks.

Opportunities

Emerging Demand for Autonomous Electronic Warfare Aircraft:

The increasing demand for autonomous electronic warfare aircraft presents a significant opportunity for the market. Unmanned aerial systems (UAS) and autonomous platforms are gaining popularity in military applications due to their ability to operate with minimal human intervention, reducing risk to personnel while enhancing mission effectiveness. These systems are capable of executing complex electronic warfare tasks such as surveillance, signal jamming, and communication disruption without the need for constant human oversight. Autonomous platforms can also stay operational for longer durations, conducting missions in high-risk environments or hostile regions without endangering pilots. As the global defense industry recognizes the strategic advantages of these systems, demand is expected to rise, particularly for cost-effective, versatile platforms. Israel, already a leader in autonomous technology, is well-positioned to capitalize on this trend by continuing to innovate in the development of autonomous electronic warfare aircraft. The growth in unmanned and autonomous systems presents a key opportunity for expansion in both domestic and international markets.

Integration of Commercial Technologies into Defense Systems:

The integration of commercial technologies into defense systems presents a unique opportunity in the Israel Electronic Warfare Aircraft Market. Many advancements in computing, artificial intelligence, machine learning, and data analytics originally developed for the commercial sector are now being adapted for military applications. This trend helps reduce the cost and development time for defense systems, while also enhancing their capabilities. Commercial off-the-shelf (COTS) technology can improve the processing power, communications, and decision-making speed of electronic warfare systems. This integration can make sophisticated systems more affordable and accessible for military forces that need to enhance their defense capabilities but face budget constraints. Israel’s defense industry has been quick to adopt and integrate these commercial innovations, enhancing the value proposition of its electronic warfare systems. The use of COTS technology also allows Israel to stay at the cutting edge of defense technology while ensuring that its systems remain relevant in the rapidly changing landscape of modern warfare. This trend presents significant opportunities for growth within the market.

Future Outlook

The future of the Israel Electronic Warfare Aircraft Market is poised for significant growth, driven by advancements in technology, growing military modernization efforts, and the expanding global need for electronic warfare capabilities. Over the next five years, the market is expected to see increased demand for AI-driven systems, autonomous aircraft, and enhanced cybersecurity measures. Israel’s defense industry will continue to lead in innovation, with both regional and global military forces increasingly turning to advanced electronic warfare solutions. The collaboration between defense contractors and governments will further propel market growth, with more countries seeking cutting-edge technologies to strengthen their defense systems.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Thales Group

- L3 Technologies

- Raytheon Technologies

- Leonardo

- Harris Corporation

- General Dynamics

- Saab Group

- Rheinmetall AG

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace manufacturers

- Technology integrators

- Security services

- Private defense firms

- International defense organizations

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that drive the market, including technological advancements, government spending, and geopolitical factors. We analyze these variables through historical data and market trends to understand their impact on market dynamics.

Step 2: Market Analysis and Construction

In this step, we construct a detailed analysis of the market by segmenting it into product types, platform types, and end-users. We focus on gathering primary and secondary data from reliable sources to map out current market trends.

Step 3: Hypothesis Validation and Expert Consultation

After constructing the initial market model, we validate hypotheses through consultations with industry experts, government officials, and market leaders. This ensures the accuracy of our findings and refines the market analysis.

Step 4: Research Synthesis and Final Output

In this final step, we synthesize all research findings into a comprehensive report. This includes integrating insights from expert consultations,

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Electronic Warfare

Rising Geopolitical Tensions

Growing Military Modernization Programs - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Technological Integration and Interoperability Issues - Market Opportunities

Emerging Demand for Autonomous Electronic Warfare Aircraft

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Integration of Commercial Technologies into Defense Systems - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Electronic Warfare

Surge in Cybersecurity Investments for Defense Systems - Government Regulations

Export Control and Compliance Policies

Government Funding and Grants for Electronic Warfare Technologies

Data Protection and Privacy Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Communication Systems

Surveillance Systems

Countermeasure Systems

Radar Systems - By Platform Type (In Value%)

Airborne Platforms

Helicopter Platforms

Unmanned Aerial Systems (UAS)

Fixed-Wing Platforms

Rotary-Wing Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Sector / Technology Firms

Security Services - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Geographical Reach, Price, Brand Reputation, Customer Loyalty)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Elbit Systems

BAE Systems

General Dynamics

Leonardo

Thales Group

L3 Technologies

Harris Corporation

Saab Group

Rheinmetall AG

Boeing

Sikorsky Aircraft

Leonardo DRS

- Military Forces’ Increasing Demand for Electronic Warfare Aircraft

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035