Market Overview

The Israel Fixed Wing VTOL UAV market is valued at approximately USD ~ billion, with strong growth anticipated as the demand for innovative UAV technologies continues to rise. The market’s growth is primarily driven by the increasing defense budgets, both domestic and international, as well as the growing use of UAVs in surveillance, reconnaissance, and agricultural sectors. The adoption of advanced UAV technology is further fueled by Israel’s strong technological ecosystem, which is renowned for its innovation in aerospace and defense systems. Additionally, the support of government initiatives and investments in R&D contribute significantly to the market expansion.

Israel dominates the Fixed Wing VTOL UAV market, supported by a well-established defense industry and technological leadership in UAV development. The country’s advanced aerospace capabilities, led by major companies such as Israel Aerospace Industries and Elbit Systems, allow it to maintain a competitive edge in both military and commercial UAV applications. Furthermore, cities like Tel Aviv and Herzliya are key hubs for innovation and military technology development, providing Israel with the infrastructure, workforce, and support required to lead the global UAV market.

Market Segmentation

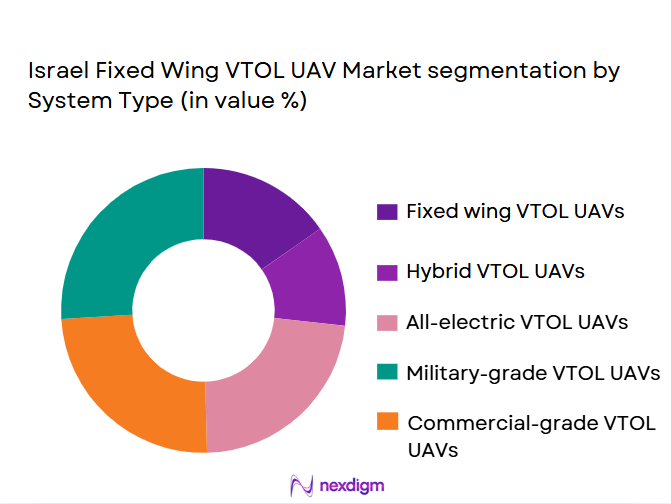

By System Type

The Israel Fixed Wing VTOL UAV market is segmented by system type into several categories, with hybrid VTOL UAVs emerging as the dominant segment. This dominance is driven by their versatility, capable of performing both vertical take-off and landing (VTOL) as well as fixed-wing flight. Hybrid systems are increasingly favored in both military and commercial applications because of their ability to perform multiple tasks, such as surveillance, cargo transport, and reconnaissance, with enhanced operational efficiency. The hybrid systems are particularly advantageous for operations in complex environments where space limitations or terrain obstacles might hinder traditional fixed-wing UAVs. Companies are continuing to innovate and improve the payload capacity and flight duration of hybrid VTOL UAVs, making them an increasingly popular choice for varied missions.

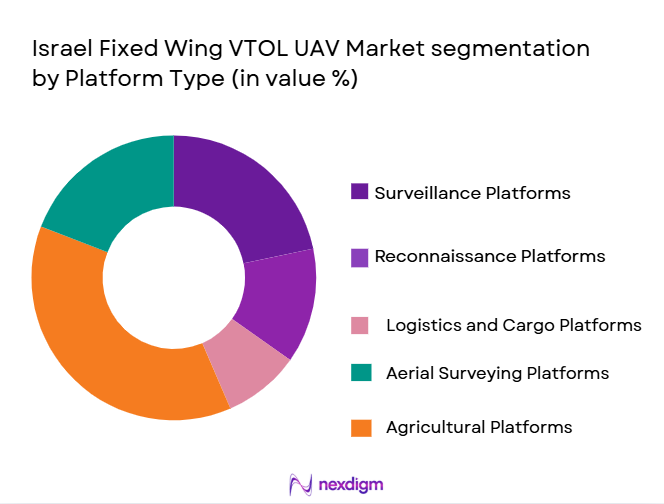

By Platform Type

The market is also segmented by platform type, with surveillance platforms capturing the largest share. Surveillance platforms dominate due to their wide-ranging applications in military, defense, and public safety sectors. These platforms are crucial for monitoring borders, conducting intelligence-gathering missions, and providing real-time situational awareness in both military and law enforcement operations. As a result, Israel’s defense contractors focus heavily on developing UAVs optimized for surveillance, equipped with advanced cameras, sensors, and communications systems. Additionally, the use of surveillance UAVs is expanding to include applications in commercial sectors such as environmental monitoring and agricultural surveillance, further driving market growth.

Competitive Landscape

The Israel Fixed Wing VTOL UAV market is dominated by a few key players, including both large defense contractors and emerging UAV manufacturers. Major companies such as Israel Aerospace Industries (IAI) and Elbit Systems have established themselves as industry leaders, owing to their long-standing presence in the aerospace and defense sectors. These companies have the infrastructure and technical expertise required to develop sophisticated UAV systems that meet both military and commercial needs. Additionally, newer entrants into the UAV market, including Percepto and Urban Aeronautics, are carving out a niche by focusing on specialized applications, such as industrial inspections and first responder support. The competition is fierce, with companies continuously innovating to stay ahead in a rapidly evolving technological landscape.

| Company | Establishment Year | Headquarters | Product Focus | Market Share Contribution | R&D Investment | Strategic Partnerships |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Percepto | 2014 | Herzliya, Israel | ~ | ~ | ~ | ~ |

| Urban Aeronautics | 2007 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Kaman Aerospace | 1945 | Bloomfield, USA | ~ | ~ | ~ | ~ |

Israel fixed wing vtol uav Market Dynamics

Growth Drivers

Increased defense investments by Israel

Israel has long been committed to maintaining a technologically advanced military, with substantial investments in defense infrastructure. In 2024, the defense budget is projected to be around USD ~ billion, a significant portion of the country’s GDP. This investment not only supports conventional defense programs but also fuels the demand for advanced technologies such as Fixed Wing VTOL UAVs. The ongoing investment in UAV systems directly contributes to the market’s expansion, enhancing Israel’s military capabilities and its strategic defense posture on both a regional and global scale.

Technological advancements in drone capabilities

The rapid advancements in drone technologies, particularly in autonomous flight, AI integration, and sensor capabilities, are crucial for the growth of the Israel Fixed Wing VTOL UAV market. In 2024, Israel’s UAV manufacturers continue to innovate, developing systems with increased payload capacity, longer flight durations, and improved operational flexibility. These technological advancements make UAVs more attractive to a wide range of industries, including defense, agriculture, and construction. As a leader in UAV technology, Israel’s constant push toward upgrading its capabilities allows the market to continue to expand across various sectors.

Market Challenges

Regulatory barriers to UAV operations

The growth of the Israel Fixed Wing VTOL UAV market faces challenges due to regulatory restrictions surrounding UAV operations. In 2024, the Israeli Civil Aviation Authority (CAAI) imposes strict regulations on UAV flights, including limited airspace access and mandatory permits for commercial and military flights. These regulations can delay deployment timelines and make it more difficult for companies to scale their UAV operations efficiently. As the UAV market grows, navigating these legal hurdles remains a significant challenge for both domestic manufacturers and foreign companies looking to enter the Israeli market.

Security and privacy concerns with UAV data

As UAVs become more embedded in military, commercial, and public safety operations, concerns regarding the security and privacy of data collected by these systems continue to grow. Israel, known for its cybersecurity expertise, has recognized these issues, dedicating considerable resources to safeguard UAV data. However, there are still unresolved concerns about how sensitive information is collected, stored, and transmitted. The growing reliance on UAVs for surveillance and data collection, particularly in high-stakes environments, requires constant oversight to ensure that privacy and data security standards are met.

Opportunities

Expanding applications in military surveillance

The Israeli military’s use of Fixed Wing VTOL UAVs for surveillance and reconnaissance continues to drive market growth. In 2024, the increasing need for real-time intelligence and border security is pushing the demand for UAVs that can operate autonomously in various terrains. The Israeli government’s focus on enhancing military surveillance capabilities presents significant opportunities for UAV manufacturers, particularly those developing systems with longer endurance, higher payloads, and enhanced imaging technologies. The expanding role of UAVs in military operations will remain a dominant growth area for the market.

Growing adoption in precision agriculture

The growing demand for precision agriculture presents a notable opportunity for the Israel Fixed Wing VTOL UAV market. In 2024, Israel’s agricultural industry is embracing UAV technology to enhance crop monitoring, soil management, and water conservation efforts. With the country facing ongoing challenges related to water scarcity and land use optimization, UAVs are becoming essential tools for improving the efficiency and sustainability of agricultural practices. The increasing adoption of UAVs in agriculture not only supports Israel’s food security goals but also creates new revenue streams for UAV manufacturers in the commercial sector.

Future Outlook

Over the next decade, the Israel Fixed Wing VTOL UAV market is expected to continue its growth trajectory, driven by ongoing technological advancements, government defense spending, and expanding commercial applications. The increasing demand for surveillance and reconnaissance UAVs, particularly in military operations, will remain a primary factor in the market’s growth. Additionally, the expanding use of UAVs in industrial applications, such as agriculture, logistics, and infrastructure inspections, will contribute to a more diversified demand. Israel’s strong technological base and innovation-driven aerospace industry position the country well to capitalize on these emerging opportunities, both in the defense and commercial UAV markets.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Percepto

- Urban Aeronautics

- Kaman Aerospace

- Aerovironment

- EHang

- Quantum Systems

- Rafael Advanced Defense Systems

- Insitu

- AVX Aircraft

- AeroLion Technologies

- Aeronautics Defense Systems

- RTL Corp

- FlightWave Aerospace Systems

Key Target Audience

- Government and regulatory bodies (e.g., Israel Ministry of Defense)

- Defense contractors and UAV manufacturers

- Investment and venture capitalist firms

- Military agencies (e.g., Israeli Defense Forces)

- Aerospace technology companies

- Industrial operators (e.g., construction, agriculture)

- Public safety agencies (e.g., police, fire departments)

- Commercial sector logistics and surveillance companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Fixed Wing VTOL UAV Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Israel Fixed Wing VTOL UAV Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple UAV manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Israel Fixed Wing VTOL UAV market.

- Executive Summary

- Israel Fixed Wing VTOL UAV Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense investments by Israel

Technological advancements in drone capabilities

Rising demand for UAVs in agriculture and construction industries - Market Challenges

Regulatory barriers to UAV operations

Security and privacy concerns with UAV data

High initial cost of VTOL UAV systems - Market Opportunities

Expanding applications in military surveillance

Growing adoption in precision agriculture

Partnerships with civilian and commercial sectors - Trends

Emerging use of autonomous VTOL UAVs

Integration of AI and machine learning for enhanced navigation

Focus on energy efficiency and battery longevity in UAV design

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed wing VTOL UAVs

Hybrid VTOL UAVs

All-electric VTOL UAVs

Military-grade VTOL UAVs

Commercial-grade VTOL UAVs - By Platform Type (In Value%)

Surveillance Platforms

Reconnaissance Platforms

Logistics and Cargo Platforms

Aerial Surveying Platforms

Agricultural Platforms - By Fitment Type (In Value%)

Modular VTOL UAVs

Custom-built VTOL UAVs

Fixed-wing VTOL UAVs

Retrofit VTOL UAVs

Lightweight VTOL UAVs - By EndUser Segment (In Value%)

Military & Defense

Agriculture

Construction & Surveying

Search and Rescue Operations

Public Safety & Law Enforcement - By Procurement Channel (In Value%)

Direct Sales

Online Sales

Government Contracts

Distributors & Resellers

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Price point, Range, Payload capacity, Battery life, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Ease of deployment) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

AeroVironment

Elbit Systems

Israel Aerospace Industries

Urban Aeronautics

Kaman Aerospace

EHang

Quantum Systems

Skyworks Global

Rafael Advanced Defense Systems

Insitu

AVX Aircraft

AeroLion Technologies

Aeronautics Defense Systems

RTL Corp

FlightWave Aerospace Systems

Percepto

- Military & defense agencies adopting advanced VTOL UAV

- technology Agricultural sector seeking more efficient aerial monitoring tools

- Surveying and construction industries leveraging UAVs for cost reduction

- Public safety organizations using drones for search and rescue operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035