Market Overview

The Israel Explosive Trace Detection market is valued at USD ~ million, based on data from 2025. The growth of this market is driven by the increasing demand for advanced security measures in both government and commercial sectors. Rising concerns over terrorism, regional instability, and the need for enhanced security protocols in airports and public infrastructure are all key drivers. The market’s growth is further fueled by technological advancements in trace detection methods such as ion mobility spectrometry (IMS) and AI-powered detection systems, which are becoming increasingly crucial for securing high-traffic areas. The market is also benefiting from government investments in defense and public safety, with ongoing support for counter-terrorism measures.

Key cities and regions dominating the Israel Explosive Trace Detection market include Tel Aviv, Jerusalem, and key international airports like Ben Gurion. Israel has long been a global leader in security and defense technologies, with the Israel Defense Forces (IDF) and national airport authorities heavily investing in state-of-the-art trace detection systems. Tel Aviv, being a major economic and technological hub, drives a significant portion of this demand. Additionally, the country’s proximity to volatile regions and its continuous need for enhanced security measures make it a primary adopter of advanced explosive trace detection technologies.

Market Segmentation

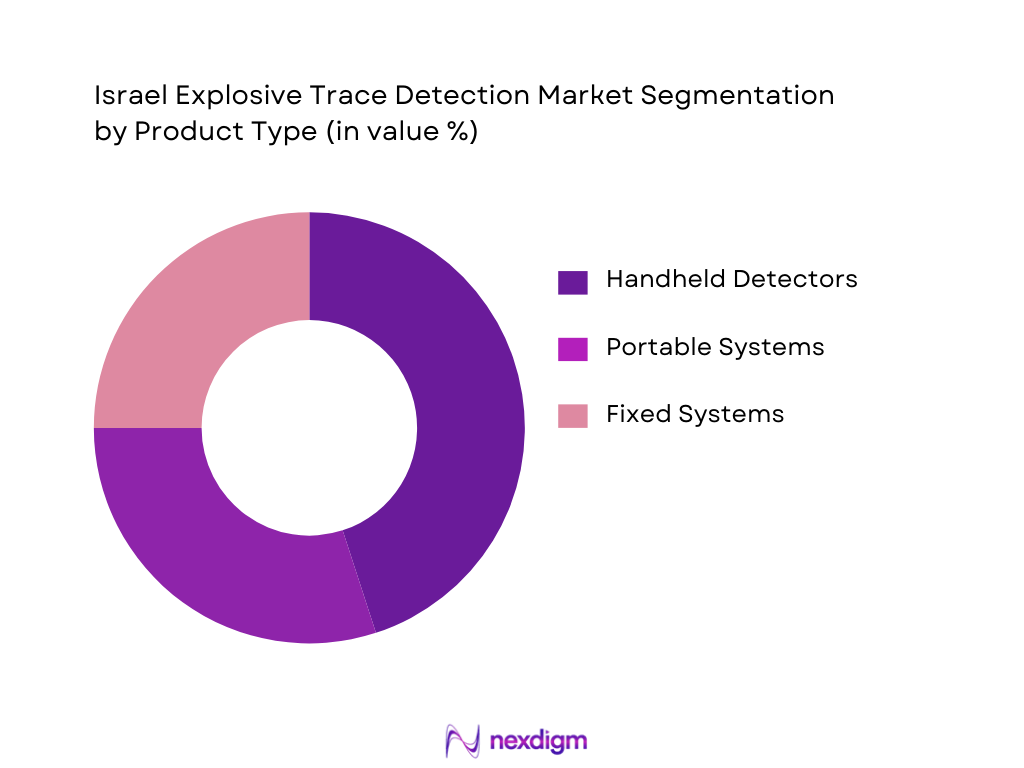

By Product Type

The Israel Explosive Trace Detection market is segmented by product type into handheld detectors, portable/mobile systems, and fixed/checkpoint systems. Among these, handheld detectors have the largest market share. Their portability and ease of use make them essential for law enforcement and security personnel in public spaces, such as airports, transportation hubs, and border checkpoints. These devices are widely used due to their ability to quickly identify traces of explosives, ensuring swift responses to potential threats. The demand for handheld devices remains strong due to their versatility and rapid deployment in high-risk environments.

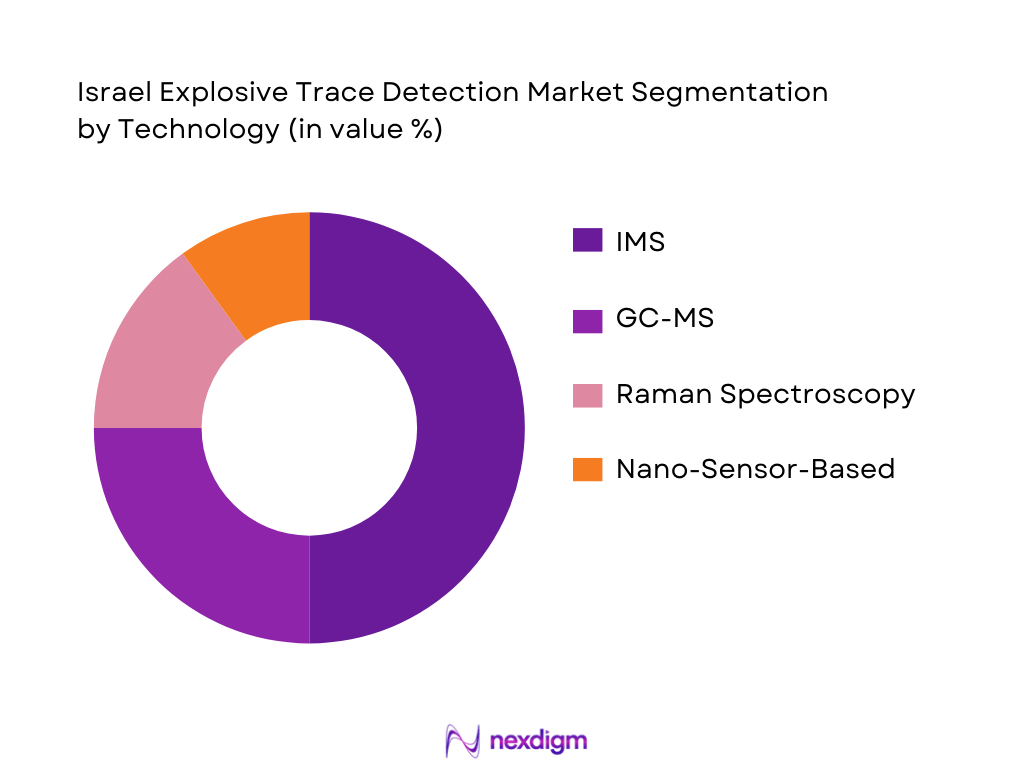

By Technology

The market is segmented based on technology into ion mobility spectrometry (IMS), gas chromatography-mass spectrometry (GC-MS), Raman spectroscopy, and nano-sensor-based systems. IMS technology holds a dominant share of the market due to its maturity, rapid detection capabilities, and widespread adoption in security screening systems. IMS-based systems are widely used for airport security and border control due to their ability to detect trace amounts of explosives in a short time, which is crucial for ensuring the safety of large public spaces.

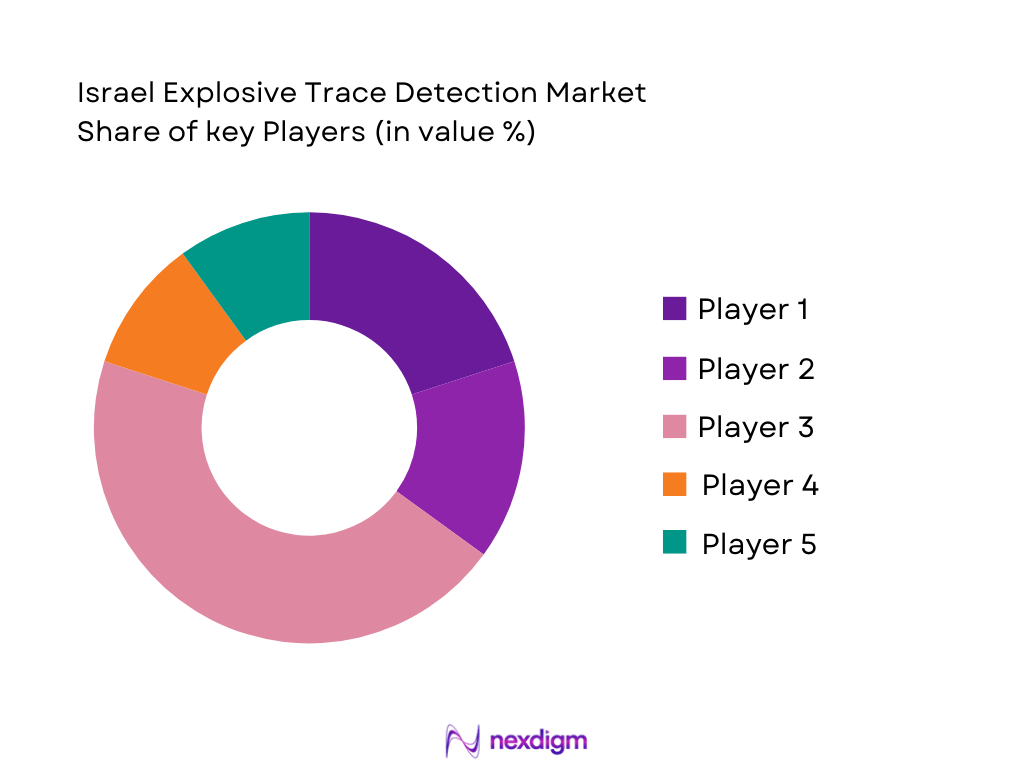

Competitive Landscape

The Israel Explosive Trace Detection market is dominated by several key players, including global manufacturers and local defense contractors. The major players in the market include Smiths Detection, Teledyne FLIR, OSI Systems, and local Israeli companies such as Elbit Systems. These companies lead the market due to their extensive experience, technological expertise, and strong relationships with government agencies and military contractors.The market is characterized by intense competition, with manufacturers continuously innovating to introduce more efficient, compact, and accurate trace detection systems. Companies focus on enhancing the sensitivity of their systems, improving throughput, and reducing the time required for threat detection. Additionally, players are expanding their footprints through strategic collaborations with airports, defense agencies, and security integrators to expand their market share.

| Company | Establishment Year | Headquarters | Detection Technology | Product Types | Key Markets | Global Reach |

| Smiths Detection | 1981 | UK | ~ | ~ | ~ | ~ |

| Teledyne FLIR | 1978 | USA | ~ | ~ | ~ | ~ |

| OSI Systems | 1987 | USA | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Nuctech | 2000 | China | ~ | ~ | ~ | ~ |

Israel Explosive Trace Detection Market Analysis

Growth Drivers

Threat Perception Index

The Threat Perception Index reflects the persistent security risks faced by Israel due to regional instability and ongoing geopolitical tensions. This heightened threat environment compels government agencies, defence forces, and critical infrastructure operators to invest in cutting‑edge detection systems to pre‑empt and mitigate explosive threats. Continuous threat alerts and historical incidents of terror activities reinforce the prioritization of rapid, reliable trace detection technologies to safeguard public spaces, transit hubs, and national assets.

Defense Expenditure Trends

Israel’s consistent investment in national defence and security technologies drives demand for advanced explosive trace detection systems. Significant defence budgets are allocated for research, procurement, and deployment of surveillance and explosive detection solutions to strengthen border security and protect strategic infrastructure. Advanced technologies such as IMS and integrated sensor networks receive support through defence programs and partnerships with Israeli high‑tech firms, reinforcing innovation and adoption in ETD systems. This sustained funding underpins robust market growth and technological upgrades.

Challenges

Budget Constraints

Budget constraints within civil sectors pose a challenge for widespread deployment of explosive trace detection technologies. While defence agencies often have significant funding, municipal and commercial entities such as airports, transit systems, and private facilities may lack sufficient budgets to procure state‑of‑the‑art ETD systems. Financial limitations can slow technology adoption cycles and push some agencies to prioritize other infrastructure needs over security upgrades, constraining market expansion outside defence segments.

Integration Complexity

Integration complexity presents operational challenges for adopters of explosive trace detection systems. Incorporating new ETD technologies into existing multi‑layered security ecosystems—such as airport checkpoints, border control networks, and national surveillance frameworks—requires careful calibration with legacy systems and real‑time data processing platforms. Compatibility issues, the need for specialized workforce training, and synchronization with broader security software suites often increase implementation timelines and costs.

Opportunities

Nano‑Sensor Technology

Nano‑sensor technology opens new opportunities in the explosive trace detection market by enabling extremely sensitive detection at microscopic levels. These sensors enhance the ability to identify trace explosive particles or vapors with higher precision and lower false‑alarm rates compared to traditional methods. Smaller form factors and reduced power requirements allow for versatile applications across handheld, portable, and fixed ETD platforms, appealing to both defence and civil security operators seeking next‑generation detection capabilities.

AI‑Augmented ETD

AI‑Augmented Explosive Trace Detection incorporates artificial intelligence to enhance system performance and analytical accuracy. Machine learning algorithms can improve pattern recognition, reduce false positives, and adapt to emerging threat signatures without extensive human intervention. These AI‑based enhancements optimize detection reliability and operational efficiency, especially in high‑throughput environments like airports and border checkpoints, where speed and accuracy are critical for effective security screening

Future Outlook

Over the next 5 years, the Israel Explosive Trace Detection market is expected to witness steady growth. This growth will be driven by ongoing advancements in detection technologies, with particular emphasis on AI-powered systems and nano-sensor-based solutions. Additionally, the increased focus on national security and defense by the Israeli government is likely to support continued demand for these technologies. The rise of cross-border security concerns and the need for enhanced airport security will further propel the market. Increased international collaboration and export opportunities for Israel’s defense technologies will also positively impact the market.

Major Players

- Smiths Detection

- Teledyne FLIR

- OSI Systems

- Elbit Systems

- Nuctech

- Bruker Corporation

- Mettler-Toledo

- Rapiscan Systems

- L3 Technologies

- Leidos

- Honeywell

- Chemring Group

- Tracense Systems

- CEIA S.p.A

- Detection Technologies Ltd

Key Target Audience

- Investments and Venture Capitalist Firms

- Israel Defense Forces (IDF)

- Israeli Ministry of Defense (MOD)

- Israel Airports Authority (IAA)

- National Security Agencies

- Border Control Authorities (Israel Customs)

- Commercial Security Agencies

- Government Regulatory Bodies (Israeli Standards Institute)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all critical variables influencing the Israel Explosive Trace Detection Market. This step is achieved through extensive desk research, utilizing secondary data sources like industry reports and databases to compile a comprehensive ecosystem map of stakeholders in the market.

Step 2: Market Analysis and Construction

In this phase, we analyze the historical data for the market, which includes penetration rates, revenue generation patterns, and sales figures for explosive trace detection systems. We focus on the performance of key technologies, such as IMS and nano-sensor systems, within different end-user segments.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and future growth drivers are validated through expert consultations. This phase involves conducting in-depth interviews with key stakeholders, including defense contractors, security agencies, and technology developers, to refine the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all the gathered data, both from top-down and bottom-up approaches and validating it through further expert consultations. We combine market size data, technological advancements, and stakeholder insights to finalize the report and ensure its accuracy.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Scope of Israel Security & Defense Parameters, Abbreviations, Base Year Selection, Market Sizing & Forecasting Approach, Primary Research Framework with Security Agencies and Defense Integrators, Limitations and Future Research Directions)

- Definition and Scope of Explosive Trace Detection

- Genesis of Israel Trace Detection Ecosystem

- Technology Evolution Pathway

- National Security & Homeland Security Ecosystem

- Israel Defense Forces (IDF) Strategic Adoption Patterns

- Civil & Critical Infrastructure Security Requirements

- Growth Drivers

Threat Perception Index

Defense Expenditure Trends

Airport Security Compliance

- Challenges

Budget Constraints

Integration Complexity

- Opportunities

Nano-Sensor Technology

AI-Augmented ETD

- Market Trends

AI/ML Integration

IoT Interoperability

Edge Detection Analytics

- Government Policy, Regulatory & Standards

National Security Guidelines

Aviation & Transportation Security Directives

Export Control and Certification Requirements

Public‑Private Security Frameworks

- SWOT Analysis

- Stakeholder Ecosystem (OEMs, Integrators, Resellers, Aftermarket Services)

- Porter’s Five Forces (Defense & Homeland Security Focused)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Form Factor (In Value %)

Handheld Trace Detectors (Mobility Index)

Portable/Mobile Trace Systems (Deployability Score)

Fixed/Checkpoint Trace Detection Systems (Throughput & OPEX Indicators)

- By Detection Technology (In Value %)

Ion Mobility Spectrometry (IMS Penetration %)

Gas Chromatography‑Mass Spectrometry (GC‑MS Adoption %)

Raman/SERS & Nano‑Sensor Based (Sensitivity Index)

- By End‑User Vertical (In Value %)

Defense & Military (IDF & MOD Procurement Spend)

Aviation & Airports (Checkpoint & Cargo Screening)

Border Security & Customs (Cross‑Border Enforcement)

Critical Infrastructure (Rail & Public Transit)

Private Security & Event Security

- By Deployment Mode (In Value %)

Permanent Installations

Temporary/Special Event Deployments

Remote & Field Operations

- Market Share Analysis (Value/Volume)

- Competitive Intensity & Density (Installed Base Share)

- Cross Comparison Parameters (Company Overview, Technology Portfolio, Product Roadmap, Recent Developments, Strengths & Weaknesses, R&D Intensity, Revenues & Market Coverage, Channel Reach, Fulfillment Capabilities, Case Studies & Local Deployments)

- SWOT Analysis of Major Competitors

- Pricing Benchmarking Across Typical SKU Portfolios

- Detailed Profiles of Major Players

Smiths Detection Group Ltd. (Trace Detection Systems)

Teledyne FLIR LLC (IMS & Portable Systems)

Analogic Corporation (Airport & Security Solutions)

OSI Systems, Inc (Global ETD Solutions)

Leidos (Explosive & Narcotics Trace Detection)

Bruker Corporation (IMS & Raman)

CEIA S.p.A (Screening Equipment)

Mettler‑Toledo GmbH (Analytical Detection)

Nuctech Company Limited (Integrated Security Systems)

L3Harris Technologies Inc (Defense ETD Solutions)

Elbit Systems Ltd (Defense Sensors & Security)

Rapiscan Systems Inc (Trace & Bulk Detection)

Tracense Systems Ltd (Nano‑sensor based Trace Detection)

TraceTech Security (Automated ETD Systems)

HTDS

- Demand Profile & Utilization Patterns

- Procurement Cycles (Defense vs. Civil Agencies)

- Budget Allocation Trends (Defense, Airport Authorities)

- Procurement Decision Drivers (Sensitivity, Throughput, Lifecycle Costs)

- Pain Point & Requirement Mapping

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035