Market Overview

The Israel geospatial defense applications market has witnessed steady growth, driven by the increasing demand for advanced surveillance, intelligence, and geospatial mapping solutions. With a market size valued at approximately USD ~billion in 2025, the market’s growth is attributed to Israel’s robust defense technology sector and its consistent investment in enhancing its military and defense infrastructure. Key growth factors include the adoption of cutting-edge satellite imagery, LiDAR, and radar systems, which enhance situational awareness for military operations. Israel’s strategic geographical location and its long-standing defense initiatives further augment the demand for these advanced systems.

Israel is the primary market leader in geospatial defense applications, owing to its highly developed defense sector and technological advancements. The country is renowned for its leadership in defense innovation, primarily driven by its military-focused technologies and substantial investments in intelligence and surveillance systems. Cities like Tel Aviv, a hub for defense innovation, and Haifa, which hosts numerous defense contractors, play pivotal roles in the market’s dominance. The extensive partnerships between Israeli defense companies and international governments contribute significantly to Israel’s preeminence in the global market for geospatial defense applications.

Market Segmentation

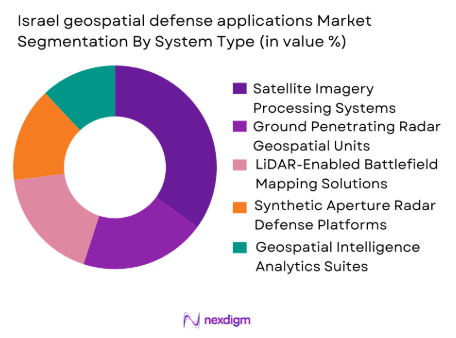

By System Type

The Israel geospatial defense applications market is segmented by system type into satellite imagery processing systems, ground-penetrating radar geospatial units, LiDAR-enabled battlefield mapping solutions, synthetic aperture radar (SAR) defense platforms, and geospatial intelligence (GEOINT) analytics suites. Among these, satellite imagery processing systems dominate the market due to their widespread application in defense surveillance, reconnaissance, and border monitoring. Satellite-based technologies allow real-time data collection and high-resolution imagery, crucial for operational decision-making. The Israeli defense forces rely heavily on satellite imagery to maintain situational awareness, especially in hostile environments. This technology’s continuous evolution has contributed to its dominance, particularly as global demand for space-based surveillance capabilities grows.

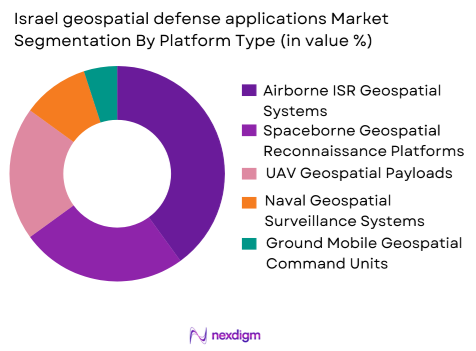

By Platform Type

In the platform type segment, the market is primarily divided into airborne ISR geospatial systems, spaceborne geospatial reconnaissance platforms, unmanned aerial vehicle (UAV) geospatial payloads, naval geospatial surveillance systems, and ground mobile geospatial command units. The dominant sub-segment in this category is airborne ISR geospatial systems. The Israeli defense forces and private contractors heavily invest in airborne ISR systems due to their ability to provide flexible, high-altitude surveillance capabilities over large areas. These systems are indispensable for Israel’s security operations, particularly in monitoring neighbouring regions and responding to evolving threats in real-time. Moreover, their integration with advanced data analytics makes them vital in modern defense strategies.

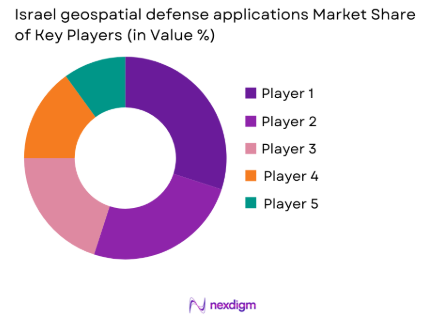

Competitive Landscape

The Israel geospatial defense applications market is dominated by several key players that provide innovative solutions for the defense sector. These players include both domestic defense companies and international technology giants. The competitive landscape highlights a mix of established players with a long history of providing cutting-edge defense systems, as well as emerging companies focusing on advanced geospatial technologies like AI, LiDAR, and satellite-based platforms.

| Company | Establishment Year | Headquarters | Defense Technology Specialization | R&D Investment | Partnerships | Global Reach | Product Offerings |

| Elbit Systems Ltd. | 1966 | Haifa | Satellite Imagery, ISR Systems | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems Ltd. | 1984 | Haifa | Radars, LiDAR, Battlefield Systems | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod | Aerospace, Geospatial Intelligence | ~ | ~ | ~ | ~ |

| Plasan Sasa Ltd. | 1985 | Migdal HaEmek | Armor Systems, Geospatial Mapping | ~ | ~ | ~ | ~ |

| Smart Shooter Ltd. | 2010 | Tel Aviv | Targeting Systems, ISR Solutions | ~ | ~ | ~ | ~ |

Israel geospatial defense applications Market Analysis

Growth Drivers

Sustained Increase in Military Expenditure Boosting Geospatial Demand

Israel’s total military expenditure jumped sharply to USD~ million in 2025 from USD ~ million in 2025, marking the highest level on record, according to SIPRI data reported via Trading Economics. This surge reflects extensive defense budgeting toward advanced technologies, including geospatial intelligence, satellite surveillance, and threat detection platforms essential for modern defense operations. Israel’s military spending equates to approximately 8.78% of GDP, significantly higher than the global average of around 2.20%, according to World Bank military expenditure data. The prioritization of defense spending directly fuels investment in geospatial applications, enhancing capabilities for real‑time battlefield intelligence and strategic situational awareness across multiple defense domains.

High National Investment in Research and Development Underpins Innovation

Israel’s commitment to innovation is evident in its world‑leading research and development expenditure, with total R&D spending reaching approximately USD~ billion in 2025 and representing over 6.3% of GDP, one of the highest ratios globally, as reported by Visual Capitalist. Such robust macroeconomic investment creates fertile ground for defense technology advancement, including geospatial systems integrating AI, LiDAR, and satellite analytics. The high R&D intensity drives the development of proprietary software and hardware solutions tailored for defense needs, supporting rapid iteration and deployment of next‑generation geospatial tools. These investments position Israel’s defense tech sector to pioneer cutting‑edge solutions, supported by both government funding and private sector innovation.

Market Challenges

Economic Strain from Elevated Defense Budget Exerts Pressure on Broader Fiscal Space

The escalation in military spending has imposed notable macroeconomic pressures that can constrain long‑term investments in specialized defense technology sectors such as geospatial applications. According to a Finance Ministry report and Reuters reporting, Israel spent ~billion shekels on defense in 2025, spurred by conflict‑related allocations of~ billion shekels for operations in Gaza and Lebanon. These figures have contributed to a widening budget deficit and a complex fiscal environment. High overall defense commitments limit flexibility for diversified technological procurement and can constrain sustained R&D funding specifically earmarked for geospatial innovation if broader economic conditions tighten.

Limited Domestic R&D Workforce and Resource Allocation Challenges

Despite strong aggregate R&D spending, the concentration of research capacity within specific tech hubs presents a bottleneck for scaling highly specialized defense geospatial applications. Israel’s private sector dominates national R&D investment, representing a significant share of the USD ~billion total, but there is intensive competition for skilled talent across sectors like cybersecurity and AI. This constrains the pool of specialists available to develop and maintain complex geospatial defense systems. In the broader macroeconomic context, Israel’s workforce participation rates and labor market limitations due to ongoing military mobilization have restrained civilian tech labor availability, as highlighted in OECD economic analyses. Such workforce dynamics can present execution risks for lengthy, high‑complexity defense geospatial projects that require persistent, specialized expertise.

Opportunities

Israel’s R&D Leadership Offers Strategic Advantages for Geospatial AI Integration

Israel’s exceptional R&D intensity — over USD ~billion invested in research and development with a rate exceeding 6% of GDP — lays a strong foundation for leveraging advanced AI and machine learning within geospatial defense technologies. The country’s robust macroeconomic ecosystem supports high‑end research collaborations between defense agencies and tech firms, enabling the integration of AI‑driven analytics with real‑time geospatial datasets. Such capabilities enhance predictive threat modelling, autonomous reconnaissance systems, and precision mapping applications. With Israel’s technology sector representing an estimated 20% of GDP and over half of total exports, the growth in technological synergies between defense and commercial R&D activities creates a strong opportunity for innovation spillover benefiting geospatial defense solutions.

Geopolitical Context Elevates Need for Advanced Geospatial Intelligence Tools

Ongoing regional instability and heightened security requirements in Israel have magnified the operational demand for geographically nuanced defense systems. The country’s military conflicts in Gaza and northern borders have led to elevated defense investment, creating demand for precise mapping, surveillance, and geospatial analytics to support rapid operational decision‑making. Israel’s economy reported sluggish GDP growth of around 0.9% in 2025, largely sustained by elevated defense expenditure, as per OECD commentary. This macroeconomic backdrop underscores the strategic imperative for advanced geospatial intelligence in mission‑critical operations, opening opportunities for domestic defense firms to develop bespoke solutions adaptable to multifaceted threat landscapes. Enhanced demand for such capabilities reinforces Israel’s role as a key innovator in defense technologies globally

Future Outlook

Over the next decade, the Israel geospatial defense applications market is expected to grow significantly due to the increasing demand for enhanced defense surveillance, reconnaissance, and intelligence systems. The continuous advancements in satellite and radar technologies, along with government investments in military modernization, are expected to fuel this growth. Furthermore, the integration of artificial intelligence (AI) and machine learning with geospatial technologies will drive innovation and improve operational efficiency in defense strategies. As global defense budgets rise and Israel continues to bolster its security infrastructure, the market for geospatial defense applications is poised for substantial growth.

Major Players

- Elbit Systems Ltd.

- Rafael Advanced Defense Systems Ltd.

- Israel Aerospace Industries (IAI)

- Plasan Sasa Ltd.

- Smart Shooter Ltd.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- BAE Systems plc

- General Dynamics Corporation

- Textron Inc.

- Thales Group

- Leonardo S.p.A.

- Pix4D SA

- Hexagon AB

Key Target Audience

- Military and defense contractors

- Government and regulatory bodies

- Investments and venture capitalist firms

- National intelligence agencies

- National defense forces

- Security agencies

- Aerospace and defense technology companies

- Private defense contractors

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying all key variables within the Israel geospatial defense applications market. This step includes desk research to collect and define critical variables impacting market dynamics, such as technological advancements, market demand, and regulatory influences. This stage will be supported by proprietary databases and industry reports.

Step 2: Market Analysis and Construction

During this phase, historical market data and trends will be analysed, focusing on market penetration and growth patterns. The construction of accurate forecasts will be based on quantitative models, ensuring a comprehensive understanding of market behaviour over time. This will help identify the underlying factors driving the demand for geospatial technologies.

Step 3: Hypothesis Validation and Expert Consultation

The developed hypotheses will be validated through expert consultations with professionals across the geospatial defense industry. These interviews with defense technology experts, manufacturers, and government bodies will allow us to refine our data models, ensuring they are aligned with the latest market developments and industry needs.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing insights gathered through direct engagement with key players in the defense and geospatial tech sectors. By combining bottom-up data collection with qualitative input from military agencies and contractors, this research will ensure a robust and comprehensive market analysis, providing valuable insights into the future of Israel’s geospatial defense applications market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for real‑time battlefield situational awareness

Advancements in high‑resolution geospatial data analytics

Increased defense budgets prioritizing geospatial capabilities - Market Challenges

Integration complexity with legacy defense systems

High costs associated with advanced sensor technologies

Cybersecurity vulnerabilities in geospatial data networks - Market Opportunities

Expansion of ISR operations in joint defense exercises

Collaborative R&D between defense tech firms and military

Adoption of AI for enhanced geospatial predictive analytics - Trends

Proliferation of multi‑sensor fusion geospatial platforms

Shift towards cloud‑based geospatial defense architectures

Increased use of autonomous geospatial data collection assets

- By Market Value 2020‑2025

- By Installed Units 2020‑2025

- By Average System Price 2020‑2025

- By System Complexity Tier 2020‑2025

- By System Type (In Value%)

Satellite Imagery Processing Systems

Ground Penetrating Radar Geospatial Units

LiDAR‑Enabled Battlefield Mapping Solutions

Synthetic Aperture Radar (SAR) Defense Platforms

Geospatial Intelligence (GEOINT) Analytics Suites - By Platform Type (In Value%)

Airborne ISR Geospatial Systems

Spaceborne Geospatial Reconnaissance Platforms

Unmanned Aerial Vehicle (UAV) Geospatial Payloads

Naval Geospatial Surveillance Systems

Ground Mobile Geospatial Command Units - By Fitment Type (In Value%)

Fixed Installation Defense Geospatial Nodes

Mobile Integrated Geospatial Kits

Modular Plug‑and‑Play Geospatial Units

Wearable Geospatial Support Devices

Vehicle‑Mounted Geospatial Systems - By End User Segment (In Value%)

National Defense Forces Geospatial Divisions

Homeland Security Geospatial Units

Defense Intelligence Agencies

Border Surveillance and Control Forces

Private Defense and Contractor Geospatial Services - By Procurement Channel (In Value%)

Government Direct Defense Procurement

Defense Contractor Subcontracts

Foreign Military Sales (FMS) Channels

Public‑Private Defense Partnership Acquisitions

International Defense Export Agreements

- Market Share Analysis

- Cross Comparison Parameters (System Accuracy, Integration Flexibility, Deployment Cost, Data Security Features, International Sales Footprint)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems Ltd.

Rafael Advanced Defense Systems Ltd.

Israel Aerospace Industries (IAI)

Plasan Sasa Ltd.

Smart Shooter Ltd.

Northrop Grumman Corporation

Lockheed Martin Corporation

Raytheon Technologies Corporation

BAE Systems plc

General Dynamics Corporation

Textron Inc.

Thales Group

Leonardo S.p.A.

Pix4D SA

Hexagon AB

- Defense forces prioritizing interoperable geospatial systems

- Intelligence agencies requiring secure encrypted data flows

- Border control units leveraging geospatial predictive models

- Defense contractors enhancing customization for end users

- Forecast Market Value 2026‑2035

- Forecast Installed Units 2026‑2035

- Price Forecast by System Tier 2026‑2035

- Future Demand by Platform 2026‑2035