Market Overview

The Israel Fire Control System (FCS) market is valued at approximately USD~ billion, a figure derived from industry reports on defense technology investments and procurement contracts. The market is primarily driven by Israel’s strategic focus on maintaining a technologically advanced defense industry, supported by ongoing government investments in modernizing the Israeli Defense Forces (IDF). Furthermore, Israel’s significant position as a global exporter of advanced defense systems contributes to the robust demand for its fire control systems. A considerable portion of this market is fueled by Israel’s commitment to developing multi-domain combat systems, where fire control systems play a critical role in increasing the precision and effectiveness of its defense capabilities.

Israel’s dominance in the Fire Control System market is largely driven by its capital city, Tel Aviv, where leading defense firms such as Elbit Systems and Rafael Advanced Defense Systems are headquartered. The country’s significant investment in defense R&D, coupled with its unique defense export agreements and collaborations with NATO members and the Middle East, positions it as a global leader in FCS. Additionally, cities like Herzliya, home to numerous defense tech companies, and the government’s strategic oversight of defense procurement further solidify Israel’s leadership in fire control systems development and integration, making it a key player in both regional and global markets.

Market Segmentation

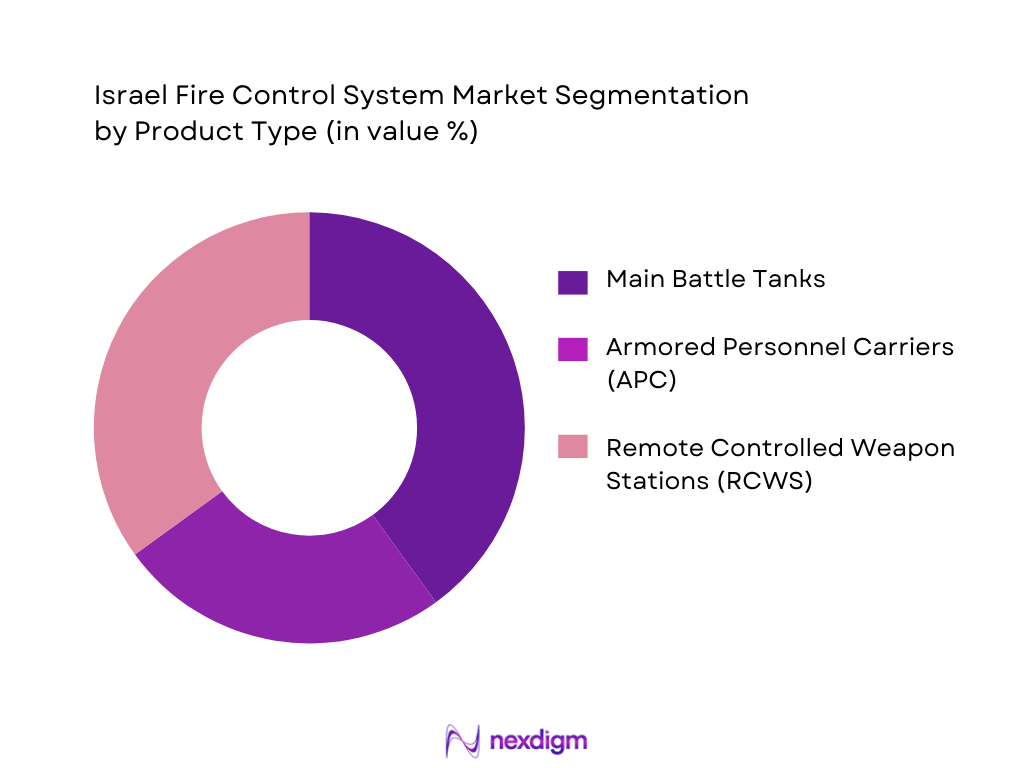

By Product Type

The Israeli Fire Control System market is segmented by product type into land-based systems, airborne fire control systems, and naval fire control systems. Among these, the land-based fire control systems dominate the market. This segment is driven by Israel’s strong defense posture and its focus on upgrading its ground combat systems, particularly its main battle tanks and armored personnel carriers (APCs). The Israeli military’s requirement for advanced target tracking, precision targeting, and automation in these systems has led to the widespread adoption of fire control technologies across its land-based platforms. Companies like Elbit Systems and Rafael have played a significant role in innovating in this area, ensuring the dominance of land-based FCS.

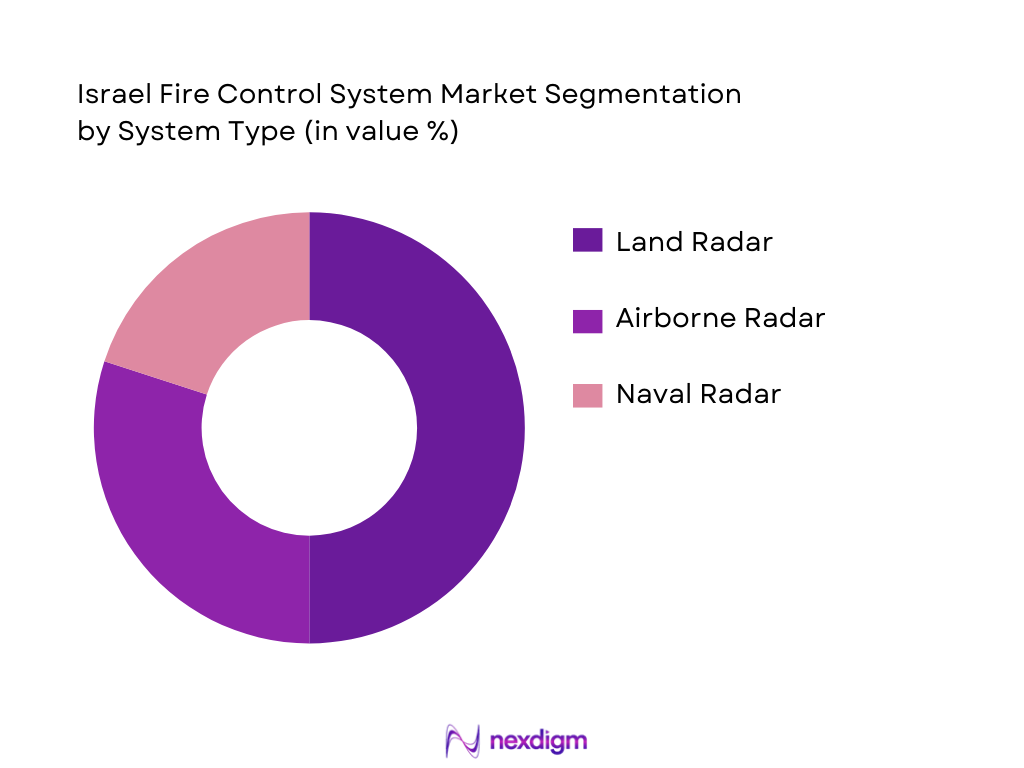

By System Type

The fire control systems in Israel are segmented by system type into target acquisition and tracking systems, fire control radar, electro-optical & infrared (EO/IR) systems, ballistic computers, and command & control (C2) integration systems. The fire control radar segment holds the largest market share. This dominance is due to the increasing demand for precise tracking and engagement capabilities, especially in complex combat scenarios involving multi-target environments. The Israeli military’s investment in radar technology, particularly for air defense and missile defense systems like the Iron Dome, highlights the critical role of radar in modern fire control systems. This segment benefits from continuous innovation, making it the dominant player in the Israeli FCS market.

Competitive Landscape

The Israel Fire Control System market is dominated by a few key players, with local firms leading the charge. Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries (IAI) are the most prominent companies in the market. These companies benefit from significant government contracts and a long history of defense innovations. In addition to local giants, international players like Lockheed Martin and Raytheon are also involved in the market, especially in terms of collaborations and exports. The consolidation of these major companies in the Israeli defense sector illustrates the significant influence of these key players in shaping the future of fire control system technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Product Portfolio | Export Presence | Key Defense Contracts |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1958 | Haifa | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ |

Israel Fire Control System Market Analysis

Growth Drivers

Geopolitical Tensions & Strategic Threat Landscape

Ongoing geopolitical instability in the Middle East, combined with Israel’s strategic focus on national security, is driving the demand for advanced fire control systems (FCS). The constant threat of missile attacks, cyber warfare, and regional conflicts necessitate the development of highly effective and precise FCS for both defensive and offensive operations. Israel’s security concerns push for innovations in fire control technologies that offer advanced defense capabilities, contributing to the expansion of the market.

Rising Demand for Precision Targeting & Automated Systems

As modern warfare continues to evolve, there is a rising need for systems that can provide real-time, precise targeting and automated fire solutions. Israel’s FCS market benefits from advancements in radar, electro-optical/infrared (EO/IR), and artificial intelligence (AI) technologies, which enable more effective and accurate targeting in complex combat scenarios. These technological advancements are enhancing Israel’s military capabilities, making the adoption of precision targeting and automated fire control systems a critical factor in the country’s defense strategy.

Market Challenges

Integration Complexity & Long Development Cycles

The development and integration of fire control systems into existing defense platforms involve complex processes and long development cycles. Ensuring interoperability between different systems, sensors, and platforms adds to the complexity, resulting in delays in deploying cutting-edge FCS technologies. The challenge of seamlessly integrating these systems with legacy platforms and achieving operational readiness in a timely manner poses a significant obstacle to the market’s growth.

High R&D and Certification Costs

Fire control systems require extensive research, development, testing, and certification to meet defense standards. The costs associated with R&D and certification are high, and the need for continuous upgrades to stay ahead of emerging threats adds financial pressure. These high costs can strain defense budgets and slow down the growth of the fire control system market, as resources are often diverted to other areas of defense technology.

Market Opportunities

AI/ML FCS Modernization Programs

The integration of artificial intelligence (AI) and machine learning (ML) into fire control systems offers a significant opportunity for market growth. AI and ML can automate decision-making, process real-time data, and enable autonomous targeting, which enhances the overall efficiency and effectiveness of FCS. These technologies are driving demand for modernization programs in Israel’s defense sector, offering the potential for smarter and more agile fire control systems that improve combat readiness and operational efficiency.

Indigenization & Localization of Subsystems

With increasing political and economic pressures, there is a shift towards localizing fire control system subsystems in Israel. This trend aims to reduce dependency on foreign technologies, ensuring greater control over sensitive technologies and boosting domestic production. Localization provides opportunities for Israel’s defense sector to enhance its technological independence and increase export potential by offering locally integrated solutions, thereby strengthening its position in the global defense market.

Future Outlook

Over the next several years, the Israeli Fire Control System market is expected to show significant growth driven by continuous advancements in fire control technologies and increasing demand for enhanced precision in multi-domain operations. Israel’s ongoing investment in defense modernization, coupled with its strategic alliances with global powers, will continue to fuel innovation in radar, EO/IR systems, and integrated command control technologies. Additionally, the focus on improving interoperability across various defense platforms will drive the expansion of networked fire control systems. Israel’s robust export agreements and partnerships in the Middle East, Europe, and the Asia-Pacific region will further propel market expansion.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Leonardo

- Saab AB

- Thales Group

- Northrop Grumman

- Rheinmetall

- Leonardo DRS

- General Dynamics

- Honeywell Aerospace

- Kongsberg Gruppen

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Contractors

- OEMs (Original Equipment Manufacturers) in Defense

- Prime Defense System Integrators

- Fire Control System Suppliers

- Aerospace and Defense Manufacturers

- Military Agencies (Israel Defense Forces, NATO)

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map will be constructed to identify key stakeholders within the Israeli Fire Control System market. This will involve extensive desk research and secondary data sources to understand the broader dynamics of the market, including market penetration and procurement behavior.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on defense procurement trends, technology adoption rates, and market penetration. Quantitative metrics such as market growth rates, sales, and deployment rates will be analyzed to provide a comprehensive view of the market’s current status.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth, technology adoption, and export dynamics will be validated through expert interviews. These will be conducted with professionals from the defense sector, including military officials and industry leaders, ensuring that the final analysis reflects both practical and strategic insights.

Step 4: Research Synthesis and Final Output

The final stage will involve engaging with manufacturers and system integrators to obtain detailed information on product segmentation, customer demand, and other critical factors. This will serve to verify and complement data gathered from earlier research stages, ensuring a comprehensive and accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations and Acronyms, Data Sources — Defense Procurement & Export Data, Primary Research Overview — IDF & Industry Experts, Secondary Research Approach, Market Modeling & Forecasting Approach, Limitations and Future Extensions)

- Definition and Scope

- FCS Technology Evolution

- Role in Integrated Defense Architecture

- Israel Defense R&D and Procurement Cycle

- Israel FCS Market Genesis and Strategic Context

- Defense Export Orientation and Government Policy

- Supply Chain & Value Chain Analysis

- Growth Drivers

Geopolitical Tensions & Strategic Threat Landscape

Rising Demand for Precision Targeting & Automated Systems

Export Demand Growth (NATO, Asia‑Pacific, Middle East)

Shift to Networked Warfare & Sensor Fusion Architectures

- Market Challenges

Integration Complexity & Long Development Cycles

High R&D and Certification Costs

Export Control Regime & Regulatory Hurdles

- Market Opportunities

AI/ML FCS Modernization Programs

Indigenization & Localization of Subsystems

Joint Ventures & Strategic Partnerships (Tech Transfer)

- Market Trends

Miniaturization & Portable Fire Control Devices (e.g., handheld systems)

Networked Sensor Fusion & Cloud‑Assisted Targeting

Laser & Directed Energy Integration

- SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform (In Value %)

Land Systems

Airborne FCS

Naval FCS

Air & Missile Defense FCS

Unmanned Systems - By System Type (In Value %)

Target Acquisition & Tracking Systems

Fire Control Radar

Electro‑Optical & Infrared

Ballistic Computers & Fire Control Algorithms

Command & Control (C2) Integration - By End‑User (In Value %)

Israel Defense Forces (IDF) Procurement

Defense Export Customers

Private Security & Homeland Defense Entities - By Technology Tier (In Value %)

Legacy Systems

Digital FCS

AI‑Enhanced FCS

Networked FCS - By Sales Channel (In Value %)

Prime System Contracts

OEM Supply Agreements

Aftermarket Support & Upgrades

- Market Share — Domestic vs Export Value & Volume

- Cross Comparison Parameters (Company Profile, Proprietary Tech & IP, Software Capabilities, Production Capacity & Yield, Export Footprint, R&D Investment Intensity, Government Contracts & Frameworks, Lifecycle Support Infrastructure)

- Detailed Profiles of Major Companies

Elbit Systems Ltd (FCS & Integrated Weapon Systems)

Rafael Advanced Defense Systems Ltd (Air & Missile Defense FCS)

Israel Aerospace Industries (IAI) (Integrated FCS & Sensors)

ELTA Systems Ltd (Radar & Sensor FCS Components)

SMARTSHOOTER Ltd (Portable FCS Devices)

MPrest Systems (Battle Management & Control Integration)

Elisra (Missile Tracking & Control Subsystems)

Lockheed Martin (Global FCS Platforms)

BAE Systems (Land & Naval FCS Platforms)

Rheinmetall AG (Land Weapon & FCS Integration)

Leonardo (Avionics & FCS Solutions)

Thales (Multi‑Domain FCS Capabilities)

Saab AB (Sensor & FCS Solutions)

Northrop Grumman (Advanced Radar & Targeting Systems)

RTX (Raytheon)

- Procurement Priorities & Decision Drivers

- Budget Allocations (IDF & Export Project Budgeting)

- Operational Requirements & Performance KPIs

- Pain Points (Integration, Training, Interoperability)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035