Market Overview

The Israel Electronically Scanned Array Radar market is poised for significant growth, driven by increasing defense investments and technological advancements. As of recent evaluations, the market size is estimated to be USD ~ billion, primarily supported by rising demand for advanced radar systems in military applications. The need for modernized defense infrastructure and surveillance capabilities further propels the growth of the electronically scanned array radar segment. The market’s expansion is also influenced by innovations such as phased array radar technology, leading to more precise detection and tracking capabilities. The advancements in radar technology, combined with robust government spending, make Israel a leading player in the global radar market.

The dominance of Israel in this market can be attributed to its well-established defense sector and cutting-edge technological innovations in radar systems. Israel has a robust aerospace and defense industry, driven by both public and private sector collaboration. Major cities such as Tel Aviv, known for its high-tech infrastructure, and the defense-centric city of Haifa, contribute significantly to the country’s radar technology development. Furthermore, the country’s geopolitical situation, with a strong focus on national security and defense, has led to continual investment in radar systems, positioning Israel as a global leader in radar technologies.

Market Segmentation

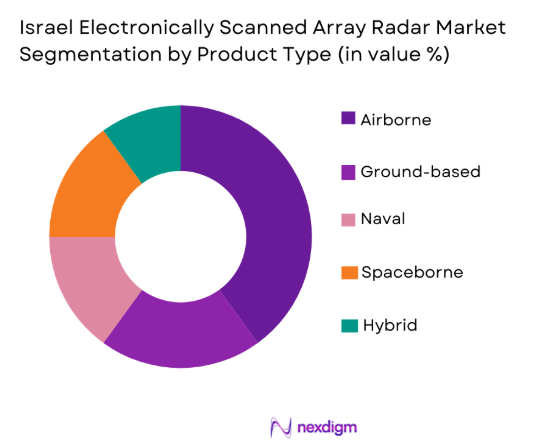

By Product Type:

The Israel Electronically Scanned Array Radar market is segmented by product type into airborne, ground-based, naval, spaceborne, and hybrid systems. Recently, airborne radar systems have shown a dominant market share due to the high demand for advanced surveillance, detection, and communication capabilities. Airborne radar systems are primarily used for military applications, including intelligence, surveillance, reconnaissance, and target acquisition, where they play a vital role in providing real-time data. The dominance of this sub-segment is due to the growing need for mobile, adaptable systems that can be deployed quickly in various military scenarios. Additionally, Israel’s strong aerospace sector and partnerships with defense organizations have positioned airborne radar as a key player in the country’s defense strategy.

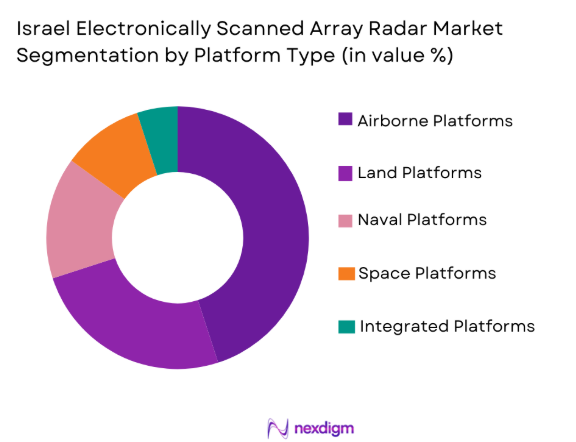

By Platform Type:

The Israel Electronically Scanned Array Radar market is segmented by platform type into land, airborne, naval, space, and integrated platforms. Among these, airborne platforms currently lead the market due to their versatility and superior capability for surveillance and defense applications. These platforms can be deployed quickly in response to emerging threats, offering the military critical real-time intelligence. The widespread adoption of drones and manned aircraft equipped with advanced radar technology has further boosted airborne platforms’ dominance. With advancements in unmanned aerial vehicles (UAVs) and integration with other high-tech systems, this sub-segment continues to evolve, making it a strategic focus in Israel’s defense modernization initiatives.

Competitive Landscape

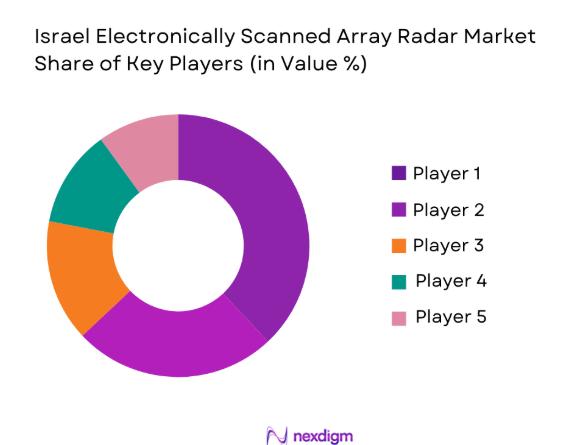

The competitive landscape of the Israel Electronically Scanned Array Radar market is highly influenced by both domestic and international players. Israel’s domestic companies dominate the market, thanks to strong collaborations between government and private defense contractors. The presence of major defense corporations such as Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries ensures a competitive and technologically advanced market. There has been an ongoing trend of consolidation and strategic partnerships, with companies continuously investing in R&D to enhance their radar technology offerings and maintain a competitive edge in the global defense market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment (%) |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| IAI Elta Systems | 1974 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Israel Electronically Scanned Array Radar Market Analysis

Growth Drivers

Government Investment in Defense:

The substantial and continuous investment in defense by the Israeli government has significantly propelled the growth of the electronically scanned array radar market. With national security as a top priority, the Israeli defense budget consistently supports advancements in radar and surveillance technologies. A portion of this budget is allocated to upgrading and expanding radar systems to enhance the country’s military capabilities, particularly in surveillance, defense against missile threats, and intelligence gathering. The government’s focus on maintaining technological superiority in the face of regional security challenges has further accelerated investment into the radar sector. Additionally, Israel’s strategic alliances with other nations and defense organizations, including joint development projects, have led to advanced radar technologies being adopted at an accelerated pace. These defense investments directly benefit the radar sector, ensuring continuous innovation and demand.

Technological Advancements in Radar Systems:

Another major growth driver for the Israel Electronically Scanned Array Radar market is the rapid technological advancements in radar systems. The continuous development of AESA (Active Electronically Scanned Array) radar and PESA (Passive Electronically Scanned Array) systems has enhanced radar performance, making them more accurate, reliable, and adaptable for various military and surveillance applications. The integration of digital beamforming and software-defined radar technologies has transformed the radar systems’ capabilities, enabling them to function more efficiently in complex operational environments. Furthermore, the adoption of AI and machine learning algorithms in radar systems has facilitated smarter and faster decision-making processes, significantly improving battlefield awareness. These technological improvements make radar systems more attractive to defense contractors, further boosting their market presence.

Market Challenges

High Capital Investment Requirements:

One of the primary challenges faced by the Israel Electronically Scanned Array Radar market is the high capital investment required for developing and deploying advanced radar systems. The high costs associated with research and development, procurement, and maintenance of radar technology often make it a barrier for smaller companies to enter the market. Furthermore, the complex integration process of radar systems with existing military infrastructure requires substantial financial resources and time, limiting rapid deployment. Additionally, given the defense-sensitive nature of the market, the procurement process is heavily regulated and subject to government policies, which can lead to delays or additional costs. While large companies can absorb these costs, the financial challenges remain a significant hurdle for many players in the market.

Regulatory and Compliance Issues:

Another challenge that impacts the growth of the Israel Electronically Scanned Array Radar market is the stringent regulatory and compliance landscape. As radar systems are primarily used in defense applications, they are subject to a myriad of national and international regulations, including export controls and security clearances. The process of meeting these regulatory requirements can lead to delays in product development, manufacturing, and deployment. Moreover, compliance with evolving international standards and defense-specific regulations often necessitates continuous monitoring and adaptation, which can increase operational costs and reduce market agility. Companies must also navigate the challenges of balancing innovation with compliance to ensure that their products meet the legal requirements of both domestic and international markets.

Opportunities

Partnerships with Global Defense Contractors:

One significant opportunity for the Israel Electronically Scanned Array Radar market is the increasing number of partnerships between Israeli defense companies and global defense contractors. These collaborations allow Israeli firms to access new markets, share research and development resources, and combine expertise to innovate new radar technologies. Global defense contractors often seek advanced radar systems for integration into their military platforms, providing Israeli companies with the opportunity to expand their global reach. Furthermore, these partnerships allow Israeli firms to leverage the global defense contractors’ extensive supply chains, manufacturing capabilities, and customer bases, ultimately boosting market penetration and growth prospects. The strategic alliances also provide Israeli companies with valuable insights into emerging defense trends and help shape the next generation of radar systems to meet evolving military demands.

Emerging Demand for Unmanned Systems:

Another promising opportunity for the Israel Electronically Scanned Array Radar market lies in the growing demand for unmanned systems, including unmanned aerial vehicles (UAVs) and drones. As unmanned platforms become increasingly integral to modern defense strategies, the need for radar systems capable of integrating with these platforms has risen sharply. Radar systems specifically designed for UAVs offer advantages such as enhanced surveillance capabilities, reduced human risk in missions, and improved operational flexibility. The expanding use of drones in both military and civilian sectors presents an untapped market for radar technology providers. As unmanned systems become more sophisticated and widely used, radar technology must evolve to keep pace with these advancements, creating growth opportunities for companies specializing in radar systems.

Future Outlook

The Israel Electronically Scanned Array Radar market is expected to see significant growth in the next five years, driven by ongoing defense modernization programs and technological advancements. The demand for more sophisticated radar systems in military applications, coupled with government support for the defense sector, will continue to drive innovation and adoption of new radar technologies. The increasing use of unmanned systems and AI in defense platforms will also contribute to market growth, providing opportunities for radar companies to expand their offerings.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- IAI Elta Systems

- Thales Group

- Northrop Grumman

- Raytheon Technologies

- Lockheed Martin

- BAE Systems

- Saab Group

- L3 Technologies

- Leonardo

- General Dynamics

- Harris Corporation

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace and defense companies

- Surveillance technology providers

- UAV manufacturers

- International defense organizations

Research Methodology

Step 1: Identification of Key Variables

Identify critical variables including market trends, technological advancements, and geopolitical factors that influence radar market dynamics.

Step 2: Market Analysis and Construction

Analyze the market structure, segment performance, and competitive landscape based on both qualitative and quantitative data.

Step 3: Hypothesis Validation and Expert Consultation

Validate hypotheses through expert consultations and industry reports to ensure the market model reflects realistic conditions.

Step 4: Research Synthesis and Final Output

Synthesize all findings and conclusions into a comprehensive market report with actionable insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Radar Systems

Rising Geopolitical Tensions

Growing Military Modernization Programs

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Radar Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Radar Systems

Surge in Cybersecurity Investments for Defense Systems

Technological Advancements in Multi-Function Radar

Integration of Commercial Technologies in Military Applications - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airborne Systems

Ground-based Systems

Naval Systems

Spaceborne Systems

Hybrid Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Phased Array Technology

Active Electronically Scanned Array (AESA)

Passive Electronically Scanned Array (PESA)

Digital Beamforming Technology

Software Defined Radar Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Raytheon Technologies

Northrop Grumman

Lockheed Martin

BAE Systems

Thales Group

Leonardo

Harris Corporation

L3 Technologies

Saab Group

Leonardo

General Dynamics

Hewlett Packard Enterprise

- Military Forces’ Increasing Demand for Advanced Radar Systems

- Government Agencies’ Role in Regulating and Procuring Radar Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Surveillance Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035