Market Overview

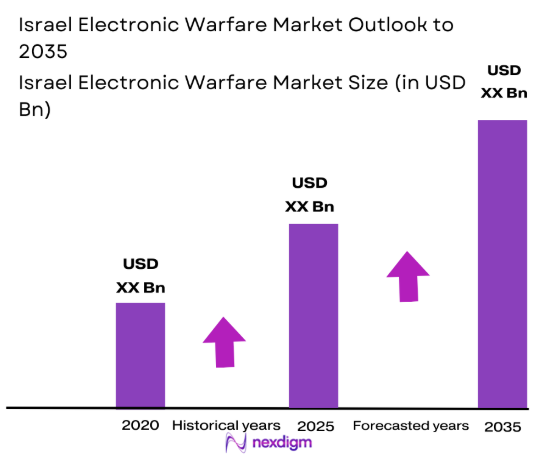

The Israel electronic warfare market is valued at USD ~ billion based on a recent historical assessment, driven by increasing demand for defense technologies in the Middle East. This market is fueled by continuous advancements in military technology, growing investments in security infrastructure, and an increasing focus on countering cybersecurity threats. Israel’s strategic location and robust defense budget further contribute to the growth, with strong government initiatives and partnerships between the public and private sectors.

Dominant players in the Israel electronic warfare market are concentrated in Tel Aviv, Haifa, and other key cities. Israel’s position as a global leader in defense technology has solidified its dominance, driven by its strong military base, highly skilled workforce, and innovation in defense systems. The government’s support for technological research and development, combined with international demand for advanced military solutions, solidifies Israel’s leadership in this sector.

Market Segmentation

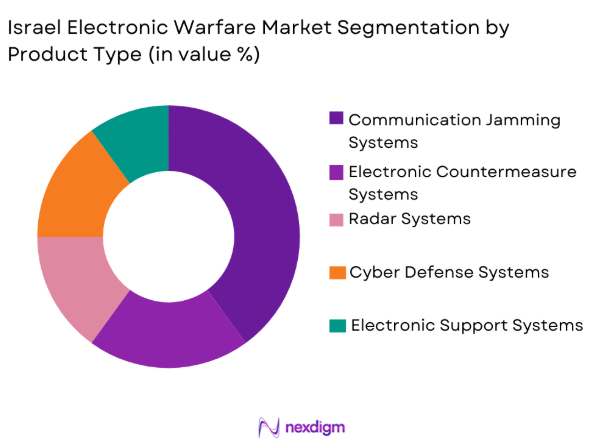

By Product Type:

The Israel electronic warfare market is segmented by product type into communication jamming systems, electronic countermeasure systems, radar systems, cyber defense systems, and electronic support systems. Recently, communication jamming systems have captured a dominant market share. This is due to their critical role in counteracting enemy communications, which are increasingly targeted in modern warfare. Their application spans military forces and defense contractors, driven by growing demand for anti-drone and anti-ISR (intelligence, surveillance, reconnaissance) systems.

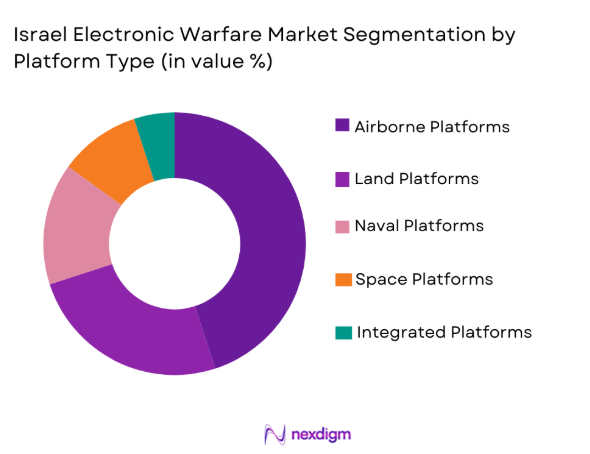

By Platform Type:

The Israel electronic warfare market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have had a dominant market share, attributed to the country’s advanced air defense systems and a strong focus on unmanned aerial vehicles (UAVs). These platforms are integral to Israel’s strategy, offering flexibility in operations across both defense and offensive missions. The strong growth in UAV and drone usage has fueled this segment’s dominance.

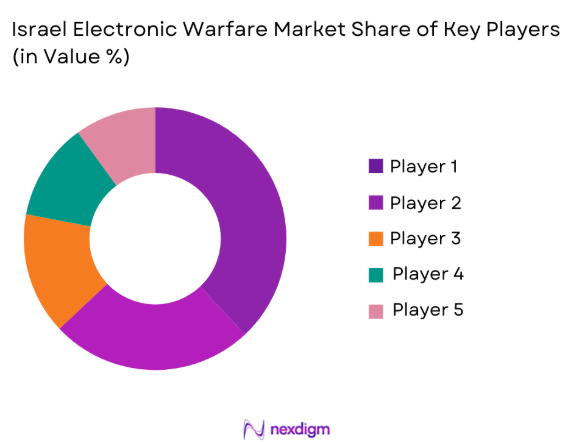

Competitive Landscape

The competitive landscape in the Israel electronic warfare market is dynamic, with several leading defense companies at the forefront of innovation. Consolidation in the industry has led to a few dominant players controlling a significant portion of the market share. These companies have extensive research and development capabilities, enabling them to produce cutting-edge solutions in the electronic warfare space. Israel’s favorable defense policies and extensive military contracts with other countries further boost these companies’ market positions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IAI (Israel Aerospace Industries) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Israel Electronic Warfare Market Analysis

Growth Drivers

Increase in Military Spending:

The increase in military spending has significantly contributed to the growth of the Israel electronic warfare market. As nations across the globe, particularly in the Middle East, focus on enhancing their defense capabilities, Israel’s defense budget has witnessed steady growth. This funding has been allocated to research and development, particularly in the areas of electronic warfare, radar systems, and communication jamming. The escalating geopolitical tensions in the region have further intensified Israel’s need to invest in advanced military technologies to safeguard national security. Alongside government funding, private sector investments have surged, facilitating technological innovations. Israel’s robust defense industry, comprising various defense contractors and military suppliers, also benefits from these spending increases. These advancements allow the market to continually evolve with the integration of cutting-edge technologies, which strengthens its competitiveness. Additionally, military modernization programs and demand for state-of-the-art warfare solutions are expected to increase military expenditures globally, further benefiting Israel’s defense sector.

Technological Advancements in EW Systems:

Technological advancements in electronic warfare systems have acted as a significant driver for Israel’s market growth. As electronic warfare becomes an essential element in modern military strategies, Israel’s industry leaders have pioneered innovations in communication jamming, signal intelligence, and radar systems. Research and development activities have enabled the creation of next-generation systems that can operate in increasingly complex and dynamic combat environments. AI integration, machine learning, and advanced signal processing technologies have allowed for real-time responses and more precise operations. The rapid growth in cyber warfare and counter-UAV systems has also influenced the expansion of electronic warfare technologies in Israel. As Israel continues to be a global leader in defense innovation, these advancements, coupled with its geopolitical challenges, ensure the demand for electronic warfare solutions will remain high in the coming years.

Market Challenges

Cybersecurity Vulnerabilities in EW Systems:

Cybersecurity vulnerabilities in electronic warfare systems represent a major challenge for Israel’s defense sector. As the world becomes more interconnected, electronic warfare systems are increasingly reliant on software and networks, making them susceptible to cyberattacks. Israel, despite being a global leader in cybersecurity, faces the challenge of ensuring that its advanced military technologies are protected from hackers and other adversarial forces. Given that EW systems often rely on signal interception and jamming, the security of the communication infrastructure becomes paramount. A breach in these systems could undermine their effectiveness and compromise national security. Additionally, the increasing integration of AI and machine learning in EW systems opens up new avenues for cyber threats. As such, it is crucial for Israel’s defense contractors to invest in robust cybersecurity measures to safeguard these critical technologies from exploitation or disruption.

High Cost of Advanced EW Systems:

The high cost of developing and deploying advanced electronic warfare systems remains a challenge for Israel’s defense industry. Despite significant government support and international demand, the capital-intensive nature of EW technologies poses a barrier to entry for smaller players and developing nations. The cost of producing sophisticated systems such as advanced radar equipment, communication jammers, and AI-driven countermeasures is substantial. For countries with limited defense budgets, it can be difficult to allocate sufficient funds for such high-tech investments, leading to reliance on foreign imports or less advanced systems. Israel’s defense contractors must continue to focus on cost optimization and scalable solutions to overcome these barriers while maintaining the performance and reliability of their products. As the demand for electronic warfare systems rises, finding cost-effective ways to produce and deploy these technologies will be crucial for maintaining global competitiveness.

Opportunities

Expansion of Counter-UAV Systems:

One significant opportunity for Israel’s electronic warfare market lies in the expansion of counter-unmanned aerial vehicle (C-UAV) systems. With the proliferation of drones and UAVs being used in modern warfare, the demand for advanced countermeasures has increased. Israel, a pioneer in UAV technology, is well-positioned to leverage its expertise to develop electronic warfare systems that can effectively neutralize these threats. The development of sophisticated C-UAV systems, incorporating radar jamming, signal disruption, and interception technology, presents a substantial growth opportunity for Israel’s defense industry. These systems are already being integrated into Israel’s military and are becoming increasingly important in defense contracts across the world. As the use of drones by non-state actors and adversarial forces rises, Israel’s technological expertise in counter-UAV systems offers a significant opportunity for market expansion and leadership in the coming years.

Partnerships with International Defense Contractors:

Partnerships with international defense contractors provide a major opportunity for the expansion of Israel’s electronic warfare market. Israel’s defense contractors, such as Elbit Systems and Rafael Advanced Defense Systems, have forged strong collaborations with global defense giants. These partnerships allow Israel to access new markets and expand its footprint beyond the Middle East. As geopolitical tensions rise globally, demand for advanced military systems, including EW technologies, is increasing. Israel’s reputation for high-quality defense systems positions it as a key partner for international defense contractors seeking to enhance their product offerings. These collaborations often involve the sharing of technology, knowledge, and expertise, enabling Israel to remain at the forefront of innovation. Moreover, these partnerships create new revenue streams and market opportunities for Israeli defense firms, contributing to the overall growth of the electronic warfare sector.

Future Outlook

Over the next five years, the Israel electronic warfare market is expected to continue its upward trajectory, driven by increasing demand for advanced defense systems, particularly in counter-UAV technologies. Technological innovations, including the integration of AI, machine learning, and quantum technologies, will further enhance the capabilities of Israel’s EW systems. The government’s commitment to supporting the defense sector, combined with international partnerships, will continue to propel the market’s growth. As Israel maintains its leadership in electronic warfare, global demand for its solutions will expand, especially in regions facing rising security threats.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- IAI (Israel Aerospace Industries)

- Raytheon Technologies

- Lockheed Martin

- Thales Group

- Leonardo

- L3 Technologies

- Harris Corporation

- BAE Systems

- Northrop Grumman

- General Dynamics

- Kratos Defense & Security Solutions

- Saab Group

- Kongsberg Gruppen

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace and defense companies

- Electronics manufacturers

- Cybersecurity firms

- International defense agencies

- Military research and development teams

Research Methodology

Step 1: Identification of Key Variables

In this step, we identify critical factors influencing the Israel electronic warfare market, such as technological advancements, geopolitical risks, and government spending on defense.

Step 2: Market Analysis and Construction

We analyze existing market data, historical trends, and competitive landscapes to construct a comprehensive model for market performance, considering product types and platforms.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses by consulting experts, conducting interviews with industry leaders, and gathering data from government sources and private sector reports.

Step 4: Research Synthesis and Final Output

We synthesize all collected data to generate actionable insights, finalizing the market report with accurate forecasts and clear strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Budgets and Investments

Rising Cybersecurity Threats

Technological Advancements in Communication Jamming

Escalating Geopolitical Tensions in the Middle East

Growing Demand for Anti-Drone Systems - Market Challenges

High Capital Investment Requirements

Technological Integration and Interoperability Issues

Cybersecurity Vulnerabilities in EW Systems

Regulatory Compliance Challenges

Limited Awareness in Developing Regions - Market Opportunities

Expansion in AI-Driven Electronic Warfare Systems

Rising Demand for Counter-UAS Solutions

Partnerships with Private Tech Firms for Advanced Jamming Systems - Trends

Integration of AI and Machine Learning in EW Systems

Increased Military Focus on Autonomous EW Platforms

Growing Interest in Portable and Mobile EW Solutions

Shift Toward Cloud-Based EW Systems

Emerging Adoption of Quantum Technologies in EW - Government Regulations & Defense Policy

Export Control Regulations for EW Technologies

Cybersecurity Laws and Standards for Defense Electronics

Government Funding for Next-Gen Electronic Warfare Solutions - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electronic Countermeasure Systems

Electronic Support Systems

Electronic Attack Systems

Signal Intelligence Systems

Communication Jamming Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Signal Processors

Jamming Technology

Radars and Sensors

Software Solutions

Power Amplifiers

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology Adoption, Innovation Rate, Cost Competitiveness, Regional Presence, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

IAI (Israel Aerospace Industries)

Raytheon Technologies

Lockheed Martin

BAE Systems

Northrop Grumman

Thales Group

Leonardo

L3 Technologies

Harris Corporation

General Dynamics

Kratos Defense & Security Solutions

Saab Group

Kongsberg Gruppen

- Increased Demand for Electronic Warfare Systems by Military Forces

- Adoption of EW Solutions in Government Agencies for National Security

- Defense Contractors’ Role in Developing Advanced EW Technologies

- Private Sector’s Growing Interest in EW for Cybersecurity and Protection

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035