Market Overview

The Israel Fixed Wing Unmanned Aerial System (UAS) market has a significant market size due to the increasing demand for military and surveillance applications. In recent years, the Israeli UAS sector has been valued at USD ~ billion, driven by continuous innovations in technology, particularly in military-grade drones, and expanding commercial adoption. This growth is also supported by government-backed initiatives, which have led to the development of advanced UAS systems tailored for both national defense and commercial sectors such as surveillance and agriculture.

Israel is one of the dominant players in the fixed-wing UAS market due to its strategic defense initiatives, technological advancements, and leading-edge military drone solutions. The country’s strong presence in the defense sector, led by government and military agencies, positions it as a key exporter of unmanned systems globally. Additionally, cities like Tel Aviv and Haifa have become hubs for UAV technology and innovation, largely because of their robust research, development infrastructure, and the collaboration between tech companies and government defense contractors.

Market Segmentation

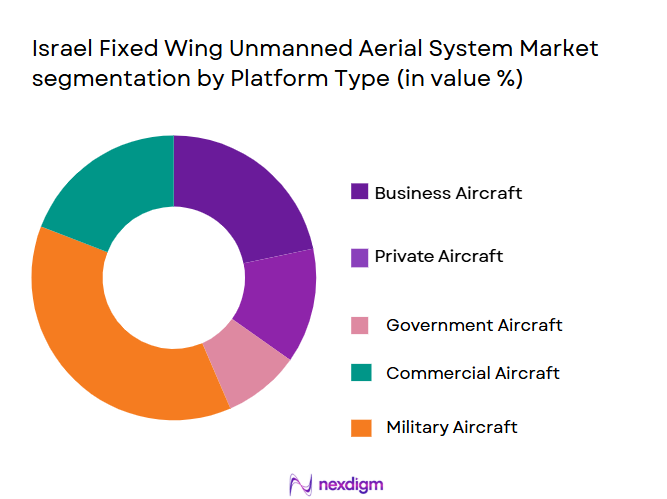

By Platform Type

The market is also segmented by platform type into military UAVs, civil UAVs, commercial UAVs, surveillance UAVs, and research & development UAVs. Among these, military UAVs dominate the market due to Israel’s strong defense focus and its integration of advanced UAV technologies into national security strategies. The Israel Defense Forces (IDF) have significantly advanced the military UAV segment, which accounts for the largest portion of the market share. Military UAVs are used for a wide range of applications, including border surveillance, intelligence gathering, and tactical strikes. The significant investments in military capabilities have driven the continued dominance of military UAVs in the Israeli market, with further expansions expected in the future.

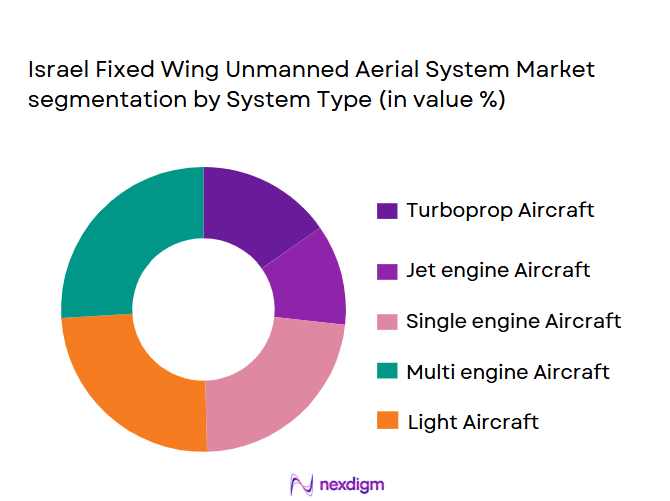

By System Type

The Israel Fixed Wing Unmanned Aerial System market is segmented by system type into lightweight UAVs, medium-range UAVs, long-endurance UAVs, high-altitude UAVs, and combat UAVs. In terms of market dominance, the medium-range UAV segment leads the market due to its versatility in both military and commercial applications. These UAVs provide a balance between operational range, payload capacity, and endurance, which makes them ideal for surveillance, reconnaissance, and tactical operations. The demand for medium-range UAVs is supported by their ability to cover large areas with extended operational time and their adaptability to multiple missions. As a result, companies like Israel Aerospace Industries (IAI) have focused on developing advanced medium-range UAV platforms to cater to both defense and commercial markets.

Competitive Landscape

The Israel Fixed Wing Unmanned Aerial System market is dominated by a few major players who drive technological advancements and innovation. These key players include both local manufacturers such as Israel Aerospace Industries (IAI) and Elbit Systems, as well as global brands that collaborate with Israel for their UAV solutions. The consolidation of major companies in the defense sector, along with strong government backing, plays a vital role in maintaining Israel’s leadership in this market.

| Company Name | Establishment Year | Headquarters | Key Market Specific Parameters |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ |

| Aeronautics Ltd. | 1997 | Yavne, Israel | ~ |

| Bluebird Aero Systems | 2002 | Herzliya, Israel | ~ |

| RT LTA Systems | 2000 | Herzliya, Israel | ~ |

Israel fixed wing unmanned aerial systems Market Dynamics

Growth Drivers

Increasing demand for defense and surveillance applications

The Israel Fixed Wing Unmanned Aerial System (UAS) market is driven by the growing demand for advanced surveillance and defense systems. Israel’s strategic geopolitical position and national security concerns have led to a consistent rise in military expenditure, which in turn fuels the demand for UAS technologies used in border surveillance, intelligence gathering, and reconnaissance. The Israeli government continues to allocate significant resources to enhance its defense capabilities, with military UAVs playing a central role in ensuring national security and responding to evolving threats.

Expansion of UAV adoption in commercial sectors

The growing adoption of UAVs in commercial and civil sectors has become a key driver of the Israel Fixed Wing UAS market. These UAVs are increasingly used for applications like infrastructure inspection, agriculture, and environmental monitoring. With government support for innovation and technology, commercial UAV operations have expanded across industries. The Israeli Civil Aviation Authority has streamlined the regulatory process for UAV integration, fostering the growth of UAV-based services. As industries look to leverage UAVs for cost-effective and efficient solutions, demand for these systems is expected to continue increasing.

Market Challenges

High costs and operational complexities

The Israel Fixed Wing UAS market faces challenges due to the high costs associated with both procurement and maintenance. Although Israel invests heavily in defense technologies, the high initial costs of advanced UAV systems make it challenging for smaller enterprises or non-defense sectors to adopt UAVs. Additionally, the maintenance and operational expenses are significant, as UAVs require regular updates, specialized parts, and skilled personnel. The financial burden of both acquiring and maintaining UAV systems remains a significant obstacle to wider market penetration, especially in the commercial sector.

Regulatory and operational restrictions

Regulatory hurdles and airspace restrictions present significant challenges for the Israel Fixed Wing UAS market. While Israel is at the forefront of UAV technology, the integration of drones into controlled airspace is still heavily regulated, particularly in densely populated areas and near sensitive military zones. The Israeli Civil Aviation Authority enforces stringent rules to ensure safe and secure UAV operations, which can delay or hinder UAV use in commercial and civil sectors. These regulatory challenges limit the potential for rapid market growth, especially in urban areas where airspace is congested.

Opportunities

Rising global military expenditure

Global military spending continues to grow, which presents a significant opportunity for Israel’s UAV industry. As nations around the world increase their defense budgets to address evolving threats and enhance security, the demand for advanced military UAVs will rise. Israel, with its world-class UAV technology, is well-positioned to supply unmanned aerial systems to countries seeking to upgrade their defense capabilities. As part of its defense strategy, Israel is expected to continue developing cutting-edge UAV technology, further boosting its global export potential in the military UAV market.

Technological advancements in autonomy and AI

Technological advancements in autonomy and artificial intelligence (AI) integration represent significant growth opportunities for the Israel Fixed Wing UAS market. As AI technology advances, UAVs can operate more autonomously, offering improved performance, operational efficiency, and mission execution. The integration of AI enables drones to perform complex tasks such as real-time data processing, adaptive flight control, and enhanced decision-making. Israel’s continuous investment in AI research and development will likely drive the next generation of UAVs, making them more effective and widely adopted in both military and civilian applications.

Future Outlook

Over the next decade, the Israel Fixed Wing Unmanned Aerial System market is expected to continue growing due to advancements in UAV technology, defense sector investments, and increasing demand from commercial industries for surveillance and mapping solutions. The market will be driven by innovations in AI integration, longer endurance capabilities, and the continued demand for secure, high-quality military applications. Additionally, the market will benefit from global geopolitical trends that favor technological superiority in unmanned systems.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Aeronautics Ltd.

- Bluebird Aero Systems

- RT LTA Systems

- Israel Military Industries (IMI)

- Novelsat

- Elcom Technologies

- Tadiran Aerospace

- Gilat Satellite Networks

- Rafael Advanced Defense Systems

- AeroVironment

- General Atomics Aeronautical Systems

- Northrop Grumman

- Lockheed Martin

Key Target Audience

- Defense Agencies (e.g., Israel Defense Forces)

- Government Regulatory Bodies (e.g., Israeli Civil Aviation Authority)

- UAV Manufacturers

- Commercial UAV Operators

- Private Sector Companies (Security, Surveillance)

- Military Contractors

- Venture Capital Firms

- Investment Firms

Research Methodology

Step 1: Identification of Key Variables

In this step, we conduct comprehensive desk research using secondary and proprietary data sources to create an ecosystem map for the Israel Fixed Wing UAS market. This includes identifying and defining critical variables, such as market growth drivers, technology adoption rates, and customer preferences, which significantly influence market trends.

Step 2: Market Analysis and Construction

We will compile and analyze historical data related to market size, adoption rates, and technology development. This data will be used to assess the competitive landscape, market penetration, and sector growth, ensuring that the analysis reflects the true market potential.

Step 3: Hypothesis Validation and Expert Consultation

To refine our analysis, we validate market hypotheses through expert interviews, including discussions with industry professionals, UAV manufacturers, and defense sector experts. This helps ensure that our market forecasts are based on reliable, actionable insights from those with direct market experience.

Step 4: Research Synthesis and Final Output

In this final phase, we synthesize all collected data, verifying it through direct engagements with key market participants. The insights gathered will be integrated into our final report to ensure the accuracy, comprehensiveness, and relevance of the market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for border surveillance and national defense

Rising adoption of UAVs in commercial and civil sectors

Advancements in UAV technology improving operational efficiency - Market Challenges

High initial costs and maintenance expenses

Regulatory hurdles and airspace restrictions

Technological complexity and integration issues - Market Opportunities

Growth in global military expenditure supporting UAV demand

Technological advancements in autonomy and AI integration

Expansion of UAV use in disaster management and emergency services - Trends

Shift towards hybrid propulsion systems for longer endurance

Integration of AI and machine learning in UAV operations

Growing trend of international collaborations for military UAV development - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Lightweight UAVs

Medium-Range UAVs

Long-Endurance UAVs

High-Altitude UAVs

Combat UAVs - By Platform Type (In Value%)

Military UAVs

Civil UAVs

Commercial UAVs

Surveillance UAVs

Research & Development UAVs - By Fitment Type (In Value%)

OEM Integration

Aftermarket Fitment

Modular Integration

Custom-Built Systems

Upgrades & Maintenance - By EndUser Segment (In Value%)

Defense Forces

Private Sector (Commercial & Surveillance)

Aerospace & Aviation

Research Institutions

Government & Regulatory Bodies - By Procurement Channel (In Value%)

Direct Procurement from OEMs

Third-Party Procurement

Government Contracts

Private Sector Purchases

Online Marketplaces

- Market Share Analysis

- Cross Comparison Parameters

(Price, System Complexity, Range, Endurance, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Payload Capacity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Aeronautics Ltd.

Bluebird Aero Systems

RT LTA Systems

Israel Military Industries (IMI)

Novelsat

Elcom Technologies

Tadiran Aerospace

Gilat Satellite Networks

Rafael Advanced Defense Systems

AeroVironment

General Atomics Aeronautical Systems

Northrop Grumman

Lockheed Martin

- Increasing adoption of UAVs by defense sectors globally

- Rising interest from commercial sectors such as agriculture and logistics

- Demand for surveillance and reconnaissance solutions in both military and civil applications

- Research and development driving innovation in UAV design and application

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035Israel Fixed Wing

- Unmanned Aerial System Future Size, 2026-2035